Study Guide Outline

advertisement

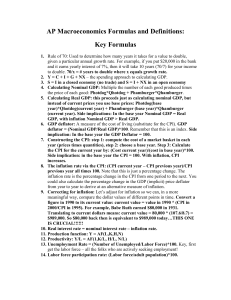

ECON 2100 Economics and Society Exam 3 Study Guide Outline (HW 8 – ?) Chapter 8: In Search of Prosperity and Stability Three Main Macro Goals o Economic Growth o Full Employment o Stable Prices 1. Economic Growth Gross Domestic Product (GDP) o Real GDP vs. Nominal GDP Sources of Economic Growth o Growth of total labor inputs (population, labor force participation rate, average hours worked) o Growth of labor productivity (productivity = output per worker, or output per labor hour) Benefits of Economic Growth o Higher average standard of living o More goods and services o Greater opportunities to choose between work and leisure Costs of Economic Growth o Budgetary Costs o Consumption Costs o Opportunity cost of workers’ time o Other Social Goals Business cycle o Expansions o Contractions o Recessions o Relationship with employment 2. Full Employment Unemployment o Bureau of Labor Statistics (BLS) o Types of Unemployment Frictional Seasonal Structural Cyclical o UE rate o Main economic cost of UE – opp cost of lost output o Problems with measurement of UE Involuntary part-time workers Discouraged workers Full Employment o Potential GDP o Natural rate of unemployment Alternate measures of employment situation o Payroll Survey o Employment-Population Ratio 3. Stable Prices Price level Inflation Consumer Price Index (CPI) o Calculate inflation rate (from period X to period Y) 𝐶𝑃𝐼𝑌 − 𝐶𝑃𝐼𝑋 𝑖𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 𝑟𝑎𝑡𝑒 = × 100 o o 𝐶𝑃𝐼𝑋 Index payments Translate from nominal to real variables i.e. wages 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝑊𝑎𝑔𝑒𝑡 𝑅𝑒𝑎𝑙 𝑤𝑎𝑔𝑒𝑡 = × 100 𝐶𝑃𝐼𝑡 Costs of Inflation o Redistributive costs Real Interest rate = nominal interest rate – inflation rate o Resource costs Chapter 9: The Circular Flow of Income and Expenditure Components of GDP: C, I, G, NX o Consumption g/s o Private investment g/s o Government consumption and investment g/s o Net exports = total exports – total imports Injections and Leakages Deficit and Surplus Total Spending = Total Output Planned Expenditure: EP = C + IP +G +NX o Consumption Spending Key influences Disposable Income Wealth Interest rate Expectations/Consumer Confidence Autonomous Consumption Spending Marginal Propensity to Consume (MPC) o Planned investment spending: IP = I - ∆ in inventories Key influences Interest Rate Business Confidence Investment Climate o Government consumption and investment spending Exogenous o Net Exports Endogenous (decrease during an expansion) Influenced by the exchange rate Expenditure Multiplier 1 o 𝐸𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒 𝑀𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟 = o ∆𝐺𝐷𝑃 = 1 1−𝑀𝑃𝐶 1−𝑀𝑃𝐶 × ∆𝐼 𝑃 (Or ∆G, ∆NX, or ∆a) Chapter 10: Measuring Economic Activity Gross domestic product (GDP) Gross national product (GNP) Measuring GDP o Expenditure Approach o Value Added Approach o Factor Payments Approach (Income Approach) Shortcomings with measurement of GDP Real income and Price level o GDP Deflator o CPI o Producer Price Index (PPI) o Biases in CPI Substitution Bias Changes in Quality Chapter 11: Money and The Banking System History of money o Commodity money o Fiat money Functions of money o Means of payment o Unit of Account o Store of Value Money: asset widely accepted as a means of payment in an economy o M1 = currency + checking accounts + travelers checks o M2 = M1 + savings accounts + money market mutual funds + time deposits o Money supply = M1 Federal Reserve System o “Responsibilities” (or Functions) Supervise and regulate banks “Bank for banks” Issue paper currency Check clearing “Guide the macroeconomy” Dealing with financial crises o Board of Governors o Regional Federal Reserve Banks o Federal Open Market Committee o Policy Tools Open Market Operations Discount Rate Reserve Requirements Interest rate on Reserves