Activate Your Card - Colorado Mesa University

Procurement Card Program

Cardholder Training

Updated 3/27/2014

Activate Your Card

Use the last 4 digits of your 700 number even though recording will ask for last 4 digits of your social security number

Billing Cycle

• Typically runs from the 16 th of the month through the 15 th of the following month

• Cardholder limit is refreshed with every new billing cycle

This is an individual card, not a department card.

Do not share card Information.

Report Lost or Stolen Card

Immediately

• Call 800-344-5696

• Contact CMU Purchasing Department

Your department is liable for any charges made before card is reported lost or stolen, not to exceed $50.00

Purchasing Goods & Services at Colorado Mesa University

Purchases of $3,000 or less

• Use your Procard

• Reallocate in Access ® Online

Purchases greater than $3,000

• Contact purchasing for available options

The Procard is the preferred method of payment for small dollar purchases. It is cost-effective for the

University and provides individuals the ability to purchase directly for their campus departments.

Cardholder Responsibilities

• Maintaining the security and integrity of the

ProCard

– US Bank will never e-mail you requesting personal or account information

• Knowing and following the Code of Ethics published by Colorado Mesa University

• Making purchase in compliance with the information set forth in the Procurement Card

Program Handbook

Cardholder Responsibilities

• Making authorized purchases of allowable goods and services for your department

• Making sure all purchases are Tax Exempt

• Maintaining original source documentation for every transaction.

• Maintaining a Procard Order Log

Cardholder Responsibilities

• Resolving problems with a merchant

• Obtaining Approving Official signature for each billing cycle

• Reallocating transactions using Access ® Online within the time frame allotted

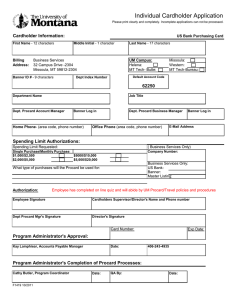

• Signing the Cardholder Agreement Form

Selecting a Merchant

Ask yourself these questions:

• Is there a State Price Agreement?

• Do they offer a discount for CMU?

• Do they accept Visa?

• Will they honor our Tax Exempt status?

Placing the Order

• Place your order via phone, fax, internet, mail or in-person

– Use caution with internet orders as it is sometimes difficult for purchases to be tax exempt

• Give your name as it appears on the card

Placing the Order

• Give accurate delivery information

– Your name needs to be on address label

– Delivery address

1260 Kennedy Ave

– Billing address

1100 North Ave

• We do not allow COD deliveries

Placing the Order

• Backorders cannot be charged to card until shipped

– Cardholder must manage backorders

• Request itemized documentation

– Description of item

– Cost of item

Receive and Inspect Goods

• Inspect all goods IMMEDIATELY

– If there is a problem contact merchant

– Keep notes regarding resolution

Returns and/or Exchanges

• Make arrangements with merchant before shipping a return

• Merchant must credit return to Procard – Do not allow merchants to refund in check or cash

• In the case of an exchange merchant must refund original purchase and charge for new transaction

• Document details including name of person you spoke with and date

Disputes

• Try resolution with merchant directly first

• Formal disputes

– Contact US Bank at 800-344-5696

– Use Access ® Online

– Must be filed within 60 days

– US Bank will credit account and investigate charge

Tracking Orders

• Procard Order Log is required

– Each order must be logged

– Helps with follow-up on late deliveries, order problems, partial shipments

– Allows for a quick reallocation reference

Sample Order Log

Documentation Requirements

Every transaction must have valid and complete source documentation from the merchant

Documentation Requirements

• Valid source documentation may be

– A itemized receipt from the vendor

– A packing slip from the delivery

– Order forms for dues, subscriptions, registrations

– An invoice showing credit card payment

Documentation Requirements

• Documentation must include

– Vendor identification (name of vendor)

– Date of purchase

– Description and quantity of each item purchased

– Per item cost if available from the vendor

– Total cost of the order

– Cardholder name or account number

Documentation Requirements

• If original documentation is lost contact merchant directly to provide replacement

• If merchant did not provide documentation contact them directly to provide it

Procard Record Management

• Cardholder’s responsibility to maintain in an orderly format

• Maintain for Three Years

• When Leaving employment or termination records are to be delivered to the next level supervisor

