Microeconomics Unit 4

advertisement

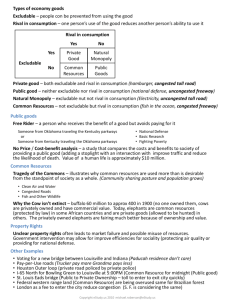

Microeconomics Unit 4 The Economics of the Public Sector In this Unit, You will learn… • Externalities • Public and Private Goods, Common Resources, and Natural Monoplolies • Progressive, Regressive, and Proportional Tax Systems Chapter 10 Externalities Economics PRINCIPLES OF N. Gregory Mankiw Introduction • Externalities are a type of market failure where there is one or more “side effects” to a transaction. • These side effects can either be positive or negative • Self-interested buyers and sellers neglect these external costs or benefits of their actions, so the market outcome is not efficient. Negative Externalities Examples of Negative Externalities include: • The neighbor’s barking dog • Noise pollution from construction projects • Health risk to others from second-hand smoke • Air pollution from a factory Graphing Negative Externalities The market for gasoline P $5 You are all familiar with Market Supply & Demand Graphs. Here is one for the Gas Market 4 Equilibrium price= $2.50 Equilibrium quantity= 25 gallons 3 $2.50 2 1 0 0 10 20 25 30 Q (gallons) Analysis of a Negative Externality The Negative externality is the harmful effect of smog and greenhouse gas emissions The market for gasoline P $5 Social cost 4 S This is the shift in Private + External Cost 3 2 D 1 0 0 10 20 25 30 Q (gallons) •External cost is the value of the negative impact on bystanders •Here you see the Negative externality increases total social costs •This needs to be changed by “Internalizing the externality” •Without this, the market is inefficient since quantity is higher than social efficient point •In other words, the social cost of the last gallon is greater than its value to society. “Internalizing the Externality” • Internalizing the externality: The altering of incentives so that people take account of the external effects of their actions • In our example, the $1/gallon tax on sellers makes sellers’ costs = social costs, so supply shifts left • Imposing the tax on buyers would achieve the same outcome Positive Externalities • Being vaccinated against contagious diseases protects not only you, but people who visit the salad bar or produce section after you. • R&D creates knowledge others can use. • People going to college raise the population’s education level, which reduces crime and improves government. Graphing Positive Externalities P $ 50 The market for Flu Shots Once again, the Market Supply & Demand Graph this time for flu shots. 40 Equilibrium price= $20 Equilibrium quantity= 25 gallons 30 $20 10 0 0 10 20 25 30 Q (gallons) ACTIVE LEARNING 1 Answers Socially optimal Q = 25 shots. P The market for flu shots $ 50 To internalize the externality, use subsidy = $10/shot. external benefit 40 S 30 Social value = private value + $10 external benefit 20 10 D 0 Q 0 10 20 25 30 Chapter 11 Public Goods and Common Resources Economics PRINCIPLES OF N. Gregory Mankiw Introduction • We consume many goods without paying: parks, national defense, clean air & water. • When goods have no prices, the market forces that normally allocate resources are absent. • The private market may fail to provide the socially efficient quantity of such goods. Important Characteristics of Goods • A good is excludable if a person can be prevented from using it. – Excludable: fish tacos, wireless internet access – Not excludable: FM radio signals, national defense • A good is rival in consumption if one person’s use of it diminishes others’ use. – Rival: fish tacos – Not rival: An MP3 file of Kanye West’s latest single The Different Kinds of Goods Private goods: excludable, rival in consumption (Not much more to them) Example: food Public goods: not excludable, not rival (Covered more in depth in chapter) Example: national defense Common resources: rival but not excludable (Covered more in depth in chapter) Example: fish in the ocean Natural monopolies: excludable but not rival (Same as for Private goods, not much to them) Example: cable TV Public Goods • Public goods are difficult for private markets to provide because of the free-rider problem. • Free rider: a person who receives the benefit of a good but avoids paying for it – If good is not excludable, people have incentive to be free riders, because firms cannot prevent non-payers from consuming the good. • Result: The good is not produced, even if buyers collectively value the good higher than the cost of providing it. • Important Public Goods: National defense, Knowledge created through basic research, Fighting poverty Cost-Benefit Analysis • Cost-benefit analysis: a study that compares the costs and benefits of providing