Meeting 4 - HawkTrade

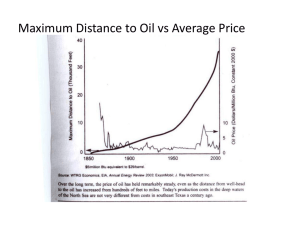

advertisement

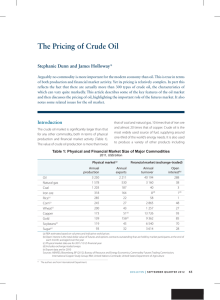

THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION DISCUSSED DURING HAWKTRADE MEETINGS. Past performance does not guarantee future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Investing in any financial instruments does not guarantee that an investor will make money, avoid losing capital, or indicate that the investment is risk-free. There are no absolute guarantees in investing. HAWKTRADE and its members do not bear any responsibility for losses or gains made by members trading on their personal accounts based on analysis from HAWKTRADE meetings. Investment Competition MacroEcon Data/ Global Issues Libya Political Unrest DATAPALOOZA Ends the Week before Finals $50,000 in cash to invest No more than 1/3 of portfolio in one stock 1st Place = iPad Airtime: Fri. Feb. 25 2011 | 11:35 AM ET Industry Summaries Current/ Projected Populations Where’s the demand? Inflation Rates Affect how much money is lent out Affects international trade Unemployment & Income levels High employment means more production The higher the average income, the more consumption Data to Keep an Eye on: Exchange Rates Data Performance Compared to Expectations Consumer Confidence 70.4 Above Existing Home Sales +12.5% Above Durable Goods Orders 2.7% Below New Jobless Claims 391,000 Better New Home Sales 284,000 Below Real GDP +2.8% Below The World is becoming more Globalized What happens in Greece affects the US What happens in the Middle East affects Europe Seriousness of Political Unrest Gaddafi’s 41 year rule is being challenged by Antigovernment forces Over 1,000 people killed. Libya on average has produced 1.6 Million crude oil barrels/day Now only producing 400,000 Different from Egypt? Airtime: Fri. Feb. 25 2011 | 6:24 PM ET Gaddafi Cornered What happens now? Claims they can ramp up production to meet demands Much wealthier country, less risk for political unrest Announced that they plan to spend $37 billion on their people Unemployed/ poor BRENT Crude is the European Warehouse U.S. WTI Crude is the U.S Stockpile BRENT is generally higher because Europe doesn't have as much reserves as the U.S. does. BRENT hit $120 a barrel in the last week, while WTI only hit like $103 Brent Crude: The global price benchmark Record High: July 2008 at $150/ barrel Past Thursday: $120/ barrel If Brent moves past $130 we should experience demand elasticity. Airtime: Fri. Feb. 25 2011 | 8:04 AM ET Saudi to Hike Oil Production For every $10 increase in crude oil, GDP decreases by 0.5% Oil in Q4 of 2010 was $85 / barrel, U.S. WTI crude now, it's $97 a barrel Q4 GDP was revised down Friday to 2.8% from 3.3% They say oil prices at $105 a barrel would most likely make U.S. GDP 1.8% OPEC- 12 countries (includes Libya) 79% Worlds known reserves 44% Worlds Oil Production US Crude Oil Import Quantities 1st 2nd 3rd Canada Mexico Saudi Arabia 2064 Thousand 1223 Thousand 1076 Thousand http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/company_level_imports/current/import.html Is oil overbought? Or will the price continue to rise?