File - Business at Sias

advertisement

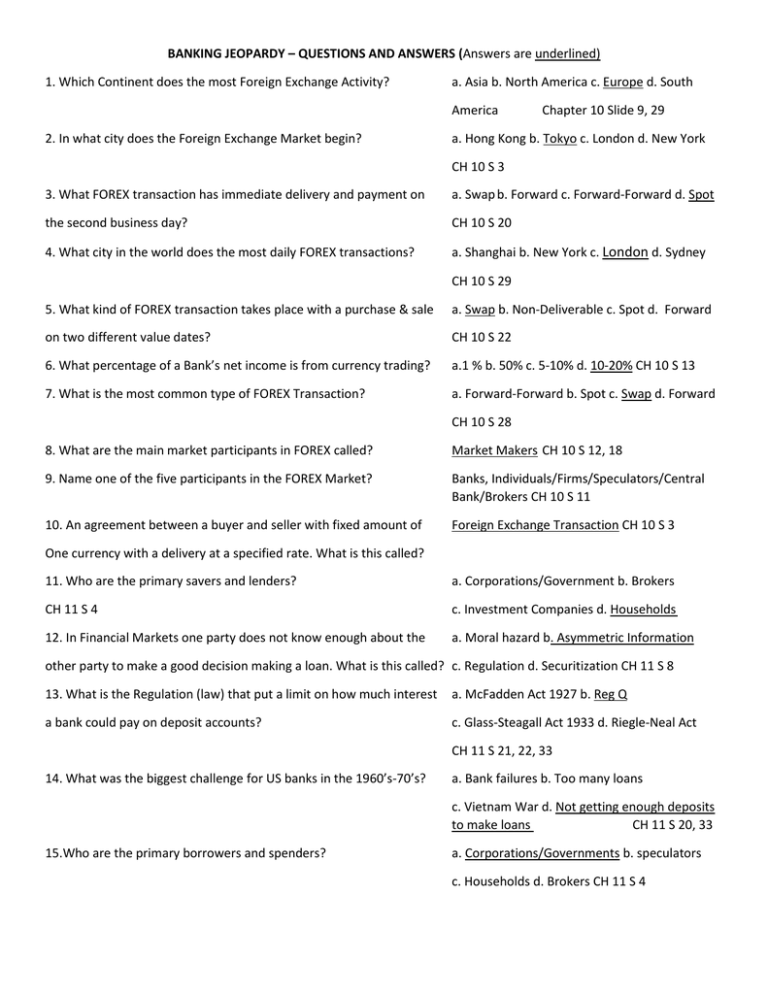

BANKING JEOPARDY – QUESTIONS AND ANSWERS (Answers are underlined) 1. Which Continent does the most Foreign Exchange Activity? a. Asia b. North America c. Europe d. South America 2. In what city does the Foreign Exchange Market begin? Chapter 10 Slide 9, 29 a. Hong Kong b. Tokyo c. London d. New York CH 10 S 3 3. What FOREX transaction has immediate delivery and payment on a. Swap b. Forward c. Forward-Forward d. Spot the second business day? CH 10 S 20 4. What city in the world does the most daily FOREX transactions? a. Shanghai b. New York c. London d. Sydney CH 10 S 29 5. What kind of FOREX transaction takes place with a purchase & sale a. Swap b. Non-Deliverable c. Spot d. Forward on two different value dates? CH 10 S 22 6. What percentage of a Bank’s net income is from currency trading? a.1 % b. 50% c. 5-10% d. 10-20% CH 10 S 13 7. What is the most common type of FOREX Transaction? a. Forward-Forward b. Spot c. Swap d. Forward CH 10 S 28 8. What are the main market participants in FOREX called? Market Makers CH 10 S 12, 18 9. Name one of the five participants in the FOREX Market? Banks, Individuals/Firms/Speculators/Central Bank/Brokers CH 10 S 11 10. An agreement between a buyer and seller with fixed amount of Foreign Exchange Transaction CH 10 S 3 One currency with a delivery at a specified rate. What is this called? 11. Who are the primary savers and lenders? a. Corporations/Government b. Brokers CH 11 S 4 c. Investment Companies d. Households 12. In Financial Markets one party does not know enough about the a. Moral hazard b. Asymmetric Information other party to make a good decision making a loan. What is this called? c. Regulation d. Securitization CH 11 S 8 13. What is the Regulation (law) that put a limit on how much interest a. McFadden Act 1927 b. Reg Q a bank could pay on deposit accounts? c. Glass-Steagall Act 1933 d. Riegle-Neal Act CH 11 S 21, 22, 33 14. What was the biggest challenge for US banks in the 1960’s-70’s? a. Bank failures b. Too many loans c. Vietnam War d. Not getting enough deposits to make loans CH 11 S 20, 33 15.Who are the primary borrowers and spenders? a. Corporations/Governments b. speculators c. Households d. Brokers CH 11 S 4 16. A structure or system where funds flow indirectly into markets a. Secondary Market b. Institutionalization through Intermediaries. What is this called? c. Central Bank FED d. Securitization CH 11 S 27,34 17. What problem does a bank have before making a loan? Adverse Selection CH 11 S 10, 32 18. What is one of the 3 main reasons for financial intermediation? Reduce costs, Portfolio diversification, Information CH 11 S 5, 32 19. What problems do banks have after a loan? Moral Hazard 20. The birth of ___________ funds was developed in the US in 1971 Money Market Mutual Funds CH 11 S 23 CH 11 S 11, 32 To give savers and investors higher interest rates 21. What is the main source of bank capital? a. Stocks b. Buildings c. Employees d. Deposit acounts CH 12 S 12 22. What is the net income after taxes as a percentage (%) of assets? a. Return on equity (ROE) b. Net Interest Margin c. Liability d. Return on Assets (ROA) CH 12 S 17 23. What