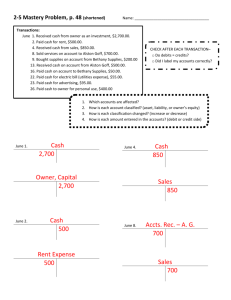

Drill 9-D1 Determining accounts affected by

advertisement

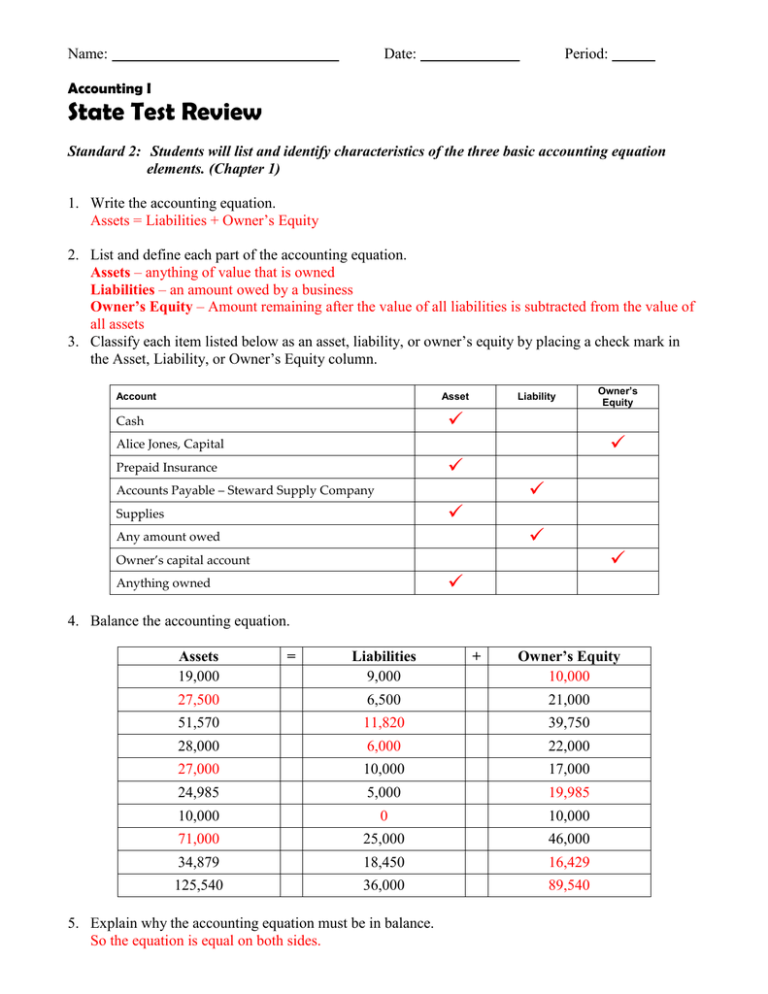

Name: Date: Period: Accounting I State Test Review Standard 2: Students will list and identify characteristics of the three basic accounting equation elements. (Chapter 1) 1. Write the accounting equation. Assets = Liabilities + Owner’s Equity 2. List and define each part of the accounting equation. Assets – anything of value that is owned Liabilities – an amount owed by a business Owner’s Equity – Amount remaining after the value of all liabilities is subtracted from the value of all assets 3. Classify each item listed below as an asset, liability, or owner’s equity by placing a check mark in the Asset, Liability, or Owner’s Equity column. Account Asset Liability Owner’s Equity Cash Alice Jones, Capital Prepaid Insurance Accounts Payable – Steward Supply Company Supplies Any amount owed Owner’s capital account Anything owned 4. Balance the accounting equation. Assets 19,000 = Liabilities 9,000 + Owner’s Equity 10,000 27,500 6,500 21,000 51,570 11,820 39,750 28,000 6,000 22,000 27,000 10,000 17,000 24,985 5,000 19,985 10,000 0 10,000 71,000 25,000 46,000 34,879 18,450 16,429 125,540 36,000 89,540 5. Explain why the accounting equation must be in balance. So the equation is equal on both sides. Standard 3: Students will apply the theory of debit and credit to the accounting equation, define a business transaction, and show how and why accounts are increased and decreased. (Chapter 2) 1. What is a business transaction? A business activity that changes assets, liabilities, or owner’s equity 2. For each account listed, assign an account number in the chart of accounts. Account Title Cash in Bank George Smith, Capital Accounts Payable – Allen Systems Accounts Receivable – Abe Dunn Revenue/Sales George Smith, Drawing Advertising Expense Supplies Rent Expense Prepaid Insurance Account Number 110 310 210 120 410 320 510 130 520 140 3. Decide which accounts in the accounting equation are changed by each of the following transactions. Place a plus (+) in the appropriate column if the account is increased. Place a minus (-) in the appropriate column if the account is decreased. Transactions 1. Received cash from owner as an investment. 2. Received cash from sales. 3. Paid cash for telephone bill. 4. Paid cash for advertising. 5. Paid cash to owner for personal use. 6. Paid cash for rent. 7. Paid cash for equipment repairs. 8. Bought supplies on account from Maxwell Company. 9. Paid cash for insurance. 10. Paid cash on account to Maxwell Company. Assets Trans. No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Cash + Supplies + Prepaid Insurance = Liabilities + Owner’s Equity = Accts. Payable Maxwell Company + Susan Sanders, Capital + + + + – – – – – – – – – – + – – + + – 4. Determine how each transaction affects the accounting equation; analyze transactions into debit and credit parts. Cash Supplies Prepaid Insurance Accounts Payable—Miller Supplies Jeff Dixon, Capital Jeff Dixon, Drawing Sales Advertising Expense Miscellaneous Expense Rent Expense Repair Expense Utilities Expense 1. 2. 3. 4. Using the account titles shown above, write the accounts affected in Column 2. For each account title, write the account classification in Column 3. For each account title, place a check mark in either Column 4 or 5 to indicate the normal balance. For each account title, place a check mark in either Column 6 or 7 to indicate if the account is increased (+) or decreased (-) by this transaction. 5. For each account title, place a check mark in either Column 8 or 9 to indicate if the account is changed by a debit or a credit. Transactions 1. Received cash from owner as an investment. 