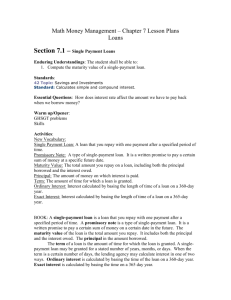

7-1 WHAT ARE SINGLE-PAYMENT LOANS? (Continued)

advertisement

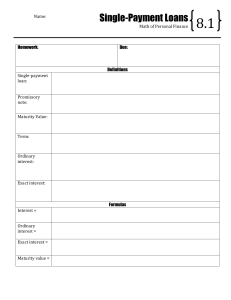

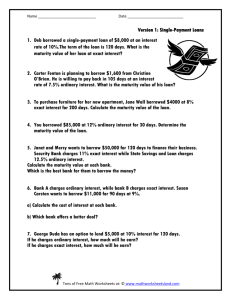

7-1 WHAT ARE SINGLE-PAYMENT LOANS? 1.A single payment loan is a loan that you repay with one payment after a specified period of time. 2.A promissory note is a type of single-payment loan. It is a written promise to pay a certain date in the future. The maturity value of the loan is the total amount you repay. It includes both the principal and the interest owed. The principal is the amount borrowed. 3.The term of the loan is the amount of time for which the loan is granted. 1 7-1 WHAT ARE SINGLE-PAYMENT LOANS? (Continued) 4. A single-payment loan may be granted for a stated number of years, months, or days. 5. When the term is a certain number of days, the lending agency may calculate interest in one of two ways: 6. Ordinary interest is calculated by basing the time of the loan on a 360-day year. Exact interest is calculated by basing the time on a 365-day year. Maturity Value= Principal + Interest Owed 2 LET’s PRACTICE Anita Sloane’s bank granted her a single-payment loan of $7200 for 91 days at an interest rate of 12%. What is the maturity value of the loan if: (1) her bank charges ordinary interest? (2) her bank charges exact interest? Find the ORDINARY INTEREST OWED. (Principal x Rate x Time) $7200 x 12% x 91/360 = $218.40 ordinary interest Find the EXACT INTEREST OWED. (Principal x Rate x Time) $7200 x 12% x 91/365 = $215.41 exact interest Find the MATURITY VALUE.(BASED ON 360 DAYS) (Principal + Interest Owed) $7200 + $218.40 = $7418.40 Maturity value Find the MATURITY VALUE.(BASED ON 365 DAYS) (Principal + Interest Owed) $7200 3 + $215.41 = $7415.41 Maturity value