04. TAC Update to COPS 041515

advertisement

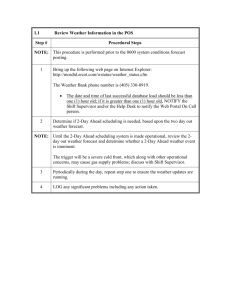

February 26, 2015 and March 26, 2015 TAC Meeting Update to COPS Michelle Trenary, April 15, 2015 TAC Other • TAC Procedures Amendment Approved Allows ERCOT CEO to designate a temporary substitute for the ERCOT COO’s ex-officio, non-voting member seat on the TAC • 2015 TAC Goals and Strategic Initiatives Approved See Appendix A for 2015 TAC Goals See Appendix B for 2015 TAC Strategic Initiatives 2 PRS Report (Feb) • NPRR654, NPRR655, NPRR657, and NPRR661, Effective Date: Upon system implementation Approved Discontinuation of the following reports: o NPRR654 - Ancillary Service Requirement Methodology Assessment o NPRR655 - Contingency List Changes Due to Weather o NPRR657 - Backup Control Plan Submittal Results, Dispatch Instructions Compliance Metrics, and Backup Control Plan Test Dates and Results Summary o NPRR661 - Profile Data Evaluation • NPRR668, Updates to TX SET Implementation Guide, Effective Date: TBD Tabled at TAC • NPRR676, ERS Offer Disclosure, Effective Date: Upon system implementation Approved with ERCOT Comments • NPRR677, Remove Outdated NERC Reference, Effective Date: May 1, 2015 Approved • NPRR642, Constraint Management During EEAs, Effective Date: TBD Remains tabled at TAC • NOGRR136, Verifying QSE Capability to Operate in Constant Frequency Control (CFC), Effective Date: March 2015 Approved 3 PRS Report (Mar) • 2015 PRS Goals Approved • Annual Review of Other Binding Documents (OBDs) Approved • NPRR642, Constraint Management During Energy Emergency Alerts (EEA), Effective Date: May 1, 2015 Approved • NPRR668, Updates to Texas SET Implementation Guide Process, Effective Date: TBD Remains tabled at TAC • NPRR670, Clarification of Portfolio Weighted Auction Clearing Price (PWACP), Effective Date: May 1, 2015 Approved • NPRR671,Incorporation of DAM Credit Parameters, Effective Date: May 1, 2015 Approved • NPRR672, Clarification of EMR Status, Effective Date: June 1, 2015 Approved • NPRR673, Correction to Estimated Aggregate Liability (EAL) for a QSE that Represents Neither Load nor Generation, Effective Date: May 1, 2015 Approved • LPGRR054, Alignment with NPRR661, Discontinue Posting Profile Data Evaluation, Effective Date: Upon system implementation Approved 4 ROS Report (Feb) • New Outage Coordination Task Force – This new Task Force will take up NPRR219, Resolution of Alignment Items A33, A92, A106, and A150 – TSPs Must Submit Outages for Resource Owned Equipment and Clarification in Status of Transmission Element Postings • Harmonization between NERC Standards and ERCOT Testing Requirements TAC assignment to ROS • NOGRR132, Automatic Under-Voltage and UnderFrequency Load Shedding Protection Systems – Load Restoration, Effective Date: March 1, 2015 Approved 5 ROS Report (Mar) • 2015 ROS Goals Approved • NOGRR135, Constraint Management During Energy Emergency Alert (EEA), Effective Date: TBD Tabled at TAC • NOGRR138, Delete Grey Box for Reporting of Back-up Control Plan Submittal, Effective Date: TBD Tabled at TAC • NOGRR139, Under/Over-Frequency Relaying Requirements, Effective Date: April 1, 2015 Approved • PGRR041, Revise and Add Requirements for NERC TPL001-4, Transmission Planning Performance Requirement, Effective Date: May 1, 2015 Approved 6 WMS Report (Feb) • NPRR638, Revisions to Certain Price Components of Estimated Aggregate Liability (EAL) Tabled at PRS MCWG is working with ERCOT staff to gain insight into the potential impacts of NPRR638. ERCOT would like implementation prior to summer 2016. • No change to 2015 DAM Collateral Parameters Recommended by WMS Approved Nodal Protocol Section 4.4.10 requires DAM Collateral Parameters, including Price Percentile, ‘e’ Factors, Real-TimeDay-Ahead (RT-DA) spread (currently 90%), PTP Obligation Discount (currently 90%), to be reviewed at least annually. 