Market Risk

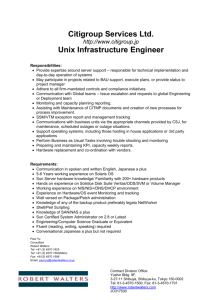

advertisement

Citigroup & Risk Management Ming Nie You Zhou About Citi Citicorp Regional consumer banking business Institutional clients group Citi Holdings Brokerage and assets management Local consumer lending Special asset pool Income Statement Continued Ratios of Citi Income summary 3Q 2010 Recent Stats Recent States Troubled Asset Relief Program (TARP) U.S government purchases assets and equity from financial institutions to help them to overcome financial crisis and revive the financial industry Signed in Oct 2008 Purchase or insure up to 700 billion “troubled assets” Entering TARP: Oct & Dec 2008: Citi raised $25 billion, and $20 billion through sales or preferred stock and warrants to the US Treasury Jan 2009: Citi issued $7.1 billion of preferred Stock to the US Treasury and FDIC July 2009: $25 billion preferred stock was exchanged to 7.7 billions shares of Citi’s common stock July 2009: $20b preferred stock issued to U.S treasury and $7.1b preferred stock issued to U.S treasury and FDIC were exchanged to trust preferred securities Result Paid U.S government approximately $2.2 billion dividends for preferred stock Paid $800 million interest for trust preferred securities Repayment of TARP Dec 2009: Citi repaid $20 billion of the trust preferred securities to U.S treasury $1.8 of the $7.1 billion were cancelled Dec 2009: Citi raised about $20.3 billion through issuance of common equity Citi made approximately $439.8 billion credit available to U.S borrowers After exiting from TARP: US Treasury holds 27% of common stock US Treasury and FDIC continue to hold $5.3 billion of trust preferred securities Risk Management Overview Credit risk Market risk Liquidity risk Price risk Operational risk Legal risk Reputational exposures Risk Management Guiding Principals a common risk capital model to evaluate risks; a defined risk appetite, aligned with business strategy; accountability through a common framework to manage risks; risk decisions based on transparent, accurate and rigorous analytics; expertise, stature, authority and independence of risk managers; and empowering risk managers to make decisions and escalate issues. “Taking intelligent risk” Citi must carefully measure and aggregate risks, must appreciate potential downside risks, and must understand risk/return relationships. “Shared responsibility” Risk and business management must actively partner to own risk controls and influence business outcomes. “Individual accountability” All individuals are ultimately responsible for identifying, understanding and managing risks. Risk Management Structure Business Chief Risk Officer: focal point for risk decisions in company’s major business groups Regional Chief Risk Officers: Accountable for risks in their geographic areas Product Chief Risk Officers: Accountable for risks within their speciality (real estate, structured products, etc) Credit Risk Credit Risk Losses result from borrowers or counterparties are not able to fulfill its obligation Business activities may involve credit risk: Lending Sales and trading Derivatives Securities transactions Settlement Act as an intermediary Credit Overview 2009: Citi reduced its aggregate loan portfolio by $102.7 billion $591.5 billion. Dec 2009: Coverage ratio of total loans increased to 6.09% from 4.27% in Dec 2008 Net credit losses of $30.7 billion during 2009 increased $11.7 billion from year-ago levels Dec 2009: Consumer non-accrual loans totalled $18.6 billion, Corporate non-accrual loans were $13.5 billion 2010 outlook Credit costs will still be a significant driver of Citi’s financial performance Asia and Latin America will show improvement in credit trends North America will show a slight improvement Outstanding loans - consumer Outstanding loans - Corporate 2009 2008 2007 2006 2005 Outstanding loans Percentage of net unearned income Credit loss Forgone interest revenue on loans Consumer Loan Modification programs Programs to assist borrower with financial difficulties Involves: modifying the original loan terms reducing interest rates extending the remaining loan duration waiving a portion of the remaining principal balance U.S. Treasury’s Home Affordable Modification Program (HAMP) reduce monthly mortgage payments to a 31% housing debt ratio by lowering the interest rate and extending the term of the loan and remove some principal of certain eligible borrowers December 2009, about $7.1 billion first mortgages entered into HAMP Short term & Long term programs Short term Long term Interest reduction up to 12- troubled debt restructuring month Term of loans are modified to Loan volume under short term program increased significantly long term Provide permanent interest reduction Credit risk mitigation Citigroup uses credit derivatives and other risk mitigants to hedge some portion of its credit risk In 2008, $95.5 billion of credit risk were hedged successfully In 2009, $59.6 billion of credit risk were hedged successfully Highly leveraged financing transactions Agreement to provide borrower higher level of funding Normally through corporate acquisitions or management buy-outs Principal and interest payment absorb a significant of cash flow generated by borrower’s business Risk of default will be higher, so a higher interest rate and fees will be charged Market Risk Liquidity risk risk that an entity may be unable to meet a financial commitment to a customer, creditor, or investor when due. 2. Price risk earnings risk from changes in interest rates, foreign exchange rates, and equity and commodity prices, and in their implied volatilities. arises in non-trading portfolios, as well as in trading portfolios. 