Managerial Accounting

by James Jiambalvo

Chapter 12:

Decentralization and

Performance

Evaluation

Slides Prepared by:

Scott Peterson

Northern State

University

Objectives

1. List and explain the advantages and

disadvantages of decentralization.

2. Explain why companies evaluate the

performance of subunit managers.

3. Identify cost centers, profit centers,

and investment centers.

4. Calculate and interpret return on

investment (ROI).

Objectives

(Continued)

5. Explain why using a measure of profit to

evaluate performance can lead to

overinvestment and why using a measure

of return on investment (ROI) can lead to

underinvestment

6. Calculate and interpret residual income

(RI) and economic value added (EVA).

7. Explain the potential benefits of using a

Balanced Scorecard to assess

performance.

Advantages of Decentralization

1. Better information leading to superior

decisions.

2. Faster response to changing

circumstances.

3. Increased motivation of managers.

4. Excellent training for future top level

executives.

Advantages of Decentralization

Disadvantages of

Decentralization

1. Costly duplication of activities.

2. Lack of goal congruence.

Why Companies Evaluate The

Performance of Subunits and

Subunit Managers

1. Decentralization naturally leads to evaluate

subunits and managers.

2. Companies evaluate performance of

subunits and managers for two reasons:

a. Evaluation identifies successful operations

and areas needing improvement.

b. Evaluating performance influences manager

behavior.

Responsibility Accounting and

Performance Evaluation

1. Responsibility accounting holds

managers responsible for only costs and

revenues which they can control.

2. To implement responsibility accounting

in a decentralized organization, costs

and revenues are traced to the

organizational level where they can be

controlled.

Responsibility Accounting and

Performance Evaluation

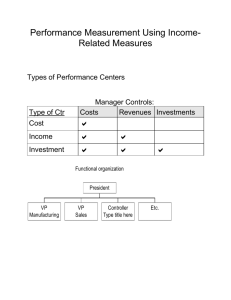

Cost Centers, Profit Centers,

and Investment Centers

1. Subunits are organizational units with

identifiable collections of related resources

and activities.

2. A subunit may be a:

a. Department

b. Subsidiary

c. Division.

3. Subunits are sometimes referred to as

responsibility centers and include cost

centers, profit centers, and investment

centers.

Cost Centers, Profit Centers,

and Investment Centers

(Continued)

4. Subunits are also called responsibility

centers.

5. Include:

a. Cost centers

b. Profit centers

c. Investment centers.

Cost Centers

1. Subunit that has responsibility for

controlling costs but does not have

responsibility for generating revenue.

2. Examples: janitorial, computer service, and

production departments.

3. Managerial goal: to provide services at a

reasonable cost to the company.

4. Evaluation: compare budgeted/standard

costs with actual costs.

Profit Centers

1. Subunit that has responsibility for generating

revenues as well as for controlling costs.

2. Examples: copier and camera divisions of

an electronics firm.

3. Managerial goal: to maximize profit

(revenues – expenses) for the division.

4. Evaluation: profit from the current year may

be compared with budget or previous years

or compared with with other profit centers on

a relative basis.

Investment Centers

1. Subunit that has responsibility for:

a. Generating revenues

b. Controlling costs

c. Investing in assets

2. Managers of investment centers have

control over inventory, receivables,

equipment purchases, etc...

3. Held responsible for generating some kind

of return on them.

Investment Centers

(Continued)

4. Examples: Nordstrom, Inc. subunit

Faconnable.

5. Managerial goal: to maximize return on

investment.

6. Evaluation: rate of return (%) relative to a

benchmark/budget rate of return or relative

to other investment center rates of return.

Evaluating Investment Centers

with ROI

1. ROI is one of the primary tools for evaluating

performance of investment centers.

2. Calculated as follows: ROI = Income

Invested Capital

3. ROI focuses on income AND investment

4. Natural advantage over income (alone) as a

measure of performance.

5. Removes the bias of larger investment over

smaller investment.