2. Paid cash for supplies. 3. Paid cash for insurance. 4. Bought supplies on account from Miller Supplies. 5. Paid cash on account to Miller Supplies. 6. Paid cash for rent. 7. Received cash from sales. 8. Paid cash to owner for personal use. 9. Paid cash for telephone bill (utilities expense). 1 2 3 Trans. No. Accounts Affected Account Classification 1. 2. 3. 4. 5. 6. 7. 8. 9. Cash Jeff Dixon, Capital Supplies Cash Prepaid Insurance Cash Supplies A/P—Miller Supplies A/P—Miller Supplies Cash Rent Expense Cash Cash Sales Jeff Dixon, Drawing Cash Utilities Expense Cash Asset Owner’s Eq. Asset Asset Asset Asset Asset Liability Liability Asset OE-Expense Asset Asset OE-Revenue OE-Drawing Asset OE-Expense Asset 4 5 Account’s Normal Balance Debit Credit 8 9 Entered in Account as Debit Credit 6 7 How is Account Affected? + - Standard 4: Students will identify and use source documents for journalizing transactions; students will post journal entries to a ledger. (Chapter 3 & 4) 1. List five different source documents and identify what type of transaction each source document would be used for. Check – pay cash; Sales Invoice – sales on account; Receipt – receives cash; Calculator Tape – cash sales; Memorandum – any other transaction 2. What is the purpose of the General Journal? To record transactions in chronological order 3. What are the steps in journalizing? (in order) 1. Date 2. Debit 3. Credit 4. Source Document 4. What is the purpose of the General Ledger? To organize transaction into accounts 5. What the steps in posting? (in order) 1. Date 2. Journal Page Number in Ledger Post. Ref. 3. Debit/Credit amount 4. New Balance 5. Account Number in Journal Post. Ref. 6. Explain the purpose of the posting references? Cross-reference between journal page number and account Let you know you are finished posting 7. What is recorded in the Post. Ref. column of the General Ledger account? Journal Page Number 8. What is recorded in the Post. Ref. column of the General Journal? Account Number 9. Analyze each transaction listed below. 1. Write the source document for each transaction in Column 2. 2. Using the following account titles, write the accounts affected by each transaction in Column 3. Cash Accounts Receivable—Darnell Lee Supplies Prepaid Insurance Accounts Payable—Gable Supplies Mary Jacobs, Capital Mary Jacobs, Drawing Sales Advertising Expense Miscellaneous Expense Rent Expense Repair Expense Utilities Expense 3. For each account title, write the account classification in Column 4. 4. For each account title, place a check mark in either Column 5 or 6 to indicate the normal balance. 5. For each account title, place a check mark in either Column 7 or 8 to indicate if the account is increased (+) or decreased (-) by this transaction. 6. For each account title, place a check mark in either Column 9 or 10 to indicate if the account is changed by a debit or a credit. Transactions 1. Paid cash for advertising. 2. Paid cash for repairs. 3. Received cash from owner as an investment. 4. Paid cash for miscellaneous expense. 5. Bought supplies on account from Gable Supplies. 6. Paid cash on account to Gable Supplies. 7. Paid cash for water bill. 8. Paid cash for supplies. 9. Paid cash for rent. 10. Sold services on account to Darnell Lee 11. Received cash from sales. 12. Paid cash for insurance. 