National Credit Regulator

advertisement

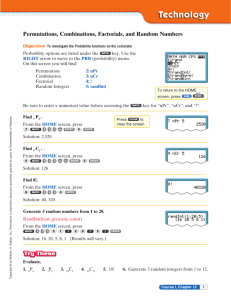

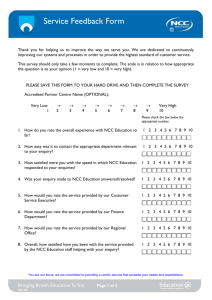

Consumer And Corporate Regulation Division Presentation to the Portfolio Committee on Trade and Industry 29 July 2014 Delegation • Zodwa Ntuli: Deputy Director General, Consumer and Corporate Regulation • Nomsa Motshegare: Chief Executive Officer, National Credit Regulator • Ebrahim Mohamed: Consumer Commission Commissioner, National • Diane Terblanche: Chairperson, National Consumer Tribunal 2 Purpose To brief members of the Portfolio Committee about the work of Consumer and Corporate Regulation Division (CCRD) focusing on Consumer Protection 3 Objectives the dti’s strategic goals are: Facilitate the transformation of the economy to promote industrial development, investment, competitiveness and employment creation; Build mutually beneficial regional and global relations to advance South Africa ’ s trade, industrial policy and economic development objectives; Facilitate broad-based economic participation through targeted interventions to achieve more inclusive growth; Create a fair regulatory environment that enables investment, trade and enterprise development in an equitable and socially responsible manner; and Promote a professional, ethical, dynamic, competitive and customerfocused working environment that ensures effective and efficient service delivery. 4 The objectives of CCRD are: CCRD Objectives To increase access to economic opportunities for small businesses and historically disadvantaged citizens. To develop efficient regulation in order to reduce the regulatory burden on business and increase confidence and certainty in South African business regulation. To create a business regulatory environment that promotes competitive, fair and efficient markets. To provide access to redress for economic citizens in order to increase confidence in the markets. To promote awareness of rights, duties/responsibilities to increase activism and public participation. To share and exchange regulatory experience with partners nationally and internationally to promote simple, appropriate and more effective regulatory solutions. 5 Programme 5 of Vote 36 Operational Context Develop and implement coherent, predictable and transparent regulatory solutions that facilitate easy access to redress and efficient regulation for economic citizens Policy and Legislative Development – policy development, legislative drafting, legislative reviews, legislative audits, drafting and issuing of regulations, amendments of laws and regulation. Enforcement and Compliance – policy and legislative briefs and reviews, research and trend analysis, market survey, regulatory impact assessment. Regulatory Services – funding of Agencies, sustainability and effectiveness of Agencies, performance monitoring and evaluation, leadership of Agencies, accountability and oversight for Agencies. 6 World Bank Rating According to the Doing Business Study, South Africa is still facing challenges in getting electricity, trading across borders, registering property – need to improve in these areas but far ahead of BRICS counterparts. 7 Agencies Minister of Trade and Industry Consumer and Corporate Regulation Division National Credit Regulator (NCR) National Consumer Commission (NCC) Established in terms of section 12 of the NCA No. 34 of 2005 and is responsible for the regulation of the South African credit industry. Established in terms of Section 85 of the Consumer Protection Act No. 68 of 2008. Conducts education, research, registration of industry participants, investigation of complaints, and ensuring the enforcement of the Act. Provides consumers with protection on issues relating to consumer agreements, product quality, accreditation of industry codes, investigation of complaints, rights to refund and repairs. Consumers (Individuals; businesses) Consumer protection Fair market Conduct National Consumer Tribunal (NCT) Established in terms of section 26 of the NCA to adjudicate on matters arising from the NCA and CPA; Functions – Applications, Declaration of prohibited practices, Referrals, Reviews, Consent Orders, Interim Relief, Cancelation of registrations Equitable consumer and credit market Consumer redress Credit providers and micro lenders (banks, retailers, etc) Credit Bureaus Debt counselling; Payment distribution Agents Consumers, suppliers, credit providers Provincial consumer offices Consumer Ombudsman 8 Consumer Protection Achievements Consumer Protection Act (68 of 2008) was promulgated and Regulations were issued. Benchmark Study conducted with other jurisdictions such as Australia, New Zealand and Singapore. Establishment of the National Consumer Commission process completed and transfer of staff from the dti Office of Consumer Protection