Evaluating Investment Centers

with ROI

(Continued)

1. ROI breaks down into two components:

a. Profit margin:

Income

Sales

b. Investment turnover:

Sales

Invested Capital

Measuring Income and

Invested Capital When

Calculating ROI

1. For ROI calculations, companies measure

“income” in a variety of ways:

a. Net income

b. Income before interest and taxes

c. Controllable profit…

2. The text uses uses Net Operating Profit

After Taxes, NOPAT. This formula does not

hold managers responsible for interest.

What is NOPAT?

Net Income

Add Back:

Interest Expense

less tax savings

NOPAT

$3,900,000

1,000,000

(350,000)

$4,550,000

Measuring Income and

Invested Capital When

Calculating ROI

(Continued)

1. Invested capital is measured in a variety of

ways.

2. In the text, invested capital is measured as:

Total Assets - Noninterest-bearing current

liabilities

3. Examples of noninterest-bearing current

liabilities:

a. Accounts payable

b. Income taxes payable

c. Accrued liabilities

Problems With Using ROI

1. Major problem with ROI: the denominator,

invested capital, is based on historical costs,

net of depreciation.

2. As those assets become fully depreciated,

the invested capital denominator becomes

extremely low and the ROI number quite

high.

3. Managers may therefore be compelled to

put off purchases of new equipment

necessary for long-term success. They

“underinvest.”

Problems of Overinvestment

and Underinvestment: You Get

What You Measure

1. Managers of investment centers with high

ROI’s may be unwilling to invest in assets

that will dilute their current ROI.

2. This will lead to “underinvestment.”

3. Conversely, evaluation in terms of profit can

lead to “overinvestment.”

Residual Income (RI)

1. Residual Income (RI): net operating profit

after taxes of an investment center in

excess of the profit required for the level of

investment.

2. RI = NOPAT - Cost of Capital x Investment

3. RI has the potential to solve both the

overinvestment and underinvestment

problem because it compels investment in

the range between cost of capital and

current ROI.

Residual Income (RI): Example

1. Facts: NOPAT=$4,550,000, Invested

Capital=$65,000,000, cost of capital=10%.

2. Calculate residual income (loss):

3. RI = $4,550,000 – (.10 x $65,000,000)

4. RI = ($1,950,000)

5. Negative residual value; not good!

Solving The Overinvestment

and Underinvestment Problems

1. What happens under RI when a project

comes along that will earn 11%?

a. The manager will make the investment:

underinvestment problem solved!

2. What happens under RI when a project

comes along that will earn 9%?

a. The manager will NOT make the

investment: overinvestment problem

solved!

Economic Value Added (EVA)

1. Economic Value Added, EVA, is a

performance measure developed by the

consulting firm Stern Stuart.

2. What is it? RI adjusted for “accounting

distortions.”

3. Primary distortion is related to research and

development (R&D).

Economic Value Added (EVA)

(Continued)

1. Under GAAP, R&D is expensed

immediately.

2. Under EVA, R&D is capitalized and

amortized over a number of future

accounting periods.

3. EVA has gained considerable attention in

the financial press.

adjusted

4. EVA = NOPAT

– (Cost of Capital x

adjusted

Investment

)

Using A Balanced Scorecard To

Evaluate Performance

1. Problem with ROI and RI/EVA is that these

financial measures are ALL “backward

looking.”

2. Balanced Scorecard is a set of performance

measures :

a. Financial perspective

b. Customer perspective

c. Internal process perspective

d. Learning and growth

Using A Balanced Scorecard To

Evaluate Performance

(Continued)

3. Balanced Scorecard uses performance

measures that are tied to the company’s

strategy for success.

4. Balance is a key factor using this technique.

How Balance is Achieved in A

Balanced Scorecard

Balance between qualitative and

quantitative, forward and backward

measures, and balanced company

dimensions!

Performance is assessed across a

balanced set of dimensions.

Quantitative measures are balanced with

qualitative measures.

There is a balance of backward-looking and

forward-looking measures.

How Balance is Achieved in A

Balanced Scorecard

Appendix: Transfer Pricing

1.

2.

3.

4.

5.

6.

7.