did the Gramm-Leach Bliley Act 1999 allow banks to do? a. Open banks across state lines b. Securitization c. Gamble d. Commercial banks and investment banks could work together. CH 12 S 30 24. A person cannot pay back their loan is what type of risk? a. Trading b. Leverage c. Credit d. Interest Rate CH 12 S 20 25. What happened to deposit accounts in the US the last 30 years? a. Went to China b. decreased c. Increased d. No change CH 12 S 6, 8 26. The difference between total interest income and total interest Net Interest Income CH 12 S 13 expense is___________________________ 27. What is an example of a NON-Bank Depository Institution? A Credit Union or Savings and Loan CH 12 S 35,36 28. What are the sources of bank funds? Liabilities 29. A changing interest rate is what type if risk? Interest rate risk CH 12 S 21 30. Banks are more efficient as they get bigger – what is this called? Economies of Scale Ch 12 S 28 CH 12 S 2 31. What do Mutual Fund Companies help people and managers do to a. Spend it b. Eat it c. Diversify and share risk invest money? d. Reduce costs CH 13 S 14 32. Which Nondepository Institution helps businesses get started? a. Property & Casualty Insurance b. Bank c. Life Insurance Co d. Venture Capital CH 13 S 23 33. Life Insurance & Pension Companies invest in what type of a. Short term bonds b. Mutual funds Securities? c. Stocks d. Long term bonds CH 13 S 7 34. What is the table called to determine Life Insurance Rates? a. Amortization table b. Ping Pong table c. Actuarial table d. Gambling table CH 13 S 18 35. What is one type of Life Insurance called? a. Pension b. Term c. Mutual Fund d. Defined benefit plan CH 13 S 5, 6 36. What is another name for Pension Funds a. Property & Casualty b. Whole Life c. Retirement d. Mutual Funds CH 13 S 9 37. Newly issued stocks are sold in the ________________Market Primary CH 13 S 19 38. A “pool” of funds from many different companies – what are these Mutual fund CH 13 S 14 Called? 39. What is one type of Nondepository institution called? Life Insurance, Pension, Mutual Fund, Finance, Property and Casualty, Investment Co, Venture Capital CH 13 S 2 40.What kind of policy protects a family when a policy holder dies? Life Insurance policy CH 13 S 3 41. What is the type of risk that puts debt and equity together to a. Credit b. Leverage c. Liquidity Purchase assets? d. Property Insurance CH 12 S 19 42. Commercial Banks & Investment Banks together form what kind of a. Financial Holding Co b. Hedge Fund Co Company? c. Life Insurance Co d. Credit Union CH 13 S 24 43. What kind of company is known for personal/commercial loans a. Bank b. Mutual Fund c. Pension Fund d. Finance Company CH 13 S 17 44. The regulation that allows banks to operate in all 50 states? a. Reg Q b. Glass-Steagle Act 1933 c. Reg S d. Riegle-Neal Interstate Act 1994 CH 12 S 25 45. What are he uses of bank funds? Assets CH 12 S 2 46. Banks offering many different products is called what? Economies of scope 47. What is net income after taxes divided by equity capital Return on Equity (ROE) CH 12 S 17 48. How did US banks replace the loss of deposit accounts? What is introduction of mutual funds, pension funds, discount loans from the FED Ch 12 S 9,10 CH 12 S 28