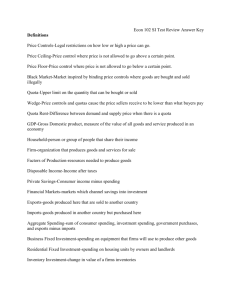

Chapter 2: The Data of Macroeconomics

advertisement

Chapter 2: The Data of Macroeconomics Stock vs. Flow Stock: quantity measured at a given point in time – Wealth – Debt – Budget Flow: quantity measured per unit of time – Income – Employment – Price The Circular Flow on Income and Product Households: – sell labor resources to earn income – spend income to buy products Firms: – buy labor resources to produce products – sell products to earn income The Circular Flow on Income and Product Income Payment Labor Resources Labor Market Households Firms Product Market Products Consumption Expenditure Gross Domestic Product Market value of all final goods and services an economy produces in a current time period (year or quarter) Total income = Total expenditure Total value-added (value of output minus value of inputs at each production stage) GDP Adjustments The GDP excludes the following items: – – – – Intermediate goods: avoid double counting Used goods: already counted Illegal goods and services: not to be produced Self-produced goods and services: non-market transactions GDP Adjustments Treatment of inventories: – Accumulation is treated as “expenditure,” thus reducing GDP – Reduction is treated as a purchase (+) and a disinvestment (-), hence offsetting each other GDP Adjustments Imputation: estimation of the value of services – Market rent for owner-occupied homes – Cost of provision for government services Note: Imputation is not applied to other services such as private transportation GDP Adjustments Seasonal adjustment: – GDP increases throughout the year, reaching a peak in the fourth quarter and then falling in the first quarter – We use a statistical technique to “smooth” seasonal variations GDP Calculations Nominal GDP = Current year prices * Current year quantities Real GDP = Base year prices * Current Year quantities GDP Deflator = Nominal GDP / Real GDP, representing the general price level Base Year Determination Real GDP: – Base year changes every five years Chain-Weighted Real GDP: – Base year changes continuously over time Components of GDP Nominal GDP = Consumption + Investment + Government purchases + Net Exports: exports less imports Y = C + I + G + NX (1997 data in %: 100 = 68 + 15 + 18 –1) Data National Income Accounting GNP: Gross National Product = GDP + Factor payments from abroad - Factor payments to abroad National Income Accounting NNP: Net National Products = GNP - Depreciation or Consumption of Fixed Capital (about 10%) National Income Accounting NI: National Income = NNP Indirect Business Taxes (e.g., sales tax; about 10%) National Income Accounting PI: Personal Income = NI - Corporate Profits - Social Insurance Contributions - Net Interest + Dividends + Gov’t Transfer Payments to Individuals + personal Interest Income National Income Accounting DPI: Disposable Personal Income = PI - Personal Income Taxes Measuring Cost of Living Consumer Price Index: – Average weighted prices of some 400 consumer products sold in urban areas around the nation – CPI = (current year market basket / base year market basket)*100 GDP Deflator vs. CPI Variable weights vs. Fixed weights All products vs. Selected products Domestic products vs. Domestic and imported products GDP Deflator vs. CPI Does CPI Overstates Inflation? CPI tends to overstate inflation because – Substitution for less expensive goods is not considered in the fixed market basket – New goods are continuously introduced in the market – Improvement in the quality of goods is not considered Population vs. Labor Force Population = Labor force + + Not in labor force In 1997, 203.1 million Labor force = Employed + Unemployed In 1997, 129.6 + 6.7 = 136.3 million Population vs. Labor Force 6.7 Unemployed Not in the labor force 66.8 129.6 Employed Labor Market Data Unemployment rate = unemployed as % of labor force In 1997, (6.7/136.3)*100 = 4.9% Labor force participation rate = labor force as % of adult population In 1997, (136.3/203.1)*100 = 67.1% Unemployment Conditions Members of the labor force Out of work Actively looking for work The Okun’s Law For any percentage point increase in the unemployment rate, the real GDP growth rate falls by 2 percent Change in real GDP = 3% - 2(change in unemployment rate) Example: if unemployment increases from 4 to 6%, GDP growth rate would fall from 3 to –1% Growth-Unemployment Trade-off