Chapter 21 Third Party Beneficiaries and Contracts

advertisement

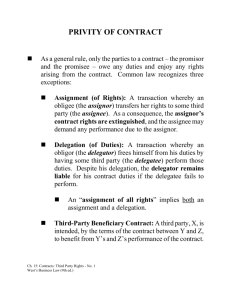

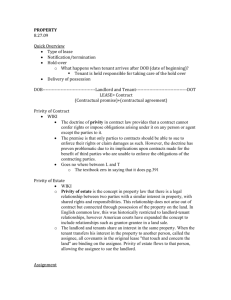

Chapter 21 Third Party Beneficiaries and Contracts David Steffel, Andrew Griener, Hahyung Bong-Johnson, Jessica Baldetti Edited by Nikki Meltabarger I. Third Party Beneficiaries Often a contract will benefit someone who is not a party to the contract. These people are third-party beneficiaries. A third party beneficiary may or may not be able to sue for the breach of someone else’s contract. They can sue if it was intended that they benefit from the contract. The intent of the contracting party is crucial to be considered a direct beneficiary; without it, the third party is simply an incidental beneficiary and not entitled to any legal remedies. For example, your neighbor agreed to sell his car to your dad. Your dad planned to give you the car. If your neighbor breaches, you can sue because you were the beneficiary of the contract (even if you were not mentioned explicitly in the contract, as long as the neighbor knew your dad’s intentions). An exception to third-party beneficiary rights is generally made in the case of public works. It is important to note that citizens are typically not considered direct beneficiaries of public works. There are two types of direct third-party beneficiary contracts: 1. Donee-Beneficiary – the contract was to result in a gift to the third party; in this case, the third party cannot sue the gift-giver. For example, your dad takes out a life insurance policy. You are the doneebeneficiary. If the insurance company breaches, you can sue them. However, if your dad breaches, you cannot sue your dad. 2. Creditor-Beneficiary- the contract was to repay the third party (to whom one of the contracting parties owed money); in this case, the third party can sue either party. For example, a bank gives Bob a mortgage. Bob sells his house to Steve. Steve takes over the mortgage. This makes the bank a creditor-beneficiary. If Steve defaults, the creditor can sue Steve and/or Bob. II. Assignment of Contract Rights Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 1 An example of the assignment of contract rights would be if Sam (Retailer (I)) was promised by Tom (Buyer (II)) 3,000 dollars for an automobile. Tom is planning to pay for the automobile in installments over the next year. Sam (I) then assigns her rights to money from the contract over to the Bank (III) for the sum of 3000 dollars. The Bank (III) now has rights to the installment payments made by Tom. Figure 1 Obligor-- A party that is responsible under a contract to carry out a duty specified in the contract. Assignor--the party with the original rights to the performance of the contract, and who transfers their rights to a third party. Assignee--the third party that accepts the assignor’s right to receive performance from the contract. There are several types of assignments and different laws governing each of them. Generally, the common law commanding assignments for goods arises from Article 2 and Article 9 of the UCC. Article 2 deals with assignments of contracts for goods and the sale of goods. (Goods are defined here as items that are held for sale in the regular course of business.) Article 9 focuses on assignments made to lock in the performance of an obligation. A. Assignment of Rights to Money Assignment of rights to money is very similar to the example mentioned above involving Sam, Tom, and the Bank. The assignment of rights to money is the transfer of one party’s right to receive a sum of money to another party. Going back to our example the original contract involved Sam and Tom. Sam originally has the right to receive payments from Tom. Sam also has the contractual duty to provide Tom Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 2 with the automobile. Tom has the right to the automobile and the duty to pay Sam in installments over the course of the year. Sam now sells her rights to the money to the Bank for $2,600. Now the Bank, not Sam, has full rights to the payments from Tom. This is a basic example of assignment of rights to money. 1. Obligor’s Permission on Assignment of Rights Usually you cannot prohibit right to assignment of money. The obligor’s permission is not needed to assign rights to a contract. A valid assignment does not need notice to be sent to the obligor of an assignment, but it is recommended. B. Assignment of Non-money Contracts Any property, as long as it is legal, can be transferred (assigned) to a third party as long as the assignment does not materially change the duty of the obligor. For example, Johnson has a contract with a soda retailer to purchase a certain number of sodas each month for one year at a certain price. If Johnson decides that he does not want the sodas anymore, then he can find someone else to take over his contract. So, Johnson talks to his neighbor, Anderson, who has always liked Johnson’s sodas, and Anderson agrees to the contract terms and is willing to take over the contract. Now, Johnson needs to look at the contract terms with the soda retailer and check if it is legal to assign contracts to Anderson. As long as the contract and the state’s laws allow, and Johnson and Anderson do not change the