Learn more - Brooks Adams Research

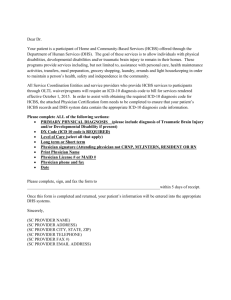

advertisement

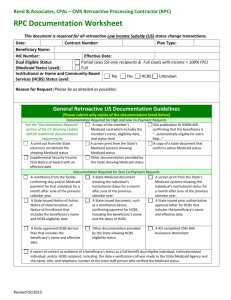

Marketing Benchmarks for Home- and Community-Based Services Creating a Sales and Marketing Culture for Home and 1 Quick Poll: Introductions • • • • Current providers of HCBS Considering providing HCBS CCRCs Others 2 Topic roughly translates to… 3 Thank You Creating a Sales and Marketing Culture for Home and Community-Based Services Bill Pickhardt, Senior VP, Presenter: Cathy Ritter Asbury Home and Community-Based Services Vice President of Marketing Cathy30, Ritter October 2013 VP of Marketing Quick Poll: Interest • My current level of interest in HCBS is... – Very Low – Low – Neutral – High – Very High 5 Objective • Identify marketing benchmarks for HCBS 6 Why HCBS? • 85% of people polled by AARP said they wanted to stay in their homes 7 Why HCBS? • Today there are 1.9 million Americans living beyond age 90 – By 2050, there will be more than 9 million (2010 US Census) 8 Why HCBS? • At least 70% of people over 65 will need long-term care services at some point (US HHS) 9 No Marketing Benchmarks Exist • CCRCs offering/considering to offer HCBS did have a common goal – Expand the service line (outside bricks and mortar) – Expand revenue base – Allow HCBS to establish the community in a better position for the future 10 No Marketing Benchmarks Exist • We have and measure benchmarks for CCRCs – They can at least be a starting point for measurement – But HCBS service lines are so different they require unique metrics 11 HCBS service lines are so different they require unique metrics 12 HCBS service lines are so different they require unique metrics We had to conduct our own study 13 Study Methodology Consumer Survey Provider Survey 14 Consumer Survey Details • Deployed in September 2013 to some members of BAR’s FiftyPlus Panel – Study open for two weeks • 406 US panelists aged 50+ are included in the analysis – Total respondents = 1,184 – Total invited = 4,500 15 About the Panelists Consumer Survey 16 Panelist Ages Percent Age 50 – 65 years Percent Age 66 – 79 years Percent Age 80+ years 17 Panelist Incomes 30% 24% 25% 20% 19% 17% 14% 15% 12% 10% 7% 6% 5% 0% Less than $20,000 $20,000 to $29,999 $30,000 to $49,999 $50,000 to $74,999 $75,000 to $99,999 $100,000 to $149,999 More than $150,000 18 Panelist Incomes 30% 24% 25% 20% 19% 17% 14% 15% 43% have incomes between $30K and $75K 12% 10% 7% 6% 5% 0% Less than $20,000 $20,000 to $29,999 $30,000 to $49,999 $50,000 to $74,999 $75,000 to $99,999 $100,000 to $149,999 More than $150,000 19 Panelist Incomes 30% 25% 20% 74% have incomes under $75K 17% 24% 19% 14% 15% 12% 10% 7% 6% 5% 0% Less than $20,000 $20,000 to $29,999 $30,000 to $49,999 $50,000 to $74,999 $75,000 to $99,999 $100,000 to $149,999 More than $150,000 20 Panelist Gender 21 Panelist Relationship Status Divorced 12% Widowed 6% Single 12% Married/Partne red 70% 22 Panelist Relationship Status Divorced 12% Widowed 6% Single 12% Married/Partne red 70% 23 Quick Poll: HCBS Prospect • I believe the following prospect is best for HCBS... – The same as a CCRC prospect – Someone who is qualified to live in a CCRC, but does not want to – Someone who would love to live in a CCRC, but who is not qualified 24 76% Own a Single Family Home 25 What Services are Consumers Looking for? 26 Home Maintenance 47% 27 Cleaning and Cooking 30% 28 Preferred Service(s) 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 47% 30% 17% 16% 13% 13% 11% 8% 29 Preferred Service(s) 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Big Shock! Age did NOT correlate with preferred services 47% 30% 17% 16% 13% 13% 11% 8% 30 What Providers are Offering 60% 50% 40% 30% 20% 10% 55% 52% 52% 52% 48% 45% 45% 45% 45% 34% 34% 31% 31% 28% 21% 10% 0% 31 54% Receiving NO Helping Hands 32 54% Receiving NO Helping Hands Others receive help from… Spouse (33%) Adult Child (10%) Family/Friend (8%) Paid Caregiver (3%) 33 Home- and Community-Based Services is an Unknown Term Home- and Community-Based Services is an unknown term 34 Home- and Community-Based Services is an Unknown Term Home- and Community-Based Services is an unknown term 50% Not Familiar 35 Home- and Community-Based Services is an Unknown Term Home- and Community-Based Services is an unknown term Only 7% Very Familiar 36 54% Understand the difference between Home Health Care and Home Care 37 But… 74% Do NOT know what is required for Medicare to cover any care in the home 38 Services Most Likely to Use Hospice 5% Medication management 8% Personal care 8% Care coordination 10% Companion services 12% Rehab 12% Home health care 13% Technology 19% Transportation 21% Concierge-type services 44% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 39 Services Most Likely to Use Hospice 5% Medication management 8% Personal care 8% Care coordination 10% Companion services 12% Rehab 12% Home health care 13% Technology 19% Transportation 21% Concierge-type services 44% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 40 When to use these services? 