Start-up Seminar -final version - Venture Association of New Jersey

advertisement

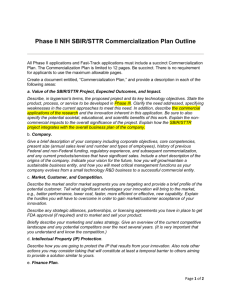

BOOTSTRAPPING STRATEGIES Randy Harmon, NJ Small Business Development Centers of Rutgers Business School DON’T COUNT VENTURE CAPITAL COMING OUT OF THE GATE Raising debt and equity financing is all about perceptions of risk and opportunity Early stage and pre-sales companies are generally perceived as too risky The further along you can develop the venture before formal financing, the better your chances are of survival and ultimately raising financing BOOTSTRAPPING - 4 Fs: - Friends Family Founders Fools - Everything else beyond the pursuit of formal debt and equity financing that an entrepreneur does to both raise and minimize the resources needed to launch their business and carry it through its early stages BOOTSTRAPPING Cleaning out your personal savings or retirement accounts Home equity loans and second mortgages Credit cards Friends & family plan Research and development grants Strategic alliances Outsourcing activities requiring large up-front investments Purchasing used equipment Bartering your product/service for someone else’s Advances from professional service providers Suppliers Advance payments from customers DOWNSIDE- There is often a trade-off between time and money and the delay can sometimes be detrimental or fatal SMALL BUSINESS INNOVATION RESEARCH PROGRAM (SBIR) Best source of risk capital Largest Federal R&D grants program targeted to small business-nearly $2 billion annually All Federal agencies with large external R&D budgets participate Three phase competitive program Dept. of Agriculture Dept. of Commerce Dept. of Defense Dept. of Education Dept. of Energy Dept. of Health and Human Services (NIH) Dept. of Transportation Environmental Protection Agency Homeland Security NASA Nat. Science Foundation THREE PHASE PROGRAM Typically annual solicitations in which agencies define areas in which they are interested in sponsoring research Phase I- up to $100,000, runs 6 months Demonstrate technical feasibility Phase II- up to $750,000, runs 2 years Proof of concept Development of a prototype Phase III- no new funding Commercialization of the technology SMALL BUSINESS TECHNOLOGY TRANSFER PROGRAM (STTR) Younger, poorer sister of SBIR program 5 largest Federal Agencies participate Department of Defense NASA Department of Energy National Science Foundation Department of Health & Human Services Less than 10% of the funding of SBIR 3 Phase program Requires 30% of contract to go to a collaboration with a nonprofit research organization CLOSEST THING TO ENTREPRENEUR’S “HOLY GRAIL” OF FREE MONEY No loans, no equity Entrepreneur maintains ownership of the technology Good odds 1 in 10 Phase I proposals are funded Presently better under STTR 2 in 5 Phase II proposals are funded PATH TO EQUITY FINANCING SBIR/STTR provides up to $850,000 in financing over a 3 year period to develop a technology and remove much of its risk. Vulnerability of technology entrepreneurs to focus almost exclusively on the technology If the company simultaneously works to reduce market and business risk it can become a prospect for equity financing. ADVANCED TECHNOLOGY PROGRAM (ATP) National Institutes of Standards and Technology (NIST) Invests in development of innovative high risk/high potential economic impact technologies Aims for grand slam home runs Research priorities set by industry based on their understanding of marketplace Cost sharing-at a minimum small companies pay all indirect costs Rigorous pear reviewed competitions $2 million over three years Approximately $60 million available STRATEGIC ALLIANCES BUSINESS PARTNERSHIPS You partner with another company to gain access to resources that you need but don’t have For most young businesses this typically means partnering with a larger, more established business More important than ever given current risk adverse venture capital environment SPEED ENTRY TO MARKETPLACE AND MINIMIZE THE REQUIRED FINANCING Loss of control Alliances come in several flavors: Financing Marketing and sales Manufacturing Licensing FINANCING Large companies may invest in smaller entrepreneurial ventures to supplement or substitute for their own R&D Less risky and more cost effective means of accessing cutting edge technology Strategic partners most likely to understand and appreciate value Potentially more favorable terms of investment MARKETING AND SALES Partner with a company that has an established sales force that is selling similar but non competing products to your prospective customers The value to the larger company is that your product may fill a gap in or extend their product line No marketing/sales employees to recruit, hire and train; no payroll Access to partner’s network of customer contacts Downside: Less control, lower priority MANUFACTURING Identify regional manufacturer Eliminates or defers costly equipment purchases No manufacturing employees to