EV Adoptions among CT Zip Codes with Flat and Off

advertisement

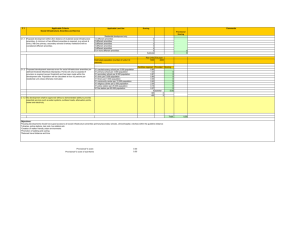

Electric Vehicle Adoptions among CT Zip Codes at Flat and Off-Peak Electricity Rates: County Impacts REMI Seminar Lake Tahoe, 12 October 2012 Peter E Gunther Senior Research Fellow CCEA Introduction: Zip Code Data • Yearly Vehicle registrations by type 2005-2009 • Aggregate Family Incomes • Commuters from Destination Zip Code (ZC) by Distance Ergo electric and gas used in GM’s Volts • Distance Ranges by Commuters possibly in EVs: – Volts 50 Miles – Tesla Up to 400 Miles – Sedans Out in Mid 2012 • CT Data on 252 residential ZCs out of 341 Background Process • Used Annual Cross-Sectional Data on 252 CT ZCs to Estimate Registrations in Other 89 • Mapped Market Penetrations @ 5% and 25% • Approximation of Required Transformer/Transmission Upgrades • Projected EVs and Total Light Vehicle Growth • Transformer Upgrades at: – 5% Market Penetration If Charged at Flat Rates – 25% Market Penetration If Charged at Off-Peak Rates Concentrations of Zip Codes Requiring Transmission Upgrades in 2022 Flat Rates (n=341) Concentrations of Zip Codes Requiring Transmission Upgrades in 2022 Off-Peak Rates (n=341) Stepwise Approach: Bifurcated for Flat and Off-Peak Rates • Based on Elasticities on the Spread between Flat and Off-Peak Rates in CT Developed a Cost Neutral Rate Spread for Homeowners to Attain Off-Peak Rates • Incremental Household Savings on Gasoline • = Increased Electricity Costs + Increased Consumption Reallocation • Off-Peak Electricity Savings $ Exceed Flat Analytical Progression • Straight Substitution of Electricity for Gasoline • GHG Reductions – Amenity Benefits @ $38.98/tonne CO2eq • Capital Adjustments-Accelerating Actual NonResidential Capital Toward Optimum Capital Connecticut Job Impacts from Adopting EVs 20132030 Flat and Off-Peak Rates without Amenities 600.0 400.0 200.0 - (200.0) (400.0) (600.0) Electricity at Flat Rates No Anemities Off-Peak Rates No Amenities County Job Impacts Off-Peak Rates without Amenities 350 300 250 200 150 100 50 0 -50 -100 Fairfield New Haven Hartford Tolland New London Windham Litchfield Middlesex Relative Intensity of GHG Reductions GHG 2027 Value of GHG Reductions (Millions 2010 $) 80.000 Fairfield 70.000 New Haven 60.000 50.000 40.000 30.000 Hartford Tolland New London Windham 20.000 Litchfield 10.000 Middlesex 0.000 Connecticut Impacts from Adopting EVs Flat and OffPeak Rates with & without Amenities (# of Jobs) 1,000.0 800.0 600.0 400.0 200.0 (200.0) (400.0) (600.0) (800.0) Electricity at Flat Rates No Anemities Off-Peak Rates No Amenities Electricity at Flat Rates & Anemities Off-Peak Rates and Amenities County Job Impacts Off-Peak Rates without Amenities 700 600 500 400 300 200 100 0 -100 Fairfield New Haven Hartford Tolland New London Windham Litchfield Middlesex 2023 & 2028 Sector Impacts from Adopting EVs at Flat and Off-Peak Rates with & without Amenities (# of Jobs) 1,000 500 (500) (1,000) (1,500) (2,000) Flat Rate Flat Rate and Amenities Off-Peak Rate Off-Peak Rate and Amenities 2,000 1,000 (1,000) (2,000) (3,000) (4,000) Flat Rate Flat Rate and Amenities Off-Peak Rate Off-Peak Rate and Amenities Connecticut Impacts on Capital Stock (Millions Fixed 2005 $) 2023 2028 2,500 2,500 2,000 2,000 1,500 1,500 1,000 1,000 500 500 - Flat Rate Flat Rate and Off-Peak Amenities Rate Actual Optimal Off-Peak Rate and Amenities Flat Rate Flat Rate and Off-Peak Amenities Rate Actual Optimal Off-Peak Rate and Amenities Connecticut Impacts on Capital Stock: Flat Rates no Amenities (Millions Fixed 2005 $) 2,500.0 2,000.0 1,500.0 1,000.0 500.0 - Actual (Millions of Fixed 2005 $) Optimal (Millions of Fixed 2005 $) Capital Adjustments • This Study Produced Estimates of Actual and Optimal Changes to Capital Stock for Each Scenario • Given that Reliability Is a Virtual Necessity, • The Gap between Optimal and Actual Is Used as a Proxy for Capital Adjustment: – 40% Construction – 30% Producer Durable Purchase of Engines & Turbines – 30% Producer Durable Purchase of Transmission Job Impacts of Capital Adjustments Flat Rates 2,000.0 1,800.0 1,600.0 1,400.0 1,200.0 1,000.0 800.0 600.0 400.0 200.0 (200.0) (400.0) (600.0) (800.0) Off-Peak Rates 2,000.0 1,800.0 1,600.0 1,400.0 1,200.0 1,000.0 800.0 600.0 400.0 200.0 (200.0) (400.0) (600.0) (800.0) Electricity at Flat Rates No Anemities Off-Peak Rates No Amenities Electricity at Flat Rates & Anemities Off-Peak Rates and Amenities Electricity at Flat Rates, Capital Adjustment, No Amenities Electricity at Flat Rates, Capital Adjustment & Amenities Off-Peak Rates, Capital Adjustment, No Amenities Off-Peak Rates, Capital