Travel Advance Process - The University of Texas at San Antonio

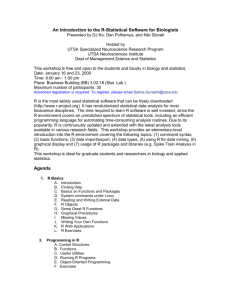

advertisement

Disbursements.travel@utsa.edu or 458-4312 Presenters: Nora Compean 458-4831 Elisabeth Cuadros 458-4832 Website: http://www.utsa.edu/financialaffairs/dts/ Purpose: • The University of Texas (UTSA) at San Antonio may advance funds to minimize financial hardship for employees and traveling students. • Travel must be for official UTSA business. • Advance must be issued in accordance to IRS accountable plan rules. • Other payment methods should first be pursued. Authority: • Board of Regents’ Rules and Regulation (Rule 20801) • Internal Revenue Service (IRC Rule 162 and various rules) Requirements and Eligibility: • Issued to faculty, staff and eligible student employees who travel infrequently • Prospective employees and students are not eligible • Domestic and foreign travel • TAR/TAC should be submitted 10 business days prior to trip departure • Approved Travel Authorization (TA) is required Requirements and Eligibility (cont): • Advances on Behalf of Students Traveling on Official UTSA Business • Referred to as Student Advance Responsible Party • TAR/TAC is authorized by the department manager who will identify the employee with custodial responsibility of the funds while students are in travel status. Requirements and Eligibility (cont): • Student Advance Responsible Party • Typically accompany the student travelers on trip, but not required • Requires a TA, if traveling with student(s) • Does not affect employees request for travel advance, if applicable • Responsible for the usage and reconciliation of monies disbursed • Complete the Travel Advance Request (TAR/TAC) • Preferred method of payment is Travel Advance Card (TAC) Requirements and Eligibility (cont): • TA is not required for the Student Advance Responsible Party, if not traveling with student. • Provide advance to student, if applicable • Explain requirements to students and assure funds are used for allowable travel cost Requirements and Eligibility (cont): • Settle the travel advance within 30 days after trip return date • If travel has not been completed and payment to Citibank is due, send a Non PO Voucher and copy of the credit card statement with approval to DTS for approval by UTSA established due date. – 20th of each month Requirements and Eligibility (cont): • Eligible activities and events include but are not limited to: • • • • • Study Abroad Athletics Research Student Activities Group travel Allowable Expenses: • • • • • • Meals and Incidentals (M&IE) Lodging Expenses Registration Transportation Student Athletics Team/Group Travel Other expenses (excluding mileage) Note: See GSA (General Services Administration) website for per diem and lodging rates http://www.gsa.gov/portal/category/21287 Accounts to be Charged: • 3100, 3105 & 3115 - Designated Funds (for travel) • 2100, 2110, 2115 & 2120 - State Appropriated General Funds: accounts receive advances for meals and lodging only per the Gov’t Code Section 660.003 Travel Expenses • 5100, 5200, 5300 & 5400 - Grants & Contracts: requires RSC approval • 5500 & 5600 - Restricted Funds: requires approval from Accounting Approvals/Certification: • Traveler must sign promissory note • Student Advance Responsible Party must sign promissory note, if applicable • Account administrator/Supervisor approval • Advances in excess of $10K require additional VP/Dean/Associate/Assistant VP approval. • RSC approval (Grants & Contracts accounts) Note: TAR/TAC forms will be returned if all required approvals have not been obtained. Settlement/Reimbursement: • Traveler/ Student Responsible Party has 30 days upon return from trip to settle all expenses associated with trip by submitting a Travel Reimbursement Settlement (TRS) packet. http://www.utsa.edu/financialaffairs/opguidelines/0109.html • DTS will approve the reimbursement within 7-10 business days from receiving a correct TRS packet. • If travel reimbursement is not settled within 30 days, the traveler may be reported to their respective VP for noncompliance with UTSA operational guidelines Settlement/Reimbursement (cont): • If returning excess travel advance funds to UTSA: • Complete the Deposit Transmittal Form and submit to Fiscal Services • Include Description of Deposit (travel advance tracking number issued by DTS and name of traveler ex. TA1234; John Doe) • Include Speed Type (Cost Center or Project ID) • Include Account: 11716 advances issued from Accounts Payable 11650 advances issued from Travel and Expense TAC Cards • Embossed cards will be issued with name of traveler • TAC is activated only for travel dates • Traveler must