Partnerships - Bannerman High School

advertisement

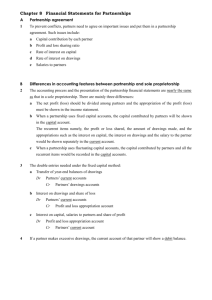

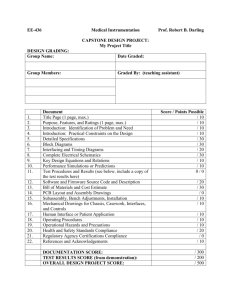

6 PARTNERSHIP ACCOUNTS FORMATION OF A PARTNERSHIP Defined in the Partnership Act 1890 as the relationship between two or more people engaging in business for profit 2 FORMATION OF A PARTNERSHIP Three important factors must be present in a partnership: partners must be carrying on a business, not one isolated business transaction must be agreement between two or more legally competent people who must be the business co-owners partners must have intent to make a profit 3 FORMATION OF A PARTNERSHIP Partnerships are separate accounting entities to the partners (owners) Owner’s Capital Accounts are kept for each individual partner Each partner has the right to share in the profits and manage the business 4 PARTNERSHIP AGREEMENT Partnership agreement doesn’t always exist, making it difficult to establish if a partnership actually exists if there is no formal partnership agreement then the Partnership Act applies agreement is essential because partnerships: have unlimited liability have a limited life • death of partner • insolvency of partner • retirement of partner 5 PARTNERSHIP AGREEMENT name of business details of each partner nature of business division of profit and losses capital contributions authority, rights and duties of partners details of salaries drawings and interest on drawings interest on capital voting and decisionmaking procedures admission of new partners resolution of disputes bankruptcy, death or retirement of partners 6 PARTNERSHIP ACT 1890 If there is no partnership agreement in writing, or if it does not cover an area of dispute, matters may be resolved by reference to the Partnership Act e.g. Act states all profits and losses are to be shared equally, so if profit ratio is not defined in an agreement, the Act is applied Partners will receive interest at 5% on excess capital (ie over and above that which they have agreed to contribute) No interest on drawings No salaries 7 ADVANTAGES OF PARTNERSHIP Creation and dissolution is easier than a company Minimal statutory regulations Resources can be pooled Expertise can be utilised Co-ownership of assets Duties and responsibilities are shared 8 DISADVANTAGES OF PARTNERSHIP Liability is unlimited (partners own personal possessions can be used to pay debts owed by the business) Partnership may cease if a partner dies, retires or becomes bankrupt Disagreements between the partners can occur Limits to raising large amounts of capital Partners can be sued by creditor, jointly or individually Partners are likely to pay higher income tax 9 LIMITED LIABILITY PARTNER Governed by the Limited Liability Partnership Act 1907 Liability is limited to the amount of capital invested by the partner A Limited Partner has no say in the Management of the Partnership business 10 PARTNERSHIP ACCOUNTS CURRENT ACCOUNTS working accounts containing details of profit, loss, drawings and interest on capital invested or charged on drawings CAPITAL ACCOUNTS partner’s original capital put into the business is considered to be ‘fixed’ capital account of each partner is usually unchanged unless additional capital is invested 11 PARTNERSHIP ACCOUNTS CREATION OF NEW PARTNERSHIP ACCOUNTING ENTRIES Can be created in two ways the introduction of cash only, entered in the cash account and the partner’s capital account the introduction of cash and other assets; entered in the cash and asset accounts and the partner’s capital account 12 PROFIT DISTRIBUTION PROFIT-SHARING RATIOS Profits and losses are shared in the way partners feel most appropriate Profit share can be determined in various ways: Amounts are shared on the basis of the amount of capital contributed by each partner Higher profit may go to a partner bringing something of particular value into the business, such as specialised expertise 13 PROFIT DISTRIBUTION PROFIT AND LOSS APPROPRIATION ACCOUNT Net profit or loss is transferred to this account from the profit and loss account Additions are made for Interest on Drawings (this is to discourage partners from making drawings from the business) Deductions are made for Interest on Capital or any Salaries paid to partners Residual Profits are then shared, as