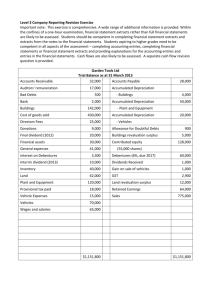

Asset valuation

advertisement

Asset Valuation Property, Plant and Equipment 1 Introduction • Property, plant and equipment are defined as fixed tangible assets which are held by a company for use in the production or supply of goods and services, for rental to others, or for administrative purpose 2 The notion of cost • Historical Cost • Replacement Cost • Fair value 3 Historical cost 4 Historical Cost • Historical cost is the amount paid to acquire goods or services. • It includes all expenditures which prepare the asset for intended use • Apart from the invoice price of the asset, it also includes the freight charges, import duties and installation costs of the asset 5 Replacement cost 6 Replacement Cost • Replacement cost is the current cost to replace or to purchase an item similar to the existing item • It abandons the realization concept • Under replacement cost accounting, the net profit obtained from the profit and loss account includes both the operating income and holding gain 7 Fair value 8 Fair value • It is the amount for which as asset could be exchanged for in a fair transaction 9 Example 1 10 Example 1 Chan started a business with a capital of 1000 units of stock at $1 per unit. On 1 October, he sold 700 units at $2 per unit. The price level indicates for the year are: Replacement Cost 1 Jan 2007 $1.0 1 October 2007 $1.3 31 December 2007 $1.5 Profit and loss account for the year ended 31 December 2007 Historical cost Replacement cost Sales (700*$2) 1400 1400 700*1.3 Less: Cost of sales 700 910 Gross profit 700 490 Realized holding gain 210 700*0.3 Unrealized holding gain 150 11 Net profit 700 300*0.5 850 Balance Sheet as at 31 December 2007 Historical cost Replacement cost Stock 300 450 Cash 1400 1400 1700 1850 Capital 1000 1000 Add Profit – realized 700 700 - unrealized 150 1700 1700 12 Valuation of Property, plant and equipment • Property, plant and equipment are fixed tangible assets that – Are held by an enterprise for use in the production or supply of goods or services, for rental to others, or for administrative purpose; and – Are expected to be used during more than one period • Property, plant and equipment should be carried at its cost less any accumulated depreciation and any accumulated impairment losses 13 Land and buildings 14 Land and buildings • Freehold land • Leasehold land • Buildings 15 Freehold Land • It has an unlimited useful life, and its value does not decline over time, so it should be treated as non-depreciable assets 16 Leasehold land • Leasehold land should be regarded as depreciable assets whether the lease is more than 50 years or not 17 Buildings • Buildings have limited useful lives. The cost should be allocated over their useful economic lives, so they should be regarded as depreciable assets 18 Exception to the treatment of land and buildings • Land and buildings held for resale • Investment properties 19 Land and building held for resale • They should be treated as trading stock. These assets are stated at the lower of cost and net realizable value • No depreciation should be provide for 20 Investment properties • They are land and buildings held as investments, and not for the consumption in the operation of business • They should not be subject to depreciation, except when the lease of a property is for less than 20 years • They should be valued at open market value 21 • An increase in value should be credited to the investment property revaluation reserve • A decrease in value should be debited to the investment property revaluation reserve. If the reserve is insufficient, the decrease can also be debited to the profit and loss account 22 Initial measurement of property, plant and equipment • Cost of property, plant and equipment • Expenditures not included in the cost of property, plant and equipment 23 Cost of property, plant and equipment • An item of property, plant and equipment should be recognized as an asset and recorded at its cost • Cost= Purchase Price + Other acquisition costs – Trade discounts - rebates 24 Example 2 • Cost of property Construction cost Stamp duty Legal cost Land premium Cost of site preparation Cost of dismantling the old property $ 2000000 140000 50000 5000000 400000 100000 7690000 25 Example 3 • Cost of equipment Purchase price Less: Trade discounts Import duty Delivery cost Installation cost $ 200000 20000 180000 10000 4000 3000 197000 26 Expenditures not included in the cost of property, plant