A Culture of Discipline

advertisement

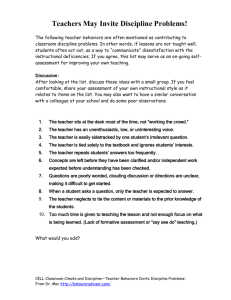

Ch. 6: A Culture of Discipline Meghan Davidson Berklye Dominguez Justin Pickard Michael Simpson Andrew Varga George Rathmann ◦ Successful Entrepreneur ◦ Amgen ◦ Learned from working at Abbott Laboratories Why do start up companies rarely become great companies? ◦ ◦ ◦ ◦ Too Too Too Too many many many many new new new new people customers orders products High Hierarchical Organization Great Organization Culture of Discipline Bureaucratic Organization Start-Up Organization Low Low Ethic of Entrepreneurship High Abbott Laboratories ◦ Bernard H. Semler ◦ Responsibility Accounting ◦ Rigor and Discipline Performance is linked to an organizations culture. Bureaucratic cultures lead to incompetence. Instead get the right people on the bus. A culture of discipline involves a duality. Build a Culture around the idea of freedom and responsibility, within a framework. Fill that culture with self-disciplined people who are willing to go to extreme lengths to fulfill their responsibilities. They will “rinse their cottage cheese.” Don’t confuse a culture of discipline with a tyrannical disciplinarian Adhere to great consistency to the Hedgehog Concept, exercising an almost religious focus on the intersection of the three circles. Equally important, create a “stop doing list” and systematically unplug anything extraneous. A Good to Great company must not always be strict and inflexible ◦ Ex: Airline Pilot on approach Build a consistent system with clear constraints, but give people freedom and responsibility within framework of that system Combination of Great store managers who had ultimate responsibility for stores. Created a consistent experience that was hard to duplicate Beat the general stock market by more than 18 times over during the next 15 years Create a discipline culture by starting with disciplined people Next disciplined thought must occur to understand the facts of reality Finally disciplined action must be taken Get self-disciplined people who engage in rigorous thinking, who then take disciplined action within framework of a consistent system Triathlon David Smith would literally rinse his cottage cheese to get the fat off Same idea applies to companies who tried to minimize expenses ◦ Ex: American Airlines and the olive ◦ Ex: Carl Reichardt with Wells Fargo “Everyone would like to be the best, but most organizations lack the discipline to figure out with egoless clarity what they can be the best at and the will to do whatever it takes to turn that potential into reality. They lack the discipline to rinse their cottage cheese.” (p.128) Looking into the disciplining of companies, Eric Hagen didn’t think it was a necessary part of the chapter. After further research, he found that in one case, the good-to-great companies became more disciplined than the direct comparison companies. On the other hand, the unsustained companies showed themselves to be just as disciplined as the good-togreat companies. During his analysis, Hagen found the way the companies approached their discipline were completely different. “Whereas the good-to-great companies had Level 5 leaders who built an enduring culture of discipline, the unsustained comparisons had Level 4 leaders who personally disciplined the organization through sheer force.” p.130 Ray MacDonald, President of Burroughs, controlled everything through his force of personality. His form of pressure became known as “The MacDonald Vise”. Every dollar invested in 1964 and taken out in 1977 produced returns 6.6 times better than the general market. Stanley Gault, President of Rubbermaid Corporation, brought strict disciplining to the Corporation. He included competitor analysis, rigorous planning, market research, profit analysis, hard-nosed cost control, and more. Gault worked 80 hour weeks and expected his managers to do the same. After reconstructing the design of the dustpan, Rubbermaid rose significantly under this very particular leader. The Corporation beat the market out 3.6 to 1. These cases demonstrate how there was a rise under a tyrannical disciplinarian followed by a decline after the disciplinarian stepped down. With them leaving, there was no enduring culture of discipline left in the corporations. Discipline is necessary for great results, but disciplined action without disciplined understanding cannot produce continued success. • Pitney Bowes – Had a monopoly for nearly 40 years – Then eventually the competitors showed up – Started losing money and thought it would eventually go under – Fortunately Fred Allen stepped in and asked the hard questions to better understand the meaning of the company's role in the world – Sees the broader concept of the business and starts specializing in many other things • • • Instituted a model of disciplined diversification such as high-end fax market and investment in new technologies The key point is that every step of diversification and innovation stayed within the three circles They ended up turning the business around and outperformed top companies such as Coca-cola, Johnson & Johnson, General Electric etc. • The good-to-great companies at their best followed a simple rule: – “Anything that does not fit with our Hedgehog Concept, we will not do. We will not launch unrelated businesses, we will not make unrelated acquisitions, and we will not do unrelated joint ventures. If it doesn’t fit, we don’t do it.” • It takes discipline to say “No” to big opportunities. The fact that something is a “once-in-a-lifetime” opportunity is irrelevant if it doesn’t fit within the three circles The more an organization has the discipline to stay within its three circles, the more it will have attractive opportunities for growth A lack of discipline to stay within the three circles is a key factor in the demise of nearly all the comparison companies. ◦ Example: R. J. Reynolds tobacco company vs. Philip Morris • • • • The best tobacco company for 25 years Then the surgeon general’s office issued a report that linked cigarettes with cancer They made the mistake of abandoning their hedgehog concept and wandering outside its three circles and bought a shipping container company and oil company (Sea-Land) They eventually had to sell the Sea-Land and lost tons of money • • • On the other had Philip Morris had the same problem and RJ Reynolds but displayed greater discipline in response to the surgeon general’s report Instead of abandoning it’s hedgehog concept, they redefined in terms of building global brands in “not-so-healthy” products such as beer, tobacco, soft drinks, chocolate etc. One dollar invested in Philip Morris beat one dollar invested in RJR by over four times Those who built the good-to-great companies made as much use of a “stop doing” list as they did a “to-do” list. They displayed a remarkable discipline to unplug all sorts of extraneous junk. When Darwin Smith took over as CEO, he made great use of “stop doing” lists. What did he “stop doing”: ◦ Stopped annually forecasting to satisfy Wall Street. ◦ Removed titles for employees and instituted new leadership qualifications. ◦ Removed Kimberly Clark from all paper company trade associations. In a good-to-great transformation is a discipline to decide which arenas should be fully funded and which should not be funded at all. In other words, the budget process is not about figuring out how much each activity gets, but about determining which activities best support the Hedgehog Concept and should be fully strengthened and which should be eliminated entirely. Kimberly Clark made the decision to not just reallocate some resources from the paper business to the consumer business. It completely eliminated the paper business, sold the mills, and invested all of the money into the emerging consumers industry. If you look back at the good-to-great companies, they displayed remarkable courage to channel their resources into only one or a few arenas. Once they understood their three circles, they rarely hedged their bets. Who did this? Kroger vs. A&P Abbott vs. Upjohn Walgreens Gillette and Sensor Nucor and the mini-mills Kimberly Clark Collins claims that the most effective investment strategy is a highly undiversified portfolio. If you can get the right people on the bus and find your Hedgehog, then having the courage to fully invest in one arena and stick to it are what helped companies transform from good to great.