Answers for Practice Questions: National Income Accounting

advertisement

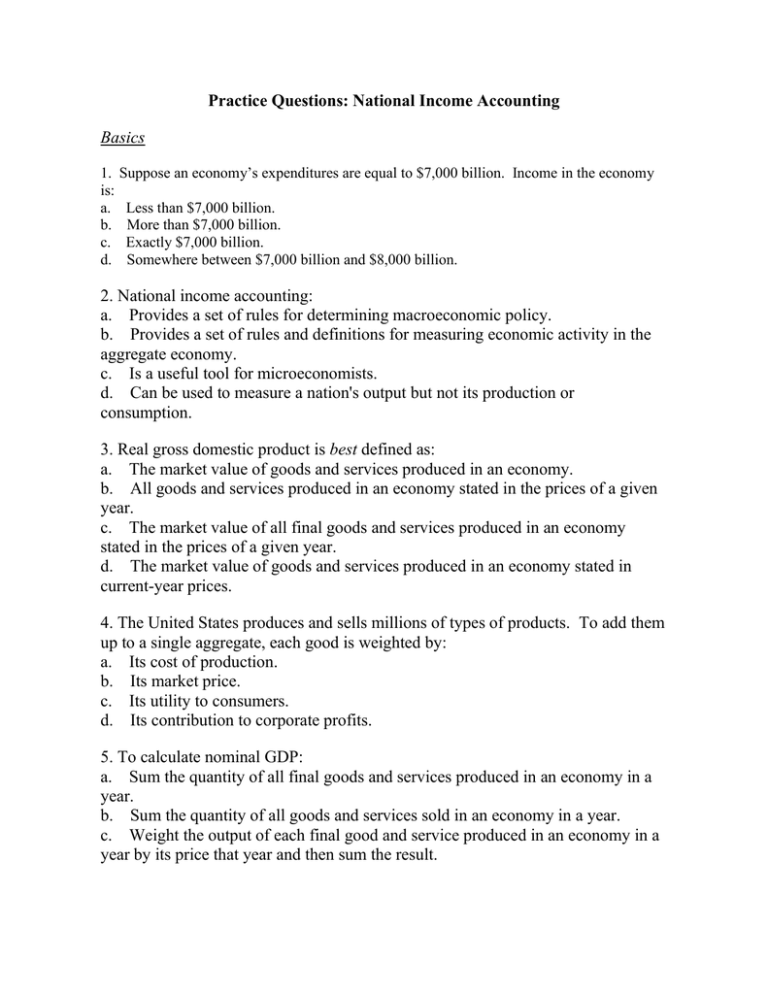

Practice Questions: National Income Accounting Basics 1. is: a. b. c. d. Suppose an economy’s expenditures are equal to $7,000 billion. Income in the economy Less than $7,000 billion. More than $7,000 billion. Exactly $7,000 billion. Somewhere between $7,000 billion and $8,000 billion. 2. National income accounting: a. Provides a set of rules for determining macroeconomic policy. b. Provides a set of rules and definitions for measuring economic activity in the aggregate economy. c. Is a useful tool for microeconomists. d. Can be used to measure a nation's output but not its production or consumption. 3. Real gross domestic product is best defined as: a. The market value of goods and services produced in an economy. b. All goods and services produced in an economy stated in the prices of a given year. c. The market value of all final goods and services produced in an economy stated in the prices of a given year. d. The market value of goods and services produced in an economy stated in current-year prices. 4. The United States produces and sells millions of types of products. To add them up to a single aggregate, each good is weighted by: a. Its cost of production. b. Its market price. c. Its utility to consumers. d. Its contribution to corporate profits. 5. To calculate nominal GDP: a. Sum the quantity of all final goods and services produced in an economy in a year. b. Sum the quantity of all goods and services sold in an economy in a year. c. Weight the output of each final good and service produced in an economy in a year by its price that year and then sum the result. d. Weight the output of each good and service produced in an economy in a year by its price in that year, and then sum the result. 6. To compute GDP, the quantity of each final good or service produced must first be weighted by: a. Its market price. b. Its cost of production. c. Its share of total output. d. Its contribution to corporate profits. Intermediate and Final Goods and Services 7. Which of the following is an example of an intermediate product? a. A pair of skis sold by a sporting goods retailer to a skier. b. A share of IBM stock. c. The lumber produced by Boise Cascade and sold to a builder of new houses. d. An antique car sold to the highest bidder. 8. Which of the following is an example of a final good or service? a. Unemployment compensation. b. A CD player purchased as a gift. c. Steel used in the production of appliances. d. Vegetables purchased by local restaurants to make soup. 9. Double counting in the national income accounts will not occur if GDP is computed by summing all: a. Sales of final output. b. Sales of final output and intermediate goods. c. Sales. d. Production costs. 10. Use the following information to answer the question. There are three firms in an economy: X, Y, and Z. Firm X buys $200 worth of goods from Y, and $300 worth of goods from firm Z, and produces 250 units of output at $4 per unit. Firm Y buys $150 worth of goods from firm X, and $250 worth of goods from firm Z, and produces 300 units of output at $6 per unit. Firm Z buys $75 worth of goods from firm X, and $50 worth of goods from firm Y, and produces 500 units at $2 per unit. Given this information, what is the economy’s GDP? Hint: remember that part of each firm’s production is used by one of the other firms as a production input (an intermediate product). a. b. c. d. $1825. $2700. $2775. $3800. Components of GDP 11. Investment is the purchase of capital equipment, inventories, and: a. Structures. b. Nondurable goods. c. Depreciation. d. Import investment. 12. Which of the following would be considered an investment expenditure? a. The Smith’s buy a home that was built in 1990. b. The federal government pays the salary of a captain in the Air Force. c. Jack’s Boat Storage buys a new boat lift. d. Chairs-R-Us buys a used lathe to manufacture chairs. 13. For purposes of calculating GDP, which of the following payments is not included in the government spending component? a. Social security payments. b. Wages paid by a local government to its road crew. c. Wages paid by a state government to the workers in its welfare department. d. The federal government’s purchase of a submarine from a shipbuilder. 