PREPARING FOR AND RESPONDING

TO IG INVESTIGATIONS

Presentation for National 8(a) Association

2015 Summer Conference by Lynne Halbrooks,

Robert Tompkins, and Sarah Curtis

Moderated by Walter Featherly

June 17, 2015

Copyright © 2015 Holland & Knight LLP. All Rights Reserved

Agenda

» Overview of Federal Inspector General (“IG”) system

» IG Authorities, Tools, and Techniques

» Coordination of Remedies

» How to Be Prepared: Policies and Procedures

» Practical Tips: What to Do In the Event of Investigation

» Office of Inspector General (“OIG”) Enforcement Trends

2

Overview Of Federal IG System

» The Inspector General Act of 1978 created civilian IGs

» Currently 72 statutory IGs

» Purpose: Independent and objective units within an agency to combat

fraud, waste, and abuse in programs and operations

» IGs do this by:

˗

Conducting audits and investigations

˗

Recommending policies to promote economy, efficiency, and effectiveness

˗

Keeping the agency head and Congress “fully and currently informed” about

problems and deficiencies

» IGs “report to and are under the general supervision of the head” of the

agency/entity. In only very narrow circumstances can the head of the

agency prevent an IG from doing work.

» IGs have dual reporting obligations to Congress

» Independence is also promoted through separate legal counsel,

separate OIG budgets, and notice to congress before removal

3

IG Authorities, Tools, And Techniques

» Each IG is given full discretion to undertake investigations that are, in

the judgment of the IG, “necessary or desirable” (IG Act, section 4(a)(1),

(a)(3))

» Many, not all, IGs have law enforcement authority

» IG has access to ALL agency records

» The IG Act provides broad authority to subpoena documents if

necessary for the performance of the functions in the IG Act. IGs may

not subpoena records from other federal agencies. Subpoenas

enforceable in federal district court. (DoD OIG issued over 700 in FY

2014)

» DoD OIG has testimonial subpoena authority

» When the IG has “reasonable grounds to believe there has been a

violation of Federal Criminal law,” the IG must report promptly to DOJ

(IG Act, section 4(d))

» DOJ will decide if grand jury, Civil investigative demands, or other

criminal or civil tools will be used

4

Coordination Of Remedies

» Role of DOJ

˗

Initiate criminal or civil legal proceedings

˗

Authority is over criminal and civil settlements in U.S. District court

proceedings

˗

Administrative remedies remain under purview of agency (usually GC and/or

SDO)

˗

Global settlements are preferred, but difficult

» Suspension and Debarment

˗

On the rise since late 2000s

˗ SBA OIG referred 49 to SBA in 2015, and 51 to other agencies

˗

DoD OIG referrals resulted in 150 suspensions and 218 debarments in FY

2014

˗

Recoupment

˗

The Contracting Officer still plays a role

˗

There may be offsets taken while criminal/civil investigation is ongoing

5

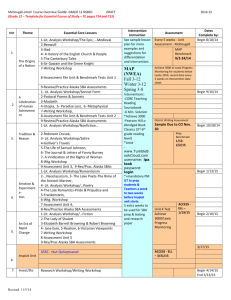

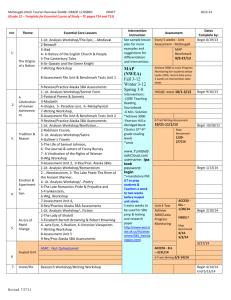

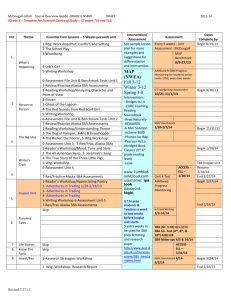

SBA Suspension/Debarment Activity By Fiscal Year

Indictments

from OIG

Cases

Convictions

from OIG Cases

Suspensions/

Debarments

Recommended

to the SBA

SBA

Proposed

Debarments

FY14

103

67

50

10

20

FY13

64

51

65

34

16

FY12

59

52

45

21

14

FY11

69

47

41

18

16

FY10

81

41

31

24

16

»