1. 1. Liquidity risk Capital resources Liquidity Capital resources Capital has historically been generated by earnings from Citi’s operating business. Generally, capital is used primarily to support assets in Citi’s businesses and to absorb market, credit, or operational losses. Citigroup’s capital management framework is designed to ensure that Citigroup and its principal subsidiaries maintain sufficient capital consistent with Citi’s risk profile and all applicable regulatory standards and guidelines, as well as external rating agency considerations. Capital resources Risk-based capital guidelines issued by the Federal Reserve Board Risk-based capital ratios: the Tier 1 Capital—the sum of “core capital elements,” such as qualifying common stockholders’ equity, as adjusted, qualifying non-controlling interests, and qualifying mandatorily redeemable securities of subsidiary trusts, principally reduced by goodwill, other disallowed intangible assets, and disallowed deferred tax assets. Total Capital also includes “supplementary” Tier 2 Capital elements, such as qualifying subordinated debt and a limited portion of the allowance for credit losses. Both measures of capital adequacy are stated as a percentage of riskweighted assets. In conjunction with the conduct of the 2009 Supervisory Capital Assessment Program (SCAP), US banking regulators developed a new measure of capital termed “Tier 1 Common,” which has been defined as Tier 1 Capital less non-common elements, including qualifying perpetual preferred stock, qualifying non-controlling interests, and qualifying mandatorily redeemable securities of subsidiary trusts. • To be “well capitalized” under federal bank regulatory agency definitions, a bank holding company must have a Tier 1 Capital ratio of at least 6%, a Total Capital ratio of at least 10%, and a Leverage ratio of at least 3%, and not be subject to a Federal Reserve Board directive to maintain higher capital levels. • Citigroup’s regulatory capital ratios: Components of capital under regulatory guidelines Citibank, N.A. components of capital and ratios under regulatory guidelines Well capitalized—Tier 1 Capital ratio of at least 6%, a Total Capital (Tier 1 Capital + Tier 2 Capital) ratio of at least 10%, and a Leverage ratio of at least 5%, and not be subject to a regulatory directive to meet and maintain higher capital levels. The estimated sensitivity of Citigroup’s and Citibank, NA’s capital ratios to changes of $100 million in Tier 1 Common, Tier 1 Capital, or Total Capital (numerator), or changes of $1 billion in risk-weighted assets or adjusted average total assets (denominator) based on financial information as of Dec 31,2009: These sensitivities only consider a single change to either a component of capital, risk-weighted assets, or adjusted average total assets. Citigroup’s cash flows and liquidity needs are primarily generated within its operating subsidiaries. Exceptions exist for major corporate items, such as the TARP repayment, and for equity and certain long-term debt issuances, which take place at the Citigroup corporate level. Citigroup sources of funding include deposits, collateralized financing transactions and variety of unsecured short- and long-term instruments. In addition to growing its deposit base and engaging in long-term debt funding, Citi has been actively building its structural liquidity by reducing total assets. Management of liquidity Citigroup runs a centralized treasury model where the overall balance sheet is managed by Citigroup Treasury through Global Franchise Treasurers and Regional Treasurers. A uniform liquidity risk management policy exists for Citigroup, its consolidated subsidiaries and managed affiliates. Liquidity management is overseen by the Board of Directors through its Risk Management and Finance Committee and by senior management through Citigroup’s Finance and Asset and Liability Committee (FinALCO). Asset and Liability Committees are also established for each region, country and/or major line of business. Monitoring liquidity Each principal operating subsidiary and/or country must prepare for approval by the Treasurer and independent risk management. Citigroup establishes its key based on stress tests and a cash capital ratio. A series of tools used to monitor liquidity position— liquidity gaps and associated limits, liquidity ratios, stress testing and market triggers. liquidity gaps and limits • measures potential funding gaps over various time horizons