Published Regulations for Genetically Modified Organisms, with a consultative conference on 25 July 2014. Published Notice on Labeling of Goods originating from East Jerusalem, Gaza or West Bank in terms of section 24 of the CPA Published Notice on the Meat Labeling following the meat scandal Consumer education and awareness campaigns conducted including media campaigns 9 Credit Regulation Achievements National Credit Policy was reviewed to reflect on appropriateness of policy positions and instruments employed. National Credit Act amended by National Credit Amendment Act 19 of 2014. Regulatory Impact Assessment on the amendment process was conducted and report produced. Debt Counseling Regulations were developed to address challenges at Magistrate Courts relating to this process. Commissioned Research on Feasibility of removing adverse credit information held by credit bureaus – done through National Credit Regulator Draft Regulations for National Credit Amendment Act developed and will be published end of July 2014 Education and awareness campaigns conducted 10 Removal of Credit Credit information Credit Regulation Parliament concerns about blacklisted who cannot access credit and employment. Research highlighted reckless lending, affordability assessments, listing requirements, discretionary income, as well as education and awareness. Public consultation and focused sessions with credit providers and credit bureaus. Notice on the Removal of Adverse Credit Information and Paid up Judgments was published in February 2014 effective 1 April 2014. Credit bureaus had two months to remove the information and all submitted reports to the NCR by 30 June 2014. The Notice benefitted about 3 million consumers with 4.5 million accounts, and saved more in terms of legal costs. 11 Concerns of Over-indebtedness Credit Regulation Economic crisis in 2008 affected consumers negatively Failure to conduct affordability assessments by credit providers Reckless lending, with increased unsecured lending targeting low income earners Abuse of credit insurance, especially credit life insurance Unlawful and deceptive advertising, including unsolicited offers in the form of pre-approved loans and credit cards Expensive monthly loans, or what is referred to as payday loans High cost of credit which keeps consumers in a continuous debt cycle Joint Committee between National Treasury, Department of Justice Constitutional Development and Correctional Services 12 Access to rural areas Contralesa Partnership Memorandum of Understanding was negotiated between the dti and Congress of Traditional Leaders of South Africa (CONTRALESA). Partnership launched on 24 November 2011. 2012-2013 fifty (50) field workers were deployed in all provinces assisting communities with various queries on consumers, establishing coops etc. Agencies utilise the field workers for educational outreaches, workshops and referrals. The field workers will also assist in recording and registration of indigenous knowledge. Some fieldworkers government sector. already received permanent positions n 13 Initial provincial spread Contralesa Partnership Western Cape – KwaLanga, Khayelitsha, George (4) Northern Cape – Kuruman (2) North West – Moruleng, Khaya Khulu, Taung (4) Mpumalanga – Bushbuckridge, KwaMhlanga, Siyabuswa (4) Limpopo – Maruleng, GaDikgale, Malamulele, Thohoyandou (8) KwaZulu Natal – Sisonke (Ixopo), Pietermaritzburg, Ndwendwe, UGU, Khahlamba, Maphumulo, Durban, Mobeni, Nquthu, Mhlabuyalingana (10) Free State – Heidelsdal, Makgolokoeng, Qwaqwa, Vrede (4) Eastern Cape – Cofimvaba, Idutywa, Elliotdale, Libode, Lusikisiki, Mthatha, Mnqesha, Mqanduli, Willowvale (10) Gauteng – Tembisa, Soweto, Tshwane (3) 14 National Credit Regulator 15 Disbursement vs. Outstanding Debtors Book - Grand Total • • • • The total number of credit active consumers as by end of March 2014 are 21.71 million, 56% (12.11 million) were in good standing. The number of consumers with impaired records decreased by 329,000 to 9.60 million by end of March 2014, from 9.93 million in the previous quarter. Consumers classified in good standing increased by 1.40 million, to 12.11 million consumers. The total outstanding debtors’ book of consumer credit as at end of March 2014 was R1.55 trillion. 16 Credit standing of consumers • • Consumers in “good standing” improved from 51.9% at the end of Dec 2013 to 55.8% for the quarter ended March 2014; and Consumers with “impaired records” decreased from 48.1% at the end of Dec 2013 to 44.2% at the end of March 2014. 17 How much do consumers owe? • • • Consumers spend more on movable assets than fixed investments such as mortgages. Most consumer credit is on secured credit, followed by mortgages and unsecured credit. The banks’ share of total credit granted as by end of March 2014 was R84.74 billion (80.24%), retailers R3.88 billion (3.67%), Non-bank financiers R6.51 billion (6.16%) and “Other credit providers” R10.48 billion (9.93%). 