The Great Depression: Getting the Story Right

advertisement

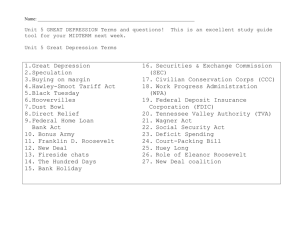

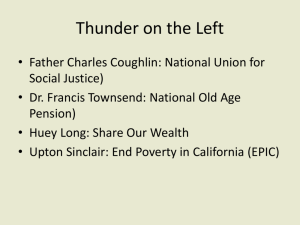

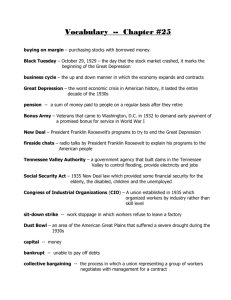

The Great Depression: Getting the Story Right Nicholas Crafts and Peter Fearon The 1930s • Deflation, slump and crisis • De-globalization: trade wars, collapse of gold standard and of foreign lending • Lessons from the downturn quite well understood; but also much to be gained from looking at recovery Contrasts in the Great Depression UK USA Real GDP -5% -27% Price Level -8% -26% Money Supply -1% -33% Bank Failures None ⅓ Proportion of Countries with Banking Crises, 1900-2008 Weighted by their share of world income 45 The Great Depression 40 Share of countries in banking crisis (left scale) 35 Emerging Markets, Japan, the Nordic Countries and US (S&L) 25 World War I 10 - 0.8 - 0.6 20 15 - 0.9 - 0.7 The Panic of 1907 - 0.5 Capital Mobility (right scale) - 0.4 - 0.3 - 0.2 5 - 0.1 - 0 0 1900 1903 1906 1909 1912 1915 1918 1921 1924 1927 1930 1933 1936 1939 1942 1945 1948 1951 1954 1957 1960 1963 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 Percentage of countries 30 - 1 Source: Reinhart & Rogoff (2009) The World in Depression Myths • Wall Street Crash caused the Great Depression • New Deal was a massive fiscal stimulus • Glass-Steagall was evidence-based policy • There was a great depression in the UK How Did the Depression Start? • Dominance of US economy in 1920s; world’s leading creditor country • 1928: Federal Reserve (FED) moved to control stock market speculation • Higher interest rates destabilized domestic and international economy • 1929 Wall Street Crash: an effect not a cause Table 1. The Great Depression in the Advanced Countries Real GDP Price Level Unemployment Trade (%) Volume 1929 100.0 100.0 7.2 100.0 1930 95.2 90.8 14.1 94.8 1931 89.2 79.9 22.8 89.5 1932 83.3 73.1 31.4 76.5 1933 84.3 71.7 29.8 78.4 1934 89.0 75.3 23.9 79.6 1935 94.0 77.6 21.9 81.8 1936 100.6 81.4 18.0 85.7 1937 105.3 91.5 14.3 97.4 1938 105.4 90.4 16.5 87.0 How Did the Depression Spread? • Most economies linked by gold standard which was re-adopted during the 1920s • Fixed exchange rate system; countries losing gold expected to deflate • Countries gaining (“hoarding”) gold, e.g. USA and France, sterilized inflows to protect against inflation Golden Fetters • After 1930, US loans ceased, imports reduced, primary product prices declined; primary producers had to deflate • 1931 major financial crisis started in Austria; moved to Germany • No co-ordinated policy response • Britain leaves the gold standard (Sept 1931) Collapse of Gold Standard • Crisis then moved to USA • 1931: 47 members of gold standard club; 1932: only 6 major economies still in • Abandonment of gold was a key to recovery • Those countries that had not devalued became much more protectionist Trade Contraction • Major contraction in international trade; value and volume both decline • Starting with Hawley-Smoot tariff (1930) protection increased; beggar-thy-neighbour policies • Drive to self-sufficiency in Germany • Major source of trade decline was inability of countries to finance imports Table 2: The UK in the 1930s Real GDP GDP Deflator Unemployment Stock Market (%) Prices 1929 100.0 100.0 8.0 100.0 1930 99.9 99.6 12.3 80.5 1931 94.4 97.2 16.4 62.8 1932 95.1 93.7 17.0 60.2 1933 96.0 92.5 15.4 74.3 1934 102.8 91.7 12.9 90.3 1935 106.6 92.6 12.0 100.0 1936 109.9 93.1 10.2 115.9 1937 114.7 96.6 8.5 108.0 1938 118.2 99.3 10.1 88.5 US/UK Comparison • UK did not experience a Great Depression • 1932-37 average real GDP growth 4%; no bank failures, rapid recovery but unemployment remained high especially in Outer Britain • Major regime change; UK abandoned gold standard, protectionist tariffs embraced • Recovery fuelled by cheap money; no fiscal stimulus until later 1930s Table 2: The USA in the 1930s Real GDP GDP Deflator Unemployment Stock Market (%) Prices 1929 100.0 100.0 2.9 100.0 1930 91.4 96.4 8.9 69.4 1931 85.6 86.3 15.6 35.8 1932 74.4 76.2 22.9 30.8 1933 73.4 74.2 20.9 46.2 1934 81.3 78.4 16.2 45.8 1935 88.6 79.9 14.4 63.1 1936 100.0 80.7 10.0 79.8 1937 105.3 84.1 9.2 50.5 1938 101.6 81.7 12.5 61.7 Why So Deep a Depression in USA? • Deflation undermined consumer and business confidence; increased real debt • Rising unemployment and collapse in farm income added