burdens, like the quantity of sodas or the price, on the soda retailer, the assignment of contract is likely to be formed. The obligor’s permission is not required when an assignment is reasonable. Reasonable means that there were no material changes made to the original contract, and the state’s laws allow the assignment. However, if there has been a material change to the contract, the obligor’s permission is needed. For the previous example, assume Johnson’s contract with the soda retailer states that Johnson will receive 100 sodas per month for one year at a certain price. If Johnson tries to assign these rights to Anderson, who only wants 50 sodas per month, then they would need the retailer’s permission to successfully complete the assignment since the change is considered to be material. 1. Obligor’s Power to Prohibit Assignment It is much easier to prohibit an assignment when dealing with rights to things other than money. Most contract rights are assignable. Under many circumstances, the obligor does not have the power to prevent the assignment of rights to an assignee. The following are some general exceptions (to help protect the obligor). Contract rights are not assignable if the material obligation of the obligor is altered. (Burden on obligor is increased either materially or in risk.) Highly personal contract rights are prohibited from being assigned. Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 3 If the contract validly prohibits the assignment of the contract, it is not assignable. Contract rights are not assignable if the assignment is prohibited by statute or public policy. A common situation where a statute prohibits assignment is with future wages. Some statutes allow the assignment of future wages as long as criteria are met; other statutes completely prohibit future wages from being assigned. C. Delegations An assignment transfers rights to another party. Delegation transfers duties. Delegation occurs when someone who has an obligation, the delegator, transfers the obligation to perform to another party, known as the delegatee. The delegatee needs to perform the obligation to benefit a third party, the obligee, who had a contract with the delegator. For example, Johnson has completed a contract with Pro Golf store to purchase and receive a set of golf clubs. In this case, Johnson is the obligee, and Pro is the delegator. However, before Johnson receives the golf set, Pro sells its business to Anderson. Pro, the delegator, then transfers its duties under the contract with Johnson to Anderson, the delegatee, and if Anderson agrees to the terms of contract, then a delegation has been formed. Anderson is now bound to the contract with Johnson. As long as the contract does not prohibit delegation, and no breach or material change is made to the contract, then no permission from the obligee is necessary. 1. Duties that are Nondelegable However, some duties are nondelegable. For example: 1. If the contract states that the delegation is not permitted, then the duties are nondelegable. 2. If the delegation contains any breach of contract or it is unreasonable, then it is nondelegable. 3. If the obligee specifically wants the obligor to perform the duties, then it is nondelegable. 4. Some duties requiring professional consultant or specialized skills, such as hiring an attorney, cannot be delegated unless approved by the obligee. 5. While an employer can delegate some obligations to his or her employee, if the employee does not finish the obligations, the employer is still liable. 6. Finally, an employee cannot delegate to a non-employee. 2. Who Is Liable When the Delegatee Fails to Perform? Suppose you own a house, and that you have an outstanding mortgage of $200,000 on the house with Homeowners Bank. The mortgage is a contract, where you are the obligor and Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 4 Homeowners Bank is the obligee. You are the obligor because you are obligated to pay the mortgage payments to the bank. It is your duty. Homeowners Bank is the obligee because they have the right to receive your mortgage payments. You are obligated to them. Now, suppose that you are ready to move to a new house. You sell your current residence to Dwight and you transfer the mortgage to Dwight. With respect to the duty to make mortgage payments, you are now the delegator, as you have delegated that duty to Dwight, and Dwight is the delegatee. If Dwight is unable to make the payments; that is completely his problem now, right? Wrong… Even though Dwight has assumed your duty of paying the mortgage payments to Homeowner’s Bank, you are not off the hook. If Dwight is unable to make the mortgage payments, Homeowner’s Bank can come after you, because you are still obligated to perform that duty to them. (Of course, if Dwight fails to make the payments and the bank comes after you, you have the power to sue Dwight for breach of your delegation contract.) When the duties of a contract are delegated, the delegatee has a legal liability to perform under the delegation contract. However, the delegator is still legally liable for performance under the original contract. 