Word - Personal Pages Index

advertisement

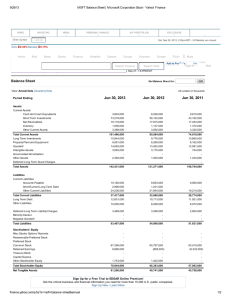

FINA 351 – Managerial Finance, Ch. 2 Questions (Ref. 2a) Read Ch. 2 and answer the following questions. Again, note that this is assigned on Thursday and due no later than Friday midnight. However, wise students will start work on it before we cover it in class on Friday. Please email the assignment to fina351@wallawalla.edu and put “2a” in the reference line. THE BALANCE SHEET Capital Structure 1. (A) T or F: The right-hand side of the balance sheet tells us who (creditors vs. owners) has claim to the assets. (B) What was the term used in Ch. 1 to refer to the mix of debt and equity on the right side of the balance sheet? (C) Go to http://finance.yahoo.com/ and enter the ticker symbol for Microsoft, which is MSFT. On the left, under Financials, click on Balance Sheet, and at the top Quarterly Data. For the latest quarter, calculate the percent of the total assets claimed by creditors (Total Liabilities / Total Assets). How would you describe in words Microsoft’s capital structure in terms of debt vs. equity financing? (D) Repeat step C for Sears Holding Company, owner of Sears and Kmart (ticker SHLD). (E) NetworthIQ is a cool website where people anonymously post their personal balance sheets. Go to https://www.networthiq.com/people/AidenPants and review the information on the page in order to answer this question: Has the net worth of this Portland young woman been getting better or worse? Why? Working Capital 2. (A) Go to http://finance.yahoo.com/ and enter the ticker symbol for Microsoft, which is MSFT. On the left, under Financials, click on Balance Sheet, and at the top Quarterly Data. For the latest quarter year, determine how much working capital Microsoft has (i.e. Total Current Assets - Total Current Liabilities). Also calculate MSFT’s current ratio (i.e. Total Current Assets / Total Current Liabilities). Does it appear that Microsoft has a working capital problem? Explain. (B) Repeat step A for Radio Shack (ticker RSHCQ). (C) Which of these two companies had better working capital and can more easily pay its bills? Explain. Liquidity 3. (A) What is liquidity? (B) Which is more liquid: Equipment or accounts receivable? Inventory or a patent? Investment in common stock of a public company or investment in a private business partnership? (C) T or F: One way that liquidity is indicated on the balance sheet is that assets are listed in order of increasing liquidity (i.e. least liquid listed first) and liabilities are listed in order of decreasing maturity (amounts due latest are listed first).| (D) What main physical property does a liquid have that a solid does not? (Hint: Why does grandpa have to liquidate the farm in order to divide the assets among all the heirs?) (E) When a divorce judge ruled that she got half of everything he owned, what did he do to the assets rather than liquidate them? See https://www.youtube.com/watch?v=ZHLg_9DGbSg Market vs. Book Value 4. Go to http://finance.yahoo.com/ and enter the ticker symbol for Wal-Mart, which is WMT. (A) On the left, click on Key Statistics and under Valuation Measures record the current market-to-book ratio of Wal-Mart. Note that Yahoo calls the market-to-book ratio the price-to-book (mrq) ratio. (B) Explain in your own words what this ratio means. (C) There are several reasons discussed in your text and the instructor notes about why the market value of a company is usually much different from the book value. What are two reasons why Wal-Mart’s market value is different from its book value? 5. Below is the Balance Sheet of XYZ Corp., which has 200 shares outstanding, each trading on the stock market for $2.00. (BV stands for book value and MV stands for market value.) (A) Calculate the book value per share and market value per share. (B) Calculate the market-to-book ratio. (C) What does a market-to-book ratio greater than one mean? (D) If a company has a market-to-book ratio less than 1:1, does this usually indicate a healthy or a sick company? ASSETS OWNERS’ EQUITY LIABILITIES BV MV BV MV Cash 100 100 Accts Pay. 100 100 PP&E 400 200 Notes Pay. 200 200 Intellectual-Soft n/a 400 Totals 500 700 300 300 BV Net Worth MV 200 400 200 400 THE INCOME STATEMENT 6. (A) What is the difference between the accrual