HW-6 Solution

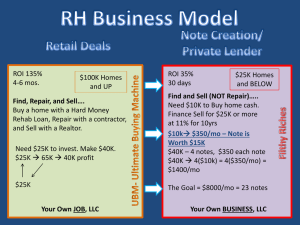

advertisement

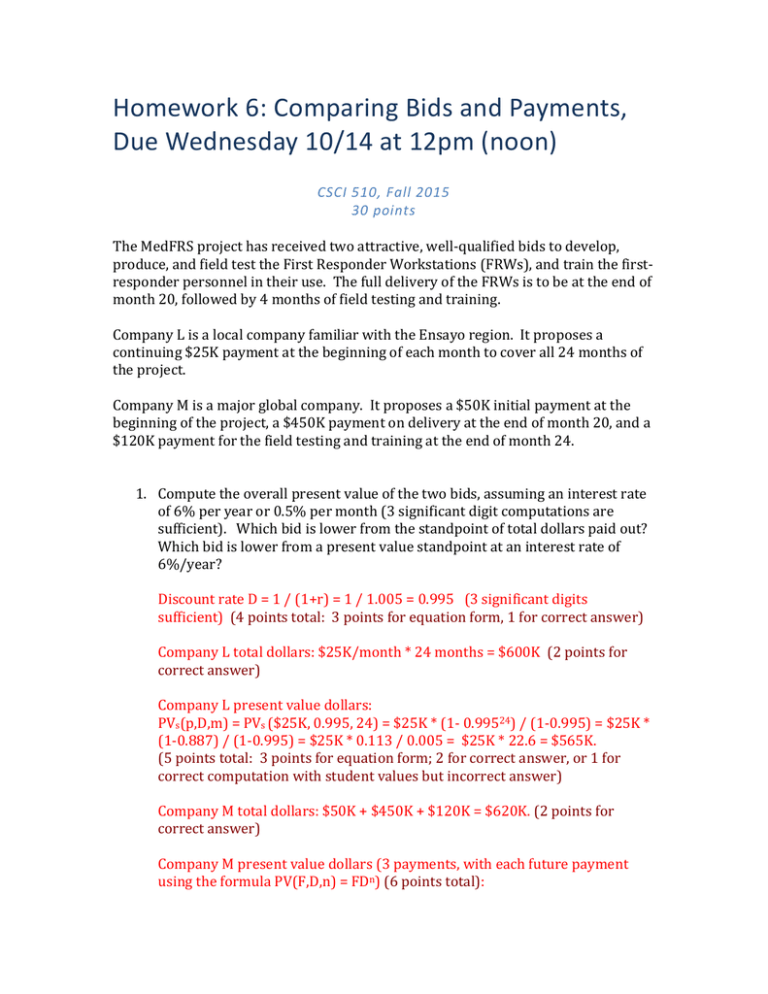

Homework 6: Comparing Bids and Payments, Due Wednesday 10/14 at 12pm (noon) CSCI 510, Fall 2015 30 points The MedFRS project has received two attractive, well-qualified bids to develop, produce, and field test the First Responder Workstations (FRWs), and train the firstresponder personnel in their use. The full delivery of the FRWs is to be at the end of month 20, followed by 4 months of field testing and training. Company L is a local company familiar with the Ensayo region. It proposes a continuing $25K payment at the beginning of each month to cover all 24 months of the project. Company M is a major global company. It proposes a $50K initial payment at the beginning of the project, a $450K payment on delivery at the end of month 20, and a $120K payment for the field testing and training at the end of month 24. 1. Compute the overall present value of the two bids, assuming an interest rate of 6% per year or 0.5% per month (3 significant digit computations are sufficient). Which bid is lower from the standpoint of total dollars paid out? Which bid is lower from a present value standpoint at an interest rate of 6%/year? Discount rate D = 1 / (1+r) = 1 / 1.005 = 0.995 (3 significant digits sufficient) (4 points total: 3 points for equation form, 1 for correct answer) Company L total dollars: $25K/month * 24 months = $600K (2 points for correct answer) Company L present value dollars: PVs(p,D,m) = PVs ($25K, 0.995, 24) = $25K * (1- 0.99524) / (1-0.995) = $25K * (1-0.887) / (1-0.995) = $25K * 0.113 / 0.005 = $25K * 22.6 = $565K. (5 points total: 3 points for equation form; 2 for correct answer, or 1 for correct computation with student values but incorrect answer) Company M total dollars: $50K + $450K + $120K = $620K. (2 points for correct answer) Company M present value dollars (3 payments, with each future payment using the formula PV(F,D,n) = FDn) (6 points total): $50K + $450K*0.99520 + $120K*0.99524 (3 for equation form on future payments; or 2 if exponents of 19 & 23 are used) = $50K + $450K*0.905 + $120K*0.887 = $50K + $407K + $106K (2 for correct answers here; or 1 for incorrect answers but correctly calculated with student values) = $563K. (1 point for correct total answer) Comparison on total dollars paid out: $600K < $620K, so L’s bid is lower. (1 point for correct answer) Comparison on present value: $565K > $563K, so M’s bid is lower. (2 points total: 2 points for correct answer, where “essentially equal” is considered correct; or 1 point for stating the comparison using student values but getting the incorrect answer.) 2. Name 2 non-dollar factors that might favor going with Company L? (4 points total: 2 points per valid factor) Company L personnel would be part of the Ensayo-region community; therefore some example factors are: o They would benefit from low-defect products when they were patients in a crisis. o They would better understand the nature and diversity of Ensayoregion first-responder product users. o The contract would be a boost in the Ensayo-region economy and a source of local jobs. 2. Name 2 non-dollar factors that might favor going with Company M? (4 points total: 2 points per valid factor) Company M project would have access to a global corporation’s advanced technology and global experts; therefore some example factors are: o It would be more likely to have experience with similar systems and products, and so deliver products of higher quality o It would be more likely to understand the rules and regulations covering safety-critical medical products, and so avoid problems with regulatory approval. o It is a bigger company, and so is less likely to fail to deliver for financial reasons.