41% will use these services after a health event 41 When to use these services? 41% will use these services after a health event 26% use now or plan to use in a few years 24% are not sure when to use 42 50% would seek a HCBS referral from a physician 43 Preferred HCBS Referral Sources Financial advisor 8% Clergy 11% Online referral agency 17% AARP 32% Internet 37% Friends 42% Family 50% Physician 50% 0% 10% 20% 30% 40% 50% 60% 44 Provider Insights • Providers reported having 10 or more direct local HCBS competitors 45 Provider Insights • Most current business comes from consumer word of mouth 46 Provider Insights • All see opportunity to build image through professional referrals – CCRCs offering HCBS see their existing referral network as a strength versus competition 47 Provider Insights • Most CCRCs offering HCBS have built the service line by offering services to both residents and external clients 48 Provider Insights • Online advertising and direct mail are the most common forms of marketing HCBS 49 Provider Insights • HCBS has three target audiences: – Senior consumers – Adult children – Referral sources 50 Provider Insights • Most are NOT tracking leads in a database (some are using a spreadsheet) 51 Shaping Research Insights into Marketing Strategies 52 HCBS Benchmark Categories • Key measures to benchmark were identified as: – Cost per lead – Cost per “sign up” – Yearly Branding Cost – Conversion Ratio from Service to Community 53 Setting Sales Goals Questions to ask: Are you utilizing a tracking system like REPS/Matrix Care Marketing? 54 Setting Sales Goals Questions to ask: Are you utilizing tools on the Internet – real time dashboards and call tracking? 55 Setting Sales Goals Questions to ask: How are you measuring (and have you set goals for)… – Calls – inbound/outbound – Inquiries – Sign-ups – Revenue Goals 56 Challenges • Single point of entry – Phone triage line • How do you staff this? • Start up cost per service line: – Home Health Care – Hospice – Concierge and Companion Services 57 Branding 58 HCBS Goal Setting 59 HCBS Sales Calculator Total clients 250 Current revenue $500,000 Targeted revenue $580,000 Additional revenue needed Average cost per service hour $80,000 (divided by) $20 Additional net service hours needed 4,000 Ave service hours per client per year (divided by) 100 Ave new clients required Annualized number of new clients Projected annual turnover New clients required 40 (times 2 =) 80 (plus) 80 160 60 Lead Generation Calculator* Total leads generated in last plan period Total sales in last plan period Leads per sale Targeted sales in new plan period Targeted lead generation Cost per lead Total lead generation budget required 240 (divided by) 120 2 (times) 160 320 (times) $100 $32,000 * This is a simplified way to calculate lead generation; this method assumes you will convert at the same rate as the previous year; also does not account for leads already in database. 61 Advertising HCBS 62 Quick Poll: Advertising HCBS • Your organization’s primary objective in advertising HCBS is... – Generating awareness – Generating leads – Converting leads – Connecting with referral sources 63 64 65 66 67 68 69 70 Items to include in HCBS marketing plan • • • • • • • • • • • • • Background Summary Target Audiences Goals and Objectives Strategy Strategic Approach Single Point of Entry Protocol Systems and Protocols, Forms Sales Management and Training Networking Branding Conversion Program New Lead Management Systems Public Relations • • • • • • • • • • • Collateral Materials Direct E-mail and Web Marketing Social Marketing Advertising Media Direct Mail Newsletter Event Marketing Action Plan Budget Reporting 71 The Importance of Planning • Our recommendations for each service line: – Develop a strong business plan – Develop a strong sales plan – Develop a strong communications and marketing Plan 72 We have started the Hub of information to track nationwide HCBS benchmarks 73 Join the conversation! http://www.researching.com/surveys/HCBSProvider 74 Quick Poll: Webinar Review • This webinar was... – Not helpful – Just okay – Very helpful 75 Thank you! • Questions can be submitted using the hand raise or chat functions 76