in a standard operating environment • limits are established such that in stress scenarios, entities are self-funded or net providers of liquidity. • the risk tolerance for liquidity funding gaps is limited based on the capacity to cover the position in a stressed environment. liquidity ratios • cash capital ratio—a broader measure of the ability to fund the structurally illiquid portion of Citigroup’s balance sheet than traditional measures such as deposits to loans or core deposits to loans. stress testing • simulated liquidity stress testing is periodically performed for each major operating subsidiary and/or country. • intended to quantify the likely impact of an event on the balance sheet and liquidity position and to identify viable funding alternatives that can be utilized in a liquidity event. stress testing (continued) • as a result of the recent financial crisis, Citigroup increased the frequency, duration, and severity of certain stress testing, particularly related to the interconnection of idiosyncratic and systemic risk. market triggers • internal or external market or economic factors that may imply a change to market liquidity or Citigroup’s access to the markets • appropriate market triggers are also established and monitored for each major operating subsidiary and/or country credit ratings • Citigroup’s ability to access the capital markets and other sources of funds, as well as the cost of these funds and its ability to maintain certain deposits, is dependent on its credit ratings. 2. Price risknon-trading portfolios One primary business function: providing financial products that meet the needs of customers. Net interest revenue (NIR): difference between the yield earned on the non-trading portfolio assets and the rate paid on the liabilities. NIR is affected by changes in the level of interest rates. • a common set of standards that define, measure, limit and report the market risk • limits are monitored by independent market risk, country and business Asset and Liability Committees (ALCOs) and the Global Finance and Asset and Liability Committee (FinALCO). • measure of risk to NIR is interest rate exposure (IRE) • IRE-measures the change in expected NIR in each currency resulting solely from unanticipated changes in forward interest rates. • IRE tests the impact on NIR resulting from unanticipated changes in forward interest rates. • the impact of changing prepayment rates on loan portfolios is incorporated into the results. • modify pricing on new customer loans and deposits • enter into transactions with other institutions • enter into off-balance-sheet derivative transactions that have the opposite risk exposures Therefore, • regularly assesses the viability of strategies when it believes those actions are prudent • additional measurements: stress testing the impact of non-linear interest rate movements on the value of the balance sheet analysis of portfolio duration and volatility, particularly as they relate to mortgage loans and mortgage-backed securities the potential impact of the change in the spread between different market indices Non-trading portfolios Approximate annualized risk to NIR assuming an unanticipated parallel instantaneous 100 bps change, as well as a more gradual 100 bps parallel change in rates compared with the market forward interest rates The following table shows the risk to NIR from six different changes in the implied-forward rates. Each scenario assumes that the rate change will occur on a gradual basis every three months over the course of one year. 2. Price risktrading portfolios Monitored using: Factor sensitivities Value-at-risk (VAR) Stress testing Factor sensitivities Expressed as the change in the value of a position for a defined change in a market risk factor, such as a change in the value of a Treasury bill for a one-basispoint change in interest rates. Citigroup’s independent market risk management ensures that factor sensitivities are calculated, monitored and, in most cases, limited, for all relevant risks taken in a trading portfolio. VAR Estimates the potential decline in the value of a position or a portfolio under normal market conditions. The VAR method incorporates the factor sensitivities of the trading portfolio with the volatilities and correlations of those factors and is expressed as the risk to Citigroup over a one-day holding period, at a 99% confidence level. Based on the volatilities of and correlations among a multitude of market risk factors as well as factors that track the specific issuer risk in debt and equity securities. Stress testing Performed on trading portfolios on a regular basis to estimate the impact of extreme market movements. Independent market risk management, in conjunction with the business, develops stress scenarios, reviews the output of periodic stress-testing exercises, and uses the information to make judgments as to the ongoing appropriateness of exposure levels and limits. Trading portfolios Each trading portfolio has its own market risk limit framework encompassing these measures and other controls. Total