OIG SBA Semiannual Reports to Congress

SBA Final

Debarments

6

How To Be Prepared: Policies And Procedures

» Important to have appropriate policies and procedures in place and

utilized PRIOR to any IG audit or investigation

» Some key policies and features your Comprehensive Compliance

Program should include:

˗

Ethics and Compliance Manual

˗

Training

˗

Regular Program Review and Update

˗ Investigation Procedures

˗ Mandatory Disclosure

˗ Document Retention, including policy on Litigation/Investigation Holds

˗ Disciplinary Procedures and Non-Retaliation Policies

˗ Other policies suggested by your organization’s circumstances

7

Compliance Program: Sampling Of Subject

Matter Covered

» Contract Performance

» Conflicts of Interest

˗

Personal

˗

Organizational

» Gifting and Anti-Bribery

» Anti-Kickback

» Political Contributions and Activity Restrictions

» Drug and Alcohol

» Environment

» Government Property

» And More

8

Compliance Program: Investigation Procedures

» As we’ve discussed, contracts with the U.S. government give the

government the right to conduct audits and investigations. Audits and

investigations happen all the time, but must be taken seriously.

» Policy Suggestions:

˗

Plan! Make sure you have a general plan for how your organization conducts

investigations generally AND a plan for how each investigation will be handled.

˗

To ensure a truthful, complete and accurate response to the government, all

information provided in response to a request by a government official must be

approved by and will be provided to the government by management/legal

counsel.

˗

Policies and Practices shall direct that employees shall not:

•

edit, remove, delete or destroy any documents in the face of an audit;

•

attempt to influence the statements or testimony of any other person, or to attempt to

dissuade or discourage someone from providing information in response to an audit;

•

omit or conceal intentionally any material fact in your response to an audit; or

•

provide false information or document in connection with the audit.

9

Do The Organization’s Investigations Or Investigation

Policies Create Risk As Opposed To Mitigate It?

» In the Matter of KBR, Inc., SEC-File No. 3-16466, April 1, 2015.

˗

The SEC fined KBR $130,000 after finding that KBR’s standard

confidentiality language used in its internal investigations could impede

whistleblowers from making reports to the government. KBR was also

required to send notices and revise policies with respect to all employees

from 2011 forward (likely more costly than the fine). Notably, the SEC acted

solely on the basis of the language in the company policy and despite

acknowledging that A) there was no evidence that any whistleblower was

impeded; and B) there was no evidence that KBR had actually enforced the

confidentiality provisions.

» Federal IGs are actively surveying the policies of many companies for

similar provisions

˗

See e.g. State OIG Report re: 30 largest contractors:

https://oig.state.gov/system/files/esp-15-03.pdf

» Publicly traded companies, and federal contractors and grantees are

especially susceptible in this area

10

Compliance Program: Mandatory Disclosure

» Mandatory Disclosure

˗

Internal Reporting Requirements and Making the Disclosure Decision

•

Who does it apply to and who makes the decision?

•

Consider internal reporting structure

•

What needs to be reported, when and to whom?

» Keep in Mind

˗

FAR Part 3 requirement for timely disclosure/full cooperation

˗

DOD IG designated “agency IG” for all DoD disclosures

˗

DOD’s process includes notification to all DoD stakeholders and cognizant

investigative agencies

˗

History of DoD program suggests few significant criminal violations; no

suspension and debarments

11

Compliance Program: Document Retention

» Adopt a document retention policy and schedule and abide by it!

˗

Biggest issues are often when documents are not destroyed according to

the adopted schedule

˗

That policy may need to be suspended upon learning of an incident,

investigation or litigation

» Adopt policies and procedures addressing the circumstances of

litigation or investigations:

˗

Upon certain event such as:

•

complaint filed

•

call from IG

˗ Retain all documents during specified period by/about/for particular people

˗ Ensure you can account for steps taken to carry out these policies (i.e.,

consider backing up servers, hard drives, etc.)