not exceed approved amount • Advance amounts will be rounded up to the next whole dollar TAC Cards (cont.) • TAC cards may be requested up to 60 days in advance of travel to pay for transportation or prepay lodging expenses • TACs can be re-used and/or refreshed for future trips upon submission of a new TAC form • TACs can be retained at the department level while not being used for travel • If TAC is for one time trip, then return to DTS TAC Cards (cont) • TAC cards will be settled by the department. (The department will create the Non PO Voucher to pay Citibank and an Expense Report to reimburse traveler • TAC cards may be picked up at DTS/Main Campus/DT • TAC cards may not be picked up by a proxy Team Travel • Complete TAR/TAC for “Student Advance Responsible Party” • Embossed TAC cards will be issued to students, if applicable • Pick up cards at DTS/Fiscal Svcs by student advance responsible party • Proper faculty/student TA’s approved-- if required Team Travel (cont.) • Proper reconciliation will be completed by dept to clear advance. The reconciliation should include name of traveler, UTEID, speed type to charge, account and amounts. Total amount must match total amount of billing statements. • TAC cards must be paid by the 20th of every month regardless of travel return dates. Citibank statements will be mailed out directly to travelers/departments. Team Travel (cont.) • Department creates Non PO Voucher • Citibank Vendor ID 0000011664 • Location UTSA3 is used • Submit complete documentation to DTS for final approval Overview of Changes Old New No reset button. Reset button clears all form fields and reverts form back to original state. Enter up to four travel destinations. Enter an unlimited number of travel destinations. Enter funding source and object code for each expense type (in Section 3 – Account(s) To Be Charged). Deleted Section 3-Account(s) To Be Charged. Funding source entered in Section 3 - Expenses. Object codes not required. Student not eligible for travel advance. Student Advance Responsible Party requests travel advance on behalf of eligible student. Mass Transit, Car Rental/Fuel, Airfare, Parking/Tolls, Registration and Other expenses completed separately. Consolidated into one expense type called ‘Transportation/Other’. Overview of Changes (cont.) Old New Each section must be completed in sequential order. Sections are independent of each other and can be completed in any order. User must delete all numeric fields, even if section is de-selected or unchecked (i.e. hidden) to be excluded from all calculations. All numeric fields are deleted once row is deleted and/or section is unchecked (i.e. hidden) and are not included in any calculations. Travel Advance Card (TAC) must be picked up at DTS office. Traveler has option of picking up TAC at DTS or any Fiscal Services office. No travel advance check option. Travel advance check option available as an exception only. If approved, traveler selects: • Check pickup option • If in-person pick up, traveler may designate proxy. You may continue to the next slide, or click on a section below for instructions specific to that section. •Section 1 – Traveler •Section 2 – Trip Information •Section 3 – Expenses •Meals (M&IE) •Lodging •Transportation/Other •Student Athletic/Group Travel •Charging Multiple Accounts •Section 4 – Travel Advance Payment Method •Section 5 - Certification TIP: Form fields that require user entry are highlighted. Fields/steps that pre-fill or contain calculations are italicized. New: Requesting a travel advance on behalf of an eligible student. Complete steps below. For more information, including eligibility, see Advances on Behalf of Students Traveling on Official UTSA Business, a section of the Travel Advances FMOG. 1. Select Student Advance Responsible Party. The Enter student name(s) row appears. TIP: Click button to delete additional row(s). 3. Enter the student’s full name. Separate multiple students with commas. TIP: Click button to add more rows. New: Travel Authorization is a 10 digit number and does not begin with TV…….. TRS Form Note: Mass Transit, Car Rental/Fuel, Airfare, Parking/Tolls, Registration and Other expense types are consolidated into one category called Transportation/Other. TIP: Deselecting any of these radio buttons will erase all of the information that you entered in that specific section in addition to hiding that section from view. User must complete four additional fields in this section. 1. If your destination is in the U.S, including Alaska, Hawaii and U.S. territories and possessions, click checkbox. 