File - phsapstatistics

advertisement

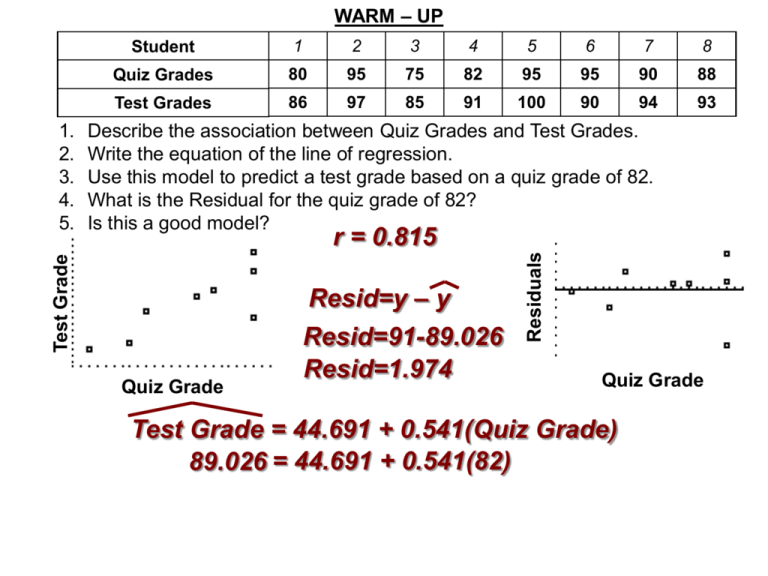

WARM – UP 1 2 3 4 5 6 7 8 Quiz Grades 80 95 75 82 95 95 90 88 Test Grades 86 97 85 91 100 90 94 93 Describe the association between Quiz Grades and Test Grades. Write the equation of the line of regression. Use this model to predict a test grade based on a quiz grade of 82. What is the Residual for the quiz grade of 82? Is this a good model? Resid=y – y Quiz Grade Resid=91-89.026 Resid=1.974 Residuals r = 0.815 Test Grade 1. 2. 3. 4. 5. Student Quiz Grade Test Grade = 44.691 + 0.541(Quiz Grade) 89.026 = 44.691 + 0.541(82) 1 True Slope of the linear relationship. H 0: β 1 = 0 H a: β 1 ≠ 0 A Linear Relationship does NOT exist A Linear Relationship does exist Regression Output Analysis WARM – UP The Statistics had an average of 81.2 with a standard deviation of 4.5. a.) What score represents the 90th percentiles? x x 81.2 x = 86.969 z z = InvNorm(0.90) = 1.282 1.282 4.5 b.) What is the probability that at least 3 out of 8 randomly selected students scored in the top 10%. P( x 3) 1 P( x 2) 1 Binomialcdf (8, 0.10 , 2) = 0.0381 c.) Assuming a Normal Distribution, what is the probability that a random sample of 3 students will have a mean score of at least 85? 85 81.2 x ) P ( x 85) P( z z 4.5 / 3 n P( z 1.463) Prob. = Normalcdf(1.463,∞) = 0.0718 WARM – UP Many Economist believe that the down turn of the US Economy is due to developments in the Housing Market. The table below indicates random Medium home prices and the Unemployment Rate at that time. DATE 3/07 6/07 10/07 12/07 Housing $100K 263 236 234 Unemployment Rate 4.40 4.50 4.70 5/08 7/08 11/08 1/09 228 229 221 225 201 5.00 5.50 5.70 6.70 7.60 1. Describe the association between Housing values and Unemployment. 2. Write the equation of the line of regression. 3. Use this model to predict unemployment if housing reaches $180,000. 4. Is this a good model? 3/07 6/07 Housing $100K 263 236 234 Unemployment Rate 4.40 4.50 4.70 10/07 12/07 5/08 7/08 11/08 1/09 228 229 221 225 201 5.00 5.50 5.70 6.70 7.60 Describe the association between Housing values and Unemployment. Write the equation of the line of regression. Use this model to predict unemployment if housing reaches $180,000. Is this a good model? Residuals Unemployment 1. 2. 3. 4. DATE Housing $100K Housing $100K Unemployment = 17.934 – 0.054(Housing $K) 8.197 = 17.934 – 0.054(180) LINEAR REGRESSION t – TEST b1 0 t SE b1 P Value 2 tcdf ( t , E 99, df n 2 ) # Hours of Study .5 3 1.5 2 1.5 1 Test Grade 72 98 82 89 76 73 Does a significant relationship exist between number of hours studying and test grades? H :β =0 Grade 63.663 11.371(hours) 11.371 0 t 1.6803 0 1 Ha: β1 ≠ 0 SE b1 1.6803 P Value 2 tcdf ( 6.767 , E 99, 4) 0.0025 Chapter 27 – INFERENCE FOR REGRESSION – Spread around the line = se: • The spread around the line is measured with the standard deviation of the residuals se. Chapter 27 – INFERENCE FOR REGRESSION – Spread of the x values = sx: • A large standard deviation of x provides a more stable regression. – Spread around the line = se – Spread of the x values = sx – Sample Size = n SE b1 se n 1 sx SE(b1) is the Standard Error about the slope. LINEAR REGRESSION t – TEST Used to determine whether a significant relationship exists between two quantitative variables. t x s / n b1 0 t SE b1 β=0 β≠0 A Linear Relationship does NOT exist A Linear Relationship does exist WARM – UP Many Economist believe that the current situation of the US Economy is due to developments in the Housing Market. The table below indicates random Medium home prices and the Unemployment Rate at that time. DATE 3/07 6/07 10/07 12/07 Housing $100K 263 236 234 Unemployment Rate 4.40 4.50 4.70 5/08 7/08 11/08 1/09 228 229 221 225 201 5.00 5.50 5.70 6.70 7.60 Dependent Variable is: URate R-squared = 68.1% s = 0.69127 with 8 – 2 = 6 degrees of freedom Variable Coefficient SE(Coeff) T-ratio P-Value Intercept 17.93434 14.20411 1.6249 0.1386 Housing -0.05410 0.015115 -3.5792 0.0117 = b1 = SE(b1) .05410 0 b1 0 t t 3.5792 0.015115 SE b1 P Value 2 tcdf ( 3.5792 , E 99, 6) 0.0117 Chapter 27 – INFERENCE FOR REGRESSION – Sample Size = n: • Having a larger sample size, n, gives more consistent estimates.