revenues of the trading business consist of: • customer revenue, which includes spreads from customer flow and positions taken to facilitate customer orders • proprietary trading activities in both cash and derivative transactions • net interest revenue In 2009, negative trading-related revenue (net losses) was recorded for 58 of 260 trading days. Of the 58 days on which negative revenue was recorded, two days were greater than $400 million. The following histogram of total daily revenue or loss captures trading volatility and shows the number of days in which Citigroup’s trading-related revenues fell within particular ranges. Back-testing Citigroup periodically performs extensive back-testing of many hypothetical test portfolios as one check of the accuracy of its VAR. The process in which the daily VAR of a portfolio is compared to the actual daily change in the market value of its transactions. Is conducted to confirm that the daily market value losses in excess of a 99% confidence level occur, on average, only 1% of the time. The VAR calculation for the hypothetical test portfolios, with different degrees of risk concentration, meets this statistical criteria. Expectations of future price and market movements Vary from period to period Market environment Price risk exposure VAR to Citigroup in the trading portfolios (including the total VAR, the specific risk-only component of VAR, and total— general market factors only, along with the yearly averages: The range of VAR in each type of trading portfolio: VAR for Citigroup’s Securities and Banking business (ICG Citicorp VAR, which excludes Consumer): Operational risk Risk of loss resulting from inadequate or failed internal processes, systems or human factors, or from external events. Includes the reputation and franchise risk associated with business practices or market conduct in which Citi is involved. Managed through an overall framework designed to balance strong corporate oversight with well-defined independent risk management. The framework includes: Recognized ownership of the risk by the business Oversight by independent risk management Independent review by Citi’s Audit and Risk Review (ARR) Goal: Keep operational risk at appropriate levels relative to the characteristics of Citigrourp’s businesses, the markets in which the company operates its capital and liquidity. And the competitive, economic and regulatory environment. Framework To monitor, mitigate and control operational risk, Citigroup maintains a system of comprehensive policies and established a consistent, value-added framework for assessing and communicating operational risk and the overall effectiveness of the internal control environment. Operational Risk Council provides oversight Council works with the business segments and the control functions to help ensure a transparent, consistent and comprehensive framework for managing operational risk globally. Framework The process for operational risk management: Identify and assess key operational risks Establish key risk indicators Produce a comprehensive operational risk report Prioritize and assure adequate resources to actively improve the operational risk environment and mitigate emerging risks The operational risk standards facilitate the effective communication and mitigation of operational risk both within and across business. Measurement and Basel II Required to capture relevant operational risk capital information Enhanced version of the risk capital model—Basel II capital calculations Uses a combination of internal and external loss data to support statistical modeling of capital requirement estimates, which are then adjusted to reflect qualitative data regarding the operational risk and control environment. Information Security Information security and the protection of confidential and sensitive customer data Citi has implemented an Information Security Program that complies with the Gramm-Leach-Bliley Act and other regulatory guidance. The Information Security Program is reviewed and enhanced periodically to address emerging threats to customers’ information. Country risk The risk that an event in a foreign country will impair the value of Citigroup assets or will adversely affect the ability of obligors within that country to honor their obligations to Citigroup. Country risk events—sovereign defaults, banking or currency crises, social instability, and changes in governmental policies Country risk includes local franchise risk, credit risk, market risk, operational risk and cross-border risk. The country risk management framework includes country risk rating models, scenario planning and stress testing, internal watch lists, and the Country Risk Committee process. The Citigroup Country Risk Committee is the senior forum to evaluate Citi’s total business footprint within a specific country franchise with emphasis on responses to current potential country risk events. The Committee regularly reviews all risk exposures within a country, makes recommendations as to actions, and follows up to ensure appropriate accountability. Cross-Border