12

Compliance Program: Disciplinary Procedures And

Non-Retaliation Policies

» There can be no retribution, disciplinary action, or adverse administrative

action against any employee who reports known or suspected violations

of the company’s policies or U.S. Laws or regulations

» Reports to a hotline or any manager should be held in strict confidence

» Disciplinary action should be taken against anyone who retaliates

against an employee reporting suspected violations

13

Compliance Program: Policies Based On Organizational

Circumstances

» Particular corporate structure

˗

Holding company

˗

Subsidiaries

˗

Corporations versus Limited Liability Companies

» Responsibilities of the Board

» Responsibilities of Management

14

Practical Tips: What To Do If An IG Contacts Your

Company

» Engage counsel and define counsel’s role

» Designate counsel as the primary point of contact in most cases

» Counsel should politely attempt to open and control the dialogue (but

remember, the IG may have the right to interview employees and others

without you)

» Understand what type of inquiry is being conducted (program review,

audit, investigation, etc.)

» Determine, as best you can, the scope and subject matter the IG is

interested in

» Determine, if you can, what prompted the inquiry (Whistleblower? Is this

part of a broader inquiry?)

15

Practical Tips: Engaging Counsel And Other Support

» IG investigations are very different than litigation. In addition to

investigative experience, counsel should have:

˗

knowledge of the government program (i.e., SBA, government contracting)

˗

the statutes and regulations

˗

the broader policy backdrop

» When: right away and almost certainly before contacting the IG directly

» Let your counsel act as a buffer with the IG. Counsel can probe the IG

in ways you may not be able to.

» It may be necessary and prudent to hire other professionals, such as an

accountant. This should be done through counsel.

16

Practical Tips: Managing The Process Internally

» First Rule: Take a deep breath – plan your investigation before you begin

» You must consider a document hold notice and/or information

preservation process

» The IG may know more than you, so it’s important to conduct your own

parallel internal investigation (see below)

» BUT…Be prepared to share your findings

» Sources of information: internal and external

» Preserving information and documenting the review

» Be mindful that your findings likely must be disclosed

˗

Mandatory Disclosure requirements

˗

Suspension and debarment considerations

˗

Federal sentencing guidelines

17

Protecting The Investigation And Work Product

» If no attorney is involved in the investigation, it is almost certainly

discoverable

» Even if an attorney is involved, the privilege is not absolute

» In many cases you may be required to, or desire to, reveal the results of

the investigation

» Understand who is in the “control group”; take appropriate steps to

protect confidentiality, but see slides 21 and 22 below

» The government is cracking down on the use of confidentiality

agreements with employees -- this issue is evolving quickly and not in a

direction that favors application of the privilege

18

Practical Tips: Acting On Information

» Be Proactive

˗

Assess compliance – is there a violation? Is there a difference of

interpretation of program rules or requirements?

˗

Assess internal controls – can they be enhanced?

˗

Determine the need for corrective action, and take it where appropriate

˗

Communicate your efforts to the IG

˗

Consider other potential proceedings and exposure (i.e., suspension and

debarment, potential whistleblower claims, etc.) and take steps to address

those risks

19

Practical Tips: Managing The Relationship With The IG Some Common Issues

» Manage the scope of the inquiry – narrowing and refining the scope of IG

requests

» Understand and anticipate the IG’s concerns and be prepared to

mitigate/explain issues

» Understand and act on the IG’s investigative requirements and standards

» Seek the opportunity to comment on findings/draft reports before they are

finalized – this is not an automatic right

» Remember: Most IGs have some degree of law enforcement authority, so

they will be looking for false statements (an 18 U.S.C. 1001 violation)

20

Practical Tips: A Recap

» Adopt and maintain a sound ethics and compliance program and

additional supporting policies

» Establish an early warning system

» Be proactive in responding to any government inquiry

» Take any IG inquiry very seriously

» Do your best to get ahead of the curve and be proactive in your

response

21

Trends: Whistleblower Protection Enhancements

» Federal law prohibits government personnel from retaliating against a

whistleblower who reports fraud, waste, or abuse to the OIG

» The NDAA of 2013 extended these protections to government

contractors, subcontractors, and grantees

» A protected whistleblower is one who discloses:

