HLS TaxHelp - Harvard Law School

advertisement

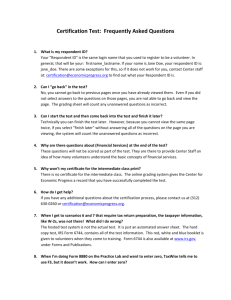

PLEASE SIGN IN! HLS TaxHelp Training February 2, 2008 (2007 Calendar Year Returns) TaxHelp Board: Jesse Gurman, Amber Greaves, Lane Morgan Overview Sign in if you haven’t already Tax law Interviewing Using TaxWise Review and filing Certification Tax Basics: Filing Status Who has to file? Most people if > $8,750, p. 8 Status – use workbook chart & tips, pp. 12-13 – Single (has no dependents) – Married filing jointly – Married filing separately – Head of household (unmarried or separated, w/deps) – Qualifying widow(er) with dependent child Married filing separately reduces credits – whenever possible file married/jointly or HoH Non-US citizens – intermediate issue Tax Basics: Dependents Use charts & tips, pp. 15-19 Children < 18 in HH, >50% expenses, tiebreakers College students 19-24, >50% expenses, “primary” res Qualifying relatives (or non-relative in HH), <$3400 Dependent as filer (“CAN” not “WILL” someone claim) Child credits automatic in TW, except child/dep care EIC – reqs mostly the same, but check (esp SSN) Divorce – no EIC or HoH for noncustodial, even w/perm Dependency and HoH not always same (student, parent) Tax Basics: Income Types Earned v. unearned (definition) Wages (form W-2) – both federal and state info, match address – check for part-year state residency issues – some government jobs/pensions not taxed by state Bank interest (form 1099-INT), dividends (1099-DIV) IRA, 401(k), other pensions (form 1099-R) – taxes are only owed if disbursed, or Roth IRA Social security, unemployment, worker’s comp, gambling Self-employment – intermediate only Tax Basics: Earned Income Credit Primary focus of VITA/TaxHelp Credit targeted to low-income taxpayers Higher for taxpayers with dependents – must file married/jointly or head of household Use flow chart/checklist to ensure all requirements met (pp. 35-38) EIC worksheet will pop up in Taxwise automatically if income cutoff is met Cutoffs: ~$38k (>1qc), ~34k (1qc), ~13k (0qc) Tax Basics: Tuition Credits/Deductions 3 different ways, all non-refundable – Hope Credit: first 2 years of undergrad, 100% credit of up to $1650 paid – Lifetime Learning Credit: any undergrad, grad or vocational, 20% credit of up to $10k paid – Straight deduction: @ tax rate, up to $4k paid Unless you are sure, try all 3 Make sure to follow charts carefully Hope and LLC form 8863, deduction 1040 p. 1 Tax Basics: Other Deductions/Credits Keep an eye out during the interview You can ask every question until you feel comfortable, or by “group” Ones that come up the most: – student loan interest – IRA contribution – Retirement Savings Credit (form 8880) Tax Basics: State (MA) Credits/deductions – Rent – Transportation – Home heating oil Proof of Health Insurance – new this year – taxpayer should receive MA 1099-HC in mail – if no insurance, might be MA refund penalty First time state filers can NOT e-file for MA Intermediate-Level Issues: Itemized Deductions Almost everyone takes standard deduction Ask taxpayer if he/she has itemized before Biggest reasons to itemize – – – – Mortgage Large health care costs Other large purchases (e.g. new car) must be > $5,350 (s), $10,700 (m), $7,850 (HoH) Itemized returns can only be completed by intermediate-certified volunteers Intermediate-Level Issues: SelfEmployment Income Some taxpayers will have self-employment income (housekeeping, babysitting, small business, etc.) May have 1099-misc or no documentation Returns with self-employment income can only be completed by intermediatecertified volunteers Advanced Issues We do not cover them They include: – complicated investments beyond 1099-int/div – sale of any stock, property, other capital gain – business income beyond basic self-employ If you have any doubt or questions, ask a site expert – do not try to do it yourself Logging into TaxWise Website is https://twonline.taxwise.com, or https://twonline.taxwise.com/training User = first initial + last name (all caps) Initial password will be the same (you will have to change it the first time) Our client number is 796235 EFIN is 040449 (don’t need for login) Completing the Return: Interview Review intake form, introductory chat Size up the bigger issues – filing status and dependents – types of income – possible credits Start TaxWise interview, enter info Keep in mind what is being asked and why If any intermediate issues, refer to expert Completing the Return: Forms USE ALL CAPS NO PUNCTUATION Check for red anywhere, CTRL + space Do federal and state unless reason not to Be very careful with SSNs and addresses Encourage e-file, but paper if taxpayer prefers Check or direct deposit; voucher or e-withdrawal Utilize 4012, Pub 17, irs.gov, and site expert See Taxwise flow chart p. 40 Completing the Return: Review Diagnostic check Every return must be quality reviewed, w/sheet E-file whenever possible – you will not e-file yourself, just mark “ready for e-file” – if paper filing, indicate in return status Print 2 copies, 1 for taxpayer, 1 for us Taxpayer signature, form 8879 Attach intake, 1040, W2, 1099-R, etc. Certification For tax lessons/reference info: http://www.irs.gov/app/vita/index.jsp For the test: http://linklearn.webtechteam.com/login.aspx?ReturnUrl= /default.aspx Basic level only (unless you want to do intermediate) 80% right, 2 tries, question types rotate Use 4012, Pub 17, and TaxWise! When you are done, email the pdf to agreaves@law.harvard.edu and you will be scheduled