7 WMS Report (Mar) • 2015 WMS Goals Approved • VCMRR006, Fuel Adder Timeline Update, Effective Date: April 1, 2015 Approved 8 COPS Report (Feb) • LPGRR054, Alignment with NPRR661, Effective Date: Upon system implementation Tabled at TAC • Load Profiling Guide: Why is it still needed? A TAC Member asked this question and COPS should provide a thorough answer to educate TAC Members Assigned to PWG • Create the Process for a Reduction in the Unregistered DG Threshold Assigned to CSWG o o o o o o o Why is this needed? What Market Participants are impacted? What Market Participant is responsible for communication? How is it communicated? Are current DGs under 1 MW grandfathered? Are there settlement impacts? Does there need to be coordination with the PUC? 9 COPS Report (Mar) • 2015 COPS Goals Approved • Load Profiling Guide: Why is it still needed? In response to a question, the following list of list of reasons the LPG is still needed was presented. o Non-AMS ESI IDs – Need to have documentation of the rules which govern them o AMS Data Gaps - Communication failures result in TDSPs relying on load profiles to estimate interval consumption o Load Forecasting – By ERCOT and REPs o Procurement – Allows for hedging strategies; Grouping of “classes” of customers o Pricing – REPs’ pricing systems may not yet be capable of utilizing AMS interval data during the price quotation process, so they utilize load profiles to accurately quote a customer a commodity price o Settlement – During the time an AMS meter is provisioned, prior to the AMS Settlement flag being activated (up to 30 days), an ESI ID is settled in the market based on their load profile o Marketing Efforts – Load profiles allow for segmenting / targeting groups of customers 10 ERCOT Reports (Mar) • Ancillary Services Redesign Update o Another FAS Workshop to further discuss “Procurement and Pricing (P&P) Options” for NPRR667, Ancillary Services Redesign – April 20, 2015 o ERCOT is planning to begin monthly Synchronous Inertial Response Service “working group” meetings – April 20, 2015 o Cost Benefit Analysis target completion date for the final report is mid-June 2015 and the Battle Group plans to present and answer questions in person at a future FAS CBA meeting • Annual ERS Report o The ERCOT Annual Emergency Response Service (ERS) report was included in the TAC Meeting Materials 11 ERCOT Reports (Mar) Cont. • LCRA Transmission Services Corp (TSC) and CPS Energy Transmission System Addition RPG Project Endorsed by TAC o Several 345 kV and 138 kV lines supporting the San Antonio system and the existing 345/138 kV transformers serving the area load are vulnerable to thermal overloads under various contingency condition by 2019 o The recommended project will address the reliability need at an estimated cost of approximately $86 million in 2019 dollars; Will go to the Board for approval • Seasonal Adjustment Factor (SAF) o CWG/MCWG voted for the 2015 SAF factors as follows 2015 Month June July August September 2014 Value 100% 200% 300% 150% ERCOT Calculation 115% 101% 224% 100% CWG/MCWG Recommendation 115% 125% 200% 100% o ERCOT staff agreed with the CWG/MCWG Recommendation 12 Appendix A 2015 TAC Goals 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Align TAC and Subcommittee Goals with the ERCOT Board of Directors’ strategic vision to work with ERCOT Staff to achieve the Board’s vision for ERCOT. Maintain market rules that support ERCOT system reliability and are consistent with PURA, PUC, and NERC Reliability Standards. Monitor resource adequacy and make improvements as necessary. Collaborate with ERCOT Staff on current trends in fuel prices and installed resource costs through market changes. Develop and implement needed market design corrections and improvements which are cost effective. Pursue the appropriate implementation of load participation. Pursue the appropriate implementation of emerging technologies. Implement Retail Market improvements and requirements. Facilitate market improvements necessary to leverage the capabilities of Advanced Metering Systems (AMS) in the retail market. Improve settlement processes to facilitate changes in the ERCOT market design. Collaborate with ERCOT Staff on the review of ancillary service needs and implement changes as necessary. Maintain market rules that support open access to the ERCOT markets and transmission network. Work with ERCOT Staff to develop Protocols and market improvements that support increased data transparency and data availability to the market. Work with ERCOT Staff to ensure appropriate credit and collateral rules exist or are created to facilitate market changes. 13 Appendix B 2015 TAC Strategic Initiatives and Assignments • • • • • • • • • • • Sub-synchronous Oscillation (SSO) – ROS Loads in SCED Part 2 – WMS Outage Coordination Improvements – ROS Switchable Generation – WMS Distributed Energy Resources – WMS Real-Time Co-optimization – WMS Multi-Interval Real-Time Market – WMS Future Ancillary Services – TAC Smart Meter Texas – RMS Review of Planning Processes – ROS Implementation of Outage Scheduler Revisions (NPRR219 and SCR783) – ERCOT 14