Legal Education Board

advertisement

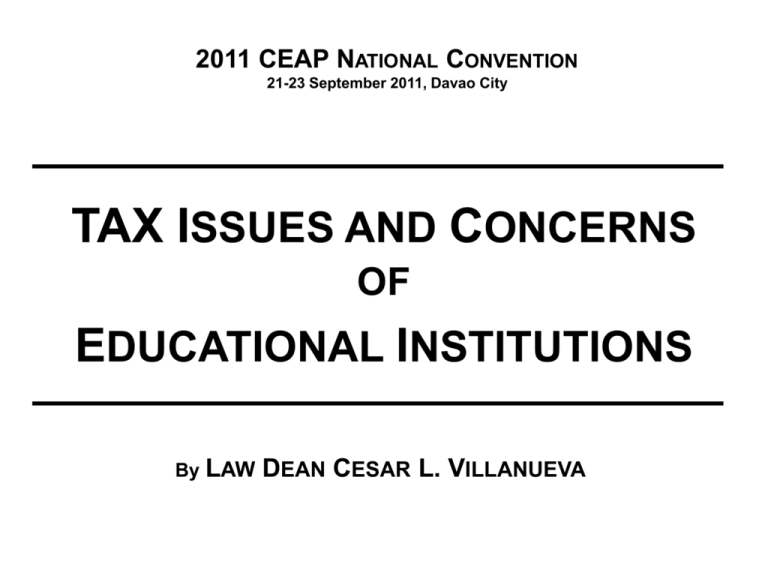

2011 CEAP NATIONAL CONVENTION 21-23 September 2011, Davao City TAX ISSUES AND CONCERNS OF EDUCATIONAL INSTITUTIONS By LAW DEAN CESAR L. VILLANUEVA PURPOSE OF SESSION (a) Review Certain Outstanding Issues on Taxation Involving Educational Institution (b) Introduce Proposed Comprehensive Bills for Tax and Tariff Duty Exemptions for Educational Institutions COMMEND TO BETTER AUTHORITIES (a) ATTY. NICASIO CABANIERO, “Taxation of Educational Institutions,” COCOPEA Seminar (b) ATTY. ULPIANO SARMIENTO, Manual of Regulation for Private Schools, “School Finance: Policy” CONSTITUTIONAL BASIS FOR TAX REFORMS FOR EDUCATIONAL INSTITUTIONS: “THE STATE SHALL PROTECT AND PROMOTE THE RIGHT OF ALL CITIZENS TO QUALITY EDUCATION AT ALL LEVELS AND SHALL TAKE APPROPRIATE STEPS TO MAKE SUCH EDUCATION ACCESIBLE TO.” SEC. 1, ART. XIV, 1987 CONSTITUTION “THE STATE RECOGNIZES THE COMPLEMENTARY ROLES OF PUBLIC AND PRIVATE INSTITUTIONS IN THE EDUCATIONAL SYSTEM AND SHALL EXERCISE REASONABLE SUPERVISION AND REGULATION OF ALL EDUCATIONSL INSTITUTIONS.” SEC. 4(1), ART. XIV, 1987 CONSTITUTION I LEADING TAX ISSUES ON EDUCATIONAL INSTITUTIONS A. INCOME TAX ISSUES FOR EDUCATIONAL INSTITUTIONS (a) NON-STOCK NON-PROFIT EDUCATIONAL INSTITUTIONS ARE EXEMPT FROM INCOME TAXATION. (b) PROPRIETARY EDUCATIONAL INSTITUT- AVAIL OF PREFERENTIAL RATES (10%) INCOME TAXATION. IONS MAY A.1. INCOME TAX EXEMPTION OF NON-STOCK NON-PROFIT EDUCATIONAL INSTITUTIONS “Sec. 30. The following organizations shall not be taxed under this Title in respect to income received by them as such: xxx (H) A nonstock educational institution; and nonprofit xxx SEC. 30, 1997 NIRC HIGHLIGHTS OF DOF ORDER 137-87 • DOF ORDER NO. 137-87 (16 December 1987): Exemptions granted to Nonstock Nonprofit Educational Institutions refer to internal revenue taxes and customs duties imposed by the National Government on all revenues and assets of non-stock and nonprofit educational institution. • Duly incorporated as a non-stock corporation • Does not pay dividends and governed by Trustees who receive no compensation • Devotes all its income, whether students’ fees or gifts, donations, subsidies, etc. to the accomplishment and promotion of the purposes for which it was organized. • Exemptions not limited to revenues and assets derived from strictly school operations, “but also extends to incidental income derived from canteen, bookstores and dormitory facilities.” • In case of incidental income, the facilities must not only be owned and operated by the educational institutions but must be located inside school premises. • Canteens operated by concessionaire are taxable. • Income unrelated to school operations like income from such deposits or trust funds, royalties, dividends and rental income are all taxable. • Use of educational institutions income or assets must all be school-related (e.g., scholarship, faculty development, professorial chairs, building expenses, library, sports facilities). • A canteen, although owned and operated by a concessionaire of the schools, is exempted from income tax and VAT as long as the concessionaire fees were actually, directly and exclusively used for educational purposes. ATENEO DE MANILA UNIVERSITY VS. CIR, CTA CASE NO. 7246 & 7293, 11 March 2010 A.2. INCOME TAXATION OF PROPRIETARY EDUCATIONAL INSTITUTIONS Proprietary educational institutions…which are nonprofit shall pay a tax of ten percent (10%) on their taxable income except those covered by Subsection (D) hereof: Provided, That if the gross income from unrelated trade, business or other activity exceeds fifty percent (50%) of the total gross income derived by such educational institutions or hospitals from all sources, the tax prescribed in Subsection (A) hereof shall be imposed on the entire taxable income. SEC. 27(B), 1997 NIRC • Special Tax Deductions Educational Institutions Allowed for Private (a) Expenditures otherwise considered as capital outlays or depreciable assets incurred during the taxable year for the expansion of school facilities, or (b) Deductions allowed for depreciation. A.3. INVESTMENTS OF DONATIONS AND GRANTS TO EDUCATIONAL INSTITUTIONS “All earnings from the investment of duly established scholarship fund of any school recognized by the government, from gifts or contribution to the school, if said earnings are actually used to fund scholarship grants to financially deserving students shall be exempt from tax until the scholarship fund is fully liquidated.” SEC. 48, EDUCATION ACT OF 1982 • Income from school-related activities is tax exempt, but when invested in the money market, the income earned from such investment is taxable. DOF ORDER NO. 137-87 • Earnings from such passive investments are to used directly, exclusively and actually for educational purposes or function, shall be exempt from the 20% final withholding tax pursuant to Sec. 4(3), Art. XIV of the Constitution. BIR RULING NO. 197-90 • Instant income from passive investments are exempt from tax, provided the educational institutions submit an annual information return with the following: (a) Bank certificate of the amount of instant income; (b) Certificate of actual utilization of said income, and (c) Board resolution of the administration of proposed projects to be funded, on or before the 14th day of the month following the end of taxable year. C. VAT EXEMPTION OF EDUCATIONAL INSTITUTIONS Private Educational Institutions exempted from VAT provided they accredited by the DepEd, CHED, TESDA. are are HOWEVER: VAT Exemption does not extend to other activities involving sale of goods and services. SEC. 109(M), 1997 NIRC REV. MEM. CIRCULAR NO. 76-2003 • Educational Institutions must register as a NonVAT Taxpayer to avoid shifting by VAT-Registered seller or supplier. • Educational Services rendered by accredited Private Educational Institutions are exempt from VAT. SEC. 109(M), NIRC D. DONATIONS, GRANTS, ENDOWMENT TO EDUCATIONAL INSTITUTIONS “All grants, endowments, donations or contributions to non-stock and non-profit educational institutions used actually, directly and exclusively for educational purposes are taxexempt. DOJ OPINION 130, S. 1987 “Gifts in favor of educational institutions are exempt from donor’s tax provided not more than 30% of said gifts shall be used by such donee for administrative purposes. SEC. 101, 1997 NIRC E. EXEMPTION FROM REAL PROPERTY TAXES “. . . all lands, buildings and improvements, actually, directly and exclusively used for . . . . educational purposes shall be exempt from taxation.” SEC. 4(3)(4), ART. XIV, 1987 CONSTITUTION “All properties of educational institutions, actually, directly and exclusively used for educational purposes are exempt from real property taxes.” SEC. 234, LOCAL GOVERNMENT CODE “RESTRICTIVE” VS. “REASONABLE” INTERPRETATION “’Exclusively’ is defined as possessed and enjoyed to the exclusion of others; debarred from participation or enjoyment; and “exclusively” is defined, “in a manner to exclude; as enjoying a privilege exclusively…The words “dominant use” or “principal use” cannot be substituted for the words “used exclusively” without doing violence to the Constitution and the law. Solely is synonymous with exclusively.” Lung Center of the Philippines v. Quezon City G.R. No. L-39086, June 5, 1988 . . . Moreover, the exemption in favor of property used exclusively for charity used exclusively for charitable or educational purposes is not limited to property actually indispensable therefor (Colley on Taxation, Vol. 2, p. 1430), but extends to facilities which are incidental to and reasonably necessary for the accomplishment of said purposes, such as in the case of hospitals, a school for training nurses, a nurses’ home, property used to provide housing facilities for interns, resident doctors, superintendents, and other members of the hospital staff, and recreational facilities, for student nurses, interns and residents (84 CJS 6621), such as “athletic fields” including “a farm used for the inmates of the institution. Herrera v. Quezon City Board of Assessment Appeals, 3 SCRA 186 (1961) BIR v. Bishop of the Missionary District, 14 SCRA 991 (1965) Abra Valley College, Inc. v. Aquino, 162 SCRA 106. ARE MACHINERIES ON REAL PROPERTY INCLUDED? “The exemption from real property taxes however, shall not include ‘machineries’ even if these are actually, directly and exclusively for…educational purposes.” SEC. 3, DOF REGULATION 1-88 F. EXEMPTION FROM TARIFF DUTIES “. . . all lands, buildings and improvements, actually, directly and exclusively used for . . . . educational purposes shall be exempt from taxes and duties.” SEC. 4(3)(4), ART. XIV, 1987 CONSTITUTION DOF ORDER NO. 137-87 (16 December 1987): Exemptions granted to Non-Profit and Non-Stock Educational Institutions refer to internal revenue taxes and customs duties imposed by the National Government on all revenues and assets of nonstock and nonprofit educational institution. II PROPOSED BILLS ON COMPREHENSIVE EXEMPTIONS FROM INTERNAL REVENUE TAXES, REALTY TAXES AND TARIFF DUTIES FOR EDUCATIONAL INSTITUTIONS