Transfer Pricing

Market Price as the Transfer Price

Market Price and Opportunity Cost

Variable Cost as the Transfer Price

Full Cost Profit as the Transfer Price

Negotiated Transfer Prices

Transfer Pricing and Income Taxes in an

International Context

Transfer Pricing

Divisions often “sell” goods or services to other

units within the same company. In the

automobile manufacturing industry, batteries

manufactured in one division may be sold to

other divisions which manufacture autos.

1. Market prices

2. Variable costs

3. Full cost plus profit

4. Negotiated prices.

Market Price As The Transfer

Price

1. This method would be the same as with any

other customer at “arm’s length.”

2. The external market price is an excellent

choice because the buying and selling

divisions are treated as independent

companies.

Market Price And Opportunity

Cost

1. Opportunity cost is the foregone benefit or

increased cost of selecting one alternative

over another.

2. The selling division has a choice between

selling to the related division or into an open

market.

3. The determining factor in deciding whether

or not to sell to the related division is the

impact to the firm (overall) of the decision.

Market Price And Opportunity

Cost

Variable Cost As The Transfer

Price

1. In some cases the transferred product is

unique and is not sold in the open market.

2. Here, variable cost may be a good transfer

price.

3. Conveys accurate opportunity cost

information.

4. When no external market for the product

exists, the opportunity cost of producing and

selling the product is variable cost per unit.

Full Cost Plus Profit As The

Transfer Price

1. With variable cost transfer pricing, selling

division cannot earn a profit

2. The price may not be acceptable to

management of the selling company.

3. Many companies add a profit margin to the

full cost of production.

4. Full Cost Plus Profit may not measure the

opportunity cost of producing the product.

Negotiated Transfer Prices

1. Some companies allow managers to

negotiate transfer prices.

2. The problem is that this price may not

reflect the opportunity cost of producing and

selling the product.

3. Reflects relative bargaining prowess of

individual managers.

Transfer Pricing And Income

Taxes In An International

Context

1. Income tax rates vary significantly between

countries.

2. When goods are transferred between

countries, these tax situations may create

incentives for relatively high or low transfer

prices.

3. Creates a bias toward having high transfer

prices when selling a product from a low tax

country to a high tax country and having a

low transfer price when selling a product from

a high tax country to a low tax country.

Quick Review Question #1

1. A profit center is responsible for all of

the following except:

a. Investing in long term assets.

b. Controlling costs.

c. Generating revenues.

d. All of the above.

Quick Review Answer #1

1. A profit center is responsible for all of

the following except:

a. Investing in long term assets.

b. Controlling costs.

c. Generating revenues.

d. All of the above.

Quick Review Question #2

2. What is the difference between RI and

EVA?

a. RI is a new concept.

b. EVA makes adjustments for “accounting

distortions.”

c. RI excludes research and development

as an expense.

d. EVA includes a capital charge.

Quick Review Answer #2

2. What is the difference between RI and

EVA?

a. RI is a new concept.

b. EVA makes adjustments for “accounting

distortions.”

c. RI excludes research and development

as an expense.

d. EVA includes a capital charge.

Quick Review Question #3

3. Return on Investment (ROI) is calculated

as:

a. Sales / Total assets.

b. Gross margin / Invested capital.

c. Investment center income / Invested

capital.

d. Income / Sales.

Quick Review Answer #3

3. Return on Investment (ROI) is calculated

as:

a. Sales / Total assets.

b. Gross margin / Invested capital.

c. Investment center income / Invested

capital.

d. Income / Sales.

Quick Review Question #4

4. Investment center income is $864,000.

Investment turnover is 2. ROI is 24%.

Sales is?

a. $8,000,000

b. $7,200,000

c. $6,000,000

d. $3,600,000

Quick Review Answer #4

4. Investment center income is $864,000.

Investment turnover is 2. ROI is 24%.

Sales is?

a. $8,000,000

b. $7,200,000

c. $6,000,000

d. $3,600,000

Copyright

© 2004 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that

permitted in Section 117 of the 1976 United States

Copyright Act without the express written permission of the

copyright owner is unlawful. Request for further information

should be addressed to the Permissions Department, John

Wiley & Sons, Inc. The purchaser may make back-up

copies for his/her own use only and not for distribution or

resale. The Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these

programs or from the use of the information contained

herein.