Accounting Ch 10 and 11

advertisement

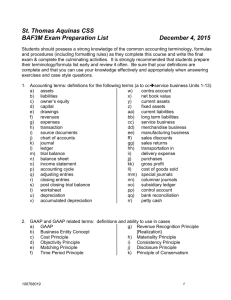

Chapters 10 Partnership A business with two or more owners combining their assets and skills Partner Each member/owner of a partnership Lesson 10.1 Merchandising A business that purchases and sells goods Retail Business Merchandising Business A merchandising business that sells to those who use or consume the goods Merchandise Goods that a merchandising business purchases to sell Wholesale Merchandising Business A business that buys and resells merchandise to retail merchandising businesses 5-Column vs. 11-Column The number of amount columns Encore Music – 5-Column Journal Omni Imports – 11-Column Journal New special amount columns: A/R, A/P, Purchases Dr., Sales Tax Payable Cr. Special amount columns For accounts that are used frequently To save time and space Cost of Merchandise/Cost of Goods Sold (COGS) The price a business pays for goods it will sell Markup The amount added to the cost of merchandise to establish the selling price Vendor The business which merchandise, supplies, or other assets are bought CONCEPT: Historical Cost Amount paid for merchandise or other items bought is recorded Cost account Because it is in the cost of merchandise division of the chart of accounts Purchases Debit Look at Omni Imports Chart of Accounts on p. 225 Temporary Account ONLY merchandise purchases (not supplies or any other purchase) normal Credit Purchases November 1 Purchased merchandise for cash, $575.00. Check No. 290. 575.00 Cash 575.00 Page 232 Lesson 10-2 Purchase An invoice used as a source document for recording a purchase on account transaction Created by the vendor Omni Imports give the invoice its own number Terms Invoice of Sale An agreement between a buyer and seller about payment for merchandise Ex: 30days (payment is due within 30 days of the vendor’s date of the invoice) Purchases November 2 Purchased merchandise on account from Crown Ltd., $2,039.00. Purchase Invoice No. 83. 2,039.00 Accounts Payable 2,039.00 Supplies - Office November 5 Paid cash for office supplies, $34.00. Check No. 292 Office Supplies are supplies used in general business operations (paper, pens, price tags, etc.) 34.00 Cash 34.00 Supplies - Store November 6 Bought store supplies on account from Foxfire Supply, $210.00. Memorandum No. 52 An invoice is received from the vendor when buying on account, to avoid confusion a memo is attached and used as the source document 210.00 Accounts Payable 210.00 Page 237 Lesson 10-3 Accounts Payable November 7 Paid cash on account to Pacific Imports, $1,050.00, covering Purchase Invoice No. 81. Check No. 294 Check no. is used as the source doc because it is our source 1,050.00 Cash 1,050.00 Advertising Expense November 9 Paid cash for advertising, $150.00. Check No. 296. 150.00 Cash 150.00 Supplies - Office November 9 Paid cash to replenish the petty cash fund, $205.00: office supplies, $35.00; store supplies, $47.00; advertising, $92.00; miscellaneous, $31.00. Check No. 297 35.00 Supplies - Store 47.00 Advertising Expense 92.00 Miscs Expense 31.00 Cash 205.00 Michelle Wu, Drawing November 10 Michelle Wu, partner, withdrew cash for personal use, $1,200.00. Check No. 298. 1,200.00 Cash 1,200.00 Karl Koehn, Drawing November 12 Karl Koehn, partner, withdrew merchandise for personal use, $300.00. Memorandum No. 53. 300.00 Purchases 300.00 Page 243 and 246 Chapter 11 Sales Tax Payable Customer A person or business to whom merchandise or services are sold Sales Debit Credit Tax A tax on a sale of merchandise or services Price of Goods x $300.00 x Price of Goods $300.00 Sales Tax Rate normal = Sales Tax 6% = $18.00 + Sales Tax = Total Amt Received + $18.00 = $318.00 Lesson 11.1 CONCEPT: No matter when payment is made revenue is recorded at the time of sale Cash Sale A sale where cash is received at the time of sale Credit Card Sale A sale where a credit card is used at the time of sale Major bank approved credit cards: VISA, MasterCard, Discover Credit Realization of Revenue card slip Totaled and recorded at the end of each week Source Document – Cash Register Tape 1. 2. 3. 4. 5. 6. 7. Omni Imports creates a cc slip for each cc sale All cc slips sent to bank each week with weekly deposit to Omni’s bank Omni’s bank accepts the cc slips the same way it accepts cash for deposit If a cc was issued by another bank, Omni’s bank sends the cc slip to the issuing bank The issuing bank bills the customer and collects the amount owed The bank that accepts and processes the cc slip for a business charges a fee for the service The fee is included on Omni’s monthly bank statement November 4 Recorded cash and credit card sales, $5,460.00, plus sales tax, $327.60; total $5,787.60. Cash Register Tape No. 4. Cash & cc sales recorded in same deposit Cash Register Tape is numbered based on the day of the month (T4) The month of November started on a Wednesday – short week of sales Cash 5,787.60 Sales 5,460.00 Sales Tax Payable 327.60 Sale on account A sale where cash is received later Invoice Prepared when merchandise is sold on account Describes the goods, quantity, and price Sales Invoice - Source document for recording a sale on account (CONCEPT: Objective Evidence) 3 A.k.a. – sales ticket, sales slip copies: Customer, Shipping Dept., Accounting Dept. November 3 Accounts Receivable Sold merchandise on account to Children’s paradise, $816.00, plus sales tax, $48.96; total, $864.96. Sales Invoice No. 76. Sales Even though cash is not received yet we still record the sale (CONCEPT: Realization of Revenue) 864.96 816.00 Sales Tax Payable 48.96 November 6 Received cash on account from Fiesta Costumes, $2,162.40, covering $69. Receipt No. 90. Omni prepares a receipt whenever cash is received and uses it as the source document 2 copies: customer, accounting dept. Cash 2,162.40 Accounts Receivable 2,162.40 Page 259 Lesson 11.2 Prove a Journal Rule single line above last line of all amount columns Date Write “Carried Forward” in the account title column Check mark in “Post. Ref.” column Total all amount columns below single underline Verify that the Debits = Credits using the form on page 260 Double underline below all totals in the amount columns 1. 2. 3. 4. 5. 6. 7. Account totals are verified as correct Bring amounts forward to next Journal page 1. 2. 3. 4. 5. Write the new Journal page number on both pages of journal (expanded journal goes on two pages) Date (same as last line of previous page) Write “Brought Forward” in the account title column Check mark in “Post. Ref.” column Bring all totals forward from previous journal page Prove the Journal page at the end of the month 1. 2. 3. 4. 5. Single underline “Totals” written in account title column Total all amount columns Verify that the Debits = Credits using the form on page 260 Double underline below totals Prove Using the form on page 264: 1. 2. 3. cash at the end of the month Add all cash received during the month (Cash debit column) to the previous cash balance and subtotal Subtract all cash spend during the month (Cash credit column) to the subtotal and total Match this amount with the amount on your last unused check stub Cash balance on your Journal MUST agree with the cash balance on your last unused check stub Page 266