Risto Herrala 11/10/2010 Summary of 'A Stochastic Frontier Analysis

advertisement

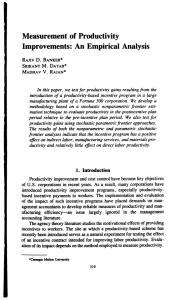

Risto Herrala 11/10/2010 Summary of ‘A Stochastic Frontier Analysis of Household Credit Conditions’ It is a widely held view that changes in credit availability contribute to economic cycles. Low assets prices, tight collateral requirements, and thorough screening may depress credit availability and economic growth during downturns (Rajan 1994; Kiyotaki and Moore 1997; Holmström and Tirole 1997; Ruckes 2004; Dell’Ariccia and Marquez 2006). Based on this view governments intervene, apparently without limit, to preserve banks’ ability to channel credit when financial stability is threatened. Despite such high stakes, our understanding of how credit availability changes during economic cycles and how public intervention affects credit availability is still incomplete (Rajan 1994; Berger and Udell 2004; Jiménez and Saurina 2006; Chen and Wang 2008). Empirical research has been challenged by data and methodological issues. Credit policy indicators are indirect and noncomprehensive. Good-quality micro data with pronounced cyclicality is rare. Most importantly, econometricians have been unable to measure credit constraints and thereby quantify credit conditions during crisis episodes. I show how credit constraints can be estimated from micro data of borrowers by stochastic frontier analysis.1 Data of household borrowers (Figures 1 and 3) is highly indicative of the presence of credit constraints. That the constraints can be modeled as a stochastic frontier is based on the insight that borrowing can be decomposed into two elements: a credit constraint and its utilization rate. This decomposition presents an analogy with efficiency analysis, the standard field of application of stochastic frontier models, in which production is decomposed into the production frontier and efficiency. I apply the method to micro data that is well suited for analysis of cyclical developments in credit conditions and the effects of government intervention. The data covers a boom-bust cycle in connection with a systemic banking crisis, widely referenced in international studies2, and a representative sample of households. The estimation results shed light on credit conditions during four dates of the cycle and its aftermath: the peak of a pre-crisis credit boom, a period of continued 1 See Chen and Wang (2008) and Wang (2003) for earlier work. The ‘Finnish Great Depression’, see Gorodnichenko et al (2009), is among the ‘five most catastrophic cases’ in Reinhart and Rogoff (2008), ranks fourth in terms of loss of GDP in Boyd, Kwak and Smith (2005), and is among the top 10 in terms of restructuring costs in IMF (1998). 2 credit contraction after a public salvage operation of the banking system, and two post-crisis periods. The analysis reveals a significant tightening of collateral requirements during the economic downturn, in line with theoretical predictions. At the same time, other aspects of credit policy, not related to borrower quality and possibly related to public intervention, contributed positively to loan availability. It appears that the intervention succeeded to the extent that credit availability recovered to the pre-crisis credit boom levels. Despite the favorable credit supply conditions, credit market volumes continued to contract. The result implies that the revival of credit supply alone may not suffice to bring about a recovery in economic activity. Keywords: credit policy, credit constraints, stochastic frontier analysis JEL: D14, E32, E51, G21