foreclosed - Portillo Realty Corp.

advertisement

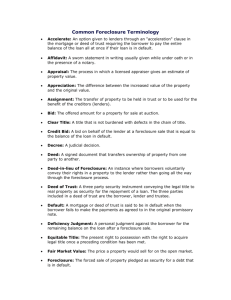

Foreclosure By: Cristina Serra Portillo Realty Corp. Foreclosure Outline I II III IV V VI VII What is a foreclosure? Types of foreclosures Foreclosure Process How to avoid a foreclosure How to stop foreclosure Statistics Conclusion I. What is a foreclosure? Foreclosure is a process where a property owner fails to make their mortgage payment, therefore creating a delinquent loan. Once the property becomes delinquent, the homeowner begins to receive letters from the lender requesting payment for the mortgage. If the homeowner does not make an effort to make any payments within 90 days, the lender will send them a notice in the mail stating that their home will be sold at public auction. II. Types of foreclosures Each state has its own statutes and regulations governing foreclosure, although foreclosures in practically all states now follow the same basic formats. Nevertheless, there are different types of foreclosure formats: Foreclosure by sale The most common type of foreclosure is the foreclosure by court sale. Upon default, the lender files a suit for foreclosure . If the plaintiff lender (mortgagee) is successful, the court will order that the subject property be sold at a foreclosure sale. Power of sale foreclosure Some mortgage loans are secured with a deed of trust (sometimes called trust deed), instead of a regular mortgage. This is an important difference, as the deed of trust normally contains a "power of sale" provision, which allows the trustee to sell the property without having to file a suit or go to court. Deed in lieu of foreclosure Some borrowers in default may wish to avoid the entire foreclosure process altogether. Such borrowers may instead simply wish to surrender the property and move on with their lives as quickly as possible. A "deed in lieu of foreclosure" would then be used to convey the property from the borrower to the lender. In exchange, the lender will consider the loan paid in full. Tax foreclosures Two of the basic powers that government can wield are taxation and eminent domain. Taxation is the ability levy taxes on people and property. Eminent domain is the government's power to take property away from private ownership. A tax foreclosure combines those two powers. III. Foreclosure Process Foreclosure is a long and difficult process for both lender and borrower. Most foreclosures take at least six months, while many can take up to two years to complete. The typical foreclosure process normally goes as follows: Delinquency The foreclosure process normally begins with a delinquency, particularly of the required loan payments Default and acceleration The first true step in the foreclosure process is the notice of default. With that notice of default, the lender will demand that the lender cure the default within a specified period (usually 15 to 30 days). Foreclosure suit Most courts require the lender to attempt to negotiate a reinstatement with the borrower, before acceleration can be validly enforced. After the acceleration demand is issued, the lender must give the borrower additional time to satisfy the acceleration demand Judgment and sale The lender has no choice but to wait for the court to process the case. The eventual conclusion, unless the borrower is able to cure the default or defeat the suit, is usually a judgment for foreclosure Deficiency judgment Lenders will occasionally accept a lower-than-desired bid and take a loss. For example, if the judgment amount is $100,000, but the lender believes that it can only market the property for $75,000, they will accept a lower bid in that market price area. The lender will then go after the borrower for that shortfall, by obtaining a deficiency judgment. Statutory redemption period Many states have statutory redemption period, which give property owners the opportunity to redeem their properties after foreclosure. The winning bidder, whether it is the lender or a foreclosure real estate investor, must respect the borrower's statutory right of redemption. [Note that the borrower's equitable right of redemption expired with the foreclosure judgment and sale.] Real estate owned properties Mortgaged properties that revert back to the lender because of foreclosure (or deeds in lieu of foreclosure) are normally called REOs, or real estate owned properties. Mortgage lenders are not in the business of owning and managing real estate. They will try to sell them as soon as possible to convert that real estate into cash. Eviction The highest bidder (and thus winner) of the foreclosure auction must respect any statutory rights of redemption that the borrower may have. Once the redemption period expires, however, the new owner will move to evict the erstwhile borrower. IV. How to avoid a foreclosure Special Forbearance. Your lender may be able to Arrange a repayment plan based on your financial situation and may even provide for a temporary reduction or suspension of your payments Mortgage Modification. You may be able to refinance the debt and/or extend the term of your mortgage loan. This may help you catch up by reducing the monthly payments to a more affordable level Deed-in-lieu of foreclosure. As a last resort, you may be able to voluntarily "give back" your property to the lender. This won't save your house, but it is not as damaging to your credit rating as a foreclosure. Selling Your Home at market value If catching up is not a possibility, the lender may agree to put foreclosure on hold, giving you some extra time to attempt to sell your home (family sale transaction is one of the most common solutions and this will involved the transfer of deed and full pay off debt) Partial Claim. Your lender may be able to work with you to obtain a one-time payment from the FHA-Insurance fund to bring your mortgage current. When your lender files a Partial Claim, the U.S. Department of Housing and Urban Development will pay your lender the amount necessary to bring your mortgage current Pre-foreclosure sale. This will allow you to avoid foreclosure by selling your property for an amount less than the amount necessary to pay off your mortgage loan. V. How to stop foreclosure Relief Against Foreclosure: Filing for Bankruptcy A bankruptcy filing is a drastic step, but sometimes it is necessary to forestall a foreclosure. Homeowners in the midst of should not consider bankruptcy until all other avenues have been exhausted and judgment seems inevitable. Don't file for bankruptcy if you're considering a refinance, as lenders prefer not to lend to borrowers in the middle of bankruptcy. Filing for bankruptcy can delay and/or suspend foreclosure procedures, but they may not delay it permanently. There are two bankruptcy options available to consumers. A chapter-13 bankruptcy collects all of the consumer's assets and tries to restructure the consumer's debt payments. The mortgage is one of the debt payments, and the bankruptcy administrator will try to negotiate a workable payment plan with the mortgage lender that will forestall foreclosure and may even reinstate the loan. A chapter-7 bankruptcy is more drastic. The bankruptcy judge or administrator collects all of the person's available assets, liquidates them and uses the proceeds to pay off the creditors. Most if not all consumer debt balances are then wiped clean. Secured debts, such as car loans and mortgage loans, are treated differently; the lenders eventually are allowed to continue with their foreclosure or repossession efforts. Many states protect the person's home from such bankruptcy liquidation, but they will allow the mortgage lender to continue with the foreclosure if the borrower is unable to pay. VI. Statistics All across the country—in rural, suburban and inner city areas— more and more families are losing their homes REO foreclosures Bankrupties Judgment and sale 0 50 100 According to statistics published by the Mortgage Bankers Association of America, foreclosure rates are at their highest level in 30 years. For the three months ending May 30, lenders initiated 134,885 new mortgage foreclosures. That represented close to 4 of every 1,000 mortgaged homes. The number of conventional loans that have been foreclosed has increased 45 percent, to 76,526, the highest level in 11 years. VII. Conclusion Most of all homes can be saved from foreclosure by taking the proper action. The property owner should seek the advice of a professional foreclosure consultant as soon as possible. The faster the property owner asks for help, the more options there are available, and the homeowner will have a greater chance for success. If is too late to solve the problem then they will have no other choice but to sell. Many people are starting up businesses these days on the back of the foreclosure boom. The idea is to buy a foreclosure taking advantage of the below-market prices and either resell at market rates, or fix the place up and sell it in its improved state at the new market rate. Both are lucrative businesses.