18 Percentage distribution of disbursement per credit type • • • Secured credit remains the leading type of credit granted at 33% of share of credit but Mortgages has shown some steady improvement in the last quarters. Mortgages have a share of 29% of new credit extensions while unsecured and credit facilities have 18% and 15% respectively. Unsecured credit has been gradually declining over the last three quarters while Mortgages and Secured credit have shown some steady improvement. 19 National Credit Regulator Handled >580 000 calls since inception with average 8000 calls per month. Consumers awarded >R16 million in refund and outstanding balance adjustments. A joint 2 day operation took place in the Northern Cape with SAPS to address illegal collection tactics by credit providers 15 people were arrested 620 bank cards, 114 Identity Documents and 577 pension cards were found. Raids were also conducted in KwaZulu Natal, Western Cape and Eastern Cape. Established the Credit Industry Forum (CIF) to facilitate agreements and address aspects of operational nature in the industry. Credit Bureaus registered with NCR are to date fourteen (14). 20 Example of some investigations conducted: National Credit Regulator Marikana Investigation - in 2012/13 thirteen (13) microlenders were raided and alarming reckless lending and illegal debt collection tactics were discovered – a follow up was conducted this year and no cards as collateral were found. Standard Bank was instructed to refund clients for extra administrative charges. African Bank for reckless lending and entered into a consent order - paid R20 million in addition to refunds to consumers. Consumer Profile Bureau (CPB) for keeping the cause of death information on its records – compliance noitice was issued. 21 National Credit Regulator Example of some investigations conducted: Wonga Finance for improper affordability assessment and record keeping – isued a compliance notice – NCR to brief Committee on this case in detail. Satinsky 128 for R699 vehicle scheme for unlawful credit marketing practices and failure to disclose total cost of credit – issued compliance notice. Junk Mail Publishing for publishing credit adverts with “blacklisted customers welcome” – compliance notice issued 22 Debt Counselling Number of debt counsellors registered is 2136 The number of consumers who applied for debt counselling during the previous financial year was 82 964 Applications for debt counselling to date from inception is 279 797 – on average per month since the beginning of this year (2014) were 10900 Number of clearance certificates is 5544 as at June 2014 – new amendments now allow early rehabilitation Amount distributed to credit providers since inception to date is > R14.7 billion 23 Payment Distribution New entrants in the industry outside NCA framework. Governed through Service Level Agreement with NCR. Payment Distributing Agents statistics: Total distribution since inception is in access of R13.9 billion Average number of credit agreements per consumer is seven (7) Total amount distributed for the month of April R359 million New amendments regulates it more effectively and curb costs to consumers 24 Educational Outreaches Workshops with Provincial Consumer Desks, Trade Unions, Government departments and employers. Good exposure across all media channels - total Advertising Value Equivalency (AVE) of R213 million for the past financial year alone. Bill boards also found to be valuable in reaching out to communities with targeted messages. Participated in exhibitions, activations and road shows across the country at 11 tertiary institutions. Participated in the Contralesa initiative of the dti - the NCR has been able to empower rural communities. Participated in various TV Interviews reaching millions of consumers. 25 National Consumer Commission 26 Statistics In 2011/12, the calls and complaints logged were very high, the role of other regulators diminished as all complaints were logged with the NCC. In 2012/13, the strategy was redefined and the NCC focused on referrals and investigations. In 2013/14, the emphasis is more on referrals, and investigation and finalising the backlog. 27 Complaints Resolution The NCC has facilitated conciliations between suppliers and consumers resulting in refunds, replacements of goods and negotiated settlements. Some examples of the settlements are: A full refund for a consumer that bought a bottled purified water franchise from an entity called H2O for R210 900, A full refund for a consumer who paid residential property deposit to Mistry Blue Investments in the sum of R63 000 The franchise, Old Fashioned Fish and Chips, refunded R100 000 to a consumer. MTN agreed to reconcile a consumer’s statement and pass a credit in the amount of R123 190.43. 