1 Trans. No. 2 Source Document 1. Check 2. Check 3. Receipt 4. Check 5. Memo 6. Check 7. Check 8. Check 9. Check 10. Sales Invoice 11. Tape 12. Check 3 4 Accounts Affected Account Classification Advertising Expense Cash Repairs Expense Cash OE-Expense Asset OE-Expense Asset Cash Mary Jacobs, Capital Miscellaneous Expense Cash Supplies A/P—Gable Supplies Asset OE OE-Expense Asset Assets Liability A/P—Gable Supplies Cash Utilities Expense Cash Supplies Cash Liability Asset OE-Expense Asset Asset Asset Rent Expense Cash A/R—Darnell Lee Sales Cash Sales OE-Expense Asset Asset OE-Revenue Asset OE-Revenue Prepaid Insurance Cash Asset Asset 5 6 Account’s Normal Balance Debit Credit 9 10 Entered in Account as a Debit Credit 7 8 How Is Account Affected? + - Standard 5: Students will prepare, analyze and interpret financial statements. (Chapter 6) 1. Determine the General Ledger account balance. 1. Beg. Balance Debit Credit Debit 800 500 2. 3. 1,300 650 250 575 900 360 4. 5. New Balance Debit Credit Credit 435 150 6. 0 215 100 335 775 300 400 690 625 290 7. 290 850 40 1,100 8. 0 239 100 139 2. What is the purpose of the trial balance? To prove debits and credits are equal 3. What are the steps for preparing a Work Sheet? Heading Trial Balance Adjustments Extend Balances Calculate Net Income 4. Extending account balances on a work sheet 1. Place a check mark in either Column 1 or 2 to indicate the Trial Balance column in which each account’s balance will appear. 2. Place a check mark in Columns 5, 6, 7, or 8 to indicate the column to which each up-to-date account balance will be extended. Account Title 1. Advertising Expense 1 2 Trial Balance Debit Credit 4. Miscellaneous Expense 7. Prepaid Insurance 8. Rent Expense 9. Repair Expense 12. Utilities Expense 10. Sales 11. Supplies 5. Maria Dorn, Capital 6. Maria Dorn, Drawing 7 8 Balance Sheet Debit Credit 2. Accts. Pay.--Bell Supply 3. Cash 5 6 Income Statement Debit Credit 5. Calculating net income or net loss on a work sheet The column totals from five different work sheets are given on the form below. Complete the following for each company. 1. Calculate the amount of net income or net loss. Write the amount on line 2 in the correct columns. Label the amount as Net Income or Net Loss. 2. Add the amounts in each column. Write the totals on line 3. 3. Verify the accuracy of your proving totals. Income Statement Debit Credit 1. Column totals 2. Net Income $9,000 $9,500 Balance Sheet Debit Credit $35,500 $35,000 500 500 3. Proving totals $9,500 $9,500 $35,500 $35,500 1. Column totals $1,500 $2,000 $7,500 $7,000 2. Net Income 500 500 3. Proving totals $2,000 $2,000 1. Column totals $5,200 $4,800 $26,500 400 400 2. Net Loss $7, 500 $7,500 $26,900 3. Proving totals $5,200 $5,200 $26,900 $26,900 1. Column totals $5,300 $8,150 $34,950 $32,100 2. Net Income 2,850 2,850 3. Proving totals $8,150 $8,150 $34,950 $34,950 1. Column totals $5,300 $4,130 $33,400 $34,570 1,170 1,170 $5,300 $34,570 2. Net Loss 3. Proving totals $5,300 $34,570 Standard 5: Students will prepare, analyze and interpret financial statements. (Chapter 7) 1. What document is used to prepare the financial statements? Work Sheet 2. What is the purpose of the Income Statement? To show financial progress over a period of time 3. What information is reported on the Income Statement? Revenue, Expenses, Net Income/Loss 4. What is the purpose of the Balance Sheet? To show financial condition on a specific date 5. What information is reported on the Balance Sheet? Assets, Liabilities, and Owner’s Equity 6. Preparing an Income Statement and Balance Sheet From the work sheet below, prepare an income statement and balance sheet for The Sound of Stone. Complete the following. 1. Total all columns of the work sheet 2. Calculate and record the amount of net income or net loss. 3. Using the form on the next page, prepare an income statement for the month ended September 30, 20--. 