Tax Research

advertisement

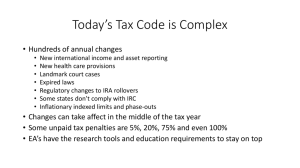

Chapter 7 Tax Research for Compliance and Tax Planning Tax Research Goals Not always to get the lowest tax liability Maximize after-tax return or benefits Some desire to minimize disputes Distinguish Tax Evasion – illegal acts Tax Avoidance –minimize taxes legally Abusive Tax Avoidance – misapplying tax laws, some tax shelters Tax Research - Defined Two different types of tax research exist: Applied tax research Checks existing law, examines the impact on a given situation. This textbook uses applied tax research. Academic tax research Often empirical, behavioral tax research Some policy oriented for society at large Occasionally theoretical Tax Research Challenges Determine the relevant facts. Facts include events and both the taxpayers and IRS’s positions. Many disputes have questions of fact. Relevancy decided by applicable law. “Relevant facts” are those that make a difference in how the law is applied. “Colorable facts” are those that only some people consider relevant. Tax Research Challenges (cont’d) Find and examine relevant tax laws. Apply the law to the facts to determine the tax consequences. Alternative correct paths may exist. Inform the client of differing options. Tax Practice Three types of tax practice for research: Tax Compliance Completes tax returns (facts have already occurred) Tax Planning Open fact engagements Carefully executed tax avoidance. Planning requires knowledge and skills. Tax Litigation Lawyers handle tax litigation. Tax Research Databases Many alternative sources of tax law exist Legal databases - LexisNexis and Westlaw. Specialized tax databases - RIA and CCH. Research Institute of America (RIA) – Checkpoint Commerce Clearing House (CCH) – IntelliConnect Databases include both Primary tax authorities: Code, Regs, & cases Secondary authorities: tax services, treatises IRS publications, private letter rulings, … Primary Tax Authorities Created by the 3 areas of government: Congress, the executive branch, & the courts Hierarchy of tax law exists: Statutory law Law passed by Congress, signed by President US Constitution, tax treaties also part of top level Primary Tax Authorities Administrative regulations Treasury Department releases treasury regulations Internal Revenue Service creates Revenue Rulings and Revenue Procedures Court cases Judicial case decisions are law in common law countries, such as the United States Court hierarchy exists The Code - Introduction Statutory law for federal taxation commonly referred to as the Code or IRC Internal Revenue Code of 1986, as Amended Found in Title 26 of the U.S. Code Within the Code, refer to sections (§). Sections are uniquely numbered The Code - Introduction (cont’d) To find a code section, search by keywords, drill down in the table of contents, or use an index in the Code or a Tax Service. If the code section number is known, the citation approach can access it quickly. The Code - Sections A section is divided into subsections, paragraphs, subparagraphs, clauses. Cite as specific as possible within the section, such as subsection, paragraph, or subparagraph. Always read subsection (a) carefully. Scan other subsections for relevancy. If another code section is referenced in a relevant part, examine that other section. Administrative Authorities Citation to a regulation references the Code provision explained. The Executive branch issues admin. auth. The Treasury Department creates Treasury Regulations which interpret and clarify statutory law Internal Revenue Service as part of the Treasury Department creates lesser authorities and enforces the law. Administrative Authorities (cont’d) Three types of Treasury Regulations Proposed Regs – trial balloons – not authority Temporary Regs - no public hearings, legally binding, but expire in 3 years Final Regulations – go through public hearing process, follow the regulations or penalties exist Treasury Regulations - Final Two types of final regulations Legislative Regulations Arise when Congress has delegated specific lawmaking authority to the Treasury Department Interpretive Regulations Arise under the authority of Section 7805(a) which expressly provides that the Treasury Department Secretary ”shall prescribe all needful rules and regulations for the enforcement of this title.” Most consider both types equal in weight of authority, some favor legislative regulations Revenue Ruling & Revenue Procedures Revenue Rulings and Revenue Procedures Both issued by the IRS. Revenue Rulings Apply the law to a specific set of facts. Weaker than Treasury Regulations. Citation to a Rev. Rul. does not reference the Code sec., but some publishers add that info. Revenue Ruling & Revenue Procedures (cont’d) Revenue Procedures Provides procedural requirements that taxpayers must follow, such as documents to include when filing a tax return involving, such as a Sec. 351 tax-free incorporation. Judicial Sources Court decisions interpret the Code and the Regulations Courts have the final say regarding what the Code words really mean. Judicial Precedent – Courts will follow prior case holdings Judicial Sources (cont’d) Federal court hierarchy exists Supreme Court is the highest court Courts of Appeals is the second highest Three alternative trial courts: Tax Court, District Court, & Court of Federal Claims U.S. Tax Court Advantage to the taxpayer: No prepayment needed for the amount in dispute. Other trial courts consider only refunds. Acquiescence (acq.) – IRS will follow the court’s decision in similar cases. U.S. Tax Court (cont’d) Tax Court has two types of decisions “Regular decision” - Chief judge decides if new legal principle announced “Memorandum decision” applies prior principle to new facts U.S. Court of Appeals U.S. Court of Appeals Court of Appeals considers only the application of the law, not redetermination of facts. Both taxpayers and IRS can appeal Tax Court and District Court decisions to the relevant regional Court of Appeals 13 court of appeals, 11 regional, DC and Federal –citation must identify the specific court District courts must follow precedent set by the relevant circuit court. U.S. Supreme Court Considers few cases involving tax issues. All courts must follow the precedent from the U.S. Supreme Court. U.S. Congress can overturn a decision by passing new statutory law. The citator enables the researcher to check the subsequent decisions referencing a case, and the case history Evaluating Tax Authorities The Code is the strongest authority Treasury Regulations are the next strongest authority Supreme Court decision applies to all courts and taxpayers. Circuit court decisions are either precedent or influential on other courts. Published IRS Revenue Rulings and Revenue Procedures are binding on IRS revenue agents, but not the courts Steps in Conducting Tax Research 1. Investigate the facts and identify issues 2. Collect the appropriate authorities 3. Analyze the research 4. Develop the reasoning and conclusions 5. Communicate the results Standards for Tax IRS Circular 230 Governs practice before the IRS and provides enforceable standards of conduct Impacted tax practice in various ways AICPA’s Statements on Standards for Tax Services Supplements the AICPA’s Code of Professional Conduct CPA Exam tests students on tax research