Investments MBA 536 Midterm Exam Study Guide for Spring 2012

advertisement

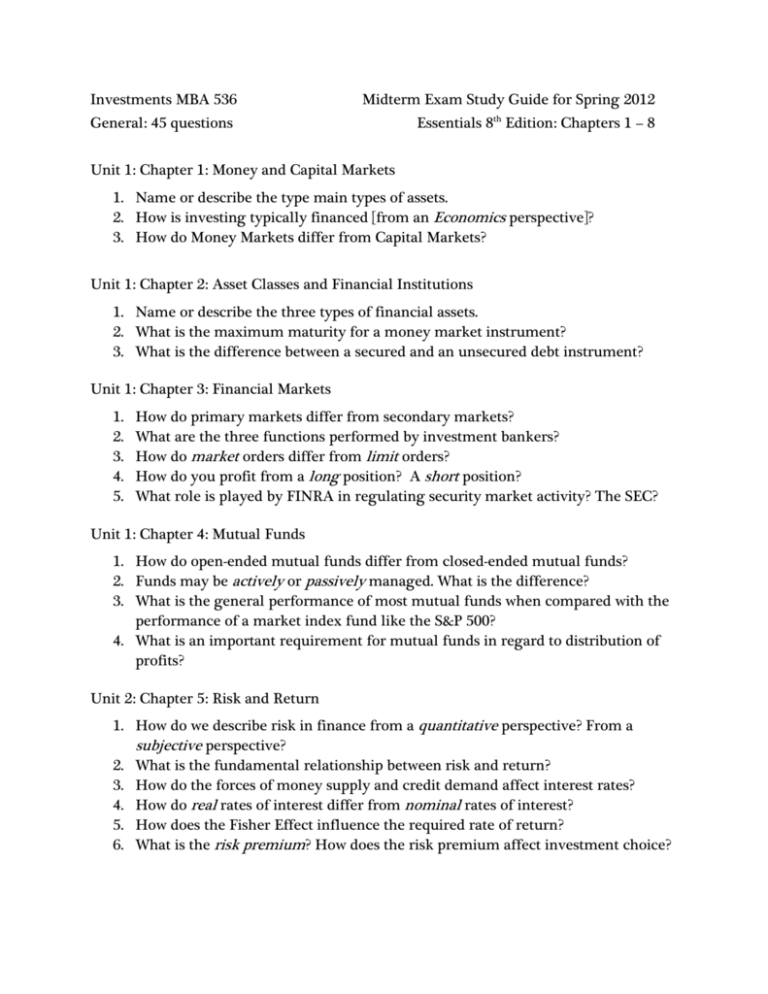

Investments MBA 536 Midterm Exam Study Guide for Spring 2012 General: 45 questions Essentials 8th Edition: Chapters 1 – 8 Unit 1: Chapter 1: Money and Capital Markets 1. Name or describe the type main types of assets. 2. How is investing typically financed [from an Economics perspective]? 3. How do Money Markets differ from Capital Markets? Unit 1: Chapter 2: Asset Classes and Financial Institutions 1. Name or describe the three types of financial assets. 2. What is the maximum maturity for a money market instrument? 3. What is the difference between a secured and an unsecured debt instrument? Unit 1: Chapter 3: Financial Markets 1. 2. 3. 4. 5. How do primary markets differ from secondary markets? What are the three functions performed by investment bankers? How do market orders differ from limit orders? How do you profit from a long position? A short position? What role is played by FINRA in regulating security market activity? The SEC? Unit 1: Chapter 4: Mutual Funds 1. How do open-ended mutual funds differ from closed-ended mutual funds? 2. Funds may be actively or passively managed. What is the difference? 3. What is the general performance of most mutual funds when compared with the performance of a market index fund like the S&P 500? 4. What is an important requirement for mutual funds in regard to distribution of profits? Unit 2: Chapter 5: Risk and Return 1. How do we describe risk in finance from a quantitative perspective? From a subjective perspective? 2. What is the fundamental relationship between risk and return? 3. How do the forces of money supply and credit demand affect interest rates? 4. How do real rates of interest differ from nominal rates of interest? 5. How does the Fisher Effect influence the required rate of return? 6. What is the risk premium? How does the risk premium affect investment choice? Unit 2: Chapter 6: Efficient Diversification 1. 2. 3. 4. 5. 6. Why is investment diversification important? Modern Portfolio Theory identifies two sources of investment risk: describe them. How does correlation affect portfolio risk? What do we mean by mean-variance efficient portfolios? How are the efficient frontier and mean-variance efficient portfolios related? Compute the expected return and variance of a two-asset portfolio. Unit 3: Chapter 7: Capital Asset Pricing Theory 1. 2. 3. 4. 5. 6. What the principal assumptions of the CAPM? What are the two sources of risk in the CAPM? How does the CML differ from the SML? What are borrowing portfolios? Lending portfolios? Which risk is priced in the CAPM? Compute Risk and expected return using the CAPM. Unit 3: Chapter 8: Efficient Market Hypothesis 1. 2. 3. 4. What is the basic claim made by the EMH? What are the three forms of the EMH? What are the implications? Are information and the random walk hypothesis consistent? What do [academic] research papers say about; a. Weak Form Efficiency b. Semi-Strong Form Efficiency c. Strong Form Efficiency 5. What do EMH proponents have to say about; a. Technical Analysis b. Fundamental Analysis c. Active vs. Passive portfolio management.