The History of Monte Carlo Simulation Methods

advertisement

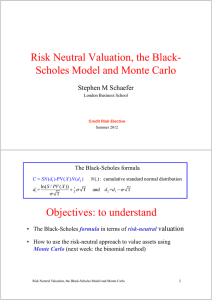

The History of Monte Carlo Simulation Methods in Financial Engineering Paul Wilmott Monte Carlo • • • • One of Monaco’s four quarters Not its capital…Monaco doesn’t have one Formula One Monaco Grand Prix Casino (1873, Joseph Jagger ‘broke the bank’) Probabilistic Concepts • Games of chance, dice games • Formal probability theory 17th Century (Pascal and Fermat) Calculating p • Buffon’s needle (1777) – Parallel lines one inch apart, needle one inch long 2 – Probability of ‘hit’ is p Brownian Motion 1827 • The Scottish botanist, Robert Brown, gave his name to the random motion of small particles in a liquid. This idea of the random walk has permeated many scientific fields and is commonly used as the model mechanism behind a variety of unpredictable continuous-time processes. The lognormal random walk based on Brownian motion is the classical paradigm for the stock market. Louis Bachelier 1900 • Louis Bachelier was the first to quantify the concept of Brownian motion. He developed a mathematical theory for random walks, a theory rediscovered later by Einstein. He proposed a model for equity prices, a simple normal distribution, and built on it a model for pricing the almost unheard of options. His model contained many of the seeds for later work, but lay ‘dormant’ for many, many years. Fokker, Planck, Kolmogorov 1913 • Adriaan Fokker and Max Planck showed how to relate transition probability density functions for random variables to partial differential equations, this is the ‘forward equation.’ Later Andrey Kolmogorov derived a related ‘backward equation.’ Manhattan Project • Stanislaw Ulam invented the technique for solving certain types of differential equation using probabilistic methods. (Again inspired by a card game.) • The name “Monte Carlo” was given by Nicholas Metropolis. Both of these were working on the Manhattan Project, towards the development of nuclear weapons. Quadrature • Suppose you want to evaluate a complicated integral b a f ( x)dx • This can be interpreted as (b – a) times average of f(x). • So…a relationship between probabilities and integrals…just pick x at random, calculate f(x) and then average! Quadrature cont’d • And this works in any number of dimensions! • And speed of convergence is roughly the same, independent of number of dimensions. 1 N 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Genuinely uniform random in two dimensions 1960s Sobol’, Faure, Hammersley, Haselgrove, Halton… • Many people were associated with the definition and development of quasi random number theory or low-discrepancy sequence theory. The subject concerns the distribution of points in an arbitrary number of dimensions so as to cover the space as efficiently as possible, with as few points as possible. The methodology is used in the evaluation of multiple integrals among other things. These ideas would find a use in finance almost three decades later. Low-discrepancy sequences • Converges like 1 N 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Low-discrepancy sequences 0.9 1 Black-Scholes 1973 • Fischer Black, Myron Scholes and Robert Merton derived the Black-Scholes equation for options in the early seventies, publishing it in two separate papers in 1973. The date corresponded almost exactly with the trading of call options on the Chicago Board Options Exchange. Scholes and Merton won the Nobel Prize for Economics in 1997. Black had died in 1995. Option Prices as Expectations • The famous Black-Scholes option-pricing model bears close resemblance to the Kolmogorov backward equation. • A close examination of these two equations leads to… Option Prices as Expectations cont’d • The fair value of an option is The present value of the expected payoff Phelim Boyle 1977 • Phelim Boyle related the pricing of options to the simulation of random asset paths. He showed how to find the fair value of an option by generating lots of possible future paths for an asset and then looking at the average that the option had paid off. The future important role of Monte Carlo simulations in finance was assured. Stochastic Models in Finance • The most successful models in financial engineering use the mathematics of stochastic calculus. • Without a doubt, there would not have been the enormous growth in quantity and types of contracts traded if there wasn’t such a solid theoretical foundation. Equities, FX and Commodities • The classic model starts with the lognormal random walk. • The asset model contains a deterministic growth rate and a volatility, the latter representing the amount of randomness in the asset path. Recent developments • As profit margins shrink and markets become more efficient, researchers develop new (and better?) models to try to capture reality: – Stochastic volatility – Jump diffusion Fixed Income • Similar models are used in the fixedincome world. • Originally the random quantity was just the spot interest rate (a very short-term rate), in a ‘single-factor’ model. Fixed Income cont’d • Then there came the multi-factor models • Now people model entire yield curves moving randomly, not just single values. So interest rates of different maturities are modelled simultaneously. The Market Price of Risk • One of the inputs into fixed-income models is the ‘market price of risk.’ • This can be interpreted as ‘how much the market wants to be compensated for taking risk.’ • But how rational is the market? The Market Price of Risk cont’d 15 GREED 10 Lambda 5 Time 0 29/03/1986 11/08/1987 23/12/1988 07/05/1990 19/09/1991 31/01/1993 15/06/1994 28/10/1995 -5 -10 -15 -20 FEAR -25 Maybe we should model this as stochastic as well! Credit Risk • Very hot at the moment are credit derivatives. • These financial instruments give a return to investors that is contingent on default of a company, for example. • These instruments can be valued using Monte Carlo simulation via models for jump processes. • Roll a dice, and you get a one, you default. • And we are back with games of chance!