National Budget Powerpoint

advertisement

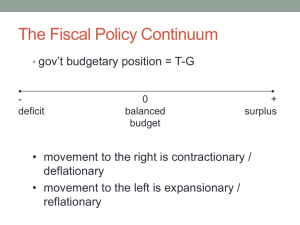

The National Budget For up-to-date-statistics visit Susan Hayes “The Positive Economist” Overview • • • • • • Government involvement in the economy National Budget Balanced Budget Budget Surplus Budget Deficit Current Income and Current Expenditure • Capital Income and Capital Expenditure • National Debt • Debt Servicing Why does the government provide services? • Ensure security: eg. Gardai, Army • Essential services/Public Utilities: eg. Education • Too expensive for individuals to set up: eg. ESB • Provide employment: Public & Civil Service State Owned Business • Is a business which is set up, financed and controlled by the government. • State owned business • State-sponsored body Semi-state bodies • • • • • Energy – An Bord Gais, Bord na Mona Training/Employment – Fas Fisheries – An Bord Iascaigh Mhara Forestry - Coilte Food – An Bord Bia …………………….. Tourism – Failte Ireland Business – IDA, Enterprise Ireland Communications – An Post, RTE Transport – Ianaroid Eireann, Dublin Bus, Luas Marketing – An Bord Trachtala Distinguish Between National & Local Government • National • Government ministers & departments run the country • Local • County councillors run towns & counties Government Departments • Finance • Education and Skills • Health • Jobs, Enterprise and Innovation Financed by tax Local Government Services • • • • • County Councils Dumps Planning permission Repair roads Libraries • Financed by charging for these services. The National Budget • Is a plan of future government income and expenditure for the country. Prepared by • The Minister for Finance • In December Decisions made • How much does the gov need to spend? • How much can be raised by tax? • How much does the gov need to borrow? Balance Budget • Planned Income = Planned Expenditure Surplus Budget • Planned Income > Planned Expenditure What can be done with a surplus budget? • Pay off loans (National Debt) • Reduce tax • Increase spending on health, education Deficit Budget • Planned Income < Planned Expenditure How can a deficit be reduced • Increase tax • Reduce spending on health, education etc. • Borrow money – increase the national debt Irish government must cut spending by 6 billion euro in 2010 budget = approx 4,000 per household Source: Irish Independent 7/11/10 National Budget • Current Budget • Money received and spent on a day-to-day basis. • It is used up within one year. • Current Income • Current Expenditure • Capital Budget • Money received and spent on a once-off basis. • It is used for things that last a long time. • Capital Expenditure • Capital expenditure Current Income • • • • • • • Income Tax PAYE: Pay As You Earn PRSI: Pay Related Social Insurance VAT: Value Added Tax CGT: Capital Gains Tax (Profit on sale of an asset) CAT: Capital Aquisitians Tax (Gift or inheritance) Corporation Tax: Tax on companies profits .......... • Customs/Import Duty: Tax on imports • Excise Duty: Tax on certain goods such as alcohol, petrol, cigarettes • National Lottery: • Service Charges: Dump, library…. • Profits of Semi-State-Bodies: eg. ESB, BNM Current Expenditure • Civil & Public Service Salaries: Teachers…… • Social Welfare: Unemployment Benefit…. • Pensions: • Servicing the National Debt: Paying interest on loans Capital Income • Loans (National Debt):Money borrowed eg. from EU or the World Bank. • Privatisation: Selling off semi-statebodies eg. Airlingus. • EU Grants: Money given to use by the EU to improve the country. Michael O’Leary offers to buy government’s share of Aer Lingus EU Commission did not allow takeover as Ryanair would then be a monopoly Capital Expenditure • Public Utilities: Building schools, hospitals, roads, libraries…… • Agriculture: Grants to farmers. • Nationalisation: The government may buy a privately owned company in order to save jobs or help the economy. e.g. Anglo Irish Bank Revenue Buoyancy • Is when the actual taxation revenue collected during the year is greater than that which had been planned for. • This is not the case now however! National Debt • Is the total amount of money that has been borrowed by the government over the years. • Interest has to be paid and is very high. Debt servicing • Servicing the national debt means paying interest on the countries loans. Economising • Means cutting down on spending in order to save money. Exam Question 2008 Q (b) National Budget Income €m PAYE 2850 VAT 1930 Corporation Tax 260 Excise Duties 215 5255 Debt Servicing 290 Subtract Health Services 1960 Social Welfare 1360 Education 1490 Agriculture 285 €m Expenditure Deficit 5385 (130) 2007 Q 3 National Budget Current A/C Current Income - Current Exp Capital A/C Capital Income - Capital Exp Surplus 2621 -1910 +711 add 5961 -5812 +149 +860 2005 Q 6 (c) National Budget Income €m PAYE 2,550 VAT 1,470 Corporation Tax 260 Customs Duties 235 €m 4,515 Expenditure Debt Servicing 190 Health Services 1,720 Social Welfare 1,230 Education & Science 1,340 Surplus 4,480 35 Exam Question 2001 Q 4 (a) Income €m €m Recap/Review • Why does the Government get involved in the economy? • What is a Balanced Budget? • How can the Government deal with a Budget Surplus? Budget Deficit? • Budget Deficit • Distinguish between Current Income and Current Expenditure? Examples? • Distinguish between Capital Income and Capital Expenditure? Examples? • What is the National Debt? • What is meant by Debt Servicing?

![Facilities Claim Form [docx / 210KB]](http://s3.studylib.net/store/data/009702131_1-a76a963067a4586a4f8f1bca351ecaf7-300x300.png)