Income Taxes - Cengage Learning

advertisement

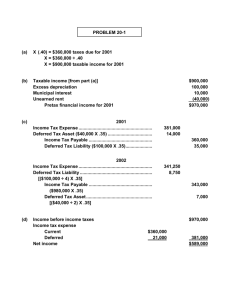

Stice | Stice | Skousen Intermediate Accounting,17E Income Taxes PowerPoint presented by: Douglas Cloud Professor Emeritus of Accounting, Pepperdine University © 2010 Cengage Learning 16-1 Deferred Income Tax Overview • The primary goal of financial accounting is to provide useful information to management, stockholders, creditors, and others properly interested. • The primary goal of the income tax system is the equitable collection of revenue. 16-2 Deferred Income Tax Overview Two basic considerations in U.S. corporations’ computed net income: 1. How to account for revenues and expenses that have already been recognized and reported to shareholders in a company’s financial statements but will not affect taxable income until subsequent years. (continues) 16-3 Deferred Income Tax Overview 2. How to account for revenues and expenses that have already been reported to the IRS but will not be recognized in the financial statements until subsequent years. 16-4 Example 1: Simple Deferred Tax Liability In 2011, Ibanez Company earned revenues of $30,000. Ibanez has no expenses other than income taxes. In this case, Ibanez is taxed on cash received. The company received $10,000 in 2011 and $20,000 in 2012. The income tax rate is 40% and it is expected to remain the same into the foreseeable future. (continues) 16-5 Example 1: Simple Deferred Tax Liability Income Tax Expense Income Taxes Payable Deferred Tax Liability 12,000 4,000 8,000 $30,000 × .40 $4,000 current year + $8,000 deferred $10,000 × .40 $20,000 × .40 (continues) 16-6 Example 1: Simple Deferred Tax Liability Ibanez Company Income Statement For the Year Ended December 31, 2011 Revenues Income tax expense: Current Deferred Net income $30,000 $4,000 8,000 12,000 $18,000 16-7 Example 2: Simple Deferred Tax Liability In 2011, Gupta Company generated service revenues totaling $60,000, all taxable in 2011. No warranty claims were made in 2011, but Gupta estimates that in 2012 warranty costs of $10,000 will be incurred for claims related to 2011 service revenues. Assume a 40% tax rate. (continues) 16-8 Example 2: Simple Deferred Tax Liability Income Tax Expense Deferred Tax Asset Income Taxes Payable $24,000 current year – $4,000 deferred 20,000 4,000 24,000 $50,000 × .40 $10,000 × .40 $60,000 × .40 (continues) 16-9 Example 2: Simple Deferred Tax Liability Gupta Company Income Statement For the Year Ended December 31, 2011 Revenues Warranty expense Income before taxes Income tax expense: Current Deferred benefit Net income $60,000 10,000 $50,000 $24,000 (4,000) 20,000 $30,000 16-10 Permanent and Temporary Differences Permanent differences are caused by specific provisions of the tax law that exempt certain types of revenues from taxation and prohibit the deduction of certain types of expenses. Nontaxable revenue—proceeds from insurance policies; interest received on municipal bonds Nondeductible expenses—fines for violations of laws; payment of insurance premiums 16-11 Permanent and Temporary Differences Temporary differences are caused by differences between pretax financial income and taxable income that arises from business events that are recognized for both financial reporting and tax purposes but in different time periods. Using ACRS for tax purposes and straightline depreciation for accounting purposes 16-12 Illustration of Permanent and Temporary Differences For the year ended December 31, 2011, Monroe Corporation reported net income before taxes of $420,000. This amount includes $20,000 of nontaxable revenues and $5,000 of nondeductible expenses. The depreciation method used for tax purposes allowed a deduction that exceeded the book approach by $30,000. (continues) 16-13 Illustration of Permanent and Temporary Differences Pretax income from income statement Add (deduct) permanent differences: Nontaxable revenues $(20,000) Nondeductible expenses 5,000 Financial income subject to tax Add (deduct) temporary differences: Excess of tax depreciation over book depreciation Taxable income Tax on taxable income (income taxes payable): $375,000 × .35 $420,000 (15,000) $405,000 (30,000) $375,000 $131,250 16-14 Illustration of Permanent and Temporary Differences • The permanent differences are not included in either the financial income subject to tax or the taxable income. • In general, the accounting for temporary differences is referred to as interperiod tax allocation. 