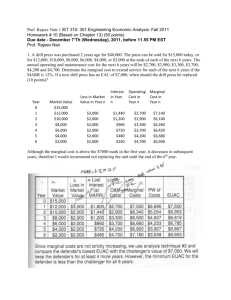

ENSC 201 Assignment 2, Due on Tuesday Sept 25, 2012

advertisement

ENSC 201 Assignment 2, Due on Tuesday Sept 25, 2012 Annuities 2.1 How much money you will earn over 12 years in a fund that pays 4% interest, if $1000 is deposited at the end of every fourth year? 2.1 Answer: At the end of 4th year we will earn $1000, its future value( at 12th year) will be: F= 1000(F/P, 4%, 8) =1000(1.3686) =$1369 At the end of 8th year we will earn $1000, its future value( at 12th year) will be: F= 1000(F/P, 4%, 4) =1000(1.1699) =$1170 At the end of 12th year we will earn $1000 Total future value will be: 1369 + 1170 +1000= $3539 I. II. III. IV. 2.2 Your MARR is A%, and there are two proposals in front of you: I) involves a large immediate investment, and yields a substantial payback at the end of three years; II) involves a fixed annual expenditure, and a (larger) annual return. Present-worth analysis ranks both equally. If the MARR now changes to B% , which proposal will you choose, if B> A, if B<A? Explain each case separately. 2.2 Answer: I. II. if B>A, case II will be more desirable, because as the MARR increase the importance of future paybacks diminishes. If B<A, case I will be more desirable, because as the MARR decreases the importance of future paybacks increases. 2.3 A company is considering purchasing a new product. It will take four years to put into operation, but at the end of the fourth year it will increase company income by $50,000, increasing by $5,000 per year for the following ten years. At the end of the fourteenth year it will be worn out and have no scrap value. If the cost of capital to the company is 20%, what is the most it is worth paying for the machine now? 2.3 Answer: If the machine started making money at the end of the current year, then its present worth would be PW = (50,000+ 5000(A/G,0.2,11))(P/A,0.2,11) But we have to wait three additional years before the money starts coming in, so the actual present worth is PW = PW(P/F,0.2,3) So the equation we have to solve is PW = (50,000 + 5,000(A/G,0.20,11))(P/A,0.20,11) (P/F,0.2,3) = (50,000 + 5,000(3.2893))(4.3271)(0.57870) = $166,388 2.4 You have decided to sell your house and buy a new one. You have an offer of $100,000 for your old house but the new house costs $300,000. Bank A offers to finance a mortgage of $200,000 at 5% annual interest; every year, you will have to pay the interest charges for that year, and repay $40,000 of the principal. Bank B offers to give you a mortgage for the entire $300,000 at 2% annual interest. Each year you will have to pay the interest on the loan, plus $50,000 of the principal. Bank C offers you $80,000 for your old house, and will then give you a mortgage on the remaining $220,000 at 10% interest per year, the principal plus accumulated interest to be paid back at the end of four years. If you sell your house and do not spend the $100,000 that you receive, you can invest it at 2% interest. Which banker should you get your mortgage from? Also solve the above problem assuming you could invest your $100,000 with 20% investment interest and choose the best deal from the above three options. 2.4 Answer: Bank A: Year 0: You sell the old house for $100K. Year 1: You pay $40,000 principal plus 200,000(0.05) interest. Year 2: You pay $40,000 principal plus (200,000-40,000) (0.05) interest. Year 3: You pay $40,000 principal plus (200,000-40,000*2) (0.05) interest. Year 4: You pay $40,000 principal plus (200,000-40,000*3) (0.05) interest. Year 5: You pay $40,000 principal plus (200,000-40,000*4) (0.05) interest, and you are done. Bank B: Year 0: You keep your $100 000 in the bank. Year 1: You pay $50 000 principal plus 300 000(0.02) interest. Year 2: You pay $50 000 principal plus (300-50)(0.02)K interest. Year 3: You pay $50 000 principal plus (300-50*2)(0.02)K interest. Year 4: You pay $50 000 principal plus (300-50*3)(0.02)K interest. Year 5: You pay $50 000 principal plus (300-50*4)(0.02)K interest. Year 6: You pay $50 000 principal plus (300 -50*5)(0.02 )K interest, and you are done. Bank C: Year 0: You will trade your house for $80K. Year 4: You pay $220 000 (F/P, 0.1,4) and you are done. Summarizing in a table: Year 0 1 2 3 4 5 6 A 0 -(40K+10K) -(40K+8K) -(40K+6K) -(40K+4K) -(40K+2K) 0 B 100K (saving) -(50K+6K) -(50K+5K) -(50K+4K) -(50K+3K) -(50K+2K) -(50K+1K) C 0 0 0 0 -220K(1.14) 0 0 You find the present worth of each of these sums, using an interest rate of 2%, and choose the smallest. This is done in the accompanying spreadsheet, 2.5.xls. We see from the spreadsheet results that Option B is by far the best. 2.5 At the beginning of the recent film, Sense and Sensibility, Mr John Dashwood and his avaricious wife, Mrs John Dashwood, are debating how he can most cheaply discharge his obligations towards his half-sister, the recently widowed Mrs Henry Dashwood and her three daughters, Elinor, Marianne and Margaret. He first considers giving her a lump sum of £2 200; then, since £2 200 seems a lot to part with in one lump, he considers paying her an annual sum of £200 for as long as she lives. But, objects his wife, although Mrs Dashwood is old, such an arrangement will encourage her to cling to life for an unreasonable time; and, should she survive for more than 10years, her half-brother will lose money by the arrangement. How long would Mrs Henry Dashwood have to live to make John Dashwood regret choosing the annuity over the lump sum, if he can invest his money at 4%? How about if the interest rate were 10%? Mr Dashwood must find the least value of N for which 2 200 < 200(P/A,4%,N) which is equivalent to finding N such that (P/A,4%,N) > 11 Consulting Appendix A, this first occurs when N = 15 years. If the interest rate is 10%, we come to the end of the table in Appendix A before finding a value of N for which (P/A,10%,N) > 11. We therefore go on to look at the capitalized value of the annuity, which is 200/0.1, or £2 000. Thus, if he can invest his money at 10%, Mr Dashwood can afford to support his widowed half-sister indefinitely for a cost equivalent to a single present payment of £2 000. 