and equipment • Assets are recorded at their cash prices. Interest expenses should not be included in the purchase price unless they are capitalized in accordance with the SSAP 19 ‘ Borrowing cost’ 27 • If the asset is produced by the firm itself, the following costs should not be included in the cost of property, plant and equipment: – – – – – Administrative cost General overhead cost Start-up and similar pre-production costs Internal manufacturing profit Abnormal amounts of wasted material, labour, or other resources incurred in the production of a selfconstructed asset 28 Subsequent expenditure • Improvement on property, plant and equipment can be recognized as assets only when the expenditure can improve the condition of assets beyond their originally assessed standard of performance • Examples of improvements, can be capitalized, include: – Modifying an asset to extend its useful life and to increase its productive capacity; – Upgrading an asset to achieve a substantial improvement in the quality of output 29 – Adopting new production processes to assure a substantial reduction in previously assessed operating costs • It the subsequent expenditure only restores or maintains the future economic benefits to the originally assessed standard, it should be written off as an expense when it is incurred. Examples include repairing and maintenance 30 Revaluation 31 Revaluation • Two different bases for the determination of the carrying amount (NBV) of property, plant and equipment • As asset may be stated either: – At cost less accumulated depreciation and any accumulated impairment losses – At a revaluated amount, being the fair value (fair market value), less any subsequent accumulated depreciation 32 • Owning to the substantial difference between the cost and market value of land and buildings, revaluation of land and buildings is a common practice in Hong Kong • The fair value is determined by appraisal normally undertaken by professional qualified valuers 33 • Although revaluation of plant and equipment is permitted by the SSAP, enterprises seldom recognize the market value of plant and equipment in their balance sheets 34 Several points should be noted upon revaluation of asset: • An increase in the value of property, plant and equipment should be credited directly to equity under the heading of “ revaluation reserve” • Accumulated depreciation prior to the revaluation should be credited to the revaluation reserve • After revaluation, depreciation should be charged against the revalued amount • When the revalued asset is disposed of, the revaluation reserve should be transferred directly to the retained profits but not to the profit and loss account 35 Example 4 • The purchase price of land and buildings was $100 million at 1 January 2000. 10% depreciation on cost was charged Revalued on 1 January 2002 Sold on 1 January 2003 $120m $140m 36 The Journal Dr. $m Cr. $m 2002 Jan 1 Land and Buildings 20 Provision for deprecation ($100*10%*2) 20 Revaluation reserve 40 Being surplus on revaluation transferred to the revaluation reserve Dec 31 Profit and loss (120/8) 15 Provision for depreciation Being provision for deprecation on the revalued amount over the remaining useful economic life 15 37 The Journal Dr. $m 2003 Jan 1 Bank 140 Provision for deprecation 15 Land and buildings Profit and loss – gain Being disposal of land and buildings Jan 1 Revaluation reserve 40 Retained profit Being transfer of the realized revaluation reserve to the retained profits Cr. $m 120 35 40 38 Treatment of revaluation surplus and deficit • An increase in value should be credited directly to equity under the heading of ‘revaluation reserve’ • A decrease should be charged directly against the revaluation reserve • If the amount of the revaluation reserve is insufficient to write off the decrease in value, the decrease can be recognized as an expense in the profit and loss account 39 • If the fair value rises again, the revaluation deficit recognized as expenses previously should be reversed and credited to the profit and loss account as income 40 Example 5 • On 1 Jan 2000, A Ltd. purchased a freehold land at a cost of $100 million. No depreciation would be provided on the freehold land • On 31 Dec 2002, owing to the property market boom, the freehold land was revalued to $140 million • On 31 Dec 2003, the property market crashed. The freehold land was revalued to $90 million • On 31 Dec 2004, the housing policy changed and the property market boomed again. The freehold land was revalued to $160 million. 