a public good • If the benefit of a public good exceeds the cost of providing it, govt should provide the good and pay for it with a tax on people who benefit. • Cost-benefit analyses are imprecise, so the efficient provision of public goods is more difficult than that of private goods. Common Resources • Like public goods, common resources are not excludable. – Cannot prevent free riders from using – Little incentive for firms to provide – Role for govt: seeing that they are provided • Additional problem with common resources: rival in consumption • Tragedy of the Commons: A parable that illustrates why common resources get used more than is socially desirable. – The tragedy is due to an externality: one person’s use of the resource diminishes other’s use of it. – This cost is neglected leading to over use • Important Common Resources: Clean air and water, Congested roads, Fish, whales, and other wildlife Chapter 12 The Design of the Tax System Economics PRINCIPLES OF N. Gregory Mankiw Introduction • As stated in Ch. 10 and 11, the government can improve market outcomes by: – Providing public goods – Regulating use of common resources – Remedying the effects of externalities • To perform its many functions, the goverment raises revenue through taxation. Remember that: – A tax on a good reduces the market quantity of that good. – The burden of a tax is shared between buyers and sellers depending on the price elasticities of demand and supply. – A tax causes a deadweight loss. Income and Consumption taxes • income taxes reduce the incentive to save: – If income tax rate = 25%, 8% interest rate = 6% after-tax interest rate. – The lost income compounds over time. • Some economists advocate taxing consumption instead of income. – Would restore incentive to save. – Better for individuals’ retirement income security and long-run economic growth Marginal and Average Tax Rates • Average tax rate – total taxes paid divided by total income – measures the sacrifice a taxpayer makes • Marginal tax rate – the extra taxes paid on an additional dollar of income – measures the incentive effects of taxes on work effort, saving, etc. Lump Sum Taxes • A lump-sum tax is the same for every person Example: lump-sum tax = $4000/person • A lump-sum tax is the most efficient tax: – Causes no deadweight loss: Does not distort incentives. – Minimal administrative burden: No need to hire accountants, keep track of receipts, etc. • But they are perceived as unfair: – In dollar terms, the poor pay as much as the rich. – Relative to income (as a percentage), the poor pay much more than the rich. Principles with Taxes • Benefits principle: the idea that people should pay taxes based on the benefits they receive from government services – Tries to make public goods similar to private goods – the more you use, the more you pay • Ability-to-pay principle: the idea that taxes should be levied on a person according to how well that person can shoulder the burden – Suggests that all taxpayers should make an “equal sacrifice” that depends not just on the tax payment, but on the person’s income and other circumstances – Called Vertical equity: the idea that taxpayers with a greater ability to pay taxes should pay larger amounts Tradeoff of Efficiency and Equity • There are two types of equity: • Vertical equity: the idea that taxpayers with a greater ability to pay taxes should pay larger amounts • Horizontal equity: the idea that taxpayers with similar abilities to pay taxes should pay the same amount – Problem: Difficult to agree on what factors, besides income, determine ability to pay. • The tradeoff of efficiency and equity leads governments to try and find the pest possible tax system Three Tax Systems • Proportional tax: Taxpayers pay the same fraction of income, regardless of income • Regressive tax: High-income taxpayers pay a smaller fraction of their income than low-income taxpayers • Progressive tax: High-income taxpayers pay a larger fraction of their income than low-income taxpayers Flat Taxes Flat tax: a tax system under which the marginal tax rate is the same for all taxpayers – Typically, income above a certain threshold is taxed at a constant rate – The higher the threshold, the more progressive the tax – Radically reduces administrative burden – Not popular with • people who benefit from the complexity of the current system (accountants, lobbyists) • people who can’t imagine life without their favorite deduction/loophole – Used in some central/eastern European countries End Of Unit 4 “Government's view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidise it” Ronald Reagan (America’s 40th US President (1981- 89), 1911-2004)