Lecture 13 Slides

advertisement

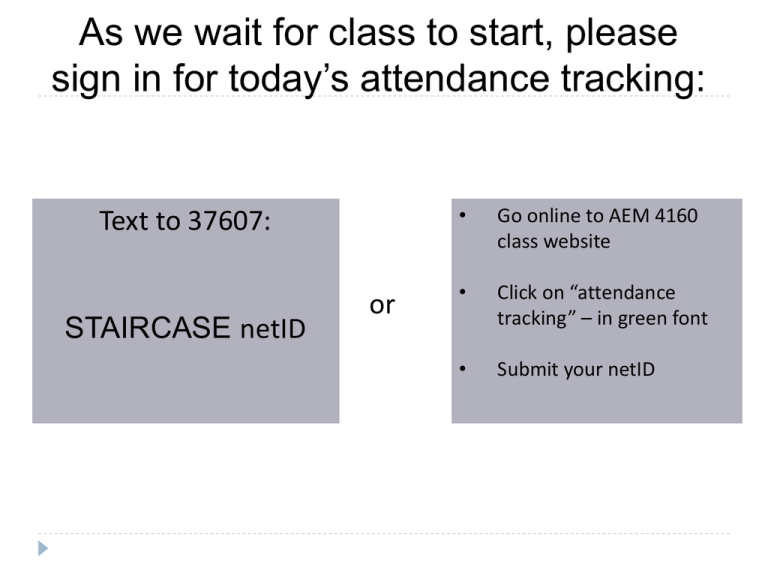

As we wait for class to start, please

sign in for today’s attendance tracking:

Text to 37607:

STAIRCASE netID

or

•

Go online to AEM 4160

class website

•

Click on “attendance

tracking” – in green font

•

Submit your netID

Lecture 13:

Advanced Booking and Capacity Constraints

AEM 4160: Strategic Pricing

Prof. Jura Liaukonyte

2

Lecture Plan

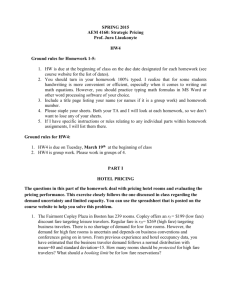

HW3, HW 4

Exam 2

Finish Gardasil

Advanced Booking

Calculating Cost per QALY

Cost Per QALY = Cost of a quality life year

Step 1: Consider the costs per person:

Cost per dose: ___________________

Cost per administration:_____________

Number of doses: _____________________

Total cost per patient: __________________

Step 2

Additional QALYs per person

At age 50, further life expectancy without cervical cancer:______

QALY per year: __________________________________________

Total QALYs: ____________________________________________

At age 50, further life expectancy with cervical cancer: ________

QALY per year: ___________________________________________

Total QALYs: _____________________________________

Step 2

Reduction in QALYs with cervical cancer:_________________

Gardasil prevents:______________________________

Gardasil incremental QALYs: ________________

Chance of Getting cervical cancer without Gardasil: _________

Incremental QALYs per person: _______________________

Cost per QALY:

Vaccination: _____________________________________

QALY: ____________________________________

Cost per QALY:___________________________

Step 2a

This was a rough calculation because it left out an

important piece of a puzzle:

COST SAVINGS

Fewer Pap tests

Fewer LLETZ procedures

Fewer cervical cancers to treat

Step 2a

Calculate COST savings

Chance that a woman will have CIN 1: ______________

Chance that a woman will have CIN 2/3:______________

Chance that a woman will have cervical cancer: ___________

Cost to treat CIN 1: ________$55______________

Cost to treat CIN2/3: _____________________

Cost to treat cervical cancer: ________________

Saved Costs per person

CIN 1: __________________________________

CIN 2/3: ________________________________

Cervical cancer: ___________________________

Gardasil will prevent (estimates):

CIN 1: 50%

CIN 2: 70%

Cervical Cancer: 70%

Calculate Total Savings:

CIN 1: ____________________

CIN 2/3: ____________________

Cervical cancer: _________________

TOTAL SAVINGS: ______________________

Savings Now or Later?

Vaccine given (average or target): __________

Cancer prevents: _______________

Difference: ___________________

Discount the cost savings at say, 8% = $16.50

In excel the command would be: =PV(0.08, 43, ,-450.2)

Savings later

So the total is:

Cost per person: _______________

Savings per person: ___________

QALY per person: 0.038

COST per QALY:__________________

Do the risks of a PR backlash and the need to grow quickly outweigh

the benefits of a higher price

Potential entrant is coming (Cervarix approved by FDA in 2009)

Patent is not forever

$360 Too Low or Too High?