16-15 Annual Computation of Deferred Tax Liabilities and Assets • FASB Statement No 109 reflects the Board’s preference for the asset and liability method of interperiod tax allocation, which emphasizes the measurement and reporting of balance sheet amounts. • One drawback of this method is that it is too complicated. 16-16 Annual Computation of Deferred Tax Liabilities and Assets Advantages of the asset and liability method: 1. Assets and liabilities are recorded in agreement with FASB definitions of financial statement elements. 2. The method is flexible and recognizes changes in circumstances and adjusts the reported amounts accordingly. 3. It has better predictive value. 16-17 Annual Computation of Deferred Tax Liabilities and Assets Identify type and amounts of existing temporary differences. Measure the deferred tax liability for taxable temporary differences (use enacted rates). Measure the deferred tax asset for deductible temporary differences (use enacted rates). Establish valuation allowance account if more likely than not some portion or all of the deferred tax asset will not be realized. 16-18 Example 3: Deferred Tax Liability For 2011, Roland computes pretax financial income of $75,000. The only difference between financial and taxable income is depreciation. Roland uses the straight-line method of depreciation for financial reporting purposes and ACRS on its tax return. The depreciation amounts for 2011 through 2014 are: (continues) 16-19 Example 3: Deferred Tax Liability The enacted tax rate for 2011 and future years is 40%. Roland’s taxable income is $60,000, computed as follows: Financial income subject to tax Deduct temporary difference: Excess of tax depreciation ($40,000) over book depreciation ($25,000) Taxable income $75,000 (15,000) $60,000 (continues) 16-20 Example 3: Deferred Tax Liability Journal Entry for 2011 Income Tax Expense Income Taxes Payable Deferred Tax Liability— Noncurrent 30,000 24,000 6,000 $30,000 – $6,000 $24,000 current + $6,000 deferred $15,000 × .40 (continues) 16-21 Example 3: Deferred Tax Liability Roland earns financial income of $75,000 in each of the years 2012 through 2014. Roland reports taxable income of $70,000, computed as follows: Financial income subject to tax $75,000 Deduct temporary difference: Excess of tax depreciation ($30,000) over book depreciation ($25,000) (5,000) Taxable income $70,000 Tax ($70,000 × 0.40) $28,000 (continues) 16-22 Example 3: Deferred Tax Liability Journal Entry for 2012 Income Tax Expense Income Taxes Payable Deferred Tax Liability— Noncurrent 30,000 28,000 2,000 $30,000 – $2,000 $28,000 current + $2,000 deferred $5,000 x 0.40 (continues) 16-23 Example 3: Deferred Tax Liability Depreciation expense in 2013 is the same for both financial and tax, so the entry is simple. Income Tax Expense Income Taxes Payable 30,000 30,000 $75,000 × 0.40 (continues) 16-24 Example 3: Deferred Tax Liability For 2014, Roland earns income of $75,000 and the taxable income is $95,000, computed as follows: Financial income subject to tax Add temporary difference: Excess of book depreciation ($25,000) over tax depreciation ($5,000) Taxable income Tax ($95,000 × 0.40) $75,000 20,000 $95,000 $38,000 16-25 Example 3: Deferred Tax Liability Journal Entry for 2014 Income Tax Expense 30,000 Deferred Tax Liability—Noncurrent 8,000 Income Taxes Payable $38,000 current – $8,000 deferred benefits 38,000 $95,000 × 0.40 (continues) 16-26 Example 3: Deferred Tax Liability 16-27 Example 4: Deferred Tax Asset For 2011, Sandusky Inc. computes pretax financial income of $22,000. The only difference between financial and taxable income is Sandusky accruing warranty expense in the year of the sale for financial reporting. For tax purpose, it deducts only actual expenditures. Actual warranty expense for 2011 was $18,000; no actual warranty expenditures were made in 2011. (continues) 16-28 Example 4: Deferred Tax Asset Taxable income for 2011 is computed as follows: Financial income subject to tax Add temporary difference: Excess of warranty expense over warranty deductions Taxable income