basis and cash basis of accounting? (B) Which accounting basis must be used by corporations that have their stock traded publicly? Why? (C) Which accounting basis do you use on your income tax return? (Hint: if you got paid in Jan. for work you did in Dec., in which year would you be taxed on that income - - the year you earned it or the year you got paid?) (D) Refer to the information below for XYZ Corp. List one possible reason why the Income Earned figure under the accrual basis is different from the Cash Receipts figure? (E) Refer to the information below for XYZ Corp. List one possible reason why the Expenses Incurred figure under the accrual basis is different from the Cash Payments figure? (F) What is earnings management? (See your text.) XYZ Corporation, Latest Fiscal Year GAAP-Accrual Cash-Basis Income Earned $5,000 Cash Receipts $4,000 Expenses Incurred $4,000 Cash Payments $2,000 Net Income $1,000 Net Cash Increase $2,000 STATEMENT OF CASH FLOW 7. (A) See the instructor notes for this chapter to complete the matching problem below, which summarizes the statement of cash flows for six different companies. Cash Flows from: Operating Activities Investing Activities Financing Activities Net Incr (Decr) in Cash Hypothetical Companies B C D E -200 +200 +300 +300 +400 -400 +200 +100 -100 +200 -500 +200 +100 0 0 +600 A -100 -200 +300 0 F +200 -100 -100 +0 Matching: 1____Going strong & ensuring strength for tomorrow by investing in the future with funds from operations and external financers (normal cash flow, particularly in early stages) 4____Poor health and getting ready to die (liquidation: selling off investments and paying off debts; reaching for the coffin lid) 2____ Satisfying cash-hungry financiers by selling investments & distributing cash (typical in late maturity stage) 5____ Moving ahead in faith; despite the odds, somebody believes in you enough to provide external financing so that you can make L/T investments and hopefully turn things around (cash flow typical in start-up stages) 3____ Hoarding cash for an unknown reason (selling assets and borrowing cash, possibly to have enough for a takeover or expansion) 6____ Going strong, investing in the future, and rewarding external financiers (normal cash flow, particularly in later maturity stages) (B) Go to http://finance.yahoo.com/ and enter the ticker symbol for Facebook, which is FB. On the left, under Financials, click on Cash Flow, and at the top Annual Data. For the latest fiscal year, determine which of the five cash flow patterns discussed in the previous problem appear to match the closest with FB’s cash flow. (Choose a letter from A-F). TAXES 8. Refer to the taxable income figures in the table below for Corporations A and B and to the tax rate schedule in your text and the instructor notes. (A) Calculate how much income tax each corporation would pay. Corp A Corp B Gross Income $160,000 $100 million Deductions $109,000 $ 70 million $51,000 $ 30 million Taxable income (B) Determine the average and marginal tax rates for each corporation. (C) Suppose that Corp A is doing some tax planning in December (end of taxable year). (1) If Corp A could claim another $1,000 of deductions in December, how much less tax would it pay for the year? (2) If Corp A had to record another $1,000 of income in December, how much more tax would it owe for the year? (D) Would the marginal or the average rate be more useful in tax planning calculations, such as in C above? (E) Refer to the table below, which shows corporate tax rates by country and regions. Run your finger down the latest average marginal rate by country (includes state and federal tax). (1) Is the corporate tax rate in the U.S. high or low compared with most other countries? (2) What implications does this has on the U.S. economy and on its global competitiveness? (For added discussion, Google the term “tax inversion.”) (F) Do you think the U.S. corporate income tax structure is progressive enough, too progressive, or just right? (progressive means that rates get higher for larger taxable incomes) (G) If corporate tax rates were raised, who do you suppose would end up paying the added cost? KPMG’s calculation of corporate tax rates by country or region. https://home.kpmg.com/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html