Buying on Margin - Riverdale High School

advertisement

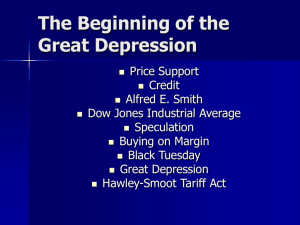

Our Standard Today US.45 Analyze the causes of the Great Depression, including the following: (E, H) · the economic cycle driven by over-extension of credit · overproduction in agriculture and manufacturing · laissez faire politics · buying on margin · excess consumerism · rising unemployment · the crash of the stock market · high tariffs The Great Depression The Great Depression had a lasting impact on how Americans view the economy, themselves and their government. Our Objective: Students analyze the causes of the Great Depression. Bellwork – Great Depression Group Work: You are reporters researching the causes of The Great Depression. Working in teams representing different newspapers, begin your research at page 462 in your textbook and create four (4) reporter's research notebook entries using this table: Event, Policy or Condition Resulting Condition or Problem Today's Agenda Bellwork Announcements Questions Bellwork Review Lecture Standard Today US.45 Analyze the causes of the Great Depression, including the following: (E, H) · the economic cycle driven by over-extension of credit · overproduction in agriculture and manufacturing · laissez faire politics · buying on margin · excess consumerism · rising unemployment · the crash of the stock market · high tariffs The Great Depression Objective: Students analyze the causes and effects of the Great Depression. The Great Depression Mother and Seven Children The Economic Cycle driven by Over-extension of Credit Consumer products from the 1920s continued to be desired into the late Twenties. The Phonograph, Radio, Telephone, Refrigerator and Automobile among other things. Excess Consumerism The Twenties gave us: Planter's Peanuts Hires Root Beer Wheaties Kool-Aid drink mix Kraft cheese 7-UP Gold Medal Flour Orange Crush Kellogg's Corn Flakes Coca-Cola Oscar Mayer wieners Dr. Pepper Birds-Eye frozen vegetables Welch's grape juice Pepsi-Cola Kellogg's Rice Krispies Del Monte canned foods Peter Pan peanut butter Libby's canned tomato soup Green Giant canned peas Jell-O Cream Of Wheat Cracker Jacks The Economic Cycle driven by Over-extension of Credit Consumerism was booming the the late 1920s. People were purchasing items on credit that was very easy to obtain. Banks were willing to loan money to collect the interest from the borrower as income to the banks. The money being loaned is from the banks' depositors. 1920s Income Average of all Industries $1407/year State and Local Government Workers $1164/year Public School Teacher $970/year Building Trades $1.08/hour Working week: 43.8 hours Medical/Health Services Worker $752/year Everyone Became Deeper in Debt A lot of Americans had monthly bills for their home (rent or mortgage), automobile, appliances and utilities. This rush of easy credit was a fairly new phenomenon for most. Budgeting began to take on importance. Consumers began to purchase less because their money was tied up in their bills. Overproduction in Agriculture and Manufacturing Overproduction of goods by manufacturers meant that consumers began to spend less on goods and this created under-consumption. Ordinary workers and farmers had used their consumer credit and did not have enough money to keep buying products that were produced. Many warehouses became full of products that couldn't be sold. This resulted in companies losing money. Purchasing Less Means Less is Needed Industries (and jobs) were changing. Credit requires people to get paid so they were able to make their payments. Some industries began to weaken. The cotton industry was impacted by the rise of synthetic materials. The railroad industry was affected by the automobile. Low food prices affected the farming industry as demand for foodstuffs dropped after WWI and the Government refused price supports for farmers in 1920's. Income-Disparity There was an uneven distribution of income. 5% of the population received 30% of the total income. One estimate was that the Income of the top 1% increased about 75%; bottom 93% = only 6%. Low wages for industrial workers and farmers. One-half of country lived below the poverty line. These were potential customers. Laissez Faire Politics The election of 1928 witnessed Herbert Hoover being nominated by the Republicans on a platform of prosperity and prohibition. Alfred E. Smith was nominated by the Democrats. Radio was used significantly for the first time in the campaign. Hoover decried un-American "socialism" and preached "rugged individualism" Religious bigotry was displayed over Smith's Catholicism: "A vote for Al Smith is a Vote for the Pope." Hoover Wins 1928 Election Herbert Hoover defeated Alfred Smith 444 to 87 in the Electoral College, 21,391,993 to 15,016,169 in the Popular Vote. A huge Republican majority was returned to the House of Representatives. Hoover had organized food drives for starving people of Belgium during WWI. His leadership of the Food Administration during WWI earned him the titles of "Great Engineer" and "Wonder Boy." Hoover Believed in Limited Government Regulation Hoover was the prototypical businessman who decried socialism or large-scale government intervention in the economy. As Secretary of Commerce, he had supported some progressive ideas e.g. endorsing labor unions and supporting federal regulation of new radio broadcasting industry. For a time, he considered government-owned radio like Britain's BBC. Hoover claimed in 1928 that "Poverty will be banished from the nation." and "Everybody ought to be rich." Buying on Margin There was a Bull market as values of stocks continued to increase during the 1920s. Dow Jones in 1924 was at 180. In September of 1929 it was up to 381 -- selling for 16X earnings; Rule of thumb = 10X Margin buying of stocks: Investors purchased stocks from stockbrokers for as little as 5% down. When stock values rose, investors would pay back their debt. If no payment, stocks were held as collateral. Margin Call: If prices of stock decreased more than 10%, broker would sell stock for whatever price they could get. Result: Banks and businesses that had financed broker's loans lost a lot of money. Banks loaned money to stockbrokers to facilitate the margin buying. Poor Banking Practices There was an unstable banking system due to mismanagement and over-speculation. Banks were granting loans for people that were at a high risk of not being able to pay back their loans. 