recruit, hire and train; no payroll Speeds market entry Often referred to outsourcing Downside: Less control LICENSING Transfer of rights to commercialize a technology, or an application of a technology to another company in return for financial consideration Typically some combination of up front cash, consulting contract and longer term royalty payments Use cash and validation generated from the license to commercialize other applications and build a company Particularly useful for first application of a platform technology or the first technology of a company with multiple technologies There is typically a tradeoff between upfront money and royalty payments Downside: Lower rate of return, loss of control, time lag before royalty payments flow CASE STUDY: INMAT, INC. Nanocomposite coating to improve air retention in rubber Initial product Air D-Fense 2000 utilized in premium Wilson tennis balls, official ball of Davis Cup Ultimate market is truck and car tires, at least several years away Client for 4 years, recipient of guidance and help in financing and building business including assistance in pursuing Springboard and Seed Capital loans and identifying an angel investor Lack of success in raising venture capital because investors wanted to see second near term commercial product Unsuccessful SBIR proposal in 2001, topic returned Attended first annual NJ SBIR conference in December 2001 Was assigned a consultant who spent 12 hours reviewing critiquing and helping to strengthen proposal Received Phase I award to explore application of coating to rubber gloves for treating hazardous chemicals Strategic alliance with major glove contractor Assisted InMat with Phase II proposal and commercialization plan Invited to negotiate Phase II contract in December 2002 Bolstered by increased probably of second product, company closed on $1.5 million in venture capital in April 2003 NJ SMALL BUSINESS DEVELOPMENT CENTERS (NJSBDC) OF RUTGERS BUSINESS SCHOOL Part of a national public, private and academic partnership Free business counseling, consulting, and affordable business training Funded in part by the U.S. Small Business Administration and the NJ Commerce and Economic Growth Commission 11 regional centers and 18 satellite offices across NJ More than 250,000 small business owners, prospective entrepreneurs and business professionals served since 1979 Serve businesses from pre-startup stage to those with 500 employees Specialty programs in international trade, government procurement, E-business, & technology commercialization NJ SMALL BUSINESS DEVELOPMENT CENTERS (NJSBDC) Services include help with: Business plans Marketing plans Financial statements Loan packages Record keeping Taxes E-commerce NJSBDC Web Site: www.NJSBDC.com SBA Web site: www.sba.gov NJSBDC TECHNOLOGY COMMERCIALIZATION CENTER MISSION: Assist New Jersey science and technology entrepreneurs in commercializing their new technologies, financing and building their businesses. TECHNOLOGY HELP DESK- 1-800-432-1TEC(832) Telephone counseling throughout the commercialization process, from startup to market entry and equity financing SBIR/STTR TRAINING AND PROPOSAL ASSISTANCE Conferences, seminars and workshops Assistance in identifying suitable topics Consultants to guide entrepreneurs through the proposal development process and to review, critique and strengthen draft proposals HELPED ENTREPRENEURS WIN $2.4 MILLION IN 2003 NJSBDC TECHNOLOGY COMMERCIALIZATION CENTER TECHNOLOGY COMMERCIALIZATION CONSULTING Targeted to SBIR and STTR award winners. Help with: Business models and plans Marketing plans Financial projections Financing strategy Approaching equity investors Strategic business partnering Assisted entrepreneurs in raising $1.8 million in equity financing during 2003 www.NJSBDC.com/SciTech LESSONS LEARNED Market entry takes more time and costs more than entrepreneurs’ most conservative estimates The better and more comprehensive your planning, the better your chances for success, minimize your surprises Reader should know after the first sentence what the company does. Layman’s terms, Don’t make reader work hard to understand the technology and the business opportunity A great technology may not be good enough, Thou shalt know thy markets and customers and their needs Differentiate yourself from your competitors in a way that provides the perception of value to your prospective customers, and that you can sustain over time LESSONS LEARNED Management, management, management First business hire or advisor should usually be a marketing and sales professional who knows your markets Venture capitalists will expect you to understand your markets and customers at least as well as anyone Validate market demand before approaching venture capitalists Develop a bootstrapping strategy which you can fall back on Develop your venture as far as you can before quitting day job Network If the reader is not EXCITED by the end of the executive summary, you have lost them