14. a. b. c. d. Spending on capital equipment, inventories, and structures is referred to as: Consumption expenditure (C). Investment expenditure (I). Government expenditure (G). Expenditure on net exports (X – M) 15. The sale of illegal drugs: a. Is included in GDP under services. b. Is included in GDP under investment. c. Is included in GDP as a component of home production (non-market activity). d. Is not included in GDP. 16. Which of the following would be counted in the calculation of GDP? a. The sale of a rare coin to a coin collector. b. Homes that are rebuilt after being completely destroyed by a hurricane. c. The sale of a 1966 Ford Fairmont. d. The sale of cocaine in the black market. 17. Which of the following would NOT be counted as a final good for inclusion in GDP? a. A piece of glass bought by a consumer to fix a broken window. b. A sheet of glass purchased by a commercial builder of a new home. c. A sheet of glass produced this year and ending up in the inventory of a retail store. d. A home that is built this year, but is not sold. 18. Which of the following economic activities would not be included in US GDP? a. Dick hires a nanny for $10 an hour to help his wife take care of their kids. b. Jose is a great hairdresser, often receiving $20 tips (which he reports on his income taxes). c. MaxiPress adds $8,000 worth of books to its inventory which remains unsold by the end of the year. d. Rita has a job after school washing dishes 2 hours each evening in her parents diner. The other dishwashers get $6 an hour, but her parents give her room and board instead. 19. Which of the following is not a part of US GDP? a. The value of an insurance policy on a new BMW sold by a U.S. company. b. The value of a BMW imported from Germany. c. The value of a BMW produced in the U.S. d. The commissions earned by a BMW dealership in the US. 20. If a used car dealer buys a car for $6,000 and resells it for $6,500, how much has been added to GDP? a. Nothing. b. $500. c. $6,000 d. $6,500. GDP Calculations 21. If U.S. imports of goods and services exceed exports: a. U.S. GDP is less than the sum of consumption, investment, and government purchases. b. U.S. GDP exceeds the sum of consumption, investment, and government purchases. c. U.S. net exports are positive. d. U.S. GDP equals the sum of consumption, investment, and government purchases. Consumption Investment Transfer payments Government expenditures Exports Imports Net foreign factor income billions of dollars 4,900 1,300 1,050 1,200 1,050 950 20 22. Use the table above to calculate GDP. a. 6,200. b. 7,400. c. 7,500. d. 8,450. 23. Use the table above to calculate net exports. a. -100. b. 100. c. 950. d. 1050. Consumption Investment Transfer payments Government expenditures Exports Imports Net foreign factor income 24. a. b. c. d. Calculate GDP using the table above. 5570 5600 6050 6320 25. a. b. c. d. Calculate net exports using the table above. 170 200 450 650 In billions of dollars 3600 800 750 1000 650 450 -30 GDP Government purchases Transfer payments Exports Imports Net foreign factor income In trillions of dollars 5.0 1.0 0.2 0.4 0.5 0.4 26. Refer to the table above. What is consumption in this economy? a. $3.6 trillion. b. $3.9 trillion. c. $4.1 trillion. d. There is not sufficient information to compute consumption. Per-Capita GDP 27. Per capita real output product is best defined as: a. The market value of all final goods and services produced in an economy in current prices. b. The market value of all final goods and services produced in an economy in current prices divided by the population. c. The market value of all final goods and services produced in an economy in the prices of a given year. d. The market value of all final goods and services produced in an economy in the prices of a given year divided by the population. 28. Suppose the Gross Domestic Product in a country is $450 million and the population of that country is $150 million. What is the per-capita GDP of that country? a. $300 million. b. $30 million. c. $3 million. d. $0.3 million. Uses and Limitations of National Income Accounting 29. GDP is a: a. Good measure of relative welfare in various countries. b. Good measure of relative prices in various countries. c. Good measure of relative living standards in various countries. d. Good measure of market activities at market prices. 30. Comparisons of GDP levels across countries are most accurate when: a. The value of non-market activities is the same across countries. b. Prices are the same across countries. c. Prices and the value of non-market activities are the same across countries. d. Prices for non-market activities are the same across countries. Answers for Practice Questions: National Income Accounting 1. C 2. B 3. C 4. B 5. C 6. A 7. C 8. B 9. A 10. C 11. A 12. C 13. A 14. B 15. D 16. B 17. B 18. D 19. B 20. B 21. B 22. C 23. B 24. B 25. B 26. D 27. D 28. C 29. D 30. C