2.6 An important part of mastering engineering economics is developing an intuitive grasp of the effects of interest rate changes. You should be able to answer some questions without doing any explicit calculation, ideally within thirty seconds or less. The following is an example of such a question: My MARR is 5%. I have two proposals in front of me: Proposal A involves a large immediate investment, and yields a substantial payback at the end of four years; Proposal B involves a fixed annual expenditure, and a (larger) annual return. Present-worth analysis ranks both equally. If my MARR increases to 10%, which proposal will I favour? B. (As the MARR increases, the importance of future paybacks diminishes the further in the future they are.) 2.7 You can make monthly deposits into a savings account that pays interest at a nominal rate of 36% per year, compounded monthly. How much should you deposit each month if you want to have $ 6,000 in two years time? First find the effective monthly interest rate; it’s 3%. Now the equation you have to solve is 10000 = A(F/A,3%,24) = A(34.426) So A = 6000/34.426= 174.29 So you should save $174.29 per month. 2.8 Your company is considering purchasing a new machine. It will take four years to put into operation, but at the end of the fourth year it will increase company income by $15,000, increasing by $500 per year for the following six years. At the end of the tenth year it will be worn out and have no scrap value. If the cost of capital to the company is 12%, what is the most it is worth paying for the machine now? If the machine started making money at the end of the current year, then its present worth would be PW’ = (15,000+ 500(A/G,0.12,7))(P/A,0.12,7) But we have to wait three additional years before the money starts coming in, so the actual present worth is PW = PW’(P/F,0.12,3) So the equation we have to solve is PW = (15,000 + 500(A/G,0.12,7))(P/A,0.12,7) (P/F,0.12,3) = (15,000 + 500(2.551))(4.563)(0.711) = 19,138 So the most it’s worth paying for the machine is $19,138 2.9 You have an old car that has lasted through your student career. On getting your first job, you decide to buy a BMW. You have $10 000 saved, but the car you want costs $40 000. Dealer A offers to finance a loan of $30 000 at 3% annual interest; every year, you will have to pay the interest charges for that year, and repay $5 000 of the principal. Dealer B offers to loan you the entire $40 000 at 1.5% annual interest. Each year you will have to pay the interest on the loan, plus $8 000 of the principal. Dealer C offers you $8 000 trade-in on your old car, and will loan you the remaining $22 000 at 15% interest per year, the principal plus accumulated interest to be paid back at the end of four years. If you don't trade in the old car, the maximum price you can get for it is $2 000. If you do not spend your $10 000 savings, you can invest them at 12% interest. Which dealer should you buy your car from? In solving this, the essential thing is to get a fair basis of comparison between the three alternatives. If all three alternatives have a cashflow in common, you do not need to represent that cashflow explicitly. So, on all three options you have the BMW and you do not have the old car. (You have either sold it or traded it in.) In option A, you have $2 000 from selling the old car; in option B, you have the $10 000 you saved, plus $2 000 from selling the old car; in option C, you have nothing. (You can add or subtract the same quantity from each of the Year Zero figures without affecting the solution.) We write down the annual cashflows for each option: Dealer A: Year 0: You sell the old car for $2 000 salvage value. Year 1: You pay $5 000 principal plus 40 000(0.03) interest. Year 2: You pay $5 000 principal plus 35 000(0.03) interest. Year 3: You pay $5 000 principal plus 30 000(0.03) interest. Year 4: You pay $5 000 principal plus 25 000(0.03) interest. Year 5: You pay $5 000 principal plus 20 000(0.03) interest. Year 6: You pay $5 000 principal plus 15 000(0.03) interest, and you are done. Dealer B: Year 0: You sell the old car for $2 000 salvage value and keep your $10 000 in the bank. Year 1: You pay $8 000 principal plus 40 000(0.015) interest. Year 2: You pay $8 000 principal plus 32 000(0.015) interest. Year 3: You pay $8 000 principal plus 24 000(0.015) interest. Year 4: You pay $8 000 principal plus 16 000(0.015) interest. Year 5: You pay $8 000 principal plus 8 000(0.015) interest, and you are done. Dealer C: Year 0: You get nothing. Year 4: You pay $30 000 (F/P, 0.15,4) and you are done. Summarizing in a table: Year A B 0 2 000 (salvage) 1 2 3 4 5 6 -(5 000+1 200) -(5 000+1 050) -(5 000+900) -(5 000+750) -(5 000+600) -(5 000+450) C 12 000 (savings plus salvage) -(8 000+600) -(8 000+480) -(8 000+360) -(8 000+240) -(8 000+120) 0 0 0 0 0 -30 000(1.154) 0 0 You find the present worth of each of these sums, using an interest rate of 12%, and choose the smallest. This is done in the accompanying spreadsheet, 2.5.xls. We see from the spreadsheet results that Option B is by far the best.