Health Benefits: Past, Present and Future

advertisement

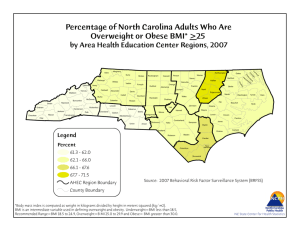

Health Insurance: Past, Present and Future Prepared for OACUBO Annual Meeting, April 2009 Dr. Melissa A. Thomasson Associate Professor, Department of Economics, Miami University Research Associate, National Bureau of Economic Research Health Expenditures as share of GDP 0.18 0.16 0.14 0.12 0.1 0.08 0.06 0.04 0.02 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Health Expenditures (millions of $), InflationAdjusted and Unadjusted 2500000 2000000 Adjusted 1500000 1000000 500000 0 Unadjusted Why are costs rising? Technology More generous insurance coverage • Less restrictive managed care • More comprehensive coverage Behavior and Demographics • Lifestyles • Aging Technological Advance takes 2 forms: • Treatment substitution – Replace CABG with angioplasty and stents • Treatment expansion – Diagnose heart disease earlier, treat more people before heart attacks. • Either case: costly, but benefits probably outweigh costs • Insurance companies must ensure proper use Changes in insurance • Pushback in the late 1990s about strict managed care • Return to discounted FFS (PPO, POS plans) – Not as effective at holding down costs • Increasing coverage of pharmaceuticals • Lower consumer out-of-pocket expenses – Moral hazard: consumers spend more when it isn’t their money Private Health Insurance and Consumer Out of Pocket Payments , % of Total Health Expenditures, 1990-2007 0.6 0.5 0.4 0.3 Consumer OOP, % of total Health Insurance, % of total 0.2 0.1 0 Hospital, Physician, and Pharmaceutical Expenditures as % of Total, 1990-2007 0.4 0.35 Percent of Total Expenditures 0.3 0.25 Hospital 0.2 Physician Pharm 0.15 0.1 0.05 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Demographics and Behavior • The good news: we are living longer. • The bad news: we are living longer. • Cost of medical care for the elderly is 3-5 times more expensive than for the nonelderly. Lifestyle choices: Obesity and Smoking • • • 20% of the population smokes; leading to high health care costs and productivity losses. 66.3% of population is overweight (BMI > 25) or obese (BMI > 30); 34% is obese. Overweight and obesity linked with – Coronary heart disease – Type 2 diabetes – Cancers (endometrial, breast, and colon) – Hypertension (high blood pressure) – Dyslipidemia (for example, high total cholesterol or high levels of triglycerides) – Stroke – Liver and Gallbladder disease – Sleep apnea and respiratory problems – Osteoarthritis (a degeneration of cartilage and its underlying bone within a joint) – Gynecological problems (abnormal menses, infertility) (Source: NIH, NHLBI Obesity Education Initiative. Clinical Guidelines on the Identification, Evaluation, and Treatment of Overweight and Obesity in Adults. Available online: http://www.nhlbi.nih.gov/guidelines/obesity/ob_gdlns.pdf (PDF-1.25Mb) Obesity is expensive: • $78.5 billion in medical spending attributable to overweight/obesity in 1998. (Finkelstein, Fiebelkorn, Wang 2003). • Study of 11,000 Duke University workers found workers’ comp claims were much higher for overweight and obese workers Medical Claims per 100 FT Employees (Duke University study of 11,000 employees) $51,091 $23,373 $19,661 $13,338 $7,503 Normal (BMI < 25) Overweight (BMI=25- Mildly Obese (BMI 30- Moderately Obese (BMI Severely Obese 29.9) 34.9) 35 - 39.9) (BMI>40) Source: Ostbye,T., Dement, J., Krause, K. “Obesity and Workers’Compensation.” Archives of Internal Medicine, vol. 167, April 23, 2007. Obesity Trends* Among U.S. Adults BRFSS, 1990, 1998, 2007 No Data <10% 10%–14% 15%–19% 20%–24% Source: CDC Behavioral Risk Factor Surveillance System: http: //www.cdc.gov/brfss/ 25%–29% ≥30% How to tame costs? • There is evidence that a well-designed employee wellness program can: – Reduce sick leave/absenteeism – Reduce WC claims – Lower health care costs • Consider changes in health insurance eligibility and plan design Health Insurance Eligibility • Incentivize employees with spousal coverage to take-up spousal coverage (and drop their own). • Utilize dependent eligibility audit to make sure ineligibles aren’t using benefits. Offer Health Savings Account • Combines high deductible health plan with a savings account that belongs to the employee. • High deductibles empower employees to make cost-conscious decisions. • Savings account means that money not spent can be saved: – Used for future health and long term care expenses. – Money belongs to the employee – they can take it with them if they leave employment. Important Details • Preventive care covered 100%. • Money contributed on pre-tax basis (cannot be combined with an FSA). • Only will work if consumers are knowledgeable and have access to information: – What does an MRI cost? What are alternatives to emergency care? • Once deductible is met, employees have no incentive to reduce spending. Do HSAs work? • They will not solve the big problem: most health care spending is incurred by a small percentage of individuals with serious health conditions. • They will help at the margin, and can be structured so as not to adversely affect employees. Will the government save us? • Employment-based system grew in the 1940s as employers sought to attract workers during wage freezes. • Tax-advantaged form of compensation. • Insurance companies like to insure people who are able to work because it reduces adverse selection. • Less attractive when firms see 20-30% of their compensation rising at a rate greater than inflation. Reform • Two primary (and opposing issues): access and cost. • Broad-based reform has never been politically appealing…until now. • The state of the economy (coupled with high and rising costs) may make reform more palatable for the middle-class. Obamacare will: • Require employers to offer coverage or contribute to the cost covering workers. • Establish a National Health Insurance Exchange to make coverage affordable: – private health insurance options and new public plan • Very similar to plan in Massachusetts Commonwealth Health • Employers with more than 50 employees – Must offer a Section 125 Plan – Could be required to pay the Free Rider Surcharge if they do not (“high and unplanned”) – Must make “fair and reasonable” contribution to health insurance or pay a “fair share contribution” of up to $295 per employee • Inidviduals must be enrolled in a plan or pay tax penalties of up to $912 Not a panacea • Largely successful in reducing the number of uninsured. • Threatened by rapidly rising costs. • What else can be done? – EMR (estimated savings of $100 billion) – Malpractice reform (eliminate “waste” of defensive medicine of $210 billion). – Encourage evidence-based medicine. • Much of what could be done would lower the level of costs but not the rate of growth. • To really reduce costs, we have to give up technology and insta-access to care.