OMB A-21, A-110, A-133

advertisement

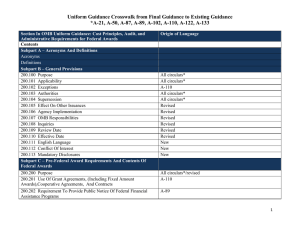

A-21, A-110, A-133 OMB The federal Office of Management and Budget (OMB) has issued circulars that define the principles and standards for sponsored projects funded by federal agencies. OMB circulars A-21, A-110, and A-133 provide instructions for handling federal funds. WHAT IS OMB A-21? This section outlines the principles and policies that must be followed regarding the accounting principles, arrangements, and exemptions for any training or work produced under the contract as agreed upon by the Federal Government. A-21 defines the cost principles applicable to grants and contracts at educational institutions Cost Accounting Standards (CAS) Direct vs. Indirect (F&A) Costs Allowable vs. Unallowable Costs Effort Reporting CAS Cost Accounting Standards Consistency in estimating, accumulating, and reporting costs Consistency in allocating costs incurred for the same purpose Accounting for unallowable costs Cost accounting period (fiscal year) DIRECT COSTS Direct Costs are costs must be: Allowable, Allocable Reasonable, Consistent Direct Costs can be directly associated with a particular sponsored project, an instructional activity, or any other institutional activity. Examples of Direct Costs: Salaries, wages, and fringe benefits Supplies Services Travel Equipment INDIRECT COSTS Indirect Costs are often referred to as facilities and administrative costs (F&A) or overhead. HCC has an approved indirect rate of 39%. Allowable Costs Allowable Costs Must be reasonable Must be allocable Must be treated consistently Must conform to any limitation or exclusion “Prudent person” test Allowable and Unallowable Costs Section J specifies which costs are allowable and unallowable as both direct and indirect costs Examples of Allowable Costs Equipment, Professional Services, Transportation Examples of Unallowable Costs Alcohol, Entertainment, Lobbying, Marketing Anything outside the scope of these costs is typically not allowed unless it falls under one of the specifically mentioned exceptions within the circular. Time and Effort Time and Effort Reporting The purpose of an effort reporting system is to provide a reasonable basis for distributing salary charges among direct and indirect activities HCC uses an after-the-fact effort reporting system WHAT IS OMB A-110 A-110 sets forth standards for uniform administrative requirements for grants and agreements among federal agencies in the administration of grants to and agreements with institutions of higher education. Cost Sharing Cost Sharing must be more than a token amount (e.g. more than 1% of project costs) Cost Sharing represents institutional commitment to the project Mandatory Cost Sharing is required by the sponsor as a condition of making the award Voluntary Cost Sharing is not required by the sponsor but may become legally binding as a commitment reflected in the proposed budget Committed (e.g. over salary cap) Uncommitted Cost Sharing Acceptable Cost Sharing must be: Verifiable and documented in recipient records Not included as matching for any other federal projects, nor paid from other federal awards Necessary and reasonable Allowable under applicable cost principles Appropriate to all OMB Circular A-110 provisions Program Income Program Income applies to funds earned during a project period Program Income includes Registration fees for a training or conference award Products or materials purchased on an award and sold after research has been conducted Sale of information produced or acquired under the award Program Income Program Income may be: Added to funds committed to the project Deducted from total project allowable costs Applied to non-federal share of project costs Recipient has no obligation to the Federal Government for funds earned after the project period unless the agency’s regulations or terms and conditions provide otherwise Program Income Program Income may be: Added to funds committed to the project Deducted from total project allowable costs Applied to non-federal share of project costs Recipient has no obligation to the Federal Government for funds earned after the project period unless the agency’s regulations or terms and conditions provide otherwise Property Control Management of property should: • Conduct a physical inventory every two years •Safeguard against damage, loss, and theft •Provide adequate maintenance •Maintain insurance •Sell competitively at highest return, when authorized Reports & Records A-110 sets forth procedures for monitoring and reporting financial and program performance and the required reporting forms, including requirements for record retention Retention of Records Financial records, supporting documents, statistical records and all other records must be retained for three years from the date of final report, except when: Litigation requires retention until matters have been resolved Records are transferred to the agency, in which case retention requirements end Other record retention requirements apply The PI and Grants Accounting Award recipients are responsible for managing and monitoring each project, program, function and activity supported by the award Award recipients are responsible for ensuring that subrecipients have also met all audit requirements Technical Reports Technical reports must be completed not more than quarterly and not less than annually Reports must contain: Comparison of actual accomplishments with set goals for the period If applicable, reasons that goals were not met Explanation for any cost over-runs or high unit costs Close Out the Grants Close-Out Requirements All reports submitted within 90 days All obligations liquidated within 90 days Prompt payment by awarding agency Recipient refund of unobligated cash advances Accounting for real and personal property Agency right to recover disallowances SUMMARY OF OMB A-133 A-133 sets forth standards for consistency in audits of organizations spending federal awards. A-133 defines the requirements of an audit and explains the responsibilities of the institution, the agency and the auditor. A sample of Federal awards and their direct cost transactions is selected and examined to determine if expenditures and procedures were appropriate A-133 requires an annual external audit of all non-federal entities expending $500,000 or more annually in Federal funds Websites A-21 http://www.whitehouse.gov/omb/circulars_a021_2004 A-110 http://www.whitehouse.gov/omb/circulars_a110/ A-133 http://www.whitehouse.gov/omb/circulars/a133_compliance_supplem ent_2010 http://www.myflorida.com/audgen/pages/subjects/ea_other.htm The federal audit reports for the entire state of Florida are rolled up into one report that fulfills the A-133 requirement. This report is copied and sent to the feds as needed. Questions?