Research and Enterprise

advertisement

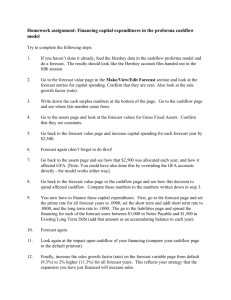

Research and Enterprise Business Awareness Programme Finance- ‘How can I fund my Idea’ Research and Enterprise Starting in Business Business Awareness Workshop “How can I fund my Idea” Bernard Curren MCMI Research and Enterprise Knowledge & Innovation Manager Research and Enterprise Starting in Business Programme Today’s topic Finance and Accounts General introductions Domestics Outline of the starting in Business Awareness programme Outline of today’s Finance and Accounts session Research and Enterprise Finance and Accounts Start-up Costs Personal Survival Budget Cashflow Forecast Profit and Loss Forecast Break Even Analysis Financial Management Sources of Finance Research and Enterprise Start-up Costs Business purchase Franchise Lease Purchase raw materials Stock Purchase Fixed Assets Re-vamp/redevelop Business Premises Assist with Cash flow (Working Capital) Insurances Research and Enterprise Further costs to consider Rent in Advance, ingoing premium Shop fitting, sign writing, Power & telephone connection Vehicles, Road Fund licence, vehicle insurance Advertising & Promotion Legal and other fees Probably some more!!!!! Research and Enterprise Start-up Costs Be realistic when estimating these costs Don’t turn a blind eye to them, these are genuine costs You have to find the money, its often pre-startup, (before trading commences) Research and Enterprise Start-up Costs How this can be funded Personal Finances • Equity • Trade Credit • Leasing and Hiring • • • • Small Firm Loan Guarantee Prime Royal British Legion Princes Youth Trust Loans Re-mortgage Overdraft Family/Friends Grants Redundancy Research and Enterprise Personal Survival Budget This is the minimum take you have from the business The Business Plan will need to sustain this overhead The PSB links with the following documents Business pricing structure Cashflow Forecast Marketing Plan Research and Enterprise Cashflow Always remember… Cash is King More Businesses fail through lack of cashflow --- than lack of no customers Research and Enterprise The Cashflow Forecast This important document helps to: Establish the amount of money required and when it is needed Ensure that capital expenditure is controlled Encourage efficient use of resources Identify any shortfalls Provides facts to help with decision-making Month 1 2 3 4 5 6 7 8 0 500 1500 3000 4500 4000 4000 4000 4000 500 1500 3000 4500 4000 4000 4000 1500 1500 1500 1500 1000 1250 1000 3000 500 500 500 500 500 500 500 500 0 0 0 0 0 0 0 500 Income Capital 2000 Loan 2000 Sales paid Total Income Expenditure Materials/purchases Survival Budget Salaries/ Drawings Rent/rates 900 Insurances 600 900 900 600 Motor 2000 250 200 200 200 200 250 250 Total Expenditure 5500 2250 2200 3450 1700 2550 3050 4250 -1500 -1750 -700 -450 2800 1450 950 -250 0 -1500 -3250 -3950 -4400 -1600 -150 800 -1500 -3250 -3950 -4400 -1600 -150 800 550 Net Cashflow Opening Balance Closing Balance Research and Enterprise The Profit & Loss Forecast Purpose To assess the profitability of a Business over a given period of time. Format Sales - Cost of Sales = Gross Profit Gross Profit - Overheads = Net Profit / (Loss) Method Match sales income with the “Cost” of producing that income Profit & Loss Forecasts cont Spread the costs across the time to which they relate. Months Sales Purchases Gross Profit Insurance Rent Motor Expenses Light & Heat Telephone Wages Profit / (Loss) Cumulative P/(L) 1 1,000 500 500 100 200 50 50 100 150 (150) (150) 2 1,000 500 500 100 200 60 50 100 150 (160) (310) 3 1,100 550 550 100 200 40 50 100 150 (90) (400) 4 1,500 750 750 100 200 50 50 100 150 100 (300) 5 2,000 1,000 1,000 100 200 50 50 100 150 350 50 …. No, it has made an overall profit of £50 for the 5 months Research and Enterprise Preparing the P&L Forecast Sales Forecast Produced from Market research Marketing plan Pricing policy Assumptions Cost of Sales Produced from Suppliers’ prices Unit costs Assumptions Overhead Budget Produced from Known costs Anticipated additional costs Assumptions Sales - Cost of Sales = Gross Profit Gross Profit - Overheads = Net Profit / (Loss) Breakeven Chart Pounds 150 Total Revenue 140 Profits Breakeven Point 100 Total Cost Losses 60 Total Variable Cost Fixed Cost 20 30 10 20 Sales Volume Research and Enterprise Breakeven Examples Level of sales Fixed Cost = stall rent + wages £12 + £12 = £24 Divided by Product price minus direct cost £5 - £3 = £2 Sales to breakeven 24/2 = 12 Units Research and Enterprise Book-Keeping Asset Register Sales Record Purchase Record Analysis book All in one accounts book Computer based system Record every transaction and asset acquisition with receipts. Keep personal finances separate. Business Bank accounts Research and Enterprise Professional Support Accountant Familiar with small businesses Recommend a book-keeping system Clear about what they will charge you. What’s the alternative!! Solicitor Strong commercial experience Member of ‘Lawyers for Business’ scheme Business Adviser Business Link 0845 6009966