Taxable income ($40,000 × 0.40) $22,000 18,000 $40,000 $16,000 (continues) 16-29 Example 4: Deferred Tax Asset Journal Entry for 2011 Income Tax Expense Deferred Tax Asset—Current Deferred Tax Asset— Noncurrent Income Taxes Payable 8,800 2,400 4,800 16,000 1/3 × $7,200 $16,000 current – $7,200 deferred benefits 2/3 × $7,200 (continues) 16-30 Example 4: Deferred Tax Asset Sandusky’s 2011 income statement would present income tax expense as follows: Income before income taxes Deferred Tax Asset—Current Deferred Tax Asset— Noncurrent Net income $22,000 $16,000 (7,200) 8,800 $13,200 (continues) 16-31 Example 4: Deferred Tax Asset In subsequent periods, taxable income would be $16,000, computed as follows: Income subject to tax Reversal of temporary difference: Excess of warranty deductions (1/3 × $18,000) over warranty expense ($0) Taxable income Tax ($16,000 × .40) (continues) $22,000 (6,000) $16,000 $ 6,400 16-32 Example 4: Deferred Tax Asset The following table illustrates the journal entries that would be made each year: 16-33 Example 5: Deferred Tax Liabilities and Assets For 2011, Hsieh reported pretax financial income of $38,000. As of December 31, 2011, the actual depreciation expense was $25,000 and the actual warranty expense was $18,000. For income tax reporting, these expenses were $40,000 and $0, respectively. The table on Slide 16-35 summarizes 2012 through 2014. (continues) 16-34 Example 5: Deferred Tax Liabilities and Assets (continues) 16-35 Example 5: Deferred Tax Liabilities and Assets Taxable income in 2011 is calculated as follows: Financial income subject to tax Add (deduct) temporary differences: Excess of warranty expense over warranty deductions Excess of tax depreciation over book depreciation Taxable income Tax ($41,000 × .40) (continues) $38,000 18,000 (15,000) $41,000 $16,400 16-36 Example 5: Deferred Tax Liabilities and Assets Journal Entry for 2011 Income Tax Expense Income Taxes Payable Deferred Tax Asset—Current Deferred Tax Asset—Noncurrent Income Tax Benefit Deferred Tax Liability— Noncurrent A subtraction from Income tax expense 16,400 16,400 2,400 4,800 1,200 6,000 16-37 Valuation Allowance for Deferred Tax Assets • A deferred tax asset represents future income tax benefits. • The tax benefit will be realized only if there is sufficient taxable income from which the deductible amount can be deducted. • Statement No. 109 requires that the deferred tax asset be reduced by a valuation allowance, a contra asset account that reduces the asset to its expected realizable value. 16-38 Valuation Allowance for Deferred Tax Assets Some possible sources of taxable income to be considered in evaluating the realizable value of a deferred tax asset are as follows: 1. Future reversals of existing taxable temporary differences 2. Future taxable income exclusive of reversing temporary differences 3. Taxable income in prior (carryback) years 16-39 Valuation Allowance Under IAS 12 Under the provisions of IAS 12, there is no valuation allowance. Instead, deferred tax assets are recognized only “to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilized.” 16-40 Accounting for Uncertain Tax Positions Case 1: Highly Certain Tax Position If the probability that the tax benefit of $100 would be greater than 50%, this would be deemed a “highly certain” position. In other words, it is more likely than not that the position taken and the amount in question would be upheld if reviewed. 16-41 Accounting for Uncertain Tax Positions Case 2: Uncertain Tax Position— More Likely Than Not Assume the following assessment of probabilities: (continues) 16-42 Accounting for Uncertain Tax Positions If Company A determines that the technical merits of its position exceed the more-than-not threshold (cumulative probability becomes greater than 50%), the amount of tax benefit to be recognize for financial statement purposes is $60. (continues) 16-43 Accounting for Uncertain Tax Positions The required journal entry is as follows: Income Tax Expense Unrecognized Tax Benefit 40 40 Current liability if payment is anticipated within one year of the current operating cycle 16-44 Accounting for Uncertain Tax Positions Case 3: Uncertain Tax Position— NOT More Likely Than Not If the company determines that it is not more likely than