41 The Journal Dr. $m 2000 Jan 1 Freehold land Bank Being purchase of Freehold land Cr. $m 100 2002 Dec 31 Freehold land 40 Revaluation reserve Being surplus on revaluation transferred to the revaluation reserve 100 40 42 The Journal Dr. $m 40 10 Cr. $m 2003 Dec 31 Revaluation reserve Profit and loss Freehold land 50 The revaluation deficit should be directly charged against the revaluation reserve. The excess amount of revaluation deficit over the related revaluation reserve should be charged as an expense to the profit and loss account 2004 Dec 31 Freehold land 70 Profit and loss 10 Revaluation reserve 60 Being reversal of the write down of $10 million and revaluation of the asset to its fair value 43 Impairment loss 44 Impairment loss • Property, plant and equipment should be stated at cost less accumulated depreciation and any accumulated impairment losses • An asset is impaired when its carrying amount exceeds its recoverable amount • If there is no indication of impairment loss, it is not required to make a formal estimate of recoverable amount 45 Definition • • • • Carrying amount Recoverable amount Net realizable value Value in use 46 Carrying amount • Carrying amount is the net book value at which an asset is recognized in the balance sheet Carrying amount = Historical cost – Accumulated depreciation – Accumulated impairment losses 47 Recoverable amount • Recoverable amount is the higher of an asset’s net realizable value and value in use 48 Net realizable value • Net realizable value is the amount at which an asset could disposed of, less any direct selling costs 49 Value in use • Value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset and from its disposal at the end of its useful life 50 • When an impairment loss occurs, the revised carrying amount shown in the balance sheet is calculated as follows: Revised carrying amount Lower of Carrying amount OR Recoverable amount Higher of Net realizable value Value in use 51 Indications of impairment • The enterprise should estimate the recoverable amount of assets if the following indications of impairment appear: – External indicators – Internal indicators 52 External indicators • A significant decline in the market value of asset • Material adverse changes in the technological, economic or regulatory environment • Long-term increase in market interest rates which results in a material decrease in the asset’s recoverable amount 53 Internal indicators • Obsolescence or physical damage of an asset • Discontinued operation or major reorganization • Evidence indicating that the economic performance of an asset is worse than expected 54 Treatment of impairment loss • If the carrying amount (cost less accumulated depreciation) exceeds the recoverable amount (the higher of net realizable value and value in use), there will be impairment loss 55 Accounting entries Dr. Profit and loss Dr. Accumulated depreciation Cr. Asset Dr. Revaluation reserve Cr. Asset Assets previously stated at cost Dr. Revaluation reserve (first) Dr. Profit and loss Cr. Asset Assets previously revalued and the revaluation reserve is less than the impairment loss Assets previously revalued and the revaluation reserve is greater than the impairment loss 56 Example 6 57 • On 1 January 1991, Fortune Ltd. bought a building at a cost of $2000000. The building had a useful life of 20 years and depreciation was charged on a straight line basis • Owing to the changes in market condition, Fortune Ltd. considered that the building might be impaired. On 31 December 2002, the directors estimated that the net selling price was $480000 (estimated selling cost of $50000 less selling cost of $20000) and the value in use of the asset was $300000 58 Historical cost Accumulated depreciation as at December 2002 (2000000*5%*12) Less: Recoverable amount (the higher pf the net selling price of $480000 and the value in use of $30000) Impairment loss $ 2000000 120000 800000 480000 320000 59 The Journal Dr. $m Profit and loss 320000 Provision for depreciation 1200000 Buildings (2000000 – 480000) Cr. $m 1520000 60 Example 7 61 • On 1 January 1991, Fortune Ltd. bought a building at a cost of $2000000. The building had a useful life of 20 years and depreciation was charged on a straight line basis • On 1 January 2001, caused by the property market boom, the building was revalued to $2500000 with a remaining useful life of 10 years • Owing to the changes