Adjustment & Amenities Job Impacts with Replacement Batteries Flat Rates Off-Peak Rates 2,000.0 1,800.0 1,800.0 1,600.0 1,600.0 1,400.0 1,400.0 1,200.0 1,200.0 1,000.0 1,000.0 800.0 800.0 600.0 600.0 400.0 400.0 200.0 200.0 - - (200.0) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 (200.0) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2,000.0 Off-Peak Rates, Capital Adjustment, No Amenities Electricity at Flat Rates, Capital Adjustment, No Amenities Off-Peak Rates, Capital Adjustment & Amenities Electricity at Flat Rates, Capital Adjustment & Amenities Off-Peak Rates, Capital Adjustment, Amenities & Batteries Flat Rates, Capital Adjustment, Amenities & Batteries Real Income Impacts (Millions Fixed 2005 $) Flat Rates Off-Peak Rates 400 400 350 350 300 300 250 250 200 200 150 150 100 100 50 50 0 0 CTRGDP Capital Adjustments CTRGDP CTRPI Capital Adjustments CTRPI CTRGDP No Capital Adjustments CTRGDP No Capital Adjustments CTRPI No Capital Adjustments CTRPI No Capital Adjustments Current Income Impacts Before Financing (Millions Current$) Flat Rates Off-Peak Rates 600 600 500 500 400 400 300 300 200 200 100 100 0 0 Personal Income Capital Adjustments Personal Income Capital Adjustments Personal Disposable Income Capital Adjustments Personal Income: No Capital Adjustments Personal Disposable Income Capital Adjustments Personal Income: No Capital Adjustments Personal Disposable Income: No Capital Adjustments Personal Disposable Income: No Capital Adjustments Further Rate Adjustments? • Scott’s approach is to adjust rates to cover capital costs • Yet, in this scenario new electricity supplies are demand driven • Test: If value added by utilities exceeds incremental capital expenditures by a significant margin, then no further rate adjustments may be need. Utility Value Added before & after Deducting Capital Expenses (Millions 2005 $) 450.0 400.0 350.0 300.0 250.0 200.0 150.0 100.0 50.0 0.0 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Value Added Flat Rates before Capital Expneses Value Added Flat Rates after Capital Expneses Value Added Off-Peak Rates before Capital Expneses Value Added Off-Peak Rates after Capital Expneses Employment Summary Flat Rates Off-Peak Rates 2,500.0 2,500.0 2,000.0 2,000.0 1,500.0 1,500.0 1,000.0 1,000.0 500.0 500.0 - - (500.0) (500.0) (1,000.0) Off-Peak Rates No Amenities Off-Peak Rates and Amenities Flat Rates No Anemities Flat Rates & Anemities Flat Rates, Capital Adjustment, No Amenities Flat Rates, Capital Adjustment & Amenities Flat Rates, Capital Adjustment & Funding, Amenities & Batteries Off-Peak Rates, Capital Adjustment, No Amenities Off-Peak Rates, Capital Adjustment & Amenities Off-Peak Rates, Capital Adjustment & Funding, Amenities & Batteries Current Income Impacts Inclusive of Financing (Millions Current $) Flat Rates 2030 2029 2028 2027 2026 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Off-Peak Rates 2013 2030 2029 2028 0 2027 0 2026 100 2025 100 2024 200 2023 200 2022 300 2021 300 2020 400 2019 400 2018 500 2017 500 2016 600 2015 600 2014 700 2013 700 Personal Income, Capital Adjustments and Financing Personal Income, Capital Adjustments and Financing Personal Disposable Income, Capital Adjustments and Financing Personal Disposable Income, Capital Adjustments and Financing Personal Income Capital Adjustments Personal Income Capital Adjustments Personal Disposable Income Capital Adjustments Personal Disposable Income Capital Adjustments Utility Output Impacts (Millions 2005 $) Flat Rate Off-Peak Rates 1000 1000 800 800 600 600 400 400 200 200 0 0 Value Added Net of Financing CT Ouput Demand Value Added Net of Financing CT Ouput Demand Utility Output Impacts (% of Base) Flat Rate Off-Peak Rates 15.00% 15.00% 10.00% 10.00% 5.00% 5.00% 0.00% 0.00% Value Added Net of Financing CT Ouput Demand Value Added Net of Financing CT Ouput Demand Conclusions • Off-peak electricity rates position EV owners to save on EV transportation operating costs and to allocate more household income to other consumption than occurs with flat rates. • With curtailed demand for gasoline, stations will close causing a drop in retail employment in all scenarios • Prior to Capital Adjustments, the Off-Peak Rate Structure Generates More Jobs and Income • Including Financing in the Model is Necessary – It Increases Employment and Income Impacts • Utility Output Impacts under Off-Peak Rates are About two-Thirds of Those under Flat Rates. • While Flat Rates Appear to Generate More Income this Occurs Only Because the Capital Adjustment Is $600 Million Higher than Necessary under Off-Peak Rates - A Measure of the Wasted Resources from Misguided Flat Rate Policies!