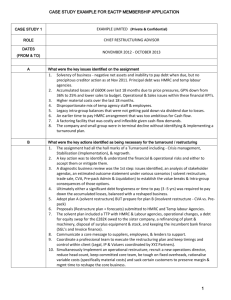

CASE STUDY TEMPLATE 1, 2 & 3 FOR FELLOW MEMBERSHIP

advertisement

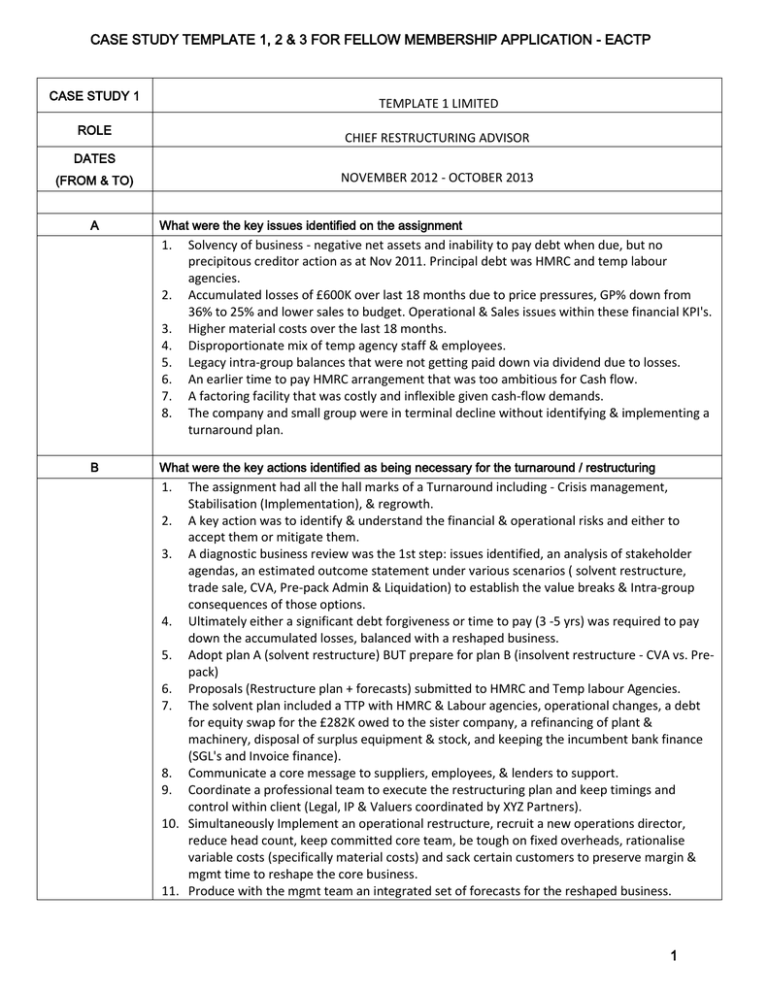

CASE STUDY TEMPLATE 1, 2 & 3 FOR FELLOW MEMBERSHIP APPLICATION - EACTP CASE STUDY 1 TEMPLATE 1 LIMITED ROLE CHIEF RESTRUCTURING ADVISOR DATES NOVEMBER 2012 - OCTOBER 2013 (FROM & TO) A What were the key issues identified on the assignment 1. 2. 3. 4. 5. 6. 7. 8. B Solvency of business - negative net assets and inability to pay debt when due, but no precipitous creditor action as at Nov 2011. Principal debt was HMRC and temp labour agencies. Accumulated losses of £600K over last 18 months due to price pressures, GP% down from 36% to 25% and lower sales to budget. Operational & Sales issues within these financial KPI's. Higher material costs over the last 18 months. Disproportionate mix of temp agency staff & employees. Legacy intra-group balances that were not getting paid down via dividend due to losses. An earlier time to pay HMRC arrangement that was too ambitious for Cash flow. A factoring facility that was costly and inflexible given cash-flow demands. The company and small group were in terminal decline without identifying & implementing a turnaround plan. What were the key actions identified as being necessary for the turnaround / restructuring 1. The assignment had all the hall marks of a Turnaround including - Crisis management, Stabilisation (Implementation), & regrowth. 2. A key action was to identify & understand the financial & operational risks and either to accept them or mitigate them. 3. A diagnostic business review was the 1st step: issues identified, an analysis of stakeholder agendas, an estimated outcome statement under various scenarios ( solvent restructure, trade sale, CVA, Pre-pack Admin & Liquidation) to establish the value breaks & Intra-group consequences of those options. 4. Ultimately either a significant debt forgiveness or time to pay (3 -5 yrs) was required to pay down the accumulated losses, balanced with a reshaped business. 5. Adopt plan A (solvent restructure) BUT prepare for plan B (insolvent restructure - CVA vs. Prepack) 6. Proposals (Restructure plan + forecasts) submitted to HMRC and Temp labour Agencies. 7. The solvent plan included a TTP with HMRC & Labour agencies, operational changes, a debt for equity swap for the £282K owed to the sister company, a refinancing of plant & machinery, disposal of surplus equipment & stock, and keeping the incumbent bank finance (SGL's and Invoice finance). 8. Communicate a core message to suppliers, employees, & lenders to support. 9. Coordinate a professional team to execute the restructuring plan and keep timings and control within client (Legal, IP & Valuers coordinated by XYZ Partners). 10. Simultaneously Implement an operational restructure, recruit a new operations director, reduce head count, keep committed core team, be tough on fixed overheads, rationalise variable costs (specifically material costs) and sack certain customers to preserve margin & mgmt time to reshape the core business. 11. Produce with the mgmt team an integrated set of forecasts for the reshaped business. 1 CASE STUDY TEMPLATE 1, 2 & 3 FOR FELLOW MEMBERSHIP APPLICATION - EACTP 12. Work up a consistent marketing message to get the buy in from customers. 13. Open dialogue with incumbent lenders (ABL's and Bank) and look to new lenders with a standard information pack to refinance the company & / or group. 14. Work up strategic & tactical plan to deal with legacy intra-group balances that would be an issue in a Admin or Liquidation scenario. 15. Plan A favored a solvent plan / CVA route. C Please provide brief details of the assignment including the type of business, sector, turnover etc 1. 2. 3. 4. 5. 6. 