1% of US banks controlled 46% of US bank resources. No one to Export Goods to There was a weak international economy. Protectionist trade policies stopped foreign trade. The Hawley-Smoot Tariff (1930) the created highest tariffs in U.S. history 23 nations retaliated by imposing tariffs on U.S. exports. Smoot-Hawley Tariffs Act The Smoot-Hawley Tariff Act of June 1930 raised U.S. tariffs to historically high levels. The original intention behind the legislation was to increase the protection afforded domestic farmers against foreign agricultural imports. Massive expansion in the agricultural production sector outside of Europe during World War I led, with the post-war recovery of European producers, to massive agricultural overproduction during the 1920s. This in turn led to declining farm prices during the second half of the decade. During the 1928 election campaign, Republican presidential candidate Herbert Hoover pledged to help the beleaguered farmer by, among other things, raising tariff levels on agricultural products. You are protecting the Farmer, Protect Me Too! But once the tariff schedule revision process got started, it proved impossible to stop. Calls for increased protection flooded in from industrial sector special interest groups, and soon a bill meant to provide relief for farmers became a means to raise tariffs in all sectors of the economy. When the dust had settled, Congress had agreed to tariff levels that exceeded the already high rates established by the 1922 Fordney-McCumber Act and represented among the most protectionist tariffs in U.S. history. The Act was a Disaster The Smoot-Hawley Tariff was more a consequence of the onset of the Great Depression than an initial cause. It provoked a storm of foreign retaliatory measures and came to stand as a symbol of the "beggar-thy-neighbor" policies (policies designed to improve one's own lot at the expense of that of others) of the 1930s. Such policies contributed to a drastic decline in international trade. For example, U.S. imports from Europe declined from a 1929 high of $1,334 million to just $390 million in 1932, while U.S. exports to Europe fell from $2,341 million in 1929 to $784 million in 1932. Overall, world trade declined by some 66% between 1929 and 1934. More generally, Smoot-Hawley did nothing to foster trust and cooperation among nations in either the political or economic realm during a perilous era in international relations. Tariffs had unintended consequences https://www.youtube.com/watch?v=R3zvJe3 Koyw Banks are losing money. The economic cycle driven by over-extension of credit led banks to having to write off losses from customers who could not make their payments. Buying on Margin Explained Video Time :-) https://www.youtube.com/watch?v=0SGGSq OZhps Margin Call!!! DEFINITION of 'Margin Call' - A broker's demand on an investor using margin to deposit additional money or securities so that the margin account is brought up to the minimum maintenance margin. Margin calls occur when your account value depresses to a value calculated by the broker's particular formula. Video Time We fast-forward to the 40 minute mark: https://www.youtube.com/watch?v=RN7ftyZig Ys&list=PLvGgZ5v2o_N8dDogxreL2NbnfKHgHxqY&index=3 The Great Crash October 29, 1929 will always be known as "Black Tuesday" Everybody wanted to sell their stock. Within hours the stock market crashed. By mid-November, $25 billion in stock value had disappeared and fortunes were wiped out almost overnight. Dow Jones in 1932 = 41. Traditional historical interpretation puts the Crash as the immediate cause of the Great Depression, however, no direct connection has ever been proven as the country did not sink into a major depression until December of 1930.Other factors important as well. Rising Unemployment By 1932, 5,761 banks had failed (22% of total). Many banks had invested in stocks before the crash. Thousands of businesses failed, 20,000 in 1929; 30,000 in 1932 Unemployment reached 25% by 1932 (13 million people) excluding farmers. As high as 33% including farmers; Chicago = 50%! Low-skilled workers most susceptible (professionals and middle-class suffered less) Total wages dropped from $12 billion to $7 billion from 1929 to 1932 (lower wages = less money spent in the economy); about 41% Remember this Scene? Movie time.... Farmers Lose Their Farms By 1932, 25% of farmers lost their farms. A major cause was the large drop in food prices. People experienced loss of self-worth and many families broke up. The marriage rate and birth rate declined. Families doubled up in houses and apartments and 3 million people became hobos and lived in makeshift shacks known as "Hoovervilles" Malnutrition became rampant in certain areas but death by starvation was uncommon. Perhaps malnutrition caused people to be more susceptible to fatal disease. The Great Depression was the longest and most devastating in U.S. history and world history with the U.S. hit the hardest among industrialized nations. America Goes Broke... The Gross National Product fell from $104 billion in 1929 to $56.1 billion in 1933. International reparations and war debts structure collapsed. U.S. exports dropped, further hurting the U.S. economy. Assessment Assessment Questions How did the economic trends of the 1920s help cause the Great Depression? What happened to industry during this time? What happened to agriculture? What happened to consumers? The Great Depression Objective: Students analyze the causes and effects of the Great Depression. Standard Today US.45 Analyze the causes of the Great Depression, including the following: (E, H) · the economic cycle driven by over-extension of credit · overproduction in agriculture and manufacturing · laissez faire politics · buying on margin · excess consumerism · rising unemployment · the crash of the stock market · high tariffs