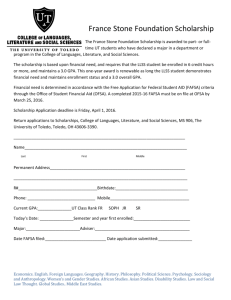

Financial Aid 101

advertisement

Racquel Smith, M.Ed University of Nevada, Las Vegas Financial Aid Counselor What is Financial Aid? Money for educational expenses Types of Aid Grants : do not have to be repaid; “gift aid” Loans: can be Federal or private, must be repaid with interest Scholarships: do not have to be repaid, based on varying criteria What is the FAFSA? Free Application for Student Aid www.fafsa.ed.gov Determines eligibility for Federal Aid Data collected and analyzed by the United States Department of Education File in January for the next academic year -example January 2014 for Fall 2014/Spring 2015 Who can get Federal Student Aid? US Citizen or permanent resident High school graduate/GED holder Eligible degree/certificate program Valid Social Security number Males must be registered for Selective Service Must make Satisfactory Academic Progress (SAP) Meet requirements set by college/university Undocumented Students Undocumented students are eligible for the Millennium Scholarship if academically qualified Undocumented students are not eligible for federal aid, but there are resources available to assist students with financing higher education http://www.nygearup.org/collegesense/students/scholar_undoc.htm http://e4fc.org/images/E4FC_Scholarships.pdf http://www.dreamactivist.org/faq/education/scholarships/ https://www.scholarshipaid.net/app/univision/ http://www.latinocollegedollars.org/ http://www.salef.org Undocumented Parents Students who are US citizens or permanent residents, but have undocumented parents should complete the FAFSA UNLV’s Financial Aid office is not a reporting agency Families should not be concerned about providing the information requested on the FAFSA Parent(s) Social security number should be entered as all zeros on the FAFSA Example: 000-00-0000 - do not use invalid SSN! Federal Maximum Amounts Federal Pell Grant: $5730/year 0 EFC; amount decreases as EFC increases; based on enrollment Federal Stafford Loans: $5500 (freshman) 3 kinds of loans: Subsidized; no payment & no interest until graduation or less than half time enrollment (less than 6 credits/semester) Unsubsidized; no payment until graduation or less than half time enrollment, interest begins to accrue when loan “pays” Parent Plus; approval is based on parent’s credit report; payment can begin while student is enrolled; a deferment can be requested All students are eligible for some type of Stafford Loan Federal Work Study: very limited at UNLV, consider regular student employment Federal Parent PLUS loan: COA minus other aid Completing the FAFSA Apply online www.fafsa.ed.gov Include school codes (UNLV: 002569) SUBMIT your application Both student & parent must sign electronically using the pin (dependent student) Most students are NOT independent On or after January 1 Pay attention to Priority Deadlines UNLVs Priority Date is FEBRUARY 1st Verification Verification is a process used to verify certain information on the FAFSA to ensure its accuracy The Federal government selected approximately 7,300 students for the 12/13 academic year and 7,150 students for the 11/12 academic year for verification We are required to make sure that all aid is awarded to students according to federal, state, and institutional regulations. If selected, the verification process must be completed before financial aid can be awarded Why students are selected and what is being verified? While there are several reasons why a student may be selected for verification some leading causes are: The submitted FAFSA application has incomplete data The data on the FAFSA application appears to contradict itself The FAFSA application has estimated information on it Random selection You and/or your parents may be asked to submit documentation or clarification of information for one or more of the following data elements on your FAFSA: Adjusted Gross Income Taxes Paid Income Earned from Work (for non-tax filers) Certain Untaxed Income Items Number of family members in the household Number of family members enrolled in college (excluding parents for a dependent student) Receipt of Food Stamps/SNAP Benefit Child Support Paid Citizenship status Compliance with Selective Service registration requirement Any other inconsistent or conflicting information (including name, date of birth, social security number, etc.) How Student need is determined Expected Family Contribution Amount family can reasonably be expected to contribute Stays the same regardless of college Two components Parent contribution Student contribution Calculated according to a federal formula using FAFSA data Cost Of Attendance Includes Tuition & Fees Room & Board Books, supplies, transportation, and misc. personal expenses Sometimes can include Loan fees Study abroad costs Dependent care expenses How Student need is determined Cost of Attendance – Expected Family Contribution ____________________________________ = Financial Need Accepting Awards Award or Financial Aid Package is the amount of assistance you have been assigned for the academic year Accept loans on MyUNLV Complete Entrance Counseling & Master Promissory Note www.studentloans.gov Money sent to cashiering first then refunds to student if there is an overage Maintaining Eligibility Scholarships: know renewal procedures specific to each scholarship GPA and completion rates are measures for Satisfactory Academic Progress 2.0 GPA 70% completion rate 186 credit limit Scholarships-Millennium Nevada resident for at least two high school years Must have graduated from a Nevada high school Must complete high school with a 3.25 cumulative gpa Must pass all Nevada High School Proficiency Exams Must have the following core units: English 4 Math (including Algebra II) 4 Natural Science (two labs) 3 Social Science 3 Will pay up to $960/semester for classes over 100 level at University Will pay up to $480/semester at a Community College Renewable with a 2.6 (first two semesters) & 2.75 following semesters No FAFSA is required UNLV Scholarships President’s Scholarship: $23,000 per year (approximate ; resident) or $38,000 per year (approximate ; non-resident) National Merit Finalist Provost’s Scholarship: $3,250 per year 3.8 unweighted GPA and 1340 SAT/30 ACT minimum Complete the FAFSA UNLV Excellence Scholarship: $2,250 per year 3.5 unweighted GPA and 1220 SAT/27 ACT minimum Complete the FAFSA Rebel Achievement Scholarship: $1750 per year 3.2 unweighted GPA and 1150 SAT/25 ACT minimum OR 3.7 unweighted GPA and 1070 SAT/23 ACT minimum Complete the FAFSA Additional Scholarships Valedictorian Scholarship: $7,350 per year (resident) or $11,900 per year (non-resident) Top 10%: $1,000 per year Clark County Housing Scholarship: $2,000 1st year, $3,000 2nd year Faculty Senate Scholarships Departmental Awards External Scholarships What is Title IV Aid? Title IV of the Higher Education Act of 1965, as amended in 1998, (Title IV, and HEA program) establishes general rules that apply to the student financial assistance programs. For purposes of Return of Title IV Funds, these programs include: Pell Grant Federal TEACH Grant Federal Supplemental Educational Opportunity Grant (FSEOG) Federal Direct Loans (Subsidized and Unsubsidized Loans) Federal Perkins Loans Federal PLUS Loans Who this Applies to Students who: Withdraw from all classes, or switched to audit in all classes Receive all non-passing grades Any combination of withdrawal, non-passing grade, or ineligible courses for Title IV aid What is Return to Title IV Funds? When a financial aid recipient withdraws from classes the Financial Aid Office must calculate the amount of financial aid the student has earned prior to withdrawing. The unearned financial aid must be returned to the respective programs. In most cases the student will owe money back to UNLV cashiering and/or the Department of Education. How you Can Help When interacting with a financial aid recipient who is in jeopardy of failing or withdrawing from all classes inform them of the financial consequences On average we perform the R2T4 calculation on 350-400 students per semester Fall 2012: Our office performed 385 R2T4 calculations. As a result UNLV had to return $481,434.00 Advise them to visit our office for further counseling if needed Questions?