7. D How and when were these actions implemented? E Template 1 Ltd is a private company registered in England & Wales & is a wholly owned subsidiary of a Holding Co. It has a sister company held by the Holding Co. The business is a plastic injection moulding business, moulding products for its customers & its own range, with both UK and overseas customers. It also manufactures small moulding tools. Many of the products are for the heating, plumbing, medical and FMCG sectors. The company had 100 workers, a mix of employees and temp labour. The year end is March & turnover in 2011 was £3.5mn & in 2012 £3.3mn, the budget for 2013 was £3.4mn. There are significant intra-group balances from the holding co to the company, from the sister company to the company and a smaller balance from the sister company to holding company. The nature of these intra-group balances are both acquisitional, loan and trade loans. Template 1 Ltd was acquired & placed into a group structure, the sister company was acquired at a later date. The small group has a majority shareholder & director. Nov 2012 - Initial discussions with principal director, review of mgtm accounts. Dec 2012 - Diagnostic business review & report plus options. Dec 2012 - Full TTP proposal to HMRC (forecasts & restructuring plan) Jan 2013 - Operational changes start to be implemented. Jan 2013 - Recruitment of new Operations Director. Feb 2013 - Valuation of Business Assets. Feb 2013 - Discussion with IP's, legal's, Bank, ABL's, deal structure & refinance. Mar 2013 - Plan B implemented, offer formatted, Pre-pack Admin implemented & appt'ed. April 2013 - Monitoring of Operational impacts / Prep of statement of affairs. Summer 2013 - Ongoing dialogue re valuation of holding co and legacy intra-group balances to finalise Administrator realisations. What was the outcome of the assignment? Is it complete? 1. 2. 3. 4. 5. 6. 7. 8. 9. HMRC rejected the TTP proposal (2 yr request was not policy) - Plan A moved to Plan B. The merits of CVA vs. Pre-pack was discussed in detailed. The incumbent bank decided to exit business but supporting the exit, panel firm (Top 4) appt. Pre-pack route devised, timings established, SIP 16 complied with. Sister company's offer for business & assets formatted, (Heads of terms). Deferred terms negotiated and debtor collect out organised. The refinancing of the merged entity - new invoice financing, new banking arrangements. Bank paid out immediately upon Administrators appointment. Valuation of all group companies (using DCF, comparisons, bal sheet etc) to assist decision making. 2 CASE STUDY TEMPLATE 1, 2 & 3 FOR FELLOW MEMBERSHIP APPLICATION - EACTP 10. Review of all legal papers for Administration & Acquisition. 11. Completion achieved upon Admin Appointment. 12. To assist tactically with the legacy intra-group balance with the holding group the shares in the sister company held by holding co were sold to a 3rd party prior to the Admin 13. Preparation of formal Statement of Affairs for Director. 14. Monitoring of Operational changes 15. The assignment is not quite complete - a final negotiation of the intra-group balance owed from holding co to Template 1 Ltd. F What was the nature of your personal involvement in the case? 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. I've been involved at every critical decision & initiative strategically & tactically since Nov 2011 to date. I dealt with Template 1 as a supplier in Oct 2011 when restructuring a tool making business. I considered I had no ethical or professional conflict in the assignment. The Director contacted me in November 2012 directly, to ask for assistance . An initial conversation led to a business review & report dated 3rd Dec 2012 & feedback. An initial time to pay proposal to HMRC report prepared dated 20th December 2012. Discussions re operational & financial changes plus timing required for a sustainable business. Further strategic & tactical options explored with assistance of external valuer's and an insolvency practitioner. Exploration of a pre-pack Admin vs. CVA, considering the consequences for the company, the group as a whole, individual companies, intra-group bals and the principal director / owner. Introduction of a restructuring solicitor. Discussions with bank & bank panel IP firm, options for bank, refinancing, negotiating a deal structure for a pre-pack admin to be implemented. (15th March 2013). Negotiation & sale of business & assets to a group sister company in common ownership. Valuation of each group company. Certain post-admin realisations remain within the group & are still being negotiated to date. SIGNED DATE 3