Lecture 3 Chapter 3

advertisement

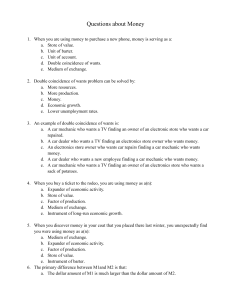

Lecture What Is Money? Chapters 3 Learning Objectives • Describe what money is • List and summarize the functions of money • Identify different types of payment systems • Compare and contrast the M1 and M2 money supplies Meaning of Money • Money – anything that is generally accepted in payment for goods or services, taxes or in the repayment of debts. • Its an asset that can be used to make transactions. • Money is different from wealth - the total collection of pieces of property that serve to store value. – Money is a component of wealth. • Money is a “stock” concept. It is different from income which is a flow concept measured per unit of time. Medium of Exchange • The alternative to money is barter. – For economic exchanges to occur using barter, ____________________ must exist. Coincidence of Wants Farmer wants haircut Cook wants furniture Mover needs to eat needs to move Writer wants corn Carpenter wants to read a novel Barber Three Functions of Money 1) Medium of Exchange: – Eliminates the trouble of finding a double coincidence of needs (reduces transaction costs) – Promotes specialization – A medium of exchange must • • • • • be easily standardized be widely accepted be divisible be easy to carry not deteriorate quickly Three Functions of Money (2) Store of Value: – used to transfer purchasing power over time. • other assets also serve this function. • Money is the most liquid of all assets but loses value during inflation (3) Unit of Account: – used to measure value in the economy Inseparability of the Store-of-Value and Mediumof-Exchange Functions – Hyperinflation Example • During hyperinflation, individuals and firms frantically attempt to get rid of money because its value deteriorates rapidly - money fails as a store-of-value! • Merchants refuse to accept payment in money, insisting instead on payment in goods and services - money fails as a medium-of-exchange! • For money to function as a means of payment it must durable and capable of transferring purchasing power from one day to the next. Liquidity • Measure of the ease an asset can be turned into a means of payment (money) • An asset is liquid if it can be easily converted into money and illiquid if it is costly to convert. – Cash is perfectly liquid. – Stocks and bonds are somewhat less liquid. – Land is illiquid. Evolution of the Payments System • Commodity Money: valuable, easily standardized and divisible commodities (e.g. precious metals, cigarettes) • Fiat Money: paper money decreed by governments as legal tender Measuring Money • Which particular assets can be called “money”? • Monetary aggregates (M1 and M2) are constructed using the concept of liquidity: M1 (the most liquid assets) M1 = currency + demand deposits + other checkable deposits + traveler’s checks . Measuring Money • M2 money adds to M1 other assets that are not so liquid, but easily converted to M1. • M2 = M1 + small denomination time deposits + savings deposits and money market deposit accounts + retail money market mutual fund shares. Government Money Private Money http://www.federalreserve.gov/releases/h6/ current/default.htm M1 vs. M2 • Which measure to use? • M1 and M2 can move in different directions in the short run (see figure). Growth Rates of the M1 and M2 Aggregates, 1960–2011 Note change after early 1980s What happened in the 80’s • High and rapid inflation in the1980’s and high nominal interest rates • Checking accounts pay zero interest. New financial products introduced – Major innovation was the introduction of the money market mutual funds. – Funds shift from checking accounts (the M1 component of M2) to money market accounts (non-M1 component of M2). – The new money market accounts made M2 more liquid, so M2 looked at by analysts. Where Are All the U.S. Dollars? • Currency = $1.3 trillion. • Population is 321 million • $4,050 of U.S. currency held per person in the United States. • Where are all these dollars and who is holding them?