3. Enter the GSA Per Diem Rate for the destination city. 2. Enter destination state/country, city. 4. Enter the total number of business days spent at destination city. If applicable, Partial Per Diem Rate pre-fills. GSA Advance Total pre-fills IMPORTANT: If traveling within the U.S, including Alaska, Hawaii and U.S. territories and possessions, you MUST select the Domestic checkbox to ensure the Partial Per Diem Rate is calculated for each destination of your trip. Note: User may enter additional destinations for each trip. 5. Enter the department authorized lower rate, if applicable. The Destination Advance Total field changes to reflect this amount (not the GSA Advance Total). 7. If applicable, click to delete row(s). 6. If the trip includes multiple destinations, click the Add Destination button to add an additional row(s). Note: User must enter the funding source(s) for this expense. 6. If this expense will be charged to multiple Chartfields, click the Add Account button. See Charging to Multiple Chartfields for details. M&IE Total prefills. 5. Enter the Chartfield information that will be charged for this expense. Note: In addition to hotel name, user must also enter the city and state/country the hotel is located in. User must enter the total estimated room and hotel tax charges and may enter additional hotels. 1. Enter the GSA lodging rate for the destination city, state/country. 2. Enter the daily/nightly room rate for the destination hotel. 4. Enter the total room charge (excluding taxes). 5. Enter the total hotel taxes. 3. Enter the hotel name and city, state/country. 6. If trip includes multiple hotels, click the Add Lodging button to add an additional row(s). New: User must enter the funding source(s) for this expense. 6. If applicable, enter additional hotel information in additional row(s). 8. If this expense will be charged to multiple accounts, click the Add Account button. See Charging to Multiple Accounts for details. Total Hotel cost field(s) pre-fills. 7. Enter the account number that will be charged for this expense. LODGING TOTAL pre-fills. IMPORTANT: If the room rate is greater than the GSA rate, the Room Rate Increase row appears. 1. Enter the total number of nights at the higher rate. 4. Select the type of cost to be avoided and the estimated cost not incurred as a result of staying at the higher rate hotel. 2. Select the reason for requesting the higher rate. 3. If additional expense was paid from state funds, select checkbox. The State Funds Cost Itemization section appears. Fields prefill. New: Consolidated multiple expense types into one section. 1. Select the expense type from the drop-down menu. 2. Enter the total amount. 3. Enter comments (optional). 4. Click to add an additional row(s), if applicable. 5. Click to delete row(s). Note: Consolidated multiple expense types into one section. 6. Enter the Chartfield information to be charged for these expenses. 7. If these expense will be charged to multiple Charfields, click the Add Account button. The Chartfield previously entered in the Charge to Chartfield is erased. Note: Consolidated multiple expense types into one section. 8. Enter the Chartfield information. 10.Click to delete row(s). 9. Enter the total amount for each expense that will be charged to each Chartfield. IMPORTANT: The TRANS/OTHER TOTAL and account total fields must match. New: Expenses are grouped by funding source and expense type. 1. Enter the account number to be charged for each expense type. 4. Click to delete row(s). 5. If an amount is entered in the Other expense type, then describe the expense in the Comments field. 2. Enter the total amount for each expense type to be charged to each account. 3. Click the Add Account button to add another account. TAR: Method of payment will default to the individuals preferred payment selection in ESS. The sum of each expense type pre-fills and the total travel advance request appears in the TOTAL field. TAC: Method of payment will default to the individuals preferred payment selection in ESS. Select pick up location IMPORTANT: TAC’s are issued in whole dollars only and are rounded up to the nearest whole dollar. Activate card prior to travel (reserve lodging, airfare, registration etc.) Enter temporary activation dates New: No changes made to this section. For instructions, see Completing the Travel Advance Request (TAR), a section of the Travel Advances FMOG. Questions? Please email the DTS inbox with questions: Disbursement.travel@utsa.edu HELPFUL LINKS: Travel Advance Guideline: http://www.utsa.edu/financialaffairs/opguidelines/2.9.2.html Travel Card Guideline: http://www.utsa.edu/financialaffairs/opguidelines/0111.html Travel Reimbursement Guideline: http://www.utsa.edu/financialaffairs/opguidelines/0109.html