agreed, according to Profit Sharing ratios 14 PROFIT AND LOSS APPROPRIATION ACCOUNT Profit and Loss Appropriation Account for Able, Bable and Cable Net Profit Add Interest on Drawings Less Interest on Capital Salary – Able Residual Profit: Shared: Able 1/3 Bable 1/3 Cable 1/3 £2,500 £5,000 £16,000 500 16,500 £7,500 £9,000 £3,000 £3,000 £3,000 £9,000 15 PROFIT DISTRIBUTION ALLOCATION AS PER PARTNERSHIP AGREEMENT Interest on capital may be payable Interest may be charged for drawings taken out of the business There may be a provision for the payment of a salary of a particular partner Interest may be payable on loans to partners by the business or loans by partners to the business 16 PROFIT DISTRIBUTION LOAN ACCOUNTS Where a partner makes a loan to the business, the debit is to bank and the credit to loan account in that partner’s name DRAWINGS Where a partner withdraws cash from the business in anticipation of profits earned, the current account is debited and cash/bank is credited 17 ADMISSION OF NEW PARTNER REASONS FOR A NEW PARTNER May bring in new products and/or customers to the business May bring specialised expertise to the business Allows the business access to further capital May bring in additional assets May provide new business contacts May be a requirement due to death, retirement or bankruptcy of an existing partner 18 ADMISSION OF NEW PARTNER NEW PARTNERSHIP AGREEMENT ADJUSTING THE EXISTING BUSINESS All existing partners must agree on the admission of a new partner Assets of the business should be revalued before a new partner is admitted Liabilities need to be reviewed for accuracy in valuation Gains and losses to existing partners from new business value will be made at the existing profit-sharing ratio 19 STEPS TO ADMIT NEW PARTNER 1. 2. 3. 4. Review value of assets (see later slide) Consider inclusion of goodwill (see next slide) Record changes in the Ledger Accounts Open a Goodwill Account and adjust the existing partners Capital Accounts according to their existing profit-sharing ratio 5. Prepare opening ledger entries for new partner 6. Calculate partners’ new profit-sharing ratio 7. Prepare a new Statement of Financial Position ie Balance Sheet 20 ADMISSION OF NEW PARTNER GOODWILL Goodwill can be defined as future benefits from assets that cannot be individually identified e.g. reputation, customer database, management ability, product, location Goodwill is an asset and as such appears in the Balance Sheet as an Intangible Asset ie one which cannot be seen 21 Recording Goodwill When the partnership is revalued: Debit the Goodwill Account with the value of the increase in the value of the business (premium) Credit the existing partners Capital Accounts according to their profit-sharing ratio 22 REVALUATION OF ASSETS Before admitting a new partner to the business, the Assets should be revalued: Some eg Buildings may have appreciated in value Some eg Machinery may not be worth as much as the Net Book Value in the Balance Sheet – perhaps insufficient amounts for depreciation has been written off over the years 23 Accounting for Revaluation Adjustments to the relevant accounts should be made Eg If Buildings have appreciated, the Buildings Account would be Debited and the Revaluation Account Credited If there has been insufficient depreciation written off machinery, the Machinery depreciation account would be credited and the Revaluation Account Debited The balance on the Revaluation Account would then be transferred to the Partners Capital Accounts according to their profit-sharing ratio 24 PARTNERSHIP DISSOLUTION REASONS FOR DISSOLVING A PARTNERSHIP Partner(s) may give notice of intention to dissolve Insolvency of a partner Ownership changes e.g. converting to company Inability to trade profitably Death of partner Voluntary agreement by partners Courts may also rule to terminate the partnership 25 KEY TERMS You should be aware of the following terms when dealing with Partnerships and be able to give clear definitions as well as know how to account for each: Capital Accounts Capital Adjustment Account Current Account Revaluation of Fixed Assets Fixed Capital Account 26 KEY TERMS Interest on Capital Interest on Drawings Partnership Act Partnership Agreement Profit and Loss Appropriation Account Profit-sharing Ratios 27