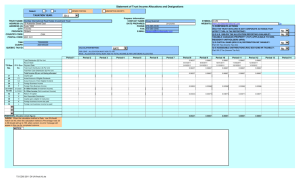

MassMutual Financial Underwriting

advertisement

Sales and DI Risk Management… Partners in success! C: 66742 Producer Use Only. Not for Use With the Public. Financial Underwriting Why do we need to do this? What information do we need? Is it “gross” or net? What about unearned income? Types of Entities: Employee Sole Proprietor Partnerships S Corp/ C Corp/ PC Producer Use Only. Not for Use With the Public. Why have a greater understanding of Financial Underwriting? So that you can target appropriate candidates for D.I. and adequately insure them. Understanding insurable income and earned income is essential when writing a disability income contract. We only insure earned income. We must consider corporate income/losses when issuing coverage. Business income or loss will be included at both underwriting and claim time (in the event of a claim under the Extended Partial Disability Benefits Rider). Producer Use Only. Not for Use With the Public. Business Entities Entity determines necessary financials: Employee/Non-Owner -- W-2 Sole Proprietor -- Schedule C Corp. Shareholder -- Form 1120, pages 1&2 and W2 S-Corp Shareholder -- Form 1120S, pg 1; K-1;W-2 OR 1040 pg 1&2; Schedule E; W-2 Partner -- K-1 OR Form 1040, pgs 1&2; Schedule E Producer Use Only. Not for Use With the Public. Tax Disclosure The information on the next two slides is being provided with the understanding that it is not intended to be interpreted as specific legal or tax advice. Neither MassMutual nor any of its employees or representatives are authorized to give legal or tax advice. Individuals are advised to seek the guidance of their own personal legal or tax counsel. Producer Use Only. Not for Use With the Public. Taxable vs. Non-Taxable When an employee is a non-owner OR an employee/shareholder of a regular corporation (1120), we need to determine who will be paying the premiums: Insured pays the premium Business pays the premium Insured pays the premium under a sec 125 plan w/ pre-tax dollars Business pays the premium AND paid includes it on employee’s W-2 Non-taxable/employee paid Taxable/employer paid Taxable/employer paid Non-Taxable/employee Producer Use Only. Not for Use With the Public. Taxable vs. Non-Taxable When insured is operating as a Sole Prop. (Sch.C), S-Corp Shareholder (1120S) or Partner in a Partnership (1065), premiums are ALWAYS considered employee-paid. Accordingly, benefits are ALWAYS non-taxable (both group LTD and individual) Limited liability companies (LLC’s) can be organized as a corporation or partnership (sometimes referred to as a LLP) - and are most often organized as a partnership. Accordingly, if the producer advises that the business is a LLC we must take it one step further and inquire whether they are filing as a corporation (Form 1120) or partnership (Form 1065). If the LLC is filing as a partnership, all partners will have non-taxable group and individual coverage Producer Use Only. Not for Use With the Public. Unearned Income Unearned income includes; interest, dividends, rental income, passive partnership & S-Corp interests, capital gains/losses. Unearned income exceeding 15% of Total Earned Income, will offset the monthly benefit amount . Unearned income will be disregarded unless it exceeds 15% of the Total Earned Income, except Military and other pension distributions are dollar for dollar offset (Taxable benefits may be discounted) Producer Use Only. Not for Use With the Public. Net Worth Will be disregarded unless exceeds $3,000,000 Will require breakdown of assets-liquid vs. nonliquid. Depending on amount of net worth, may need to reduce coverage and indemnity applied. Producer Use Only. Not for Use With the Public. The Art of Averaging Guide is 2 years, but u/w may request 3rd. Decreasing earned income is not averaged. Income that should be averaged includes: Business Owner income increasing by 15% Commissioned employee earnings Bonuses Unearned income Producer Use Only. Not for Use With the Public. The END!! MassMutual Financial Group is a marketing designation (or fleet name) for Massachusetts Mutual Life Insurance Company and its affiliates, Springfield, MA 011110111 Producer Use Only. Not for Use With the Public. Questions?? Producer Use Only. Not for Use With the Public. Producer Only. Not Use With• the Public. Massachusetts Mutual Life Insurance Company and affiliates,Use Springfield, MA for 01111-0001 www.massmutual.com