˗

A violation of law, rule, or regulation

˗

Gross mismanagement

˗

Gross waste of funds

˗

An abuse of authority

˗

A substantial and specific danger to public health or safety

» New DFARS Clause 252.203-7998 (Mar 2015) implements 2015 Budget

Reconciliation Act prohibition on employee confidentiality agreements

˗

Note: the clause applies to subcontractors as well

» The Whistleblower Protection Act of 2012 requires an ombudsman in

each OIG to educate employees about their rights if retaliated against

22

Other Enforcement Trends

» Increase in resources and congressional support

˗

OIGs are a good return on Congress’s investment: 14,000 employees in OIG

offices in FY 2013 returned $21 for every $1 invested

˗

IGs engage on congressional requests (statutory, report language, individual or

committee requests)

˗

President’s FY 2016 budget reflects increases after sequestration

» IGs will be more aggressive

˗

Congress is considering additional tools

•

Exemption from computer matching requirements and the Paperwork Reduction Act

•

Expansion of testimonial subpoena authority

˗ IGs are receiving more attention and scrutiny themselves

˗ Efforts to enhance Program Fraud Civil Remedy Act for small dollar/no loss

false statement cases

˗ Social media presence

» Special appropriations will mean more concentrated oversight and joint IG

collaboration

23

Resources

» DOD Mandatory Disclosure website:

http://www.dodig.mil/programs/CD/index.html

» FAR: www.farsite.hill.af.mil

» SBA Regulations:

http://www.access.gpo.gov/nara/cfr/waisidx_07/13cfrv1_07.html

» Select Client Alerts:

˗

http://www.hklaw.com/GovConBlog/SEC-Enforcement-Action-Puts-PubliclyTraded-Contractors-Internal-Investigation-Policies-in-the-Cross-Hairs-04-022015/

˗

http://www.hklaw.com/Publications/DC-Circuit-Upholds-Attorney-ClientPrivilege-in-Internal-Investigations-06-30-2014/

24

Questions?

25

Thank You!

26

Lynne M. Halbrooks

Lynne M. Halbrooks is a partner in Holland & Knight's Washington, D.C., and Northern Virginia offices. A

former federal prosecutor and acting inspector general (IG) of the Department of Defense, she is a member of

the firm's Government Contracts and White Collar Defense Investigations Teams.

Ms. Halbrooks has extensive experience in civil and criminal investigations and litigation. During her

government career, she advised her clients in a wide range of legal areas, including ethics issues, fiscal and

appropriation law, employment law, and data custody and privacy matters. She has an in-depth knowledge of

IG investigative and audit practices, suspension and debarments, procurement fraud, the False Claims Act, the

Foreign Corrupt Practices Act and contractor whistleblower protections.

In addition, Ms. Halbrooks has held a number of senior positions in the federal government. From 2009 through

April 2015, she was general counsel and then principal deputy inspector general at the Department of

Defense's Office of Inspector General. During this time, she served as the acting inspector general for 21

months. She was previously the general counsel for the special inspector general for Iraq reconstruction, and

spent four years with the U.S. Senate sergeant at arms, first as general counsel and then as deputy sergeant

at arms.

Her experience also includes serving as a deputy director in the Executive Office for United States Attorneys at

the Department of Justice and as an assistant United States attorney in the Eastern District of Wisconsin. She

held a top secret security clearance throughout her federal service.

» Lynne M. Halbrooks

» Partner

» (202) 469-5248

»

Lynne.Halbrooks@hklaw.com

» Washington D.C.

Practice

• Litigation and Dispute

Resolution

• Government

Contracts

• White Collar Defense

and Investigations

• Risk and Crisis

Management

Education

• Marquette

University Law

School, J.D., with

honors

• University of

Minnesota, B.A.

