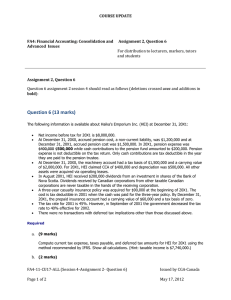

AC1220 Lab 2

advertisement

AC1220 ACCOUNTING I Lab 2.1 AC1220 Lab 2.1 Introduction Jake’s Computer Repair Service earned a small profit for the month ended January 20x1. Jones expects the business to continue operating into the foreseeable future. In fact, he expects the business to grow so long as it continues to provide customers with excellent service. The following transactions take place in February 20x1: a. Feb. 1, 20x1. Jones pays off the accounts payable balance of $410 in cash. b. Feb. 2, 20x1. Jones contacts a local advertising agency, Hype! Inc. The agency offers to provide six months of customized advertising and promotional services for a fee of $1,200. Jones agrees and mails a check to Hype! Inc. for the full amount. Hint: Record a prepaid expense. c. Feb. 24, 20x1. Jones receives a utility bill for the month of February, $490. This amount is due on March 6, 20x1, and is still payable at month end. d. Feb. 28, 20x1. Service revenues for the month total $5,300: $3,900 cash and $1,400 on account. e. Feb. 28, 20x1. A customer brings in a laptop for repair and a software upgrade. The customer writes a check for $120 to cover the service. Jones begins work on the laptop on March 2, 20x1. f. Feb. 28, 20x1. Jones pays rent of $500 in cash. g. Feb. 28, 20x1. Jones withdraws $1,000 in cash. h. Feb. 28, 20x1. Wages are paid during the month, amounting to $900 in cash. Requirement 1 Make the necessary entries to journalize these transactions for the month of February. DATE 2/1/x1 REF a a DATE 2/2/x1 REF b b DEBIT 1 CREDIT AC1220 ACCOUNTING I Lab 2.1 DATE REF DATE 2/24/x1 REF c c DATE 2/28/x1 REF d d d DATE 2/28/x1 REF e e DATE 2/28/x1 REF f f DATE 2/28/x1 REF f f DATE 2/28/x1 REF f f DEBIT CREDIT On February 28, Jones takes the following facts into account: i. Feb. 28, 20x1. The supplies account had a balance of $910 on Feb. 1, 20x1. Some supplies were used during the month. Jones determines that the original cost of the remaining supplies is $260. j. Jones accrues an additional $30 in wages for the hours that Dave worked on Monday, February 28, 20x1; Dave’s wage for that pay period is scheduled for payment on Friday, March 4, 20x1. 2 AC1220 ACCOUNTING I k. Lab 2.1 Feb. 28, 20x1. Jones considers the prepayment made for advertising services on February 2, 20x1, and makes an entry to account for advertising expense for the month of February, 20x1. l. Feb. 28, 20x1. Interest of $120 has accrued on the note payable. The interest is scheduled for payment early in March. Requirement 2 Make the necessary adjustment entries for the facts described: DATE 2/28/x1 REF i i DATE 2/28/x1 REF j j DATE 2/28/x1 REF k k DATE 2/28/x1 REF l l DEBIT 3 CREDIT AC1220 ACCOUNTING I Lab 2.1 Requirement 3 Using an accounting worksheet, Jones prepares a trial balance before making adjustments. Complete the worksheet, showing the adjustments, and compute the ending (adjusted) balance amounts. Label each adjustment in parentheses, (i)-(l). Account Cash Accounts Receivable Supplies Prepaid Advertising Equipment Trial Balance Debit $7,760 $1,630 $910 $1,200 $6,200 Accounts Payable Wages Payable Interest Payable Note Payable Unearned Revenue Capital, Jones Withdrawal, Jones Service Revenue Wage Expense Rent Expense Utilities Expense Advertising Expense Interest Expense Supplies Expense Total Adjustments Adjusted Balance Credit $490 $10,000 $120 $4,680 Total debits must equal total credits $5,300 adjusted trial balance columns! for the trial balance, adjustments, and $1,000 $900 $500 $490 - Ensure that the debit and credit columns are equal before proceeding to Requirement 4! $20,590 $20,590 4 AC1220 ACCOUNTING I Lab 2.1 Requirement 4 Prepare an income statement, a statement of owner’s equity, and a balance sheet for Jake’s Computer Repair Service for the month ended February 28, 20x1. Use the adjusted trial balance amounts you computed in Requirement 3, and the template below. 5 AC1220 ACCOUNTING I Lab 2.1 JAKE’S COMPUTER REPAIR SERVICE INCOME STATEMENT FOR THE MONTH ENDED FEBRUARY 28, 20x1 Service Revenue: Less Expenses: Wage Expense Supplies Expense Rent Expense Utilities Expense Advertising Expense Interest Expense Total Expenses Net Income JAKE’S COMPUTER REPAIR SERVICE STATEMENT OF OWNER’S EQUITY FOR THE MONTH ENDED FEBRUARY 28, 20x1 Capital, Jones, February 1, 20x1 Plus: Additional Owner Investment During Month Plus: Net Income, February, 20x1 Less: Drawings, Jones Capital, Jones, February 28, 20x1 $4,680 JAKE’S COMPUTER REPAIR SERVICE BALANCE SHEET FEBRUARY 28, 20x1 ASSETS Cash Accounts Receivable Supplies Prepaid Advertising Equipment Total Assets LIABILITIES Accounts Payable Wages Payable Interest Payable Unearned Revenue Note Payable Total Liabilities OWNER’S EQUITY Capital, Jones Total Liabilities & Owner’s Equity 6 AC1220 ACCOUNTING I Lab 2.1 Requirement 5 Jones recognizes utilities expense as soon as the utilities bill arrives, and recognizes service revenues only when the related service is performed (refer back to transactions c and e in Requirement 4). Which basis of accounting is Jones correctly applying? a) Cash basis b) Accrual basis c) Historical cost basis d) Transactional basis Requirement 6 Jones makes adjustments at month end to assign revenues to the period in which they are earned and to assign expenses to the period in which they are incurred. As a result, revenues earned in February are reported together with the expenses incurred to generate those revenues. Which accounting principle or concept is Jones correctly applying? a) Accounting period concept b) Time period concept c) Matching principle d) Faithful representation principle Requirement 7 Adjustment entries involve revenue or expense accounts but never affect the cash account. a) True b) False 7 AC1220 ACCOUNTING I Lab 2.1 Requirement 8 Jones accrues interest on the note payable with an adjusting entry. Explain the effect on the income statement if Jones had failed to make this entry. Requirement 9 True or false? The cash basis of accounting is required under Generally Accepted Accounting Principles (GAAP) when preparing financial statements. Explain, if necessary. 8