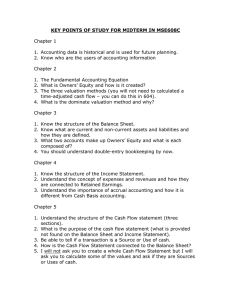

Managerial Accounting Chapter 13

advertisement

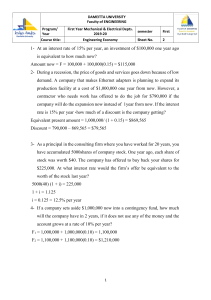

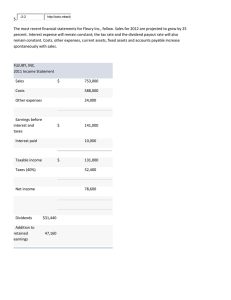

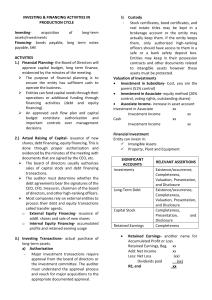

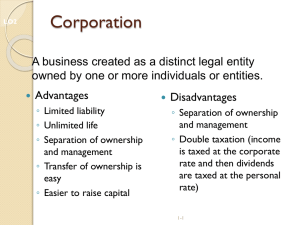

Chapter 13 Managerial Accounting Discount Rates Prepared by Diane Tanner University of North Florida What is a Discount Rate? An interest rate Used to determine the cost of money over time Its use in managerial accounting decisions To determine how much future cash flow amounts are worth in the present Two common discount rates Weighted average cost of capital Referred to as the 'cost of capital' or WACC Required rate of return (RRR) When assessing capital budget decisions Use the required rate of return 2 Cost of Capital Assets are ‘financed’ by the two equities on the right side of the accounting equation Assets = Liabilities + Owners’ Equity Debt Financing Occurs when a company Obtains long-term loans /bonds Equity Financing Occurs when a company Issues stock Earns profit which increases net worth 3 Calculating the Cost of Capital Assets = Liabilities + Owners’ Equity Debt Financing Equity Financing Creates interest expense which reduces profit Creates a cost consisting of returns to investors Dividends Stock value growth thru earnings retention Managers weigh the two costs based on the proportion of the company that is financed by Results in debt and the proportion financed by equity financing. Weighted average cost of capital 4 5 Required Rate of Return (RRR) Indicates the minimum amount—the hurdle—an investment must meet in order to be accepted Also known as the hurdle rate Weighted Required Rate = average cost + Risk % + Inflation % of Return of capital Sometimes a % component for desired profit is added The End 6