4. Calculate and record the component percentages for total expenses and net income. Round percentages to the nearest 0.1% 5. Prepare the September 30, 20-- balance sheet for The Sound of Stone. Account Title 1. Cash 2. Petty Cash 3. Accts. Rec.—HartCo 4. Accts. Rec.—Starlite Club 5. Supplies 6. Prepaid Insurance 7. Accts. Pay.—First Audio 8. Accts. Pay.—Office Supply Co. 9. Shannon Stone, Capital 10. Shannon Stone, Drawing 11. Income Summary 12. Sales 13. Advertising Expense 14. Insurance Expense 15. Miscellaneous Expense 16. Rent Expense 17. Supplies Expense 18. Utilities Expense 1 2 Trial Balance Debit Credit 8,272 200 100 720 4,051 1,200 5 6 Income Statement Debit Credit 7 8 Balance Sheet Debit Credit 8,272 200 100 720 1,487 1,100 2,564 100 1,360 20 10,000 1,360 20 10,000 600 600 4,411 4,411 273 273 100 10 250 2,564 115 100 10 250 2,564 115 15,791 20. Net Income 3 4 Adjustments Debit Credit 15,791 2,664 2,664 3,312 4,411 12,479 11,380 4,411 12,479 12,479 1,099 4,411 1,099 Income Statement The Sound of Stone Income Statement For month ended September 30, 2008 % of Sales Revenue: Sales Expenses: Advertising Expense Insurance Expense Miscellaneous Expense Rent Expense Supplies Expense Utilities Expense Total Expenses Net Income 4,411 100.0 273 100 10 250 2,564 115 3,312 1,099 75.1 24.9 Balance Sheet The Sound of Stone Balance Sheet September 30, 2008 Assets Liabilities 8,272 Accts. Pay.—First Audio 200 Accts. Pay.—Office Supply Co. Cash Petty Cash Accts. Rec.—HartCo Accts. Rec.—Starlite Club Supplies Prepaid Insurance Total Assets 100 Total Liabilities 720 Owner’s Equity 1,487 Shannon Stone, Capital 1,100 11,879 Total Liab. and Owner’s Eq. 1,360 20 1,380 10,499 11,879 7. Determine the ending capital balances. 1. 2. 3. 4. Beginning Capital Investments + Revenue + Expenses - Withdrawals - Ending Capital 10,000 0 25,000 45,785 5,000 25,000 10,000 0 20,000 30,000 50,000 66,350 5,000 50,000 10,000 15,900 3,000 5,000 6,000 5,000 27,000 0 69,000 91,235 Standard 6: Students will prepare adjusting and closing entries and a post-closing trial balance. (Chapter 8) 1. What is the difference between permanent and temporary accounts? Permanent accounts carry-over a balance from fiscal period to fiscal period. Temporary accounts are closed at the end of each fiscal period and start each new fiscal period with a zero balance 2. Determining accounts affected by adjusting and closing entries 1. For each account title on the chart, place a check mark in either Column 2 or 3 to indicate whether the account is affected by an adjusting entry. 2. For each account title on the chart, place a check mark in either Column 4 or 5 to indicate whether the account is affected by a closing entry. 3. For each account title on the chart, place a check mark in either Column 6 or 7 to indicate whether the account has a balance after closing entries are posted. 1 Account Title 2 Account Is Affected by an Adjusting Entry Yes 1. Advertising Expense 2. Accts. Pay.--Baer Supplies 3. Cash 4. Accts. Pay.--Gates Office Supplies 5. Alisha Downs, Capital 6. Alisha Downs, Drawing 7. Income Summary 8. Insurance Expense 14. Supplies Expense 15. Utilities Expense No 6 7 After Closing Entries Are Posted, Account Has a Balance Yes No 12. Sales 5 Account Is Affected by a Closing Entry Yes 11. Rent Expense 13. Supplies 4 No 9. Miscellaneous Expense 10. Prepaid Insurance 3 3. Why is the post-closing trial balance prepared? To prove debits and credits are still equal 4. Why do only the balances of permanent accounts appear on the post-closing trial balance? Because those accounts are the only ones that still have a balance. 