in market conditions, Fortune Ltd considered that the building might be impaired . On 31 December 2002, the directors estimated that the net selling price was $480000 (estimated selling cost of $500000 less selling cost of $20000) and the value in use of the asset was $300000 62 Revalued amount Accumulated depreciation as at December 2002 (2500000*2/10) Less: Recoverable amount (the higher pf the net selling price of $480000 and the value in use of $30000) Impairment loss $ 2500000 500000 2000000 480000 1520000 63 The Journal Dr. $ 2001 Jan 1 Building 500000 Provision for depreciation ($2000000*5%*10) 1000000 Revaluation reserve Being surplus on revaluation transferred to the revaluation reserve 2001 Dec 31 Profit and loss 250000 Provision for depreciation ($2500000*10%) Being provision for depreciation on the revalued amount Cr. $ 1500000 250000 64 The Journal Dr. Cr. $ $ 250000 2002 Dec 31 Profit and loss Provision for depreciation ($2500000*10%) Being provision for depreciation on the revalued amount 2002 Dec 31 Revaluation reserve (1st ) 1500000 Profit and loss (then) 20000 Provision for depreciation 500000 Buildings (2500000-480000) Being carrying amount written down to the recoverable amount 250000 2020000 65 Subsequent reversal of an Recoverable amount impairment loss • After the recognition of an impairment loss, the depreciation should be provided on the revised carrying amount, less any residual value, over its remaining useful life • If the impairment loss recognized in previously years decreases or on longer exists, the carrying amount of the asset should be increased to its recoverable amount. That increase is a reversal of an impairment loss • The reversal of impairment loss is restricted to the amount that will restore the carrying amount 66 as if no impairment loss has been recognized Example 8 67 • On 1 January 1991, Fortune Ltd. bought a building at a cost of $2000000. The building had a useful life of 20 years and depreciation was charged on a straight line basis • Owing to the changes in market conditions, Fortune Ltd. considered that the building might be impaired. On 31 December 2002, the directors estimated that the recoverable amount was $480000. 68 Ans. • An impairment loss of $320000 was recognized (I.e. 2000000*8/20 - $480000) • After recognition of impairment loss, the depreciation 60000 (I.e. 480000*1/8) should be provided on the revised carrying amount of $480000 over its remaining useful life of 8 years • The carrying amount at 31 December 2003 was $420000(I.e. $480000*7/8) 69 Ans • After the recognition of impairment loss, the depreciation $60000 should be provided on the revised carrying amount of $480000 over its remaining useful life of 8 years 70 • Owning to the change of the housing policy, the directors determined the recoverable amount at 31 December 2004 has increased to $1700000 71 Ans • The recovery of carrying amount is shown $ as follows: Carrying amount as at 31 Dec 2003 as if no impairment loss has been recognized ($800000*7/8) Less: Carrying amount as at 31 Dec 2003 after recognizing the impairment loss Reversal of impairment loss 700000 420000 280000 200000*8/20 72 Ans. The Journal Dr. Cr. Buildings 280000 Profit and loss 280000 *The carrying amount of buildings will be shown as $700000 73 • If the enterprise wants to recognize the market value of the property (I.e. $1700000) in its balance sheet, the remainder of the uplift (I.e. $1000000) would be treated as a revaluation movement 74 Ans. The Journal Dr. Buildings 1220000 Provision for depreciation (480000*1/8) 60000 Profit and loss (first) Cr. 280000 *The carrying amount of buildings will be shown as $700000 75 Investments • Both long-term investments and current investments should be valued at the lower of cost and market value • Investment are recorded at their cost of acquisition, while permanent decreases in value may be written off against current profits. Increases in value are not recognized until realized 76 Example • Cost of quoted securities in 1995 $100,000 • Market value of investment in 1996 $95,000 • Market value of investment in 1997 $110,000 77 Ans: 1996 Dr. Profit and loss $5000 Cr. Provision for Diminution in value of investment $5000 1997 Dr.Provision for Diminution in value of investment Cr. Profit and loss $5000 $5000 Balance Sheet as at 31 Dec (extract) $ 1996 Investments Quoted securities ,at market value (cost$100000) 95000 1997 Investments Quoted securities ,at cost (mkt. value$110000) 100000 78