Money & Banking

advertisement

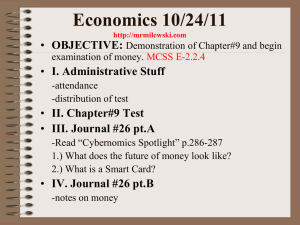

Money & Banking History of Money Most early societies operated on a barter system. Goods and services were exchanged for items of tangible value. Societies eventually evolved to the use of commodity money or fiat money. This was brought upon by the realization by goldsmiths (the original bankers) that money could be created so long as their own precious metal deposits remained relatively stable. History of Money This system of money creation was essentially flawed in that it could be abused out of greed or manipulated for profit. It would become necessary for governments to oversee the money supply and set rules and regulations for banks to abide by. These rules have been altered dramatically, and the greed and corruption are still present. The power to control it has simply shifted. Early Banking Examples The Knights Templar were able to provide security for much of the gold in and around Europe after the Crusades. This allowed them to enter the world of banking by issuing usury notes in exchange for deposited treasure. Functions of Money Medium of Exchange – any time you buy something, money is operating as this Measure of Value – common system that all agree on that places value on goods and services Store of Value – the ability to save, money must hold it value over time so that savings can be accumulated Gradual Change The barter system was not completely eliminated however as it still remained common for individuals to trade items of value. Colonial America was no different. Tea, tobacco, gun powder are examples of commonly exchanged items. Tobacco even became so common that it was accepted as commodity money as well. Cost of Tobacco - 3 shillings per pound Money in Early Societies Commodity Money – money that has an alternate use as an economic good, or a commodity. Examples: ancient Chinese compressed tea leaves & early Russian dried cheese & meats Fiat Money – money by government decree. Money doesn’t have enough value to be considerd valuable on its own. Examples: modern money and ancient coins Money in Early America Continental Dollars – Used to financed the Revolutionary War, printed by the Continental Congress, no gold or silver backing, 550 million in circulation by the end of the war, virtually worthless . Specie Money Coins also existed and were the most desired form of money due to their limited supply and because they were made from actual precious metal. Origins of the Dollar The Spanish peso was the most common form of currency in America at the time that Washington took office. This was a result of the Spanish mining silver in Mexico and engaging in a triangle of trade with the U.S. that involved molasses, slaves, and silver. This led to abundant supplies of all three in the colonies. Origins of the Dollar The U.S. then created its own “peso” borrowing also from the Austrian “taler” essentially creating the U.S. dollar. Characteristics of Money Portability – Has to be accessible to be effective in a consumer driven economy Durability – Must hold up over repeated use and constant handling Divisibility – Be able to “change” Limited Availability – Too much money in circulation devalues quickly Monetary Standards Several have existed for the U.S. throughout history. After the disaster that was the Continental Dollar, private banks in the newly formed states began issuing their own currency. Results were the same. Unregulated issuance and a lack of uniformity eventually doomed this particular monetary standard. Enemy of the Bank President Andrew Jackson fought hard against the 2nd National Bank. Ultimately, he won as he vetoed the Bank’s charter and deposited tax revenues in state banks or “pet banks.” Jackson thought a Federal bank was a threat to civil liberties. Monetary Standards The Civil War required once again each side to print their own currency to finance their end of the War. The Union funds were known as “greenbacks.” The Confederacy mirrored this action by creating its own currency Legal Tender Act (1862) Monetary Standards Gold Certificates – Issued by the Federal Government, backed by gold deposits Silver Certificates – Also issued by the Federal Government, backed by silver deposits. Treasury Coin Notes – Issued in 1890, last currency issued until the banking overhaul of 1913. All forms of currency existed together until 1913 The Origins of the (FED)eral Reserve Prior to the creation of the Fed and the modern banking system the country had experimented numerous times with a “Central” bank to govern bank activity nationwide. The 1st and 2nd Banks of the United States were destroyed by accusations of corruption and the public’s distrust of the Federal Government. The Origins of the (FED)eral Reserve A third attempt was made shortly after the Civil War in an attempt to keep greenbacks from becoming devalued. The NBS was created and included numerous national banks that printed and issued currency secured by the Federal Government. The NBS forced out private run banks by heavily taxing any deposits into these banks essentially establishing itself as the “only bank in town.” The Federal Reserve Panic of 1907 leads to movement for banking overhaul 1913 – Federal Reserve System is established Federal Reserve = Central Bank that can loan to banks in times of emergency Issued Federal Reserve Notes, replaces all money, same money as in your wallet, backed by gold until 1934 Gold Standard 1900 - Gold Standard Act Money could now be exchanged for a set amount of gold. Gold set at $20.67 per ounce As of yesterday, May 12, gold was at $1242.20 per ounce. Pros & Cons of the Gold Standard Advantages Consumer Confidence Promotes discipline in regards to the circulation of money Idea is that money will only be printed relative to the amount of gold deposits Disadvantages Price of gold really can’t be controlled by a single government – Swiss Example Limits growth in an economy by not being able to increase money supply effectively Bank Failures & Abandonment 1934 – United States abandons gold standard after numerous bank failures initiated by the Great Depression. Fear of a “run on gold” led FDR to move the country off the standard and move to an “exchange” system. Current system is based on “faith & credit” Sleep tight FDIC – Federal Deposit Insurance Corporation Glass-Steagall Act 1934 Currently insures up to $250,000 per account FDIC budget currently operating in the “red” No worries, it is backed by the “full faith & credit of the United States”