risk The risk that actions taken by a non-US government may prevent the conversion of local currency into non-local currency and/or the transfer of funds outside the country, among other risks, thereby impacting the ability of Citigroup and its customers to transact business across borders. Examples include actions taken by foreign governments such as exchange controls, debt moratoria, or restrictions on the remittance of funds. The above actions might restrict the transfer of funds or the ability of Citigroup to obtain payment from customers on their contractual obligations. Recent example of this risk— Venezuelan Bolivar Devaluation The Venezuelan government enacted currency restriction in 2003 that have restricted Citigroup’s ability to obtain foreign currency in Venezuela at the official foreign currency rate. Citigroup uses the official rate to re-measure the foreign currency transactions in the financial statements of the Venezuelan subsidiaries, which have US dollar functional currencies, into US dollars. At , Citigroup had net monetary assets denominated in bolivars and subject to the official rate of approximately . On , the Venezuelan government announced the of the official foreign currency exchange rate from bolivars per dollar to bolivars per dollar and the creation of a dual, subsidized exchange rate of 2.6 bolivars per dollar for the importation of certain essential goods. The devaluation in the rate is expected to result in a to the Company of approximately in the first quarter of 2010. Additionally, revenue and net operating profit in US dollar terms will be reduced on an ongoing basis. Cross-border outstandings are reported under Federal Financial Institutions Examination Council (FFIEC) regulatory guidelines. All countries where total FFIEC cross-border outstandings exceed 0.75% of total Citigroup assets: Derivatives Derivative Obligor Information: The global derivatives portfolio by internal obligor credit rating, as a percentage of credit exposure: The global derivatives portfolio by industry of the obligor as a percentage of credit exposure: Credit valuation adjustments (CVA) Citigroup applies the fair value adjustments to derivative carrying values CVA are used to OTC derivative instruments, in which the base valuation generally discounts expected cash flows using LIBOR interest rate curves. Not all counterparties have the same credit risk, a CVA is necessary to incorporate the market view of both counterparty credit risk and Citi’s own credit risk in the valuation. Derivatives activities Futures and forward contracts • Commitments to buy or sell at a future date a financial instruments, commodity or currency at a contracted price and may be settled in cash or through delivery. Swap contracts • Commitments to settle in cash at a future date or dates that may range from a few days to a number of years, based on differentials between specified financial indices, as applied to a notional principal amount. Option contracts • Give the purchaser, for a fee, the right to buy or sell within a limited time a financial instrument, commodity or currency at a contracted price that may also be settled in cash. Trading purposes— own account Trading purposes— customer needs Reasons for entering into derivative contracts Hedging Hedge certain risks or reposition the risk profile of the Company Example: issue fixed-rate long-term debt and then enter into a receive-fixed, pay-variable-rate interest rate swap with the same tenor and notional amount to convert the interest payments to a net variable-rate basis Most common form of an interest rate hedge—minimizing interest risks inherent in specific groups of on-balance-sheet assets and liabilities Foreign-exchange contracts are used to hedge non-US-dollardenominated debt, foreign-currency-denominated availablefor-sale securities, net capital exposures and foreign-exchange transactions The notional amounts, for both long and short derivative positions, of Citigroup’s derivative instruments: Fair value hedges—hedging of benchmark interest rate risk Citigroup hedges exposure Citigroup also hedges to changes in the fair value of outstanding fixed-rate issued debt and borrowing. The fixed cash flows from those financing transactions are converted to benchmark variable-rate cash flows by entering into receive-fixed, pay-variable interest rate swaps. exposure to changes in the fair value of fixed-rate assets, including availablefor-sale debt securities and loans. The hedging instruments used are receive-variable, pay-fixed interest rate swaps. Fair value hedges—hedging of foreign exchange risk Citigroup hedges the change in fair value attributable to foreign-exchange rate movements in available-for-sale securities that are denominated in currencies other than the functional currency of the entity holding the securities, which may be within or outside the US. The hedging instrument employed is a forward foreignexchange contract. Citigroup considers the premium associated with forward contracts (differential between spot and contractual forward rates) as the cost