Approving Official

• Statement must be reviewed by designated

Approving Official

• Approving Official must sign Order Log

• Approving Official signature must be obtained by the 15 th of the following month

• It is the cardholder’s responsibility to get

Approving Official signature

Statement of Account

• Available to print in Access® Online

• Cardholder will receive e-mail notification from US Bank when available to print

• Cardholder must reconcile statement with order log and source documentation for each billing cycle

Transactions to Avoid

• Personal Purchases

– Contact Accounts Payable Department immediately

– Will be asked to reimburse CMU

• Unauthorized Purchases

– Must have written authorization for purchases made for other departments

• Allowing someone else to use your card

Transactions to Avoid

• Flower and Gifts

– Violates fiscal policy

– Take up a collection and pay cash for this type of purchase

• Cash or Cash-like Transactions

– Cash refunds for Procard purchases

– Cash refund for sales tax adjustments

– Gift Cards

Transactions to Avoid

• Split Purchases

– Transaction split into two charges to circumvent card limits or purchase order requirements

• Furniture

– Per State Statute must be purchased through

Colorado Correctional Industries

– Purchasing can assist with purchase

Transactions to Avoid

• Computers and Software

– Must be pre-authorized by IT Department

• Rental Contracts

– Venues for sporting events, shelters at area parks, studios for art exhibits, etc.

– Contract must be signed by Andy Rodriguez

Merchants to Avoid

• Banks, ATM’s and Financial Institutions

• Dining Establishments

– Taking staff, recruits, search candidates or others out to dinner

• Travel and Transportation

– Airlines, taxi, shuttle, auto rental, hotel, Travel

Agencies, etc.

Merchants to Avoid

• Vehicle and Automotive

– Auto dealerships, auto parts store, fuel, etc.

• Entertainment Providers

– Bars, cocktail lounges, nightclubs, movie theaters, sporting events, etc.

Food Vendor Purchases

• Must be brought to campus

• Requires an Official Function Form to be keep with Procard records

Violations and Consequences

• CMU uses a weighted point system

• Violations can be reported by anyone including Approving Officials, Program

Administrators, auditors or the cardholders themselves

• Violation Notifications will become part of the cardholder’s employee record

Violations and Consequences

• Cardholders with 100 or more violation points will have their cards suspended for six months

• Cardholder will be required to complete

Procard training prior to card reinstatement

• Violation points will be eliminated from the

Cardholder’s record 2 years after violation point assessment

Violations and Consequences

Purchasing Violations

• Card Abuse/Employee Fraud – 100 points

• Contract without authorized signature – 100 points

• Inappropriate purchase (as defined in the

Procurement Card Program Handbook) -50 points

• Taxes charged – 15 points

Violations and Consequences

Procard Specific Violations

• Split purchases – 25 – 100 points

• Cash or cash like transactions – 100 points

• Unapproved Liquor purchase (see Official Function

Policy 040104) – 50 points

• Travel/Travel related expenses – 25 points

• Sharing credit card number – 50 points

Violations and Consequences

Procard Specific Violations

• Documentation failure (see Procurement Card

Program Handbook) – 50 points

• Inadvertent personal purchase – 15 points

• Reallocation failure within prescribed timeframe –

15 points

• Failure to obtain Approving Official approval within prescribed timeframe – 25 points

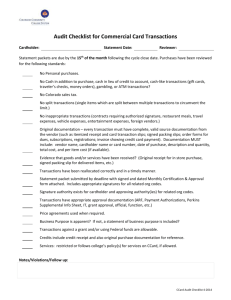

Audit

• Audits are selected at random

• If selected for Audit you must provide

– ProCard Order Log

– Statement of Account

– All source documentation

Reallocating Transactions

• Transaction reallocation is how Procard transactions are “mapped” into Banner and your budget

• It is the cardholder’s responsibility to reallocate in a timely manner

• Transactions can be reallocated as soon as they are posted in Access ® Online

Reallocating Transactions

• You have 5 days following the close of the billing cycle to make sure all transactions for that billing cycle are reallocated.

• Once the 5 days have passed the transactions become locked and you will not be able to reallocate

Access

®

Online

https://access.usbank.com

Thank You!

Please sign the cardholder agreement