Suppose prices are set so that cost of QALY is $30,000

What is the maximum price that could be set?

x = cost per person

_____________________

_____________________

_____________________

Advanced Booking and Capacity Constraints

1

4

Dynamic Pricing

Dynamic pricing is a blanket term for any shopping

experience where the price of an item fluctuates

frequently based on complicated algorithms.

A retailer might frequently change the price of an item

based on consumer demand, price fluctuations at a

competing retailer, or even the time of day and weather

conditions.

Dynamic pricing can be found in a wide variety of

industries.

Dynamic Pricing

One segment on the rise with dynamic pricing is

professional sports with Real Time Pricing.

E.g., the St. Louis Cardinals set their ticket price algorithms

based on factors like team performance, pitching match ups,

weather, and ticket demand.

Dynamic Pricing

In certain grocery stores, the price consumers pay for the

exact same product can differ based on personal data

collected through loyalty card programs.

At a Safeway in Denver, a 24-pack of Refreshe bottled water

costs $2.71 for Customer A. For Customer B, the price is

$3.69.

The difference? The vast shopping data Safeway maintains on

both customers through its loyalty card program.

Customer A has a history of buying Refreshe brand products,

but not its bottled water, while customer B, a Smartwater

partisan, is unlikely to try Refreshe.

A Safeway Web site shows Customer A the lower price, which is

applied when she swipes her loyalty card at checkout

Some U.S. airline industry observations

From 95-99 (the industry’s best 5 years ever) airlines earned

3.5 cents on each dollar of sales:

The US average for all industries is around 6 cents.

From 90-99 the industry earned 1 cent per $ of sales.

Carriers typically fill 72.4% of seats while the break-even load

is 70.4%.

0

250

500

750

1000

American: DFW-LAX All Tickets Sold in 2004Q4

0

3

7

14

Days Purchased in Advance

Roundtrip Fare

Average Fare

21

The “Prime Booking Window”

Don’t buy your ticket too early!

Best time to buy your ticket is 54 days in advance

Advanced Selling

Requires an inverse relationship between consumer price

sensitivity and customer arrival time.

Less price sensitive customers are unwilling to purchase

in the advance period so that advance purchases are

made to only low-valuation customers

Similar to traditional models of second-degree price

discrimination.

Advanced Booking

Consumers making reservations differ in their probability

of showing up to collect the good or the service at the

pre-agreed time of delivery.

Firms can save on unused capacity costs, generated by

consumers’ cancellations and no-shows, by varying the

degree of partial refunds

Airline companies in selling discounted tickets where

cheaper tickets allow for a very small refund (if any) on

cancellations,

Whereas full-fare tickets are either fully-refundable or subject

to low penalty rates.

Advanced Booking and Partial Refunds

Partial refunds are used to control for the selection of

potential customers who make reservations but differ

with respect to their cancellation probabilities.

Capacity Constraints

Examples of fixed supply – capacity constraints:

Travel industries (fixed number of seats, rooms, cars, etc).

Advertising time (limited number of time slots).

Telecommunications bandwidth.

Size of the Dyson business program.

Doctor’s availability for appointments.

The Park Hyatt Philadelphia

118 King/Queen rooms.

Hyatt offers a rL= $159 (low fare)

discount fare targeting leisure travelers.

Regular fare is rH= $225 (high fare)

targeting business travelers.

Demand for low fare rooms is abundant.

Let D be uncertain demand for high fare

rooms.

Assume most of the high fare (business)

demand occurs only within a few days of

the actual stay.

Objective: Maximize expected revenues

by controlling the number of low fare

rooms sold.

Yield management decisions

The booking limit is the number of rooms to sell in a fare class or lower.

The protection level is the number of rooms you reserve for a fare class or

higher.

Let Q be the protection level for the high fare class. Q is in effect while selling

low fare tickets.

Since there are only two fare classes, the booking limit on the low fare class is

118 – Q:

You will sell no more than 118-Q low fare tickets because you are

protecting (or reserving) Q seats for high fare passengers.

0

118

Sell no more than the low

fare booking limit, 118 - Q

Q seats protected for

high fare passengers

The connection to the newsvendor

A single decision is made before uncertain demand is realized.

There is an overage cost:

If D < Q then you protected too many rooms (you over protected) ...

… so some rooms are empty which could have been sold to a low fare

traveler.

There is an underage cost:

D: Demand for high fare class;

Q: Protection level for high fare class

If D > Q then you protected too few rooms (you under protected) …

… so some rooms could have been sold at the high fare instead of the low

fare.

Choose Q to balance the overage and underage costs.