28 Investigations Conducted the following investigations: Meat labelling – investigation was concluded and the Notice on Meat Labelling is being enforced. Cell phone agreement - Contract terms and conditions were revised and included the pricing. The contacts are 100% (area that is still outstanding S63 that talks to expiry of data/ airtime). SANRAL - investigation led to revision on terms and conditions eTag pre-implementation of e-Tolls; provision of sales records and their collection method that was unconscionable during the implementation phase. 29 Recalling of products Guidelines for recalls were developed and published for comments in 2012. Recalls were facilitated and communicated for the following products: Meat Labelling (Horse Meat) Findus Foods. There were seventeen products imported by Findus South Africa (Sea Harvest), only one contained beef as an ingredient. The company, as a precaution, withdrew the product from the market and conducted DNA analysis to determine any possible trace of horse meat. Twenty (20) product safety recall Notifications were issued in 2013/14 UD Trucks (E06, E11 and E12 Models) by UD Trucks Southern Africa. Mastercraft Bottle Jacks by Massmart. Mastercraft 2 ton trolley jack by Massmart. Mastercraft 3 ton garage jack by Massmart. Honda Jazz - Master Switch by Honda Motors Southern Africa. Honda FR - V and S2000- Brake Booster by Honda Motors Southern Africa. 30 Recalling of products Garmin quatix watch by Garmin International. Dettol disinfectant liquid as per the National Regulator for Compulsory Specifications (NRCS). Easton Axis arrows by Easton Technical Products. Spray paint (Homestead and Spectra spray brands) by Spectra Spray. Spray paint (Primaries) by Spectra Spray. Bosch and Siemens Dishwashers by BSH Home Appliances. Womens sandals with metal trim by Woolworths. Samaritan PDU 400 home semi-automatic defibrillator by HeartSine Technologies. Navigator HD Ureteral access sheath set by Boston Scientific. Diesel return line manufactured for the Volkswagen Amarok 2.0l CR TDI models by Volkswagen South Africa. Chevrolet Trailblazer tow bar by General Motors South Africa. Chevrolet Spark 1.2 (M300) by General Motors South Africa. Toyota Prius (ECU Recalibration) by Toyota SA Motors. Lenovo Thinkpad computers battery by Lenovo S.A. 31 National Consumer Tribunal 32 National Consumer Tribunal There are approximately 35 different types of applications and 150 different types of referrals from the NCA and CPA that may be brought to the NCT, including provision for a matter that can be brought from an application to the High Court. In the past financial year the NCT has seen an increase in the number, types and complexity of applications filed both in terms of the CPA and the NCA. The Tribunal has received a total number of 5386 applications for adjudication in 2013/14, which is a 28.4% increase from the number of applications filed in 2012/13. The majority of the applications are applications for consent orders in respect of debt re-arrangement agreements. The NCT imposed the administrative fine of R900 000 in the case against Lebathu Finance, which was trading as Werlan Cash Loans – failed to register as a credit provider and ignored a compliance notice issued. 33 The challenges exist for agencies: Challenges Funding continue to be limited for expanding mandate of the NCR, NCC and NCT – donor funding being sourced where possible. Increasing workload from the NCR and NCC impact on the human and financial resources of the NCT – prioritisation is being applied to manage workload effectively Functioning on manual and ageing IT systems – NCR will be replacing the system while NCT will be automating their manual system Scarce skills in dealing with specialised regulatory issues remain a chalenge – all entities are implementing internships to grow their own trees Space continues to be a challenge for the NCR, but the financial resources available does not permit bigger premises. 34 Priority Areas for CCRD: Future Work Regulations for implementation of the National Credit Amendment Act, as well as for Genetically Modified Organisms. Strenthen education and awareness programs, especially through radio and outreach programs in rural areas with Contralesa. Building capacity for inspections across agencies, to enable raids and mystery shopping to uncover violations proactively. Improve visibility and accessibility of the agencies, especially the NCC. Conduct regulatory impact assessments on an ongoing basis to detect and remove unnecessary and redundant regulations. Appeal for funding for the agencies to implement their mandate effectively. 35 Conclusion Thank You 36