5. Journalize adjusting and closing entries using the information from the worksheet on the previous page. General Journal Date Account Title 2008 Adjusting Entries Sep 30 Supplies Expense Doc. No. Post. Ref. Debit Credit 2,564 Supplies 30 2,564 Insurance Expense 100 Prepaid Insurance 100 Closing Entries 30 Sales 4,411 Income Summary 30 Income Summary 4,411 3,312 Advertising Expense 273 Insurance Expense 100 Miscellaneous Expense 10 Rent Expense 250 Supplies Expense 2,564 Utilities Expense 30 Income Summary 115 1,099 Shannon Stone, Capital 30 Shannon Stone, Capital Shannon Stone, Drawing 1,099 600 600 Standard 7: Students will demonstrate proper cash management. (Chapter 5) 1. Define and show an example of a blank endorsement. Endorsement consisting of a signature only. 2. Define and show an example of a restrictive endorsement. Endorsement that restricts further transfer of ownership. 3. What are the steps for preparing a bank reconciliation? 1. Write date 6. Add outstanding deposits 2. Balance on check stub 7. Calculate subtotal 3. Deduct bank charges 8. Deduct outstanding checks 4. Calculate adjusted check stub balance 9. Calculate adjusted bank statement balance 5. Balance on bank statement 10. Compare adjusted balances (should be equal) 4. Using the information below, calculate the adjusted checkbook balance: Balance on last unused check stub is $3,000; outstanding deposits of $400, bank service charge of $25, outstanding checks totaling $450, and a dishonored check for $75. What is the adjusted checkbook balance after the bank reconciliation is prepared? Balance on check stub 3,000 Deduct bank charges –25 Deduct dishonored check –75 Adjusted checkbook balance 2,900 5. Using the information below, calculate the adjusted bank balance: Bank statement balance is $5,000; outstanding deposits of $150, bank service charge of $30, and outstanding checks totaling $600. What is the adjusted bank balance after the bank reconciliation is prepared? Balance on bank statement 5,000 Add outstanding deposits +150 Deduct outstanding checks –600 Adjusted bank balance 4,550 6. Which accounts are affected when journalizing a bank service charge? Debit: Miscellaneous Expense Credit: Cash 7. Which accounts are affected when journalizing a dishonored/NSF check? Debit: Accounts Receivable Credit: Cash 8. What does it mean to “prove cash”? To compare the balance on the last unused check stub with the balance in the cash account. These two numbers should be the same. 9. Why is it important for a company to establish a petty cash fund? To be more cost effective and efficient when paying out small cash payments. 10. What accounts are affected when establishing a petty cash fund? Debit: Petty Cash Credit: Cash 11. What accounts are affected when replenishing a petty cash fund? Debit: Accounts affected by petty cash payments (Generally Supplies and Expenses) Credit: Cash 12. Journalize entries to replenishing a petty cash fund KeepClean replenished petty cash on the dates shown in Column 2 of the following table. The information in Columns 3 to 5 is obtained from the petty cash reports. Record the journal entry for each petty cash replenishment. 1 2 Trans./Doc. No. Replenished on A / C43 B / C54 C / C67 D / C79 3 Supplies July 31 August 31 September 30 October 31 4 Summary of Petty Cash Slips Advertising 32.00 21.00 40.00 10.00 5 Miscellaneous 25.00 20.00 20.00 5.00 15.00 20.00 General Journal Date Jul 31 Account Title Supplies Doc. No. C43 Advertising Expense Post. Ref. Debit 32.00 25.00 Cash Aug 31 Supplies 57.00 C54 Advertising Expense 21.00 20.00 Miscellaneous Expense 5.00 Cash Sep 30 Supplies 46.00 C67 40.00 Advertising Expense 20.00 Miscellaneous Expense 15.00 Cash Oct 31 Supplies Miscellaneous Expense Cash Credit 75.00 C79 10.00 20.00 30.00