“Too much” and “too little” costs

As Q increases => Overage costs increase

As Q increases => Underage costs decrease

Overage cost:

If D < Q we protected too many rooms and earn nothing

on Q - D rooms.

We could have sold those empty rooms at the low fare,

so Co = rL.

Underage cost:

If D > Q we protected too few rooms.

D – Q rooms could have been sold at the high fare but

were sold instead at the low fare, so Cu = rH – rL

Balancing the risk and benefit of

ordering a unit

As Q increases by one more unit, the chance of overage increases

Expected loss on the Qth unit = Co x F(Q), where F(Q) = Prob{Demand <= Q)

Essentially: overage costs multiplied by probability of overage costs happening

The benefit of ordering one more unit is the reduction in the chance of

underage:

Expected benefit on the Qth unit = Cu x (1-F(Q))

Essentially: underage costs multiplied by probability of underage costs happening

As more units are ordered,

the expected benefit from ordering one unit decreases

while the expected loss of ordering one more unit increases.

Expected gain or loss

.

Graphical Analysis

Expected marginal benefit

of understocking

Expected marginal loss

of overstocking

Units

Expected profit maximizing order quantity

To minimize the expected total cost of underage and overage,

order Q units so that the expected marginal cost with the Qth unit

equals the expected marginal benefit with the Qth unit:

Co F (Q) Cu 1 F Q

Cu

F (Q )

C o Cu

Rearrange terms in the above equation ->

The ratio Cu / (Co + Cu) is called the critical ratio.

Hence, to minimize the expected total cost of underage and

overage, choose Q such that we don’t have lost sales (i.e., demand

is Q or lower) with a probability that equals the critical ratio

Optimal protection level

Optimal high fare protection level:

Optimal low fare booking limit = 118 – Q*

Choosing the optimal high fare protection level is a Newsvendor

problem with properly chosen underage and overage costs.

Recall: Co = rL; Cu = rH – rL

F (Q* )

Cu

r r

H L

Co Cu

rH

Hyatt example

Critical ratio:

Cu

r r 225 159 66

h l

0.2933

Co Cu

rh

225

225

Demand for high fare is uncertain, but has a normal distribution with a

mean of 30 and Standard deviation of 10.

See the Excel File Posted on the course website for calculations.

You can use normdist(Q,mean,st.dev, 1)=0.29 Excel function to solve for Q

(see column E).

Answer: 25 rooms should be protected for high fare travelers.

Similarly, a booking limit of 118-25 = 93 rooms should be applied

to low fare reservations.

WE DID NOT COVER OVERBOOKING, SO IT WILL

NOT BE ON THE TEST

Revenue Management:

Overbooking

Hold the reservation!

http://www.youtube.com/watch?v=o4jhHoHpFXc&featur

e=related

Ugly reality: cancellations and noshows

Approximately 50% of reservations get cancelled at some

point in time.

In many cases (car rentals, hotels, full fare airline passengers)

there is no penalty for cancellations.

Problem:

the company may fail to fill the seat (room, car) if the passenger

cancels at the very last minute or does not show up.

Solution:

sell more seats (rooms, cars) than capacity.

some customers may have to be denied a seat even though they

have a confirmed reservation.

Passengers who get bumped off overbooked domestic flights to

receive

Danger:

If the airline is not able to get you to your final destination within one hour of your original

arrival time, the airline must pay you an amount equal to 200% of your one-way fare, with a

maximum of $650.

According to usa.gov

Hyatt’s Problem

The forecast for the number of customers that do not show up

( X ) is Normal distribution with mean 9 and Standard Deviation

3.

The cost of denying a room to the customer with a confirmed

reservation is $350 in ill-will (loss of goodwill) and penalties.

How many rooms (y) should be overbooked (sold in excess of

capacity)?

setup:

Single decision when the number of no-shows in uncertain.

Insufficient overbooking: Overbooking demand=X>y=Overbooked

capacity.

Excessive overbooking: Overbooking demand=X <y=Overbooked

capacity.

Overbooking solution

Underage cost when insufficient overbooking

Overage cost when excessive overbooking

if X >Y then we could have sold X-Y more rooms…

… to be conservative, we could have sold those rooms at the low

fare, Cu = rL.

if X <Y then we bumped Y-X customers …

… and incur an overage cost Co = $350 on each bumped customer.

Optimal overbooking level:

Critical ratio:

F (Y )

Cu

.

Co Cu

Cu

159

0.3124

Cu Co 350 159

Optimal overbooking level

Normal Distribution

Mean=9

Standard Dev. 3

Optimal number of overbooked rooms is Y=7.

Hyatt should allow up to 118+7 reservations.

There is about F(7)=25.24% chance that Hyatt will find itself

turning down travelers with reservations.