to distress • Three waves of bank failures: late 1930; late 1931; winter 1932-33 undermined investment • Policy response entirely inappropriate New Deal Recovery • 1933-37 real GDP grew at 8% per annum • Gold standard abandoned; banking stabilized; inflationary expectations established • Monetary policy accidentally expansionary • Little fiscal stimulus • Serious new recession 1937-38 Devaluation in the 1930s • Very good for early recovery; staying on the gold standard made things much worse • Regain control of interest rate, change inflationary expectations, lower real wages, increase international competitiveness, improve fiscal arithmetic • Pursuit of self-interest (beggar-thy-neighbour) undermines world trade Changes in Exchange Rates and Industrial Production, 1929-1935 Production 1935 (1929=100) 130 •Finland •Denmark •Sweden 120 •United Kingdom 110 •Norway •Germany 100 •Italy •Netherlands IP1936=153.9-0.69ER1935 90 80 70 40 60 •Belgium •France 80 100 120 Exchange Rate 1935 (1929=100) Bad Behaviour • Fixed exchange rate systems potentially undermined by big balance of payments surpluses • Gold hoarding by France and USA put severe deflationary pressure on the gold standard • Deficit countries took the strain of adjustment (initially) Regime Change • US escape from liquidity trap after 1933 based on leaving gold • Changed inflationary expectations and reduced real interest rates • Needed a new policy framework; ambiguity about this became a problem in 1937 Fiscal Stimulus • With interest rates at zero-bound, expect fiscal multiplier to be relatively large • On balance, 1930s evidence suggests this is right; values for UK and US of 1.5+ • In the early 1930s, fiscal policy didn’t fail, it wasn’t tried; Keynesian stimulus later on from rearmament Fiscal Consolidation • Exposes economy to risk of double-dip recession if monetary policy not supportive • USA in 1937/8 is perfect unpleasant example • Monetary policy was supportive when real interest rates were held down • Suggests conventional inflation targeting not appropriate at lower bound A Recession to Remember: Real GNP in USA 1929 III 1933 I 1936 I 1936 II 1936 III 1936 IV 1937 I 1937 II 1937 III 1937 IV 1938 I 1938 II 1938 III 1938 IV 100 68.4 85.2 90.6 93.2 96.3 95.9 98.4 98.0 91.0 87.1 88.6 93.7 97.4 Source: Balke and Gordon (1986) Banking Crises • Asset price collapse, non-performing loans, scramble for liquidity, shortage of collateral: credit for investment severely restricted • Market failure with asymmetric information • Frequent when bank regulation inadequate especially when capital is internationally mobile • Imply major decline in economic activity not just ordinary recession and fiscal hangover • Easy to understand ex-post; hard to predict Banking Crisis: Impact on Potential Output • Output is permanently reduced (making structural budget deficit worse) • Direct and indirect effects: investment and policy response • In 1930s USA, New Deal increased U* and collapse in investment meant lower capital stock … but TFP growth remained very strong • Y* in 1941 at least 10 per cent below 1929 forecast Table 3. Growth Accounting Decompositions, United States 1919-1941 (% per year) ΔY/Y ΔK/K ΔL/L ΔA/A Δ(Y/L)/(Y/L) 1919-29 3.08 2.69 1.10 1.44 1.96 1929-41 2.52 0.04 0.27 2.03 2.25 1919-29 4.06 2.93 1.73 2.04 2.30 1929-41 2.36 -0.14 -0.02 2.34 2.38 GDP Private NonFarm Resolving the Banking Crisis • Re-capitalizing and re-regulating banks was key part of Roosevelt’s policy • Deposit insurance (and moral hazard) is important legacy of the depression • Accompanying bank regulation was politically captured and not well designed but did deliver financial stability for several decades in ‘capitalimmobile’ world Concluding Thoughts • Once the crisis began, economics informed by economic history has done quite well and we haven’t repeated the worst errors of the early 1930s • Failure to predict the crisis both now and then understandable; failure to prevent the crisis may be less forgivable since economics does explain very clearly why banks fail Central bank discount rates, now vs then (7 country average) 2008 1929 6 5 4 3 2 1 0 0 5 10 15 20 25 30 Source: Alumunia et al (2010) 35 40 45 50 World Industrial Production, now vs then 100 95 90 85 80 75 70 65 60 0 5 10 15 20 25 April 2008=100 30 35 June 1929=100 Source: Eichengreen & O'Rourke (2010) 40 45 50