3. Novation The exception to the above rule is called novation. Novation is basically the process that lets the original obligor off the hook. Refer to the previous example. You sell your house to Dwight, and he assumes the duties of your mortgage. You are still liable. However, you can ask Homeowners Bank to discharge you of your duty as obligor, and make Dwight the new obligor in the agreement. If you, the bank, and Dwight all agree to it, you are now off the hook, and Dwight is the only one with a duty to pay Homeowners Bank. An important thing to remember is that the bank must agree to relieve you of your duty. Just because they accept payments from Dwight does not mean they are letting you off the hook. You must have Homeowners Bank agree that you are no longer liable. That is novation. D. Defenses in Assignment of Contract Rights Suppose you have a house, and would like to have a swimming pool built in the backyard. You enter into a contract with Skinny Dippers Inc., where Skinny Dippers has the rights to your payment of $10,000 in return for its construction of the swimming pool by August 1st. With respect to the payment of the money, you are the obligor, as you are obligated to pay Skinny Dippers, so long as it holds up its end of the bargain by building your swimming pool by August 1st. Now, assume that Skinny Dippers starts building your pool, but after the first week it starts to have some financial trouble. In return for some cash, it assigns the rights to your money Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 5 to Dirty Finance Co. Skinny Dippers is the assignor, and Dirty Finance is the assignee. Skinny Dippers has given up the right to collect the money from you, and Dirty Finance has assumed the rights to your $10,000. August 1st comes and goes, and your swimming pool is not even close to being finished, and Skinny Dippers has not done any work on it for weeks. Dirty Finance calls you and says you owe them $10,000. Do you have to pay? No! When Dirty Finance assumed Skinny Dippers rights to your money, it “stepped into the shoes” of Skinny Dippers. This means that it assumed exactly the same rights to your money that Skinny Dippers had. Skinny Dippers would only be able to collect your $10,000 if it built your pool by August 1st, and Dirty Finance is now in that same role. If the swimming pool is not built by August 1st, it does not have the rights to your money. Dirty Finance is not completely out of luck. When Skinny Dippers assigned the rights to your money, it guaranteed that there would be no reason for Dirty Finance to be unable to collect. That guarantee is known as the assignor’s warranty to assignee, and is legally enforceable under all assignments of contract rights. Dirty Finance has the right to sue Skinny Dippers over the breach of this warranty. E. Notification When an assignment of contract rights has taken place, the assignor should give prompt notification of the assignment to the obligor. While prompt notification is not required for the assignment to be legal and valid, it can prevent confusion when it comes time for the obligor to perform his or her duty. If an obligor has not been notified of an assignment and renders performance to the original assignor, then the obligor is discharged of their contractual liability upon that performance. The assignor is then liable to the assignee for the benefits they received. If an obligor has been properly notified of an assignment and mistakenly pays the original assignor, then the obligor is still legally bound to perform his or her duty to the assignee. Suppose you borrow money from Shady Bank on June 1st, and promise to pay it back by September 1st. Under contract law, once you pay back your debt to Shady Bank (assuming you do it before September 1st), you are fully discharged of your duty to pay the bank, and it no longer has rights to your money. Assume that Shady Bank assigns the right to your money over to Rank Bank on July 1 st, but Shady Bank never gets around to notifying you. When you pay Shady Bank, you are fully discharged of your duty to pay, just as before. Shady Bank now owes that money to Rank Bank. In this case, Rank Bank could sue Shady Bank, as Shady Bank is now legally obligated to give Rank the payment it received from you. Now, assume that after Shady Bank assigns the rights to your money over to Rank Bank, it gives you adequate notice of the assignment. You now know that you should pay Rank Bank, not Shady Bank. For some reason, you forget about Shady Bank notifying you of the Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 6 assignment, and you mistakenly pay them as you originally planned to do. Rank Bank calls and tells you that you owe it money. Do you? Yes. Even though you originally owed Shady Bank, and were simply paying your original debt, you still owe Rank Bank because you were given adequate notification of the assignment. Since you paid the wrong bank, you are still obligated to fulfill your duty of paying Rank Bank. Rank can also sue Shady for taking the money. In summary, if the obligor is notified and pays the wrong party, the assignee can sue either the obligor or assignor. If the obligor is not notified, the assignee can only sue the assignor. The assignee cannot sue the obligor since no notice was given. Chapter 21 Third Party Beneficiaries and Assignment of Contract Rights Page 7