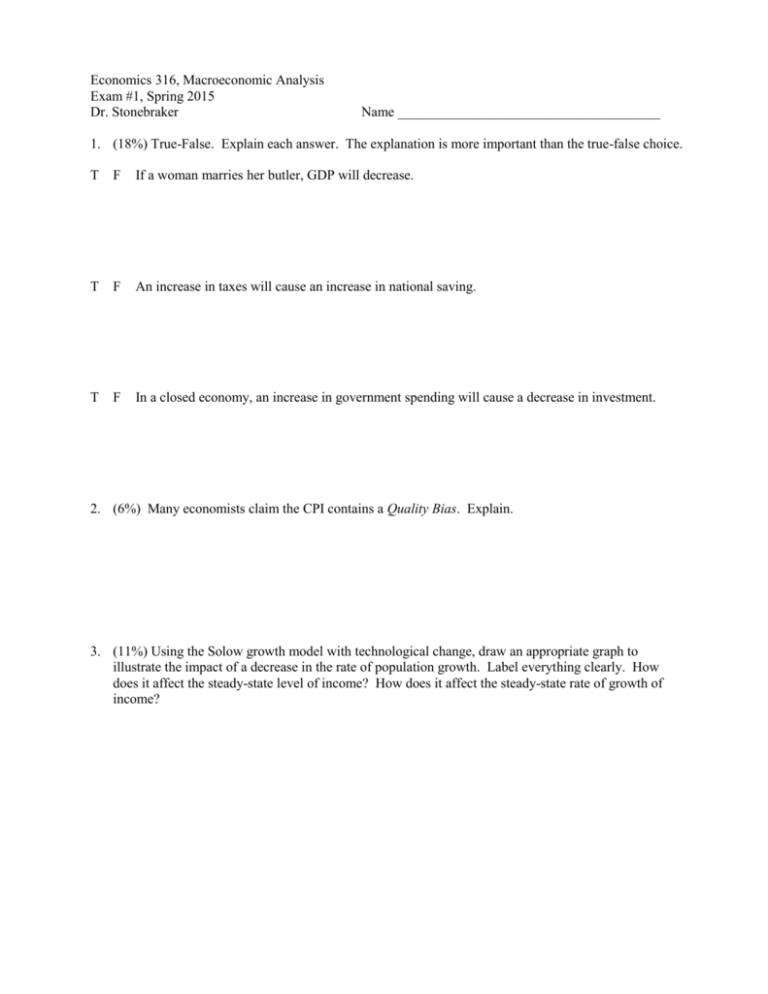

Exam #1, Spring 2015

advertisement

Economics 316, Macroeconomic Analysis Exam #1, Spring 2015 Dr. Stonebraker Name ______________________________________ 1. (18%) True-False. Explain each answer. The explanation is more important than the true-false choice. T F If a woman marries her butler, GDP will decrease. T F An increase in taxes will cause an increase in national saving. T F In a closed economy, an increase in government spending will cause a decrease in investment. 2. (6%) Many economists claim the CPI contains a Quality Bias. Explain. 3. (11%) Using the Solow growth model with technological change, draw an appropriate graph to illustrate the impact of a decrease in the rate of population growth. Label everything clearly. How does it affect the steady-state level of income? How does it affect the steady-state rate of growth of income? 4. (2%) About ___% of U.S. GDP goes to the owners of labor. 5. (3%) List two things that GDP measures. How can it measure two things at the same time? 6. (3%) What is the Law of Diminishing Marginal Returns? 7. (10%) Suppose the U.S. imposes tariffs on all imported goods. Explain how this will affect the U.S. trade deficit and the exchange rate. 8. (2%) Suppose you are told that the GDP Deflator or GDP Price Index is 147. What does that mean? 9. (13%) Suppose there is an increase in government spending in a small open economy. What will happen to saving, investment, the rate of interest, the exchange rate and net exports? Explain why. 10. (8%) Use the Solow growth model with technological change to explain why the share of GDP going to labor relative to capital over time should remain constant. 11. (8%) If: Y = C + I + G, Y = 7000, G = 1300, T = 1000, C = 150 + 0.8(Y-T), and I = 1200 - 50r a. Calculate private saving, public saving and national saving. b. Calculate the equilibrium interest rate (r). 12. (16%) An economy is comprised of the three firms below. The cotton and sewing machines are sold to the clothing company. Calculate GDP using both the expenditures approach and the value-added approach. Show your work. Sewing Machine Company Cotton Company Clothing Company sewing machine sales: $700 cotton sales: $450 clothing sales: $2,400 wages: 290 depreciation: 100 interest expense: 70 imported parts: 140 profit: 100 wages: 250 rent: 50 profit: 150 cotton purchases: 450 sewing machine purchases: 700 wages: 1400 depreciation: 150 profit: 300