Bar Admission

• District of Columbia

27

Robert K. Tompkins

Bob Tompkins is a partner in Holland & Knight's Washington, D.C.,

office and co-chair of the firm’s National Government Contracts Group.

Mr. Tompkins provides strategic advice and counsel to government

contractors, their management and investors. He is experienced in

government contract protests and disputes, government investigations

and related proceedings, mergers and acquisitions, matters related to

the U.S. Small Business Administration (SBA) government contracting

programs and providing general counseling to clients.

» Robert K. Tompkins

» Partner

» (202) 469-5111

»

Robert.Tompkins@hklaw.com

» Washington D.C.

Practice

• Government

Contracts

• False Claims Act

Defense

• Indian Law

• Congressional

Investigations

• Regulatory and

Federal Litigation

Education

• Washington and

Lee University

(J.D.)

• Washington and

Lee University

(B.A.)

Bar Admission

• Virginia

• District of Columbia

• Maryland

28

Sarah M. Curtis

Sarah Curtis is an associate in Holland & Knight's Anchorage office. Ms. Curtis

focuses her practice on Alaska Native and Native American-owned businesses.

She regularly counsels clients on a wide range of matters including: transactional;

corporate business and governance; shareholder relations; employment;

government contracting; and tax.

Ms. Curtis assists clients in navigating the intricacies of the Alaska Native Claims

Settlement Act (ANCSA) and the U.S. Small Business Administration’s 8(a)

Business Development Program. Additionally, Ms. Curtis has argued before the

Alaska Supreme Court and has participated in representations for a broad client

base, from small pro bono matters to $12 billion litigation cases.

Ms. Curtis has also served as general counsel and sole in-house legal advisor for

the village of Wainwright's Alaska Native Corporation – a $200 million family of 15

companies engaged in both government contracting and commercial transactions.

» Sarah M. Curtis

» Senior Associate

» (907) 263.6386

»

Sarah.Curtis@hklaw.com

» Anchorage, Alaska

Practice

•

•

•

•

•

•

Government Contracts

Compliance Services

Corporate Services

Corporate Governance

Indian Law

Mergers and

Acquisitions

Education

• University of

Washington School of

Law, LL.M., Taxation

• Roger Williams

University School of

Law, J.D.

• University of Alaska –

Anchorage, B.A.

Bar Admission

• Alaska

29

Walter T. Featherly

Walter T. Featherly is the executive partner of Holland & Knight's Anchorage office. Mr. Featherly

focuses his practice on Alaska Native- and Native American-owned businesses. He regularly

counsels boards of directors and executives on matters including corporate law and governance, the

Alaska Native Claims Settlement Act, the Alaska National Interest Lands Conservation Act,

securities law, intellectual property protection, government contracting, employment practices,

finance and real estate.

Mr. Featherly assists minority-owned businesses to navigate the regulations governing admission to

the Small Business Administration's (SBA) 8(a) Business Development and the Historically

Underutilized Business Zones (HUBZone) programs, particularly those related to subcontracting and

team opportunities.

In addition, Mr. Featherly regularly speaks on the subjects of corporate governance and compliance,

teaming and joint venturing, the requirements of the Federal Acquisition Regulation, the SBA and

other laws applicable to small, minority and disadvantaged contractors and the large companies that

team with them.

In Alaska, Mr. Featherly has tried numerous cases in the areas of commercial transactions, real

estate, construction, antitrust, bankruptcy, products liability, personal injury and eminent domain. He

has also tried cases in federal courts and has argued appeals to the Alaska Supreme Court and the

Ninth Circuit Court of Appeals.

» Walter T. Featherly

» Partner

» (907) 263.6395

»

Walter.Featherly@hklaw.com

» Anchorage, Alaska

Practice

• Compliance Services

• Corporate Governance

• Public Companies and

Securities

• Indian Law

• Risk and Crisis

Management

Education

• Harvard Law

School, J.D.

• St. John's College,

B.A.

Bar Admission

• Alaska

30