of hedging, this is excluded from the assessment of hedge effectiveness and reflected directly in earning. Dollar-offset method is used to assess hedge effectiveness. Citigroup’s fair value hedges Cash flow hedges Citigroup hedges variable cash flows resulting from floating-rate liabilities and rollover of short-term liabilities. By entering into receive-variable, pay-fixed interest-rate swaps and receive-variable, pay-fixed forward-starting interest-rate swaps. Citigroup locks in the functional currency equivalent of cash flows of various balance sheet liability exposures, including short-term borrowings and long-term debt that are denominated in a currency other than the functional currency of the issuing entity. The hedging instruments used are foreign-exchange forward contracts, crosscurrency swaps and foreign-currency options. For some hedges, Citigroup matches all terms of the hedged item and the hedging derivative at inception and on an ongoing basis to eliminate hedge ineffectiveness. Manages the risk associated with highly leveraged financing it has entered into by seeking to sell a majority of its exposures to the market prior to or shortly after funding. Hedged with a total return swap. The pretax change in Accumulated other comprehensive income (loss) from cash flow hedges: Net investment hedges Citigroup uses foreign-currency forwards, options and swaps and foreign-currency-denominated debt instruments to manage the foreign-exchange risk associated with Citigroup’s equity investments in several non-US dollar functional currency foreign subsidiaries. The pretax loss recorded in foreign-currency translation adjustment within Accumulated other comprehensive income (loss), related to the effective portion of the net investment hedges, is $4,560 million during the year ended December 31, 2009. Credit derivatives A bilateral contract between a buyer and a seller under which the seller agrees to provide protection to the buyer against the credit risk of a particular entity. Citi makes markets in and trades a range of credit derivatives, both on behalf of clients as well as for its own account. Through these contracts, the Company either purchases or writes protection on either a single name or a portfolio of reference credits. Citi uses credit derivatives to help mitigate credit risk in its corporate and consumer loan portfolio and other cash positions, to take proprietary trading positions, and to facilitate client transactions. The range of credit derivatives sold includes credit default swaps, total return swaps and credit options. Key characteristics of Citi’s credit derivative portfolio as protection seller Payment/performance risk Citigroup evaluates the payment/performance risk of the credit derivatives to which it stands as a protection seller based on the credit rating which has been assigned to the underlying referenced credit. Where external ratings by nationally recognized statistical rating organizations (Moody’s and S&P) are used, investment grade ratings are considered to be Baa/BBB or above. Internal ratings are in line with the related external credit rating system. The in the table above primarily includes credit derivatives where the underlying referenced entity has been downgraded subsequent to the inception of the derivative. Citi’s credit derivative portfolio Citi actively monitors its counterparty credit risk in credit derivative contracts. Approximately 85% and 88% of the gross receivables are from counterparties with which Citi maintains collateral agreements as of Dec 31, 2009 and 2008. A majority of Citi’s top 15 counterparties are banks, financial institutions or other dealers. Contracts with these counterparties do not include ratings-based termination events. Key characteristics of Citi’s credit derivative portfolio by counterparty and derivative form: Concentrations of credit risk Exist when changes in economic, industry or geographic factors similarly affect groups of counterparties whose aggregate credit exposure is material in relation to Citigroup’s total credit exposure. In connection with the Company’s effort to maintain a diversified portfolio, the Company limits its exposure to any one geographic region, country or individual creditor and monitors this exposure on a continuous basis. Most significant concentration—the US government and its agencies. Primarily results from trading assets and investments issued by the US government and its agencies. The Mexican and Japanese governments and their agencies are the next largest exposures. Risk Management Practice Risk management oversight for Citigroup’s U.S. pension plans and largest non-U.S. pension plans Managed by Citigroup’s Independent Risk Management Regional Units Risk Management Practices Periodic asset liability management and strategic asset allocation studies Monitoring of funding levels and funding ratios Monitoring compliance with asset allocation guidelines Monitoring asset class performance against asset class benchmarks Monitoring investor manager performance against benchmarks Quarterly risk capital measurement