not that the tax position will be sustained, then the entire amount of the position must be recognized as a liability. Income Tax Expense Unrecognized Tax Benefit 100 100 16-45 Carryback and Carryforward of Operating Losses Net operating loss carryback is applied to the preceding two years in reverse order Carryback Election Year –2 Loss Year Net operating loss carryforward Carryforward Election is applied to income over the next 20 years Year +20 16-46 Net Operating Loss (NOL) Carryback Prairie Company had the following pattern of income and losses for 2010 through 2012: Journal Entry in 2012: Income Tax Refund Receivable Income Tax Benefit from NOL Carryback [$3,500 + (30% × $9,000)] 6,200 6,200 16-47 Net Operating Loss (NOL) Carryforward Continuing with the Prairie Company illustration from Slide 16-47, assume that in 2013 the firm incurred an operating loss of $35,000. Income Income (Loss) Year Tax Rate Tax 2012 $(19,000) 30% $0 2013 (35,000) 30% 0 The only loss remaining against which operating income can be applied is $5,000 from 2011. This leaves $30,000 to be carried forward from 2013 as a future tax benefit of $9,000 ($30,000 × .30). (continues) 16-48 Accounting for NOL Carryforward The journal entry for 2013 to record the tax benefits: Income Tax Refund Receivable Deferred Tax Asset—NOL Carryforward Income Tax Benefit from NOL Carryback Income Tax Benefit from NOL Carryforward (continues) 1,500 9,000 1,500 9,000 Current asset if expected to be realized in 2014 16-49 Accounting for NOL Carryforward The firm reports a taxable income of $50,000 in 2014. The tax carryforward allows management to deduct the carryforward from the $15,000 tax ($50,000 × .30) that would be due without the carryforward. Journal Entry in 2014: Income Tax Expense Income Taxes Payable Deferred Tax Asset—NOL Carryforward (continues) 15,000 6,000 9,000 16-50 Accounting for NOL Carryforward • If, however, it is more likely than not that some portion or all of the deferred tax asset will not be realized, a valuation allowance account is needed. • To illustrate, assume that Prairie Company’s management believes that losses will continue in the future and the tax benefit will not be realized. As a result, management believes it is more likely than not that none of the asset will be realized. (continues) 16-51 Accounting for NOL Carryforward The journal entry to record the carryback and carryforward would be as follows: Income Tax Refund Receivable Deferred Tax Asset—NOL Carryforward Income Tax Benefit from NOL Carryback Allowance to Reduce Deferred Tax Asset to Realizable Value— NOL Carryforward 1,500 9,000 1,500 9,000 16-52 Scheduling for Enacted Future Tax Rates • Proper recognition of deferred tax assets and liabilities is required when future tax rates are expected to differ from current tax rates. • The firm must determine the temporary differences that will reverse. • Statement No. 109 eliminates much of the need for scheduling through the “morelikely-than-not” criterion for future income. 16-53 Financial Statement Presentation and Disclosure The income statement must show, either in the body of the statement or in a note, the following components of income taxes related to continuing operations. 1. Current tax expense or benefit 2. Deferred tax expense or benefit 3. Investment tax credits 4. Government grants recognized as tax reductions (continues) 16-54 Financial Statement Presentation and Disclosure 5. Benefits of operating loss carryforwards 6. Adjustments of a deferred tax liability or asset for enacted changes in tax laws or rates or a change in the tax status of an enterprise 7. Adjustments in beginning-of-the-year valuation allowance because of a change in circumstances 16-55 International Accounting for Deferred Taxes • No-deferral approach―Using this approach, the differences are ignored. Income tax expense equal to the amount of tax payable for the year is reported. • Comprehensive recognition approach―Deferred taxes are included in the computation of income tax expense and reported on the balance sheet. (continues) 16-56 International Accounting for Deferred Taxes • Partial recognition approach―A deferred